What is a Tenant Screening Report A Comprehensive Guide

Introduction to Tenant Screening Reports

A tenant screening report is a comprehensive document used by landlords and property managers to assess the suitability of prospective tenants. This report is a key tool in the rental process, offering landlords an objective view of an applicant’s background and financial history to help them make an informed decision. It compiles crucial data such as criminal background, credit history, eviction records, and rental history to provide a snapshot of a tenant’s reliability, stability, and overall fit for the property.

What is a Tenant Screening Report?

A tenant screening report is a document that consolidates various pieces of information regarding an applicant’s personal and financial background, typically collected from multiple sources. This report serves as a guide for landlords and property managers to ensure that they are renting to responsible individuals. It helps landlords determine whether an applicant can afford rent, abide by lease terms, and take care of the property.

Tenant screening reports generally include the following data points:

- Criminal background check: This reveals any criminal offenses the applicant may have committed.

- Credit history: Provides insight into the applicant’s financial stability and ability to make timely payments.

- Eviction history: Reveals any prior evictions that may indicate the applicant has had issues with paying rent or adhering to lease agreements.

- Rental history: Offers details about the applicant’s previous rental relationships, including their payment track record and behavior as a tenant.

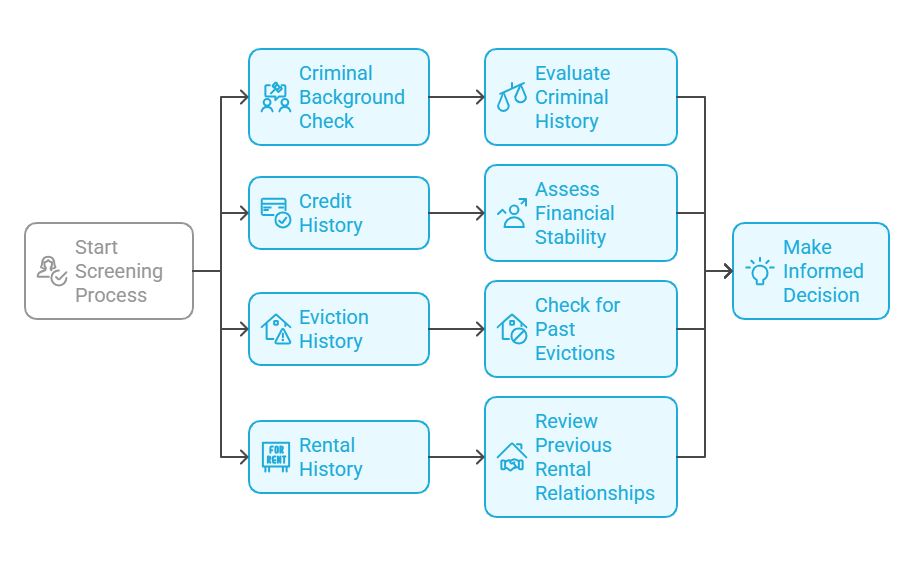

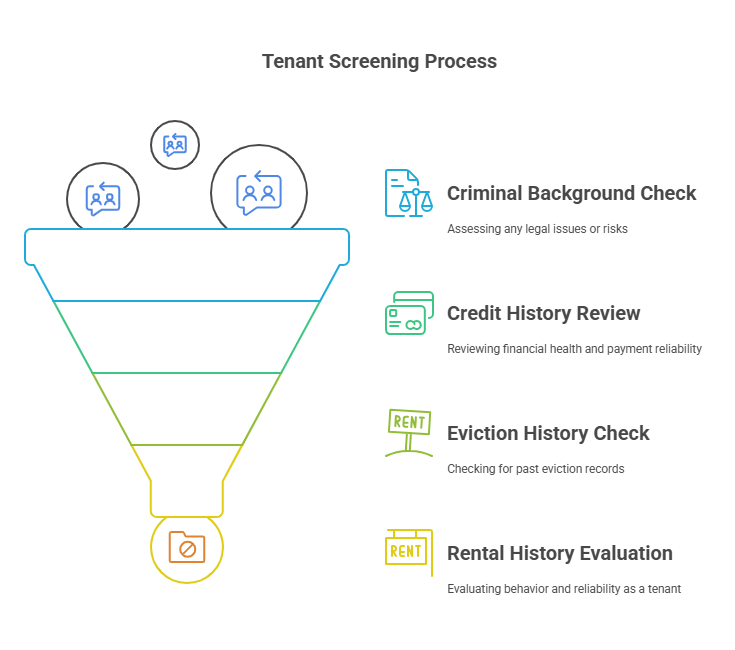

The Tenant Screening Process

The tenant screening process typically starts when a potential tenant submits a rental application. After receiving the application, landlords request consent from the applicant to conduct background checks and verify certain pieces of information. Once consent is granted, landlords gather the necessary data, often through third-party screening services.

After gathering the information, a comprehensive tenant screening report is generated, summarizing the results of criminal background checks, credit reports, eviction history, and rental references. This information helps landlords evaluate whether the applicant is a good match for the rental property.

The screening process is critical for protecting the landlord’s investment, ensuring that tenants are capable of paying rent on time, maintaining the property, and complying with lease terms. Many landlords turn to professional tenant screening services like Precisehire to streamline this process and receive accurate, reliable, and legally compliant reports.

Key Information Found in Tenant Screening Reports

Tenant screening reports include several key data points that help landlords assess whether a potential tenant is a reliable renter. These include:

1. Criminal Background Check

A criminal background check reveals any legal issues in the applicant’s past, such as felony convictions or misdemeanors. This check helps landlords assess the risk to other tenants and the safety of the rental property. For example, landlords may choose to avoid renting to applicants with violent or drug-related criminal records.

2. Credit History

A credit report is an essential part of the tenant screening process, as it provides an overview of the applicant’s financial health. The report shows the applicant’s credit score, outstanding debts, and payment history. A good credit score typically indicates that the tenant has been responsible with their finances, while a low score may raise concerns about their ability to make rent payments on time.

3. Eviction History

Eviction records highlight whether an applicant has ever been evicted from a previous rental property. This is an important factor to consider, as it may suggest that the applicant has been difficult to work with or has had trouble paying rent in the past. A history of evictions can be a significant red flag for landlords.

4. Rental History

A rental history report details the applicant’s past rental agreements, including their payment history, behavior as a tenant, and relationship with previous landlords. Positive rental history indicates that the tenant has been responsible and reliable, whereas negative rental history can point to potential issues.

Why Tenant Screening Reports Are Important for Landlords

Tenant screening reports provide landlords with valuable information that can prevent costly mistakes. Without a comprehensive report, landlords may rely on personal judgments or gut feelings, which can lead to renting to unreliable tenants. By reviewing the information in the screening report, landlords can minimize the risk of financial loss, property damage, or legal issues.

Some of the key reasons tenant screening reports are crucial for landlords include:

1. Assessing Financial Stability

Credit reports included in tenant screening reports help landlords determine whether a tenant is financially stable enough to pay rent consistently. This helps landlords avoid tenants who may struggle to meet their rental obligations.

2. Ensuring Tenant Reliability

Criminal background checks and eviction records give landlords insight into the applicant’s behavior and reliability. This reduces the risk of renting to someone who may cause trouble on the property, such as violating lease terms or engaging in illegal activities.

3. Reducing Rental Risks

Tenant screening reports reduce the risks landlords face by providing concrete, data-driven insights into the applicant’s background. With a comprehensive screening report, landlords can make informed decisions and avoid the potential consequences of renting to unreliable tenants.

By using tenant screening reports, landlords gain valuable insights into the financial stability and trustworthiness of potential renters, ultimately helping to safeguard their properties and investments. In the next section, we will break down the specific components of a tenant screening report and explain how landlords can interpret the information to make better decisions.

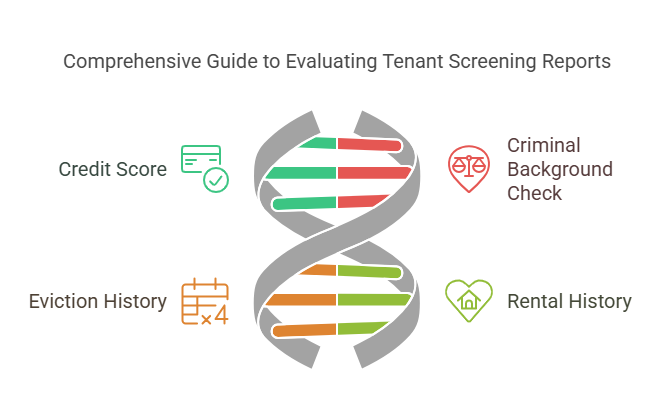

Components of a Tenant Screening Report and How to Interpret It

A tenant screening report is a crucial tool for landlords and property managers when evaluating prospective tenants. It includes various components, each providing specific insights into the tenant’s financial and personal background. Understanding these components helps landlords make informed decisions about renting their property.

In this section, we will break down the key components of a tenant screening report, explain what each part means, and offer guidance on how landlords can interpret the information to make the best decisions.

1. Credit Score and History

The credit score is one of the most important aspects of a tenant screening report, providing insight into an applicant’s financial reliability and their ability to pay rent on time. A credit report typically includes the tenant’s credit score, which ranges from 300 to 850.

- What It Means: A higher credit score (above 700) generally indicates a financially responsible individual with a history of paying bills on time, while a lower score (below 600) could signal financial instability. However, a low credit score doesn’t necessarily disqualify an applicant—it’s just a warning sign that the landlord may need to dig deeper into the tenant’s financial history or offer a co-signer or higher security deposit.

- How It Affects the Landlord’s Decision: Credit scores can give landlords an idea of whether the tenant is likely to pay rent on time. A score that falls in the fair or poor range might require additional verification or a larger deposit to mitigate risk.

Factors Included in a Credit Report:

- Outstanding Debts: Amounts owed on loans, credit cards, or other accounts.

- Payment History: History of timely payments, late payments, and defaults.

- Credit Inquiries: Shows how many times the applicant has requested credit in the past two years.

- Public Records: Bankruptcy or other legal actions that could affect financial stability.

2. Criminal Background Check

A criminal background check is an essential part of a tenant screening report, revealing any criminal offenses the applicant may have committed. This section typically includes records of felonies, misdemeanors, arrests, or convictions that could impact the applicant’s eligibility to rent.

- What It Means: If the criminal background check reveals a history of violent crimes or drug-related offenses, this might raise a red flag for landlords. A criminal record doesn’t necessarily disqualify an applicant, but landlords may have specific policies regarding the nature and timing of criminal offenses.

- How It Affects the Landlord’s Decision: Landlords need to consider the severity and relevance of the criminal offenses. Some landlords may have a zero-tolerance policy for serious offenses such as violent crimes, while others may take into account the applicant’s rehabilitation and the time passed since the conviction.

Factors Included in a Criminal Background Check:

- Felony Convictions: Serious offenses such as theft, assault, or drug-related crimes.

- Misdemeanors: Lesser offenses that may still impact tenant suitability.

- Arrests: Whether the applicant has been arrested, even if not convicted.

- Sex Offender Registry: Some landlords check if the tenant is on a national or state sex offender registry.

3. Eviction History

An eviction history is another critical part of the tenant screening report. It reveals whether the applicant has been evicted from previous rental properties, providing insight into their history as a tenant.

- What It Means: An eviction history can indicate a tenant’s poor rental history, including an inability or unwillingness to pay rent or follow the terms of a lease agreement. However, it’s important for landlords to look at the context of each eviction—whether it was due to non-payment, property damage, or other issues.

- How It Affects the Landlord’s Decision: A past eviction might make a landlord cautious about renting to that individual, as it could indicate a pattern of problematic behavior. However, some landlords might be willing to overlook an eviction if it occurred a long time ago or was due to factors beyond the applicant’s control, such as a job loss or a medical emergency.

Factors Included in an Eviction History:

- Eviction Dates: When the eviction took place and how recent it was.

- Eviction Reasons: Non-payment of rent, violation of lease terms, property damage, etc.

- Court Judgments: Whether the eviction resulted in a court ruling or judgment against the tenant.

4. Rental History

The rental history section of the screening report offers insight into the applicant’s behavior as a tenant in previous rental properties. This can include details about past lease agreements, payment history, and relationships with previous landlords.

- What It Means: A positive rental history is typically a good sign that the applicant is reliable and takes care of the property. It reflects their history of paying rent on time and respecting the terms of their lease. On the other hand, a poor rental history, including late payments or complaints from previous landlords, can be a significant red flag.

- How It Affects the Landlord’s Decision: Landlords should pay close attention to how long the applicant has lived at previous residences, whether they have been timely with payments, and if there have been any complaints or issues during the tenancy.

Factors Included in Rental History:

- Previous Landlords: Names and contact information for previous landlords.

- Payment History: Whether rent was paid on time or late.

- Lease Violations: Any history of violating lease terms (e.g., subletting, noise complaints, unauthorized pets).

- Damage to Property: Any evidence of damages caused to previous rental properties.

Data Table: Components of a Tenant Screening Report

| Component | Purpose | What It Shows |

|---|---|---|

| Credit Score | Assesses financial stability and ability to pay rent | Creditworthiness, debt, payment history, public records |

| Criminal Background | Checks for past criminal offenses that might affect tenant suitability | Felony convictions, misdemeanors, arrests, sex offender status |

| Eviction History | Identifies previous evictions, which may indicate tenancy issues | Reasons for eviction, dates, court judgments |

| Rental History | Provides insights into past rental relationships and tenant behavior | Timely payments, lease violations, property damage, landlord references |

How Precisehire Assists with Tenant Screening

Precisehire offers comprehensive tenant screening services to landlords, providing detailed screening reports that include all the components discussed above. With Precisehire, landlords can access accurate, reliable, and up-to-date information to ensure they are making informed rental decisions. By utilizing these services, landlords can reduce the risk of renting to problematic tenants and protect their rental properties from potential financial or legal issues.

Legal Aspects of Tenant Screening Reports

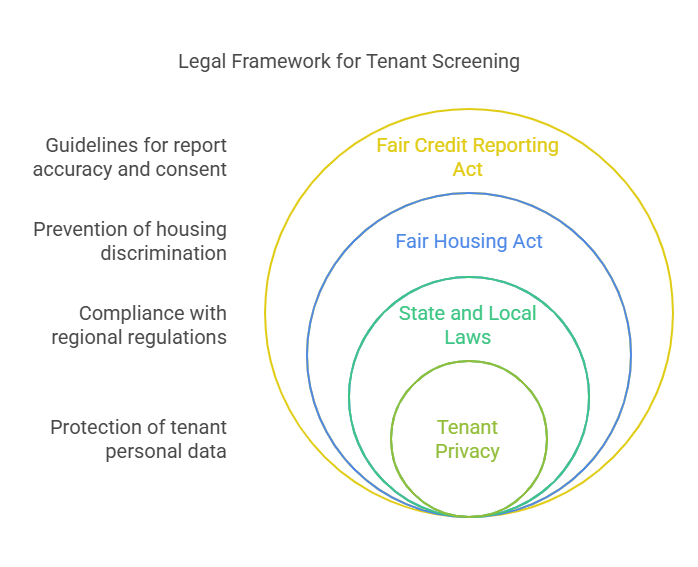

When conducting tenant screenings, landlords must be aware of various legal requirements and protections to ensure compliance and avoid discrimination. Several key laws govern the use of tenant screening reports, and understanding these regulations is essential for landlords. Below are some of the key legal considerations:

- Fair Credit Reporting Act (FCRA): The FCRA is a critical law that governs how tenant screening reports are obtained and used. The FCRA ensures that landlords use accurate and up-to-date information and that applicants’ rights are protected during the screening process. Key provisions include:

- Consent: Landlords must obtain written consent from the tenant or applicant before conducting a background check.

- Notice of Adverse Action: If a landlord decides not to rent to an applicant based on the tenant screening report, they must provide a “Notice of Adverse Action,” explaining the reason and providing information on how the applicant can dispute the findings.

- Accuracy: Landlords must ensure the accuracy of the information they use, and they are prohibited from using outdated or incorrect information in the tenant screening report.

- Fair Housing Act (FHA): The Fair Housing Act prohibits discrimination in housing based on race, color, national origin, religion, sex, familial status, and disability. When using tenant screening reports, landlords must ensure they do not violate these protected categories. This means that certain types of information, such as race, religion, or familial status, cannot be used to make decisions during the screening process.

- State and Local Laws: In addition to federal laws, landlords must also be aware of state and local tenant screening regulations. These laws can vary widely, and landlords must comply with specific rules regarding:

- What information can be used during the tenant screening process.

- How long tenant screening reports are valid.

- Specific eviction and criminal record laws within the landlord’s jurisdiction.

- Tenant Privacy: Tenant screening reports often contain sensitive information. Landlords are obligated to protect the privacy of the tenant and their personal data. This includes ensuring that screening reports are stored securely, and information is shared only with authorized parties. Tenants must be notified about how their personal data will be used and stored.

Frequently Asked Questions (FAQs)

How accurate are tenant screening reports?

Tenant screening reports are typically very accurate, as they are compiled from a variety of reliable sources, such as credit bureaus, court records, and government databases. However, it's essential for landlords to verify the information with the applicant, as mistakes or outdated data can sometimes appear. Using a trusted service, like Precisehire, ensures access to the most current and accurate reports.

How often should tenant screening be done?

Tenant screening should be conducted for every new applicant before entering into a rental agreement. In some cases, landlords may want to conduct screenings periodically, especially for long-term tenants, to ensure they continue to meet financial obligations. However, regular screening beyond the initial check is not typically required unless there are specific reasons to do so.

Can a tenant refuse to undergo a screening?

Yes, a tenant can refuse to undergo a screening. However, if a landlord requires tenant screening as part of the rental application process, refusing to consent to a screening may result in the application being denied. Tenants should be informed upfront that screening is a standard part of the process.

How long do the results of a tenant screening report last?

Tenant screening reports typically remain valid for 30 to 60 days. However, landlords should keep in mind that certain factors, such as credit scores and criminal records, can change over time. If a tenant applies after a significant amount of time has passed, landlords may want to request a new report.

Can a landlord rent to someone with a criminal record?

Yes, a landlord can rent to someone with a criminal record, but they must be careful not to discriminate based on the individual's criminal history. It is important for landlords to follow local and federal guidelines to ensure they are not violating fair housing laws. For example, certain criminal offenses may disqualify an applicant, but blanket policies that automatically deny all applicants with any criminal history may be considered discriminatory.

Conclusion

Tenant screening reports are an essential tool for landlords in making informed, responsible decisions when selecting tenants. By providing detailed information about an applicant’s credit history, criminal background, eviction history, and rental references, these reports help landlords assess whether an applicant is financially stable, trustworthy, and a good fit for their rental property.

Landlords must navigate a complex legal landscape when using tenant screening reports. It is crucial to comply with the Fair Credit Reporting Act (FCRA), Fair Housing Act, and any state or local laws to ensure that the tenant selection process is both legal and fair. Additionally, protecting the privacy of tenants’ personal information is a responsibility that should not be overlooked.

Services like Precisehire provide reliable tenant screening solutions, helping landlords gather comprehensive reports that facilitate smarter decision-making. By using accurate and up-to-date screening reports, landlords can reduce the risk of renting to problematic tenants, safeguard their properties, and create a positive rental experience for both parties.

Ultimately, tenant screening is an investment in the security and profitability of a rental property. By conducting thorough screenings and adhering to legal requirements, landlords can ensure a smooth, risk-free rental process, benefiting both tenants and landlords alike.