Understanding the Renter Background Check Process

Introduction & Importance of Background Checks for Renters

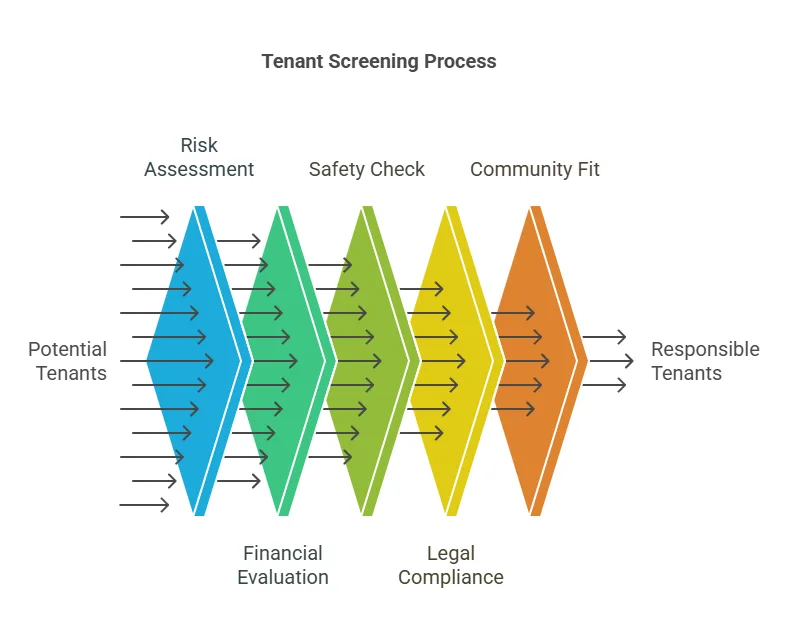

In today’s competitive rental market, landlords and property managers are faced with the challenge of selecting responsible and reliable tenants. One of the most effective tools for ensuring that the individuals they lease to are trustworthy is the background check for renters. This process involves reviewing a potential tenant’s history to assess their suitability for renting a property.

Background checks for renters are an essential part of the tenant screening process. They help property owners and managers identify potential risks, protect their investments, and maintain a safe living environment. In this part, we will explore the significance of background checks, the benefits they offer to both renters and landlords, and the key factors that are typically reviewed in a renter’s background check.

What is a Background Check for Renters?

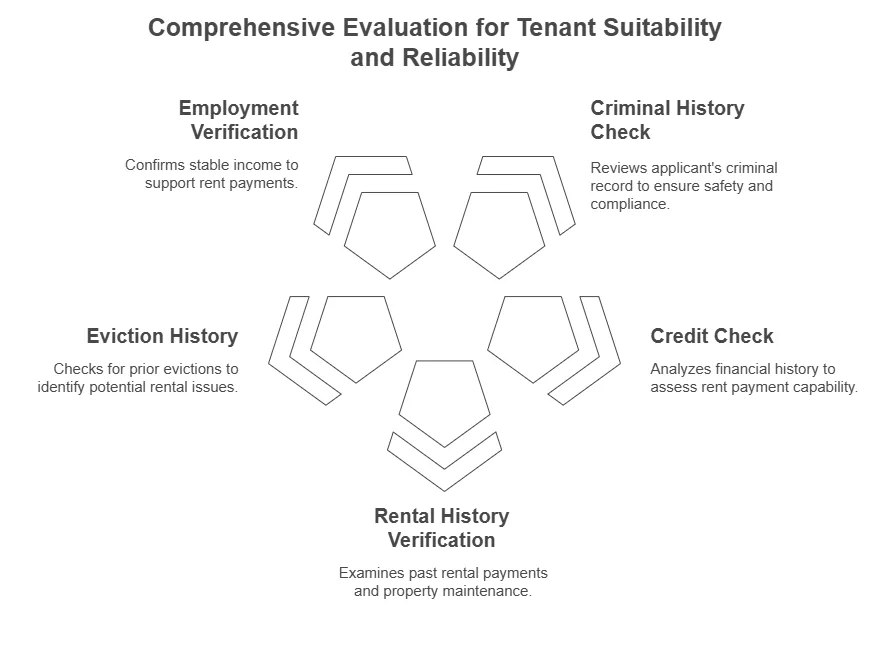

A background check for renters is a thorough investigation into a potential tenant’s personal, financial, and criminal history. This helps landlords and property managers evaluate whether an applicant is likely to pay rent on time, take care of the property, and follow the terms of the lease. The background check process typically includes several components:

- Criminal History Check: Reviewing the applicant’s criminal record to ensure they do not have a history of violent crime, theft, or other criminal behaviors that could pose a risk to the safety of other tenants or the property.

- Credit Check: Analyzing the applicant’s credit score and financial history to determine their ability to manage finances and pay rent consistently. A good credit score generally reflects financial responsibility.

- Rental History Verification: Looking into the applicant’s previous rental history to see if they have a track record of paying rent on time and maintaining their rental properties.

- Eviction History: Checking if the applicant has any prior evictions, which could indicate issues with paying rent or damaging property in the past.

- Employment Verification: Ensuring the applicant is employed and has a steady source of income to support rent payments.

Why Are Background Checks Important for Landlords and Property Managers?

For landlords and property managers, background checks are crucial for protecting their investments and minimizing the risk of renting to problematic tenants. Without a background check, landlords may inadvertently rent to individuals who are financially unstable, have a criminal history, or have been evicted previously. These types of tenants can cause significant financial losses, legal issues, and safety concerns.

Here are several reasons why background checks for renters are important:

- Minimizing Risk: Background checks help landlords minimize the risk of renting to tenants who might not pay rent on time, damage the property, or cause disturbances in the community. By evaluating applicants’ criminal and financial history, landlords can make informed decisions about who is most likely to be a responsible tenant.

- Ensuring Financial Stability: A background check that includes a credit report allows landlords to evaluate a potential tenant’s financial responsibility. Tenants with poor credit or outstanding debts may struggle to pay rent regularly, which could result in late payments or non-payment altogether.

- Promoting Safety: Ensuring that tenants do not have a criminal history, especially involving violent crimes or offenses that would jeopardize the safety of other residents, is an important consideration in the screening process. Background checks help property owners ensure that their residents feel secure.

- Preventing Legal Issues: By conducting proper background checks, landlords can reduce the risk of being sued for discrimination or neglecting to perform due diligence. Screening tenants based on consistent and legally compliant criteria is vital for avoiding lawsuits and disputes.

- Building a Positive Community: Renting to tenants who are financially stable and have a history of being good neighbors helps maintain a harmonious and well-managed community. Background checks help ensure that the individuals moving in will contribute to a safe and positive living environment for everyone.

Benefits of Background Checks for Renters

Background checks benefit both landlords and renters. While landlords gain valuable information that helps them make more informed decisions, renters also benefit from the transparency that comes with a formal screening process. Here are some of the advantages for both parties:

For Landlords and Property Managers:

- Reduces Rental Risk: Screening applicants for criminal behavior, financial instability, and eviction history helps landlords mitigate the risk of renting to individuals who may cause financial or legal problems down the line.

- Increases Tenant Retention: When landlords select tenants who have a positive rental history, are financially responsible, and have no criminal background, there is a higher likelihood of long-term tenancy and fewer lease terminations.

- Ensures Legal Compliance: Proper background checks ensure that landlords follow the laws governing tenant screening, including fair housing and anti-discrimination regulations.

For Renters:

- Transparency and Fairness: Renters are given an opportunity to present their background information, and they can also dispute any inaccurate data that may affect their rental application.

- Improved Rental Prospects: Renters who pass background checks may have access to better rental properties with more favorable lease terms, as landlords are more likely to trust applicants with clean backgrounds.

- Security and Peace of Mind: Renters can feel more secure living in a building or complex with other tenants who have been vetted through background checks, knowing that their neighbors are also likely to be responsible and safe.

Key Factors Considered in a Renter’s Background Check

When conducting a background check for renters, several factors are typically evaluated to determine an applicant’s suitability. These factors help landlords assess the likelihood that a renter will be reliable and responsible. Below are the most common components of a renter’s background check:

1. Criminal History

A criminal background check is essential for ensuring that a tenant does not have a criminal record that could pose a threat to other residents. This check typically looks at any felony or misdemeanor convictions, especially those related to violent crimes, theft, or drug offenses. Landlords may also look for patterns of criminal behavior that suggest the applicant may be a risk to the property or community.

2. Credit Score

A potential tenant’s credit score is a reflection of their financial history and responsibility. Landlords often use this as an indicator of whether the applicant can afford rent and pay it on time. A higher score suggests a history of making timely payments, while a lower score may indicate financial instability.

3. Rental History

Reviewing an applicant’s previous rental history helps landlords determine whether the applicant has been a reliable tenant in the past. This includes checking whether the individual paid rent on time, whether there were any complaints from previous landlords, and if there is a history of property damage or eviction.

4. Eviction History

Evictions are serious red flags that suggest the tenant may have difficulty following rental agreements. An eviction history can help landlords assess the potential risks involved in renting to a particular applicant. Even a single eviction could indicate trouble with paying rent or complying with the terms of a lease.

5. Employment and Income Verification

Finally, landlords may verify the applicant’s employment status and income level to ensure that they have the financial means to pay rent. Verifying employment helps landlords determine if the applicant has a reliable source of income to cover their rental obligations.

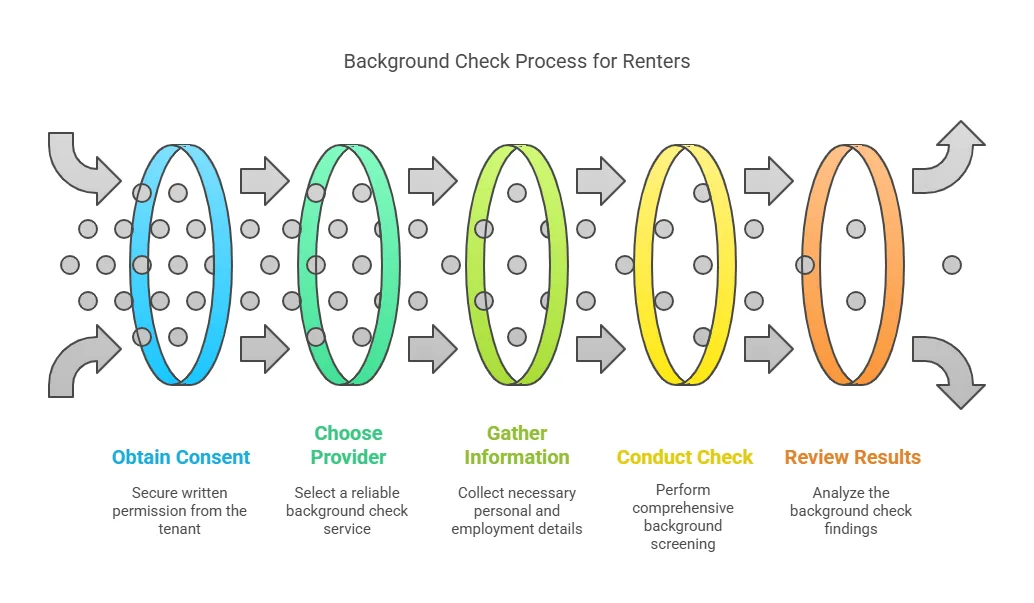

Step-by-Step Guide on How to Perform a Background Check for Renters

Conducting a background check for renters may seem like a complex process, but it is manageable if you follow a clear set of steps. Whether you are a first-time landlord or an experienced property manager, understanding the steps will help ensure that you are gathering the right information in a compliant and efficient manner.

1. Obtain Written Consent from the Applicant

Before performing any background check, it is essential to obtain the tenant’s consent in writing. The Fair Credit Reporting Act (FCRA) requires landlords to get explicit permission from applicants before conducting a background check. This includes notifying the applicant that their personal information will be reviewed and explaining how it will be used during the screening process.

Most rental applications will include a consent form for background checks, but it’s crucial to ensure that the language complies with local and federal regulations. This helps protect both the landlord and the applicant and ensures the screening process remains legally sound.

2. Choose a Reliable Background Check Provider

Once you have obtained consent from the applicant, the next step is to select a reliable background check provider. There are various companies that specialize in tenant screening services, including Precise Hire, which offers comprehensive background checks for landlords and property managers.

Some of the essential features to look for in a background check service include:

- Access to multiple databases (criminal records, credit history, eviction records, etc.)

- Comprehensive tenant screening reports that offer detailed information

- Timely turnaround on reports to streamline the leasing process

- FCRA compliance, ensuring that the provider adheres to legal regulations

It’s important to choose a provider that can deliver accurate and up-to-date information while also being transparent about the sources of their data.

3. Gather the Necessary Applicant Information

In order to conduct a thorough background check, you will need certain information from the renter, such as:

- Full name (including any aliases or maiden names)

- Date of birth

- Social Security number (if required by the screening service)

- Current address and previous addresses (for the past few years)

- Employment details (employer’s name, job title, and duration of employment)

Make sure to request this information in the application form and verify its accuracy before proceeding with the background check. Accurate data will help avoid delays and discrepancies in the screening process.

4. Conduct the Background Check

Once you have all the necessary information, you can initiate the background check through the selected provider. The check will typically involve a combination of the following:

- Criminal history check

- Credit report

- Rental history check

- Eviction records search

- Employment verification

- Identity verification

Depending on the provider and the specific needs of the landlord, the scope of the background check can vary. For instance, landlords may choose to include a search for outstanding debts, drug or alcohol offenses, or financial judgments, all of which could affect an applicant’s suitability as a tenant.

5. Review the Results

After the background check is completed, the next step is to carefully review the results. A background check report typically includes various categories of information, and it’s important to understand what each section means and how it will impact your decision to rent to the applicant.

What to Look for in a Renter’s Background Check

There are several key factors that landlords should focus on when reviewing a potential tenant’s background check results. By understanding the significance of each category, you can make informed and fair decisions.

1. Criminal History Check

A criminal history check will reveal whether the applicant has been convicted of any crimes. Criminal records are one of the most critical elements landlords consider when reviewing an applicant’s background. Here are some red flags to look for:

- Violent crimes: Violent crimes, such as assault, battery, or domestic violence, can pose a safety risk to other tenants and property.

- Theft or fraud: A history of theft or financial fraud may indicate a lack of integrity, which could translate into non-payment of rent or property damage.

- Drug offenses: Drug-related offenses may raise concerns about drug abuse or illegal activity occurring within the rental property.

It’s important to note that not all criminal offenses should automatically disqualify an applicant, as Fair Housing Laws prevent discrimination based on certain criminal records. Review the nature of the crime, when it occurred, and whether the applicant has demonstrated rehabilitation.

2. Credit Check

The credit score is another critical element to evaluate when screening potential tenants. A credit report will provide insight into the applicant’s financial history, including:

- Outstanding debts: Look for unpaid bills, collections, or bankruptcies, which could indicate that the applicant may have trouble paying rent on time.

- Payment history: A consistent track record of late payments may suggest that the tenant is unreliable or financially unstable.

- Credit score: A low credit score (usually under 600) could indicate financial mismanagement. However, some applicants may have a low score due to factors like medical debt or student loans, so it’s important to consider the context.

A credit check will help determine whether an applicant can be trusted to pay rent regularly and maintain good financial habits while living in your rental property.

3. Rental History Check

A rental history check will reveal the applicant’s track record with previous landlords. This information helps verify whether the applicant has been a responsible tenant in the past. Key things to look for include:

- Timeliness of rent payments: If the applicant consistently paid rent on time, it’s a good sign that they will do the same in your rental property.

- Evictions or lease violations: An eviction history may suggest that the applicant has struggled with paying rent or following lease terms in the past.

- Property care: Positive rental history includes taking care of the property and leaving it in good condition when moving out.

4. Eviction History

An eviction history will show whether the applicant has been evicted in the past. Even one eviction may be a red flag, as it could indicate a pattern of non-payment, lease violations, or property damage. However, keep in mind that not all evictions are the same, and a single eviction may not necessarily disqualify a potential tenant if they have explained the circumstances.

5. Employment Verification

Employment verification ensures that the applicant has a stable source of income to pay rent. It is critical to confirm whether the applicant is employed and how much they earn. If an applicant does not have steady employment or a reliable income, it may raise concerns about their ability to meet rent payments.

6. Identity Verification

Finally, identity verification is essential to ensure that the applicant is who they say they are. This process typically involves confirming the individual’s identity through documents like a driver’s license or passport. Accurate identity verification can help prevent fraudulent applications or identity theft.

How to Interpret Background Check Results

When reviewing background check results, it’s important to interpret them carefully and consider the context of the information. For instance, an applicant with a low credit score may still be a good tenant if they can demonstrate a history of paying rent on time and managing other financial responsibilities. Similarly, a past criminal conviction may be less of a concern if it occurred many years ago and the applicant has since demonstrated rehabilitation.

Precise Hire’s Background Check Services for Renters

At Precise Hire, we provide comprehensive and reliable background check services tailored to the needs of landlords and property managers. Our services include access to criminal history, credit reports, eviction history, rental verification, and more, helping you streamline the tenant screening process and make informed decisions. We understand the importance of having trustworthy tenants, and we offer fast, accurate, and compliant background check services to meet your needs.

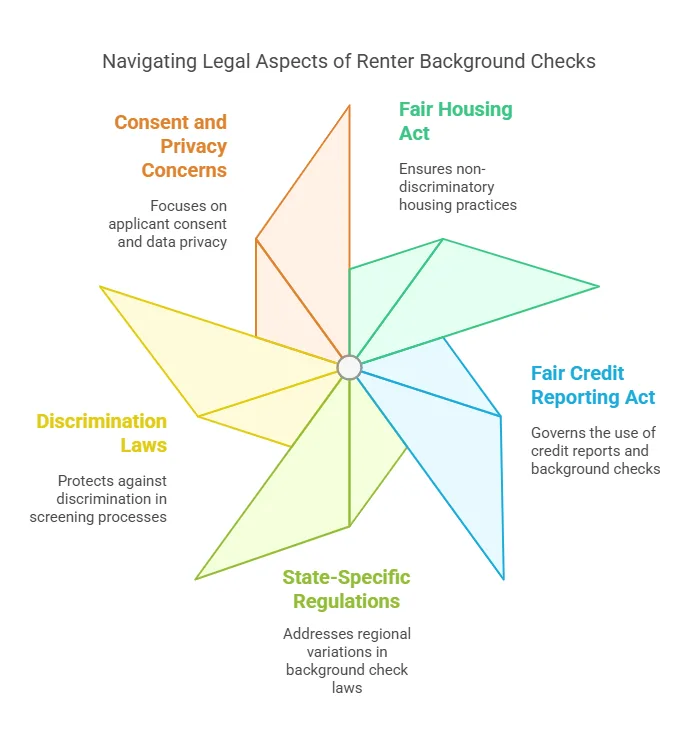

Legal Considerations for Background Checks for Renters

Landlords and property managers must navigate various laws and regulations when conducting background checks. These rules are designed to protect applicants’ privacy and prevent discrimination. Here are some key legal aspects to consider:

1. Fair Housing Act (FHA)

The Fair Housing Act (FHA) is a federal law that prohibits discrimination in housing based on race, color, national origin, religion, sex, familial status, or disability. It also covers housing practices, such as tenant screening, eviction, and lease terms.

When conducting a background check for renters, landlords must ensure that their screening process is consistent for all applicants. For instance, they should not apply different standards to tenants of different races, nationalities, or genders. Background check results should be reviewed impartially, without bias toward protected classes.

While the FHA does not prohibit landlords from using background checks, landlords must ensure that they don’t discriminate against applicants based on protected characteristics. For example, an applicant’s criminal history cannot be used to unfairly exclude someone based on their race or ethnicity.

2. Fair Credit Reporting Act (FCRA)

The Fair Credit Reporting Act (FCRA) governs how background checks and credit reports are used by landlords. Under the FCRA, landlords must obtain written consent from applicants before running a background check. Additionally, if a landlord decides to reject an applicant based on the information in the background check, they must notify the applicant and provide them with a copy of the report.

Some important FCRA requirements include:

- Notice of adverse action: If a landlord chooses not to rent to an applicant based on the results of a background check, the applicant must be informed of the decision. They must also receive a copy of the report and be given an opportunity to dispute any inaccuracies.

- Accuracy of information: Background check providers must ensure that the data they provide is accurate and up-to-date. Landlords must use accurate information to make decisions regarding applicants.

3. State-Specific Regulations

In addition to federal laws, each state may have specific regulations regarding background checks for renters. These laws can vary significantly, so it’s essential for landlords to familiarize themselves with the laws in their state. For example:

- Ban the Box Laws: Some states and municipalities have passed “ban the box” laws, which prohibit landlords from asking about an applicant’s criminal history on the initial rental application. Instead, landlords must wait until later in the process to inquire about criminal records.

- Eviction Record Expungement: Some states allow individuals to expunge or seal certain eviction records after a certain period or under specific circumstances. Landlords must be aware of these rules to avoid using outdated or inaccurate eviction history.

4. Discrimination Laws

Beyond the FHA, several other laws protect applicants from discrimination during the screening process. These include:

- Americans with Disabilities Act (ADA): Landlords must ensure that individuals with disabilities are not discriminated against during the screening process. In some cases, reasonable accommodations must be made for applicants with disabilities.

- Equal Credit Opportunity Act (ECOA): This law prohibits discrimination in rental housing based on race, color, sex, marital status, or age when reviewing credit reports for rental purposes.

To comply with discrimination laws, landlords must ensure that their background check process does not disproportionately exclude individuals from protected classes. For example, if a criminal conviction disproportionately affects people of a particular race or ethnicity, the landlord should evaluate each case individually to ensure fairness.

5. Consent and Privacy Concerns

Another critical legal consideration is the tenant’s privacy. Landlords must ensure that they obtain the applicant’s consent before accessing personal information like credit reports and criminal records. Additionally, the information gathered during the background check must be handled responsibly and securely to prevent data breaches or misuse.

It’s also important for landlords to inform applicants about the type of data being collected and how it will be used. Transparency is crucial to maintaining compliance with privacy laws and building trust with applicants.

Frequently Asked Questions (FAQs) About Background Checks for Renters

To help clarify common concerns, we’ve compiled a list of frequently asked questions about renter background checks. These answers will provide valuable insights for both landlords and potential tenants.

Can a landlord deny a rental application based on a criminal record?

While landlords can consider criminal records during the screening process, they must do so in a fair and consistent manner. The decision should be based on factors such as the nature of the crime, when it occurred, and the applicant's behavior since the conviction. “Ban the Box” laws in some areas may also limit when landlords can inquire about criminal history.

Additionally, landlords must be careful not to discriminate based on race or ethnicity, as certain groups may be disproportionately affected by criminal convictions. Always ensure compliance with the Fair Housing Act (FHA) when reviewing criminal records.

How far back do background checks go for renters?

The scope of a background check depends on the specific service being used. For example:

- Criminal records: Some states limit how far back criminal records can be checked (e.g., up to 7 years), while others allow landlords to review criminal histories without limitations.

- Credit history: Landlords can access credit reports that cover several years of financial activity.

- Rental history: Rental history typically covers the applicant’s past 3–5 years of renting.

The length of time that a landlord can use certain records for screening purposes may be subject to state laws, so it’s important to verify the regulations in your jurisdiction.

Do I need to conduct a background check on every applicant?

While not legally required, conducting background checks on all applicants is highly recommended for landlords to mitigate risks and ensure fair treatment. Screening helps verify an applicant’s financial and rental history, reducing the likelihood of late payments, property damage, or other issues.

If you choose not to run background checks, you may open yourself up to legal liabilities if the tenant engages in problematic behavior that could have been identified through screening.

Can I charge applicants for background checks?

Yes, landlords can charge applicants for the cost of a background check. However, the charge must be reasonable and disclosed in advance. Some jurisdictions have limits on how much landlords can charge for tenant screening, so make sure to check local regulations.

What should I do if a background check reveals inaccurate information?

If a background check reveals inaccurate information, the applicant has the right to dispute it. Under the Fair Credit Reporting Act (FCRA), landlords must inform applicants of any adverse actions based on the background check results, and the applicant can request that the screening provider correct any errors.

How can I ensure my background check process is compliant with the law?

To ensure compliance, follow all federal and state laws regarding background checks. Familiarize yourself with the FCRA, Fair Housing Act, and state-specific regulations. Additionally, always obtain written consent from applicants before conducting any background check, and maintain transparency in your screening process.

Can a landlord deny a rental application based on a criminal record?

While landlords can consider criminal records during the screening process, they must do so in a fair and consistent manner. The decision should be based on factors such as the nature of the crime, when it occurred, and the applicant's behavior since the conviction. “Ban the Box” laws in some areas may also limit when landlords can inquire about criminal history.

Additionally, landlords must be careful not to discriminate based on race or ethnicity, as certain groups may be disproportionately affected by criminal convictions. Always ensure compliance with the Fair Housing Act (FHA) when reviewing criminal records.

How far back do background checks go for renters?

The scope of a background check depends on the specific service being used. For example:

- Criminal records: Some states limit how far back criminal records can be checked (e.g., up to 7 years), while others allow landlords to review criminal histories without limitations.

- Credit history: Landlords can access credit reports that cover several years of financial activity.

- Rental history: Rental history typically covers the applicant’s past 3–5 years of renting.

The length of time that a landlord can use certain records for screening purposes may be subject to state laws, so it’s important to verify the regulations in your jurisdiction.

Do I need to conduct a background check on every applicant?

While not legally required, conducting background checks on all applicants is highly recommended for landlords to mitigate risks and ensure fair treatment. Screening helps verify an applicant’s financial and rental history, reducing the likelihood of late payments, property damage, or other issues.

If you choose not to run background checks, you may open yourself up to legal liabilities if the tenant engages in problematic behavior that could have been identified through screening.

Can I charge applicants for background checks?

Yes, landlords can charge applicants for the cost of a background check. However, the charge must be reasonable and disclosed in advance. Some jurisdictions have limits on how much landlords can charge for tenant screening, so make sure to check local regulations.

What should I do if a background check reveals inaccurate information?

If a background check reveals inaccurate information, the applicant has the right to dispute it. Under the Fair Credit Reporting Act (FCRA), landlords must inform applicants of any adverse actions based on the background check results, and the applicant can request that the screening provider correct any errors.

How can I ensure my background check process is compliant with the law?

To ensure compliance, follow all federal and state laws regarding background checks. Familiarize yourself with the FCRA, Fair Housing Act, and state-specific regulations. Additionally, always obtain written consent from applicants before conducting any background check, and maintain transparency in your screening process.

Conclusion

In conclusion, conducting a background check for renters is an essential step in the tenant screening process. By following the legal guidelines, understanding the key elements of a background check, and interpreting the results fairly, landlords can make informed decisions that protect their property while offering equal opportunities to all applicants.

Moreover, using a reliable background check service like Precise Hire ensures you are gathering accurate information and complying with applicable laws. Background checks help landlords avoid costly mistakes, reduce risks, and build strong, responsible tenant relationships.

By integrating these practices into your rental process, you can foster a safe and successful leasing experience for everyone involved.