Understanding Digital Identity Verification Benefits

What is Digital Identity Verification and Why Is It Important?

In today’s increasingly digital world, the need to verify a person’s identity online has never been more critical. Digital identity verification refers to the process of confirming that a person is who they claim to be when interacting with online services. With more transactions and personal interactions taking place over the internet, digital identity verification has become a cornerstone of cybersecurity, fraud prevention, and customer trust.

What is Digital Identity Verification?

Digital identity verification is a process that uses various technologies and methods to confirm a person’s identity in digital environments. Unlike traditional methods, such as physical IDs or in-person checks, digital verification occurs online, enabling businesses to authenticate users remotely without requiring face-to-face interaction. This process is commonly used by businesses, governments, and other organizations to ensure that their users are legitimate, authorized, and secure. Digital identity verification typically involves several layers of security, ranging from simple username and password combinations to more sophisticated biometrics and document scanning technologies. The goal is to protect sensitive information, prevent fraud, and ensure that the person accessing a service is the one they claim to be.

Why Is Digital Identity Verification Important?

As we move further into the digital age, the risk of identity theft and online fraud continues to rise. Cybercriminals are becoming more adept at stealing personal information, and traditional security measures, such as passwords, are no longer sufficient to protect against these threats. This is where digital identity verification becomes crucial.

- Preventing Fraud: With more financial transactions taking place online, businesses must ensure that the person making a purchase or accessing services is authorized. Digital identity verification helps mitigate the risk of fraudulent activity by ensuring the integrity of the user’s identity.

- Enhancing Security: By utilizing advanced technologies like biometrics, document verification, and AI-based systems, digital identity verification provides an additional layer of protection against cyber threats. This makes it harder for malicious actors to access sensitive data or engage in fraudulent activities.

- Streamlining User Experience: Digital identity verification improves the online user experience by allowing for faster, more efficient authentication. Instead of relying on traditional methods, users can verify their identity with a few clicks or scans, saving time and effort for both parties involved.

- Compliance with Regulations: In many industries, digital identity verification is required to comply with regulations and laws, such as Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. This helps businesses meet legal standards while reducing the risk of penalties for non-compliance.

- Building Trust with Customers: Digital identity verification helps businesses build trust with their customers. By providing secure, seamless verification methods, companies can foster confidence in their digital platforms, leading to higher customer satisfaction and loyalty.

The Growing Need for Digital Identity Verification

The demand for digital identity verification is growing rapidly across a variety of sectors. As digital services expand, consumers expect more convenience, security, and transparency. At the same time, organizations need to protect their platforms from misuse. Digital identity verification plays a vital role in striking the balance between ease of use and robust security. As cybercrime becomes more sophisticated and regulations tighten, businesses are increasingly turning to digital identity verification solutions to meet these challenges. Whether it’s for online banking, e-commerce, or healthcare services, identity verification is an essential component of securing digital interactions.

How Does Digital Identity Verification Work? Methods and Technologies Explained

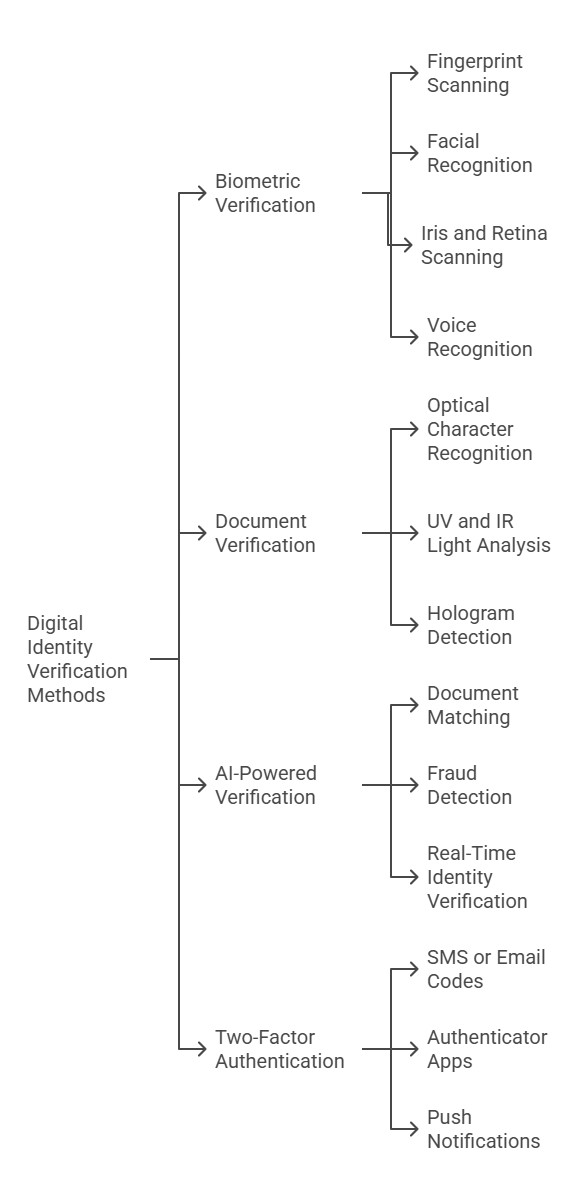

Digital identity verification uses various technologies and methods to confirm a person’s identity in a secure and efficient manner. From biometric scanning to artificial intelligence-powered systems, each method is designed to meet different security, convenience, and regulatory requirements. Below, we explore the primary methods used in digital identity verification and how they work.

Key Methods Used in Digital Identity Verification

Digital identity verification methods can be categorized into several key types, each offering unique advantages and use cases.

1. Biometric Verification

Biometric verification uses an individual’s unique physical or behavioral characteristics to confirm their identity. It is one of the most secure methods of identity verification because biometric traits are difficult to replicate or steal. The common types of biometric methods used are:

- Fingerprint Scanning: This method involves capturing the fingerprint of the individual and matching it with a stored database of authorized fingerprints.

- Facial Recognition: This technique uses cameras or smartphone front-facing cameras to scan and analyze facial features, then compares them to a stored image or database.

- Iris and Retina Scanning: Scanning the unique patterns in the eye provides a highly accurate and difficult-to-replicate biometric identifier.

- Voice Recognition: This method uses voice patterns, such as tone, pitch, and accent, to verify a person’s identity.

Benefits of Biometrics:

- Provides high security due to the uniqueness of biometric traits.

- Offers a seamless and user-friendly verification process.

- Difficult for fraudsters to replicate.

2. Document Verification

Document verification involves scanning and verifying government-issued identification documents, such as driver’s licenses, passports, and national ID cards. This method confirms that the document provided is authentic and belongs to the person submitting it.

- Optical Character Recognition (OCR): OCR technology scans the document and extracts text, such as the person’s name, birthdate, and identification number.

- UV and IR Light Analysis: Documents are scanned under ultraviolet (UV) or infrared (IR) light to detect hidden security features like watermarks or microtext.

- Hologram Detection: Holographic images embedded in documents are verified using specialized technology to ensure their authenticity.

Benefits of Document Verification:

- Can be performed remotely, requiring only a camera or smartphone.

- Works with a wide variety of identification documents.

- Provides a straightforward and familiar method of identity verification.

3. AI-Powered Verification

Artificial intelligence (AI) is increasingly used to enhance digital identity verification systems by automating complex verification tasks, detecting fraud, and ensuring real-time identity matching. AI technologies like machine learning and deep learning help analyze large sets of data to identify patterns and anomalies.

- Document Matching: AI systems can compare images of documents provided by users to images in secure databases for accuracy.

- Fraud Detection: AI can monitor behavioral patterns, such as login times, IP addresses, and typing speeds, to detect potential fraud.

- Real-Time Identity Verification: AI-powered systems can cross-check user data with external sources, such as government or financial institution databases, instantly.

Benefits of AI-Powered Verification:

- Offers fast and efficient data processing.

- Continuously improves and adapts through machine learning.

- Provides real-time, dynamic verification to ensure accuracy.

4. Two-Factor Authentication (2FA)

Two-factor authentication (2FA) is an additional security layer often used in conjunction with other methods to verify a user’s identity. This requires users to present two forms of verification: something they know (e.g., a password) and something they have (e.g., a mobile device or security token).

- SMS or Email Codes: A temporary code is sent to the user’s phone or email address, which they must enter to complete the verification process.

- Authenticator Apps: Apps like Google Authenticator generate time-sensitive codes that users input along with their password.

- Push Notifications: Users receive a notification on their mobile device asking them to approve or deny a login attempt.

Benefits of 2FA:

- Adds an extra layer of security without requiring sophisticated technology.

- Easy for users to understand and use.

- Significantly reduces the risk of unauthorized access.

Comparing the Different Methods of Digital Identity Verification

| Method | Technology Used | Security Level | User Experience | Use Cases |

|---|---|---|---|---|

| Biometrics | Fingerprint, Facial, Voice | Very High | Seamless, fast | Banking, Secure Logins |

| Document Verification | OCR, UV/IR Light Analysis | High | Easy to perform | Online Sign-ups, KYC |

| AI-Powered Verification | Machine Learning, Deep Learning | High | Fast, efficient | Fraud Detection, Real-time Verification |

| Two-Factor Authentication | SMS/Email, Authenticator Apps | Moderate | Simple, fast | Banking, Sensitive Applications |

These methods of digital identity verification are designed to offer businesses and users the highest levels of security and convenience, ensuring both parties can trust digital transactions and online interactions. Each method has its unique strengths, and the right one for a business depends on factors like the level of security required, regulatory compliance, and user preferences.

Why Precisehire Stands Out Among Competitors

Small landlords often face unique challenges, such as limited resources and time constraints. Precisehire is specifically designed to address these challenges, offering a blend of affordability, comprehensive reporting, and ease of use. Unlike other platforms that cater primarily to large property management companies, Precisehire focuses on the needs of individual landlords and small-scale operations.

FAQs, Best Practices, and Conclusion on Digital Identity Verification

As digital identity verification becomes a critical tool for businesses and consumers alike, it’s important to understand the common questions and best practices for utilizing this technology. This section addresses frequently asked questions, provides actionable best practices for businesses and individuals, and wraps up with key takeaways.

Frequently Asked Questions about Digital Identity Verification

How Secure is Digital Identity Verification?

Digital identity verification can be extremely secure, depending on the methods used. For example:

- Biometrics such as facial recognition and fingerprint scans are difficult to replicate, providing high levels of security.

- Document verification using advanced technologies, including OCR and UV/IR light analysis, helps confirm the authenticity of documents.

- AI-powered systems analyze patterns to detect fraud in real-time, offering an additional layer of security. When multiple methods (such as biometrics combined with two-factor authentication) are used, digital identity verification offers robust protection against fraud and unauthorized access.

What Are the Benefits of Digital Identity Verification for Businesses and Consumers?

Digital identity verification benefits both businesses and consumers in several ways:

- For Businesses:

- Reduced fraud: By ensuring that users are who they claim to be, businesses can significantly lower the risk of fraud.

- Compliance: Many industries require strict regulatory adherence, such as Know Your Customer (KYC) and Anti-Money Laundering (AML), which digital identity verification helps achieve.

- Operational efficiency: Automating identity verification speeds up processes like onboarding and transactions, increasing overall productivity.

- For Consumers:

- Convenience: Quick and easy identity verification from anywhere, anytime, makes processes such as signing into accounts or approving transactions seamless.

- Privacy: Many systems use biometric data without storing excessive personal information, ensuring better privacy for consumers.

- Security: Advanced verification methods make it harder for hackers to impersonate legitimate users.

What Industries Use Digital Identity Verification the Most?

Several industries rely heavily on digital identity verification to ensure secure transactions and meet regulatory standards:

- Banking and Financial Services: To meet KYC and AML regulations, verify online transactions, and protect customers from financial fraud.

- E-Commerce and Retail: For verifying customers making purchases, especially for high-value items, or during payment transactions.

- Healthcare: To safeguard access to sensitive medical records and comply with data protection laws.

- Telecommunications: To verify customer identities when activating services or making changes to accounts.

- Government Services: To authenticate citizens for tax filing, voting, and accessing other government services.

What Are the Key Considerations When Choosing a Digital Identity Verification Service?

When selecting a digital identity verification provider, businesses should consider:

- Security and compliance: Ensure that the service complies with industry regulations and provides top-notch security for data protection.

- Ease of integration: The service should seamlessly integrate with your existing systems (e.g., CRM or payment gateways).

- Customer support: Look for providers that offer robust customer support to resolve any issues quickly.

- Scalability: Ensure the solution can scale as your business grows.

How Can Consumers Protect Their Digital Identity?

For consumers using digital identity verification, here are some tips:

- Avoid suspicious links: Only engage with trusted platforms to avoid phishing attempts.

- Update your data regularly: Keep your documents and biometric data up-to-date to avoid delays.

- Use strong passwords: Enable two-factor authentication (2FA) and use strong, unique passwords to enhance security.

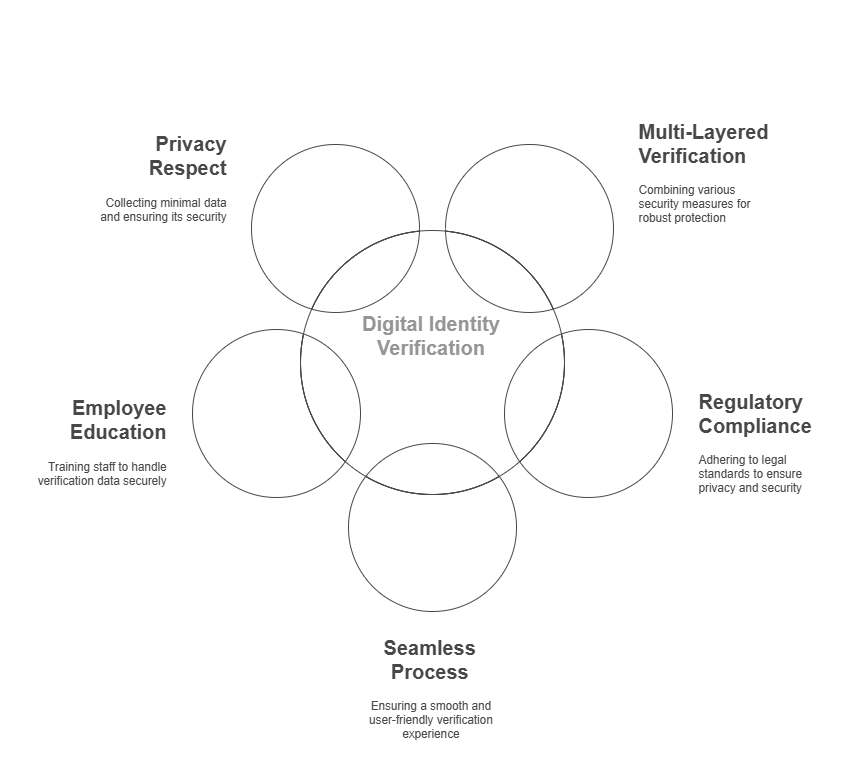

Best Practices for Digital Identity Verification

For Businesses:

- Implement Multi-Layered Verification: Combine biometric verification, document scanning, and AI-powered fraud detection to ensure maximum security.

- Ensure Compliance with Regulations: Stay updated on the latest regulations like GDPR and KYC to avoid potential legal issues.

- Make the Process Seamless: The verification process should be fast and user-friendly to avoid customer frustration.

- Educate Employees: Ensure that staff is trained on how to handle verification data securely and efficiently.

- Respect Privacy: Only collect and store necessary data, and ensure all information is securely encrypted.

For Consumers:

- Be Mindful of Data Requests: Only provide personal information to trusted services and companies.

- Review Security Settings: Regularly update privacy settings and use additional security features, like 2FA, when possible.

- Monitor Your Accounts: Keep an eye on your digital accounts and report any suspicious activity immediately.

Conclusion

Digital identity verification is essential in today’s digital landscape, offering security, convenience, and efficiency for both businesses and consumers. By adopting the right technologies, following best practices, and understanding the benefits and limitations, businesses can protect their customers and ensure compliance, while consumers can enjoy safer and more convenient digital experiences. As the need for secure online interactions continues to grow, digital identity verification will play an increasingly important role in shaping the future of online transactions and identity management.