Understanding Fintech Identity Verification Key Technologies

Introduction to Fintech Identity Verification

In the fast-paced world of financial technology (fintech), identity verification plays an indispensable role. As fintech companies continue to disrupt traditional financial systems by offering more convenient, faster, and more accessible services, the need for secure and reliable identity verification has never been more critical. This section will explore the concept of fintech identity verification, its importance, the challenges fintech companies face without it, and how it aids in fraud prevention and regulatory compliance.

What Is Fintech Identity Verification?

Fintech identity verification refers to the process of confirming the identity of individuals or entities engaging in transactions or services within the fintech space. This process ensures that only legitimate users are able to access financial services, preventing fraudulent activities such as identity theft, money laundering, and cybercrime.

Unlike traditional financial institutions, fintech companies typically operate online or via mobile applications, which increases the need for advanced digital identity verification tools. These tools allow companies to confirm the identity of their users quickly and securely without the need for physical documentation or in-person interactions.

The primary goal of fintech identity verification is to safeguard both the business and the customers, ensuring that transactions are valid, and individuals are who they say they are.

Why Is Identity Verification Crucial for the Fintech Industry?

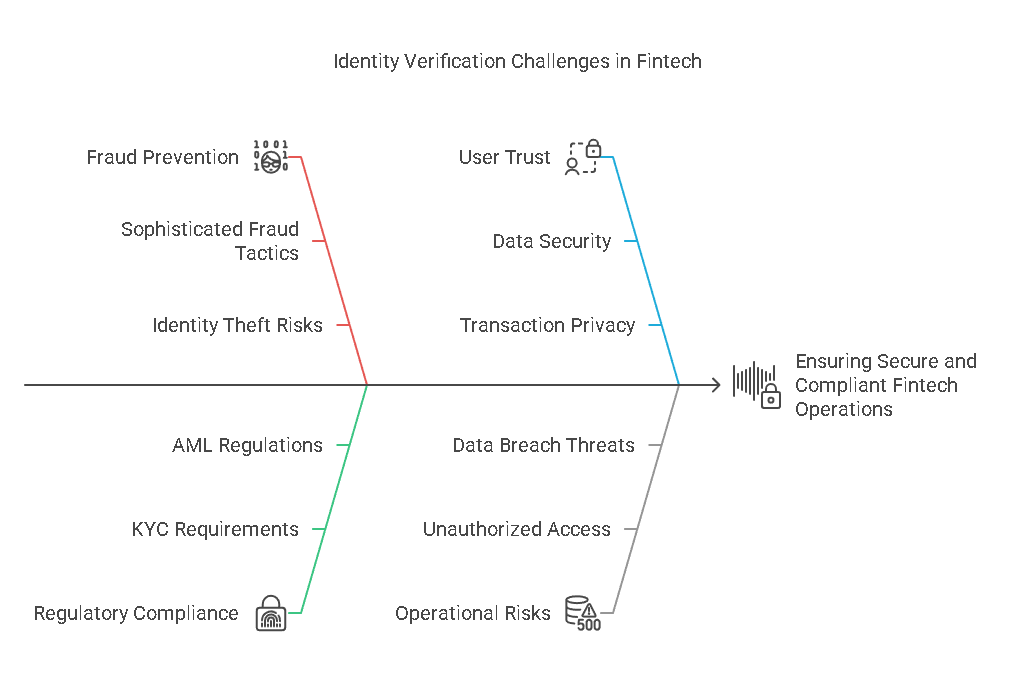

The fintech industry operates in a rapidly evolving digital environment where convenience, speed, and security are paramount. Identity verification serves as the first line of defense against a wide range of financial crimes and operational risks. Here are several key reasons why fintech identity verification is so crucial:

1. Fraud Prevention

Fraud prevention is one of the primary reasons for implementing robust identity verification systems. As fraudsters become more sophisticated in their tactics, fintech companies need advanced tools to verify the identity of users and detect fraudulent activities. Without reliable verification, cybercriminals can easily manipulate digital systems, steal identities, and conduct fraudulent transactions.

2. Regulatory Compliance

Fintech companies must comply with numerous regulations aimed at ensuring the integrity of the financial ecosystem. These regulations often require businesses to verify the identities of their users to prevent financial crimes such as money laundering and terrorist financing. By performing identity verification, fintech companies help safeguard the financial system and ensure compliance with regulations such as Know Your Customer (KYC) and Anti-Money Laundering (AML).

3. Enhancing User Trust

Consumers expect the same level of security and trust when engaging with fintech services as they do with traditional financial institutions. Effective identity verification provides customers with peace of mind, knowing their personal data and financial transactions are protected.

4. Reducing Operational Risks

Financial technology companies handle sensitive customer data and transactions, making them a prime target for hackers. Identity verification systems help mitigate operational risks by preventing unauthorized access to accounts and systems.

5. Enabling Seamless Customer Onboarding

Modern fintech companies aim to make onboarding processes as fast and seamless as possible. By using digital verification methods such as biometric recognition and real-time document verification, companies can offer a smooth experience without compromising security.

Challenges Faced by Fintech Companies Without Proper Identity Verification

While fintech companies aim to make services more accessible and convenient, they also face significant challenges if they lack a reliable identity verification process. These challenges include:

1. Increased Risk of Fraud and Financial Crime

Without proper identity verification, fintech companies are vulnerable to identity theft, account takeovers, and fraudulent transactions. Hackers can easily exploit weak identity verification processes to gain unauthorized access to customer accounts, leading to potential financial losses.

2. Legal Penalties and Compliance Risks

Regulatory frameworks like KYC and AML impose strict requirements on financial institutions, including fintech companies, to verify their customers’ identities. Non-compliance can result in heavy fines, legal action, and reputational damage. Without proper verification measures, fintech businesses may inadvertently violate these laws, leading to significant financial and legal repercussions.

3. Negative Customer Experience

If the identity verification process is inefficient or cumbersome, it can lead to customer frustration and abandonment. Fintech companies must balance stringent security measures with a smooth user experience. Customers may opt for competitors offering easier, quicker services if the verification process is too complex.

4. Increased Operational Costs

Inadequate identity verification can lead to increased costs associated with fraud investigation, chargebacks, and system repairs. Additionally, manual verification processes are resource-intensive and may slow down the overall operations of the fintech company.

5. Loss of Reputation and Trust

In the world of financial services, reputation is everything. If a fintech company becomes associated with data breaches, fraud, or identity theft, customers will quickly lose trust in the platform. Identity verification processes are essential to maintaining a positive reputation and building long-term customer relationships.

The Role of Identity Verification in Preventing Fraud and Ensuring Regulatory Compliance

Fintech identity verification directly contributes to fraud prevention and regulatory compliance, two of the most pressing concerns in the industry.

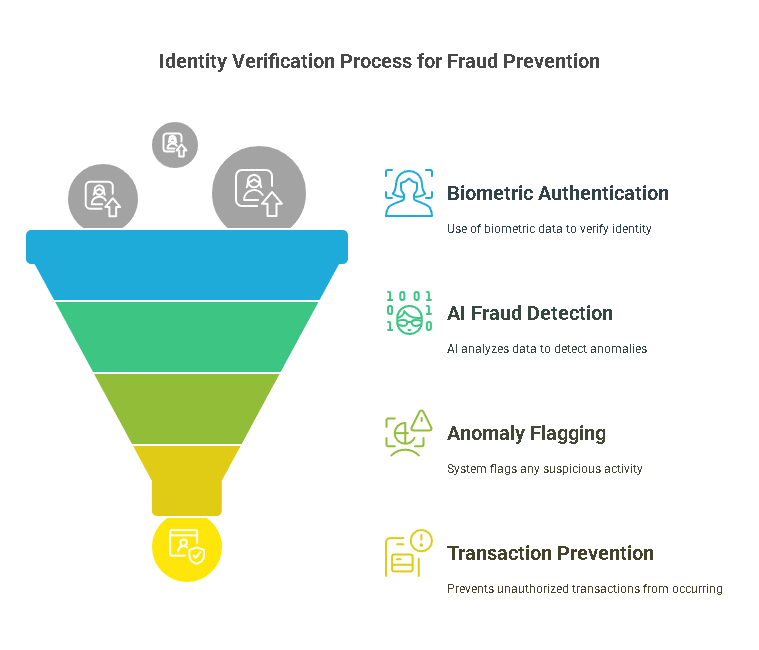

Fraud Prevention

Fraudsters continuously adapt their tactics, making it increasingly difficult to detect fraudulent behavior. Modern identity verification methods, such as biometric authentication and AI-powered fraud detection, enable fintech companies to stay ahead of fraudsters. These technologies can identify suspicious activity, flag anomalies, and prevent unauthorized transactions from occurring.

For example, facial recognition or fingerprint scans help ensure that the individual requesting access is the legitimate account holder, making it much harder for fraudsters to impersonate others. By implementing these technologies, fintech companies can significantly reduce the chances of fraud.

Regulatory Compliance

Fintech companies must adhere to a variety of laws and regulations to avoid financial crimes. Key regulations such as KYC and AML require businesses to verify the identity of their customers and report suspicious activities to authorities. Failure to comply with these regulations can result in hefty fines, penalties, and even the loss of operating licenses.

By implementing effective identity verification systems, fintech companies can ensure they meet regulatory requirements and avoid the legal risks associated with non-compliance.

AML and KYC

- KYC (Know Your Customer): This process requires fintech companies to verify the identity of their customers during onboarding. KYC aims to ensure that companies do not unknowingly facilitate money laundering or other illicit activities.

- AML (Anti-Money Laundering): AML regulations require businesses to monitor and report transactions that may involve illegal activities, such as money laundering or terrorism financing. Proper identity verification helps ensure that only legitimate customers can access financial services, preventing fraudulent transactions.

The Process of Fintech Identity Verification and Tools

The process of fintech identity verification is complex, involving multiple stages and technologies. In this section, we will provide a detailed explanation of how fintech identity verification works, the technologies that make it possible, and the tools that are essential for businesses in this space. Additionally, we’ll discuss how Precise Hire offers solutions to help businesses stay compliant and secure while enhancing user experience.

How Does Fintech Identity Verification Work?

Fintech identity verification is a multi-step process that typically includes several layers of verification to ensure the authenticity of the individual or entity involved in a transaction. The process can be broken down into three primary stages:

1. Document Verification

Document verification is the initial step where users provide valid identification documents (e.g., passport, driver’s license, or national ID). These documents are then scanned or photographed using the fintech app or website. Automated systems, powered by artificial intelligence (AI), are employed to read the document’s information and verify its authenticity.

AI systems can analyze the text on the document, cross-check it against global databases, and detect any anomalies or signs of tampering. For example, the system may check for expired documents or compare the applicant’s photo with known fraud databases.

2. Biometric Authentication

The second step in fintech identity verification often involves biometric authentication. Biometric verification is based on unique physical traits, such as fingerprints, facial features, or iris scans. This method is becoming increasingly popular in the fintech industry because it provides an added layer of security beyond traditional passwords or PINs.

Facial recognition is one of the most common biometric techniques used in fintech identity verification. In this process, the user’s face is compared to the photo on their ID, ensuring they match. AI algorithms are used to analyze key facial features and ensure there are no discrepancies. Biometric verification is especially useful for remote identity verification and is more accurate than text-based methods alone.

3. Liveness Detection

Liveness detection is a critical feature that ensures the biometric data submitted is from a live person, not a photo or a video. This method is used to prevent fraudsters from using stolen images or videos to impersonate others. During the verification process, users may be asked to perform certain actions, such as blinking, smiling, or rotating their head. This helps confirm that the biometric data comes from a real person.

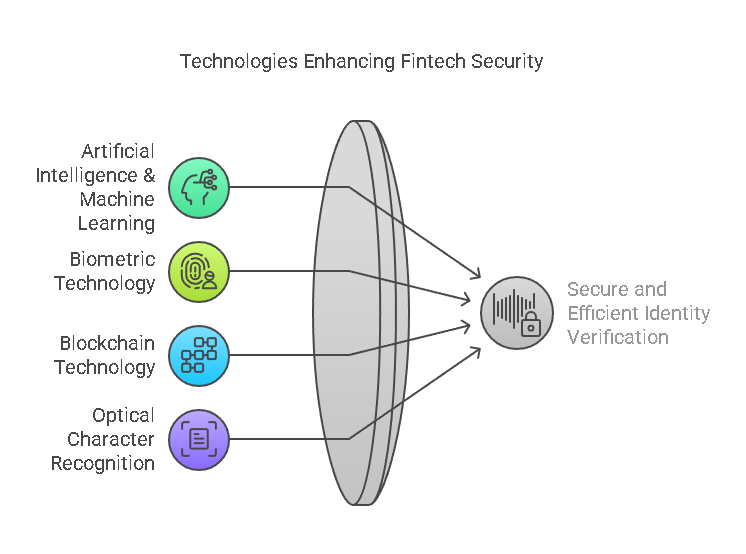

Technologies Behind Fintech Identity Verification

Several advanced technologies are used in fintech identity verification, ensuring that the process is secure, reliable, and compliant with industry standards. Let’s take a closer look at some of the key technologies:

1. Artificial Intelligence (AI) and Machine Learning (ML)

AI and machine learning algorithms play an essential role in fintech identity verification by analyzing vast amounts of data and detecting patterns. These technologies are used to verify the authenticity of documents, flag fraudulent activities, and make the verification process more efficient. For example, AI systems can quickly compare user-provided documents against government-issued IDs in real-time and flag any inconsistencies.

AI-driven fraud detection systems can also analyze transaction histories, customer behaviors, and other data to predict the likelihood of fraud. If the system detects unusual patterns (e.g., a sudden change in spending habits), it can trigger an alert for further investigation.

2. Biometric Technology

Biometric verification systems rely on unique physical or behavioral traits to authenticate users. There are several types of biometric technology used in fintech identity verification:

- Facial Recognition: Uses algorithms to match the user’s face to their official identification photo.

- Fingerprint Scanning: Analyzes the unique patterns on a person’s fingertips.

- Voice Recognition: Identifies users based on the uniqueness of their voice.

- Iris Scanning: Uses the unique pattern in a person’s iris to verify identity.

These biometric technologies make it harder for fraudsters to impersonate legitimate customers, offering a higher level of security than traditional methods.

3. Blockchain Technology

Blockchain technology has also found its way into fintech identity verification. Blockchain offers a decentralized and immutable ledger where personal data can be stored securely. Because blockchain ensures that no one can tamper with the data once it has been entered, it is an excellent choice for storing sensitive information related to identity verification.

For example, a blockchain-based system can store a user’s verified identity data in a way that allows only authorized parties to access it. This prevents data breaches and ensures that personal information is protected from unauthorized use.

4. Optical Character Recognition (OCR)

OCR is a technology used to extract data from physical documents. During identity verification, OCR systems scan documents such as driver’s licenses, passports, and utility bills to extract relevant information (e.g., names, dates of birth, addresses) and compare it against the data entered by the user. OCR ensures that the process is efficient, reducing manual intervention and minimizing errors.

Precise Hire’s Role in Fintech Identity Verification

At Precise Hire, we understand the critical role of identity verification in the fintech sector. Our advanced solutions combine cutting-edge technologies to offer seamless, secure, and compliant identity verification services. Whether you need to verify a user’s identity during onboarding or conduct ongoing monitoring, our platform can help you meet regulatory requirements and reduce the risk of fraud.

We specialize in integrating biometric authentication, document verification, and AI-powered fraud detection into a single solution. Our tools are designed to provide a smooth user experience while ensuring high levels of security and compliance with KYC and AML regulations.

Popular Tools and Methods for Fintech Identity Verification

Below is a summary of some of the most widely used tools and methods for fintech identity verification:

| Verification Method | Description | Popular Tools |

|---|---|---|

| Document Verification | Verifies the authenticity of government-issued IDs using AI-driven systems. | Jumio, Onfido, Shufti Pro |

| Facial Recognition | Uses AI to compare the user’s face with the photo on their official ID. | Face++ (by Megvii), BioID, TrueFace |

| Fingerprint Scanning | Scans the unique patterns on a person’s fingertips to verify identity. | IDEX Biometrics, Veridium, Fingerprint Cards |

| Voice Recognition | Uses voice patterns to authenticate users during phone or voice-based transactions. | Nuance, Pindrop, Verint |

| Blockchain-based Identity | Leverages the security and decentralization of blockchain to store and verify identity data. | Civic, SelfKey, uPort |

| Liveness Detection | Prevents fraud by ensuring that the user is physically present during the verification process. | BioID, FaceTec, iProov |

Legal Aspects, FAQs, and Conclusion

In this final section, we will explore the legal and regulatory aspects of fintech identity verification, answer some frequently asked questions, and provide a conclusion that emphasizes the importance of robust identity verification for fintech businesses. As the fintech industry continues to evolve, businesses must remain compliant with regulations and stay ahead of fraud prevention to ensure secure operations.

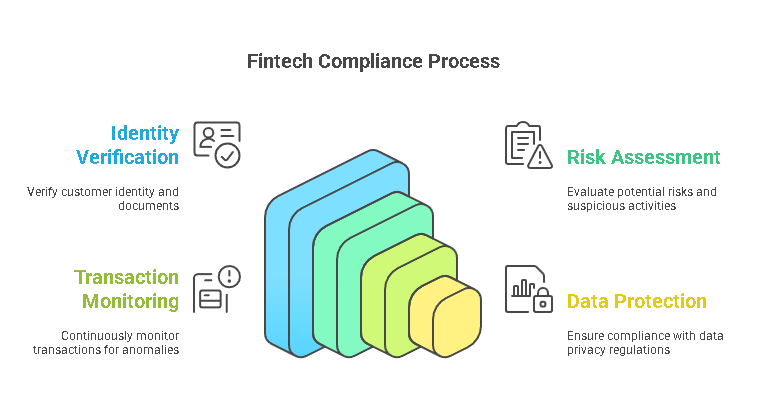

Legal and Regulatory Frameworks Surrounding Fintech Identity Verification

Fintech companies must comply with a range of laws and regulations designed to ensure the legitimacy of financial transactions and prevent crimes such as money laundering, fraud, and terrorist financing. Identity verification plays a pivotal role in achieving compliance with these laws, which vary by jurisdiction. Below are the key legal and regulatory frameworks that impact fintech identity verification:

1. Know Your Customer (KYC)

KYC is a fundamental regulatory requirement for all financial institutions, including fintech companies. The primary goal of KYC is to prevent fraud, money laundering, and terrorist financing by ensuring that companies know their customers and their financial activities. KYC procedures involve collecting detailed information about customers, including their identity, address, and the nature of their financial activities.

Fintech companies must verify the identities of their customers at the onboarding stage and sometimes throughout the customer relationship. This can include providing government-issued identification documents, verifying addresses, and even validating the source of funds.

Key KYC regulations vary by country, but the general requirements remain consistent. KYC regulations require fintech companies to:

- Collect and verify customer identity information.

- Screen customers for potential risks or suspicious activities.

- Maintain records for compliance reporting.

By adhering to KYC regulations, fintech companies can reduce the risk of fraud and ensure they are not unknowingly facilitating criminal activities.

2. Anti-Money Laundering (AML)

AML regulations are designed to combat money laundering and the financing of terrorism. AML laws require businesses, including fintech companies, to take measures to detect, report, and prevent suspicious transactions that may involve illicit funds. This includes not only verifying customer identities but also continuously monitoring their transactions to identify unusual behavior.

Fintech companies need to establish robust AML compliance programs that include:

- Regular screening of customers and transactions for any signs of money laundering.

- Reporting suspicious activities to the relevant authorities, such as the Financial Intelligence Unit (FIU).

- Implementing transaction monitoring systems that flag activities like rapid fund transfers or large cash deposits.

Effective AML measures help ensure that fintech businesses comply with global financial regulations and maintain the integrity of their services.

3. General Data Protection Regulation (GDPR)

For fintech companies operating in the European Union (EU), GDPR is another critical legal framework that regulates the collection and storage of personal data. GDPR ensures that personal data, including identity information, is handled with the utmost care, privacy, and security. This regulation mandates that companies obtain explicit consent from individuals before collecting their personal information and requires them to implement strict data protection measures.

Fintech companies must:

- Obtain clear consent from users for collecting and processing their identity data.

- Provide users with rights to access, correct, and erase their personal data.

- Ensure that personal data is securely stored and protected from unauthorized access.

Non-compliance with GDPR can result in significant fines, making it essential for fintech businesses to align their identity verification processes with privacy standards.

4. The Financial Action Task Force (FATF) Guidelines

The FATF is an intergovernmental body that sets international standards for combating money laundering and the financing of terrorism. While FATF does not have the power to enforce laws, its recommendations influence the legal frameworks of many countries. Fintech companies are expected to comply with FATF guidelines, which include ensuring effective KYC and AML practices.

The FATF guidelines provide a framework for countries to adopt effective measures in preventing financial crimes. By complying with FATF standards, fintech companies not only protect their reputation but also contribute to the global effort to combat financial crime.

Frequently Asked Questions (FAQs) About Fintech Identity Verification

What is the difference between KYC and AML in fintech identity verification?

KYC (Know Your Customer) is a process used to verify the identity of a customer, ensuring that they are who they claim to be. It typically involves collecting personal information, verifying documents, and performing checks against databases for fraud detection.

AML (Anti-Money Laundering), on the other hand, involves monitoring transactions for suspicious activity and reporting potential money laundering or terrorist financing. While KYC is focused on verifying a customer's identity, AML is about ensuring that a customer’s transactions do not involve illegal activities. Both are critical in fintech identity verification.

What technologies are used in fintech identity verification?

Several technologies are used to verify identities in the fintech industry:

- Biometric authentication (e.g., facial recognition, fingerprint scanning).

- Document verification using AI-powered tools to check the authenticity of identity documents.

- Artificial Intelligence (AI) and Machine Learning (ML) to detect fraud patterns and analyze customer behavior.

- Blockchain technology for secure and immutable identity storage.

- Optical Character Recognition (OCR) to extract and verify information from physical documents.

How does fintech identity verification prevent fraud?

Fintech identity verification prevents fraud by ensuring that only legitimate users can access financial services. Through technologies like biometric authentication, document verification, and AI fraud detection, fintech companies can verify the identities of their users, flag suspicious activities, and prevent unauthorized access. Liveness detection further adds to security by ensuring that the identity verification process involves a live person, not a stolen image.

How long does it take to verify an identity in fintech?

The time required for identity verification in fintech depends on the methods used and the tools employed by the fintech company. Traditional methods may take longer, involving manual verification of documents. However, with modern AI-powered tools and biometric verification, the process can be completed in real-time or within a few minutes.

What happens if a user fails identity verification?

If a user fails identity verification, they may be denied access to the fintech service. This is typically the case when discrepancies are found in the documents provided or if there is a mismatch between biometric data. In some cases, users may be asked to submit additional documentation or reattempt the verification process. Failure to successfully verify identity may also lead to account suspension or the cancellation of the service.

Conclusion

In today’s fast-paced digital economy, fintech companies must prioritize identity verification to ensure security, compliance, and trust. Robust identity verification systems are crucial in preventing fraud, ensuring regulatory compliance, and safeguarding the integrity of financial transactions. As the fintech industry grows, the role of identity verification will only become more significant in protecting both businesses and their customers.

The legal frameworks, advanced technologies, and tools discussed in this article highlight the complex nature of fintech identity verification and the steps companies must take to ensure a secure environment for their users. By embracing innovative solutions and staying compliant with industry regulations, fintech companies can build a foundation of trust and security that fosters long-term success in the marketplace.

At Precise Hire, we are committed to offering cutting-edge identity verification solutions that help fintech businesses navigate the challenges of fraud prevention and regulatory compliance. By implementing the latest technologies, we ensure that companies can focus on growth while maintaining secure and compliant operations.