Top Reasons to Use Level 3 Background Check

Introduction to Level 3 Background Checks

Background checks are a standard part of the hiring process in many industries, ensuring that potential employees are reliable, trustworthy, and qualified for the positions they apply for. Level 3 background checks are among the most comprehensive types of background screening, often used for roles that require a higher degree of security, responsibility, or trustworthiness. This article explores what a Level 3 background check entails, how it differs from other background check levels, and the industries or roles that require this in-depth screening.

What is a Level 3 Background Check?

A Level 3 background check is an advanced and thorough screening process that verifies an individual’s history in several key areas, including criminal activity, employment history, credit history, and references. This level of background check is typically reserved for positions that involve significant responsibilities, such as those in the financial industry, government agencies, or other roles that require high-level security clearances.

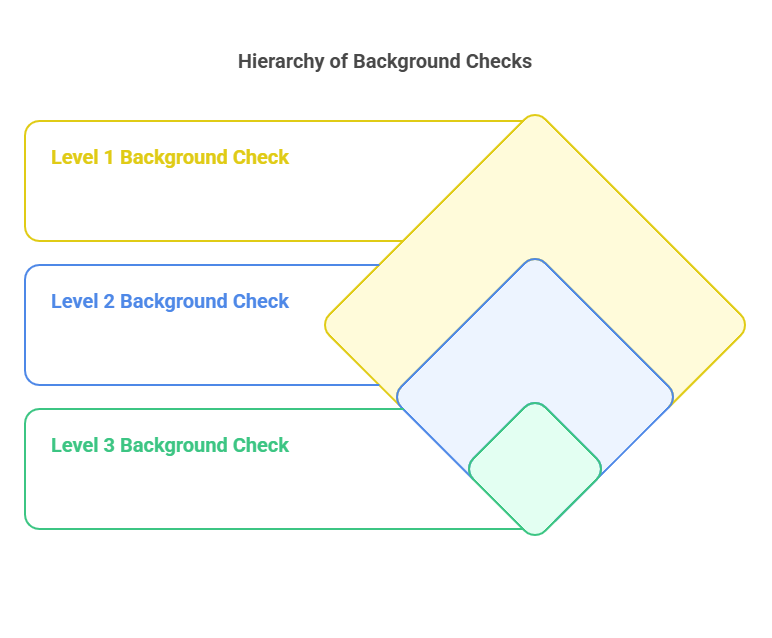

While Level 1 and Level 2 background checks are more basic and may focus on criminal records or minimal verification checks, a Level 3 background check provides a deeper look into a candidate’s background. It ensures that an individual meets the high standards required for certain sensitive roles, especially in industries where trust, confidentiality, and security are paramount.

Differences Between Level 3 and Other Types of Background Checks

Background checks are commonly categorized into different levels, with each level corresponding to the scope and depth of the screening process. Below is a comparison table outlining the differences between Level 1, Level 2, and Level 3 background checks:

| Background Check Level | Scope | Common Checks Involved | Typically Required For |

|---|---|---|---|

| Level 1 | Basic background check | Criminal records, basic identity verification, and employment verification. | Entry-level jobs, general workforce positions. |

| Level 2 | Intermediate background check | Criminal records, employment history, driving records (for certain jobs). | Mid-level jobs, positions with public contact. |

| Level 3 | Comprehensive, in-depth background check | Criminal records, credit history, employment history, reference checks, education verification, drug testing (if required). | High-security or high-responsibility roles (government, financial, healthcare, etc.). |

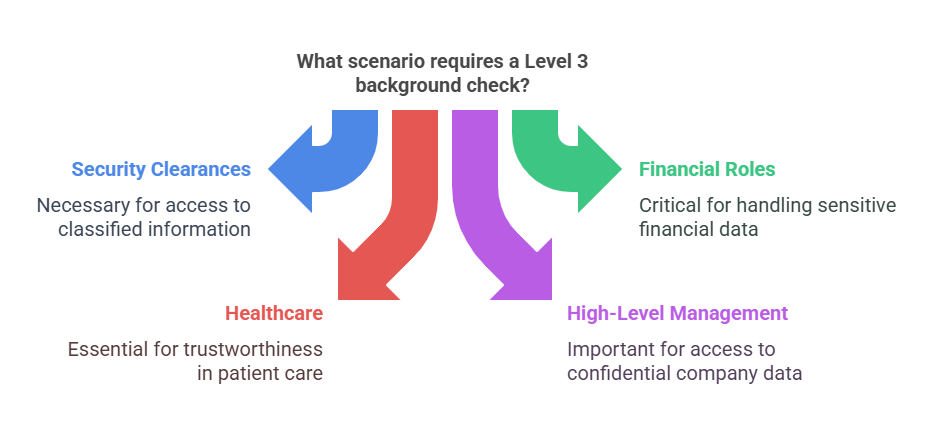

When and Why Level 3 Background Checks are Required

Level 3 background checks are necessary for positions that require a higher level of scrutiny, often due to the nature of the job and the degree of responsibility. These checks are common in industries or positions that deal with sensitive information, high-level security clearance, or significant financial responsibilities.

Common Scenarios for Level 3 Background Checks

- Security Clearances: Individuals applying for positions with a government agency or contractor that require access to classified information.

- Financial Roles: Jobs in banking, investment firms, or any position that involves handling large sums of money or sensitive financial data.

- Healthcare: Positions in healthcare settings, such as doctors, nurses, or administrators, where trustworthiness and integrity are critical to patient care.

- High-Level Management: Executive roles that require access to confidential company data and decision-making authority.

- Legal and Law Enforcement: Lawyers, paralegals, and law enforcement officers must undergo thorough checks due to their access to sensitive legal information and involvement in the justice system.

In each of these scenarios, a Level 3 background check provides employers with a more comprehensive understanding of a candidate’s history, helping them assess the risks involved in hiring that individual for a particular role.

Components of a Level 3 Background Check

A Level 3 background check generally includes the following components:

1. Criminal History

A Level 3 check includes an in-depth search of national, state, and local criminal databases to identify any past criminal convictions. It may cover a broader range of offenses than lower-level checks, including felonies, misdemeanors, and even arrest records (depending on the laws of the state).

2. Credit Report

Many Level 3 checks also involve a review of the candidate’s credit history. This is especially important for positions that involve financial responsibilities. A credit report can provide insight into the candidate’s financial responsibility, habits, and potential red flags like bankruptcies, delinquencies, or fraud.

3. Employment Verification

An employment history check is a standard part of a Level 3 background check. Employers want to confirm that candidates have the experience they claim to have. This includes verifying job titles, employment dates, and roles held at previous companies.

4. Education Verification

In addition to verifying employment history, a Level 3 background check typically includes education verification. This ensures that the candidate holds the degrees and certifications they claim to possess, which is essential for roles that require specific educational qualifications.

5. Reference Checks

Contacting references is a critical step in Level 3 background checks. Employers want to confirm the candidate’s work ethic, reliability, and professionalism from people who have directly worked with the individual. This can provide an additional layer of insight into the candidate’s character.

6. Drug Testing (If Required)

Certain industries or positions may require drug testing as part of a Level 3 background check. This is common for positions where safety and reliability are paramount, such as in transportation, healthcare, or high-security environments.

7. Social Media and Online Presence

In some cases, a Level 3 background check might also include an investigation of the candidate’s social media activity or online presence. Employers may review publicly available information to assess whether the candidate’s behavior and values align with the company’s policies and culture.

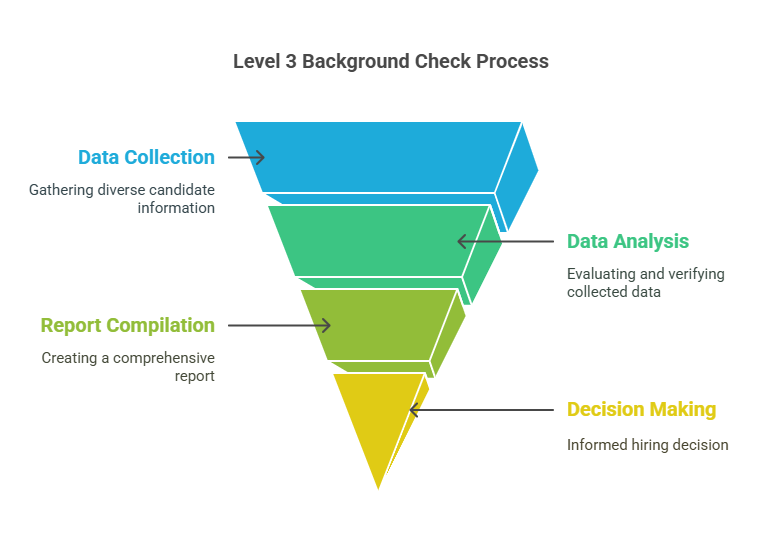

How a Level 3 Background Check is Conducted

The process of conducting a Level 3 background check is more involved than lower-level checks, as it requires accessing a wide variety of data sources and verifying a candidate’s history in multiple areas. Here’s an overview of the steps involved:

Step 1: Obtain Consent

Before initiating a Level 3 background check, the employer or organization must first obtain explicit consent from the candidate. This is a legal requirement under the Fair Credit Reporting Act (FCRA). The candidate must be informed that a background check will be conducted and must agree to the screening process in writing.

Failure to obtain consent could result in legal issues for the employer, including penalties and disputes. Candidates are also entitled to a copy of the report if it is used to make an adverse decision, such as denying employment.

Step 2: Gather Information

Once consent is granted, the employer or third-party background screening provider will begin gathering data from various sources. The types of data collected depend on the components of the Level 3 background check, but typically include:

- Criminal History: A detailed search of local, state, and national criminal databases is conducted to identify any relevant criminal convictions, pending charges, or arrest records.

- Credit Report: If relevant to the position, a credit report is obtained, detailing the candidate’s credit history, including any bankruptcies, credit card debt, or other financial information.

- Employment History: Employers will verify job history by contacting past employers and confirming dates of employment, job titles, and performance.

- Education Verification: Educational institutions are contacted to verify the degrees and certifications listed by the candidate.

- Reference Checks: Professional references provided by the candidate are contacted to assess their work ethic, skills, and character.

Step 3: Data Analysis and Report Compilation

Once the necessary data has been gathered, the screening provider or employer compiles the findings into a comprehensive background check report. This report details all the findings, including any discrepancies or issues uncovered during the process. It may also include information that the candidate can dispute if they believe any inaccuracies are present.

Step 4: Review and Decision-Making

After receiving the Level 3 background check report, the employer reviews the information to make an informed hiring decision. If any issues are found (such as criminal records or discrepancies in employment history), employers will need to evaluate whether these factors disqualify the candidate for the role.

Employers should also follow best practices for ensuring fairness in this process, which includes adhering to legal requirements such as providing candidates with a chance to explain any issues found in the background check before making an adverse decision.

Why Level 3 Background Checks are Crucial for Certain Job Roles

The thoroughness of a Level 3 background check makes it particularly valuable for certain industries or roles where trust and security are of utmost importance. Here are several reasons why Level 3 background checks are essential for high-security roles:

- Protection of Sensitive Information: Many roles require employees to handle sensitive or classified information, and a Level 3 check ensures that the candidate does not have a history of unethical behavior, criminal activity, or financial instability that could compromise security.

- Ensuring Trustworthiness: For jobs involving financial responsibilities, a Level 3 check can uncover any issues with a candidate’s credit history or past financial mismanagement, which could indicate potential risks for embezzlement, fraud, or other issues.

- Reducing Risk for Employers: For employers, hiring an employee who is not fully vetted can result in risks such as theft, fraud, and legal liabilities. A Level 3 check helps mitigate these risks by providing a deeper understanding of the candidate’s background.

- Maintaining Compliance: Certain industries, such as healthcare and government, have strict regulations governing hiring practices. A Level 3 background check helps employers ensure compliance with these legal requirements.

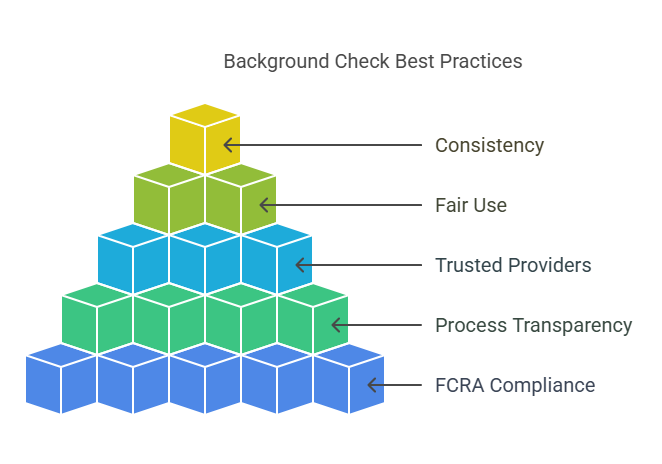

Best Practices for Employers Conducting Level 3 Background Checks

Employers must follow certain best practices when conducting Level 3 background checks to ensure they comply with legal requirements and maintain fairness throughout the hiring process. These best practices include:

1. Ensure Compliance with the Fair Credit Reporting Act (FCRA)

The FCRA governs how background checks are conducted and protects candidates’ rights throughout the process. Employers must:

- Obtain written consent from candidates before performing the background check.

- Inform candidates if an adverse action will be taken based on the background check (e.g., if the candidate is not hired due to negative findings).

- Provide the candidate with a copy of the background check report and a summary of their rights.

2. Be Transparent About the Process

Employers should clearly communicate the level of background check required for the job and explain why certain checks (such as a credit report or criminal background search) are necessary. This helps candidates understand the purpose of the check and avoid surprises during the process.

3. Work with a Trusted Background Screening Provider

Working with a reliable third-party background screening provider, such as Precise Hire, ensures that the Level 3 background check is conducted thoroughly and in compliance with all applicable laws. Professional providers can help manage the complex nature of Level 3 checks and minimize the risk of errors or omissions.

4. Use the Information Fairly

When reviewing a Level 3 background check report, employers should consider the relevance of the findings to the role being filled. For example, a criminal conviction for a minor offense may not disqualify a candidate for a non-sensitive role, while the same conviction might be a red flag for a high-security position.

5. Be Consistent

It’s important to apply the same background check standards across all candidates for the same role. This helps ensure fairness and compliance with Equal Employment Opportunity Commission (EEOC) guidelines, which prohibit discrimination in hiring based on certain factors, such as race, age, and gender.

Tips for Employees Navigating the Level 3 Background Check Process

For job candidates, understanding how Level 3 background checks work can help them prepare and ensure a smoother process. Here are a few tips for candidates:

- Be Honest: Always provide accurate information on your resume and application. If there are any issues in your background (e.g., criminal history, credit problems), it’s best to disclose them upfront to avoid surprises.

- Prepare Your Documents: Ensure that all your documents (e.g., employment records, educational certificates) are up-to-date and accurate. If possible, provide references that can verify your employment history and character.

- Check Your Credit: If a credit report is part of the background check, it’s helpful to review your credit beforehand. If you notice any discrepancies, address them with the credit reporting agency before the employer runs the check.

- Dispute Inaccuracies: If you believe there are errors in your background check report, you have the right to dispute them. Be proactive in resolving any discrepancies to ensure the background check reflects your true history.

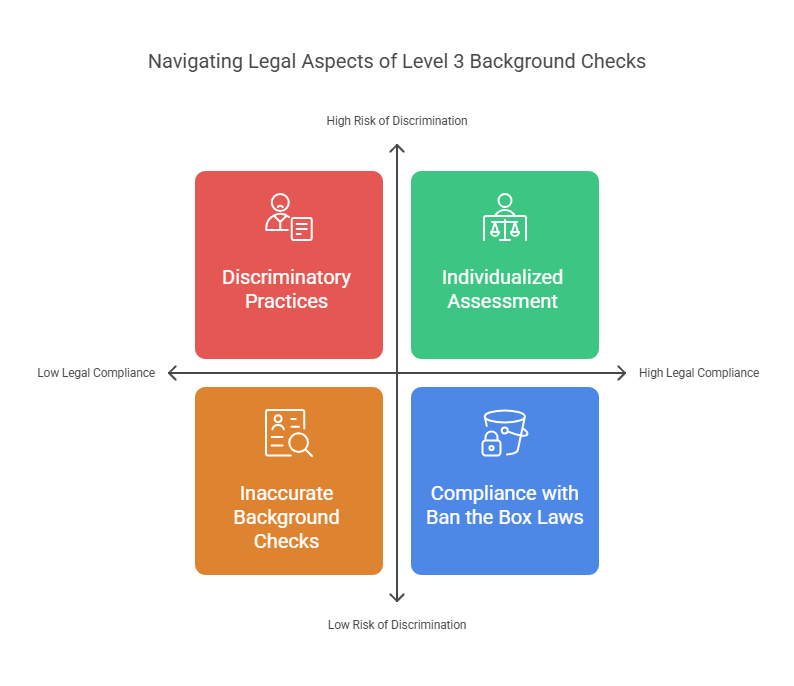

Legal Aspects of Level 3 Background Checks

1. Compliance with the Fair Credit Reporting Act (FCRA)

The Fair Credit Reporting Act (FCRA) is the primary regulation that governs the use of background checks for employment purposes. The FCRA ensures that individuals are treated fairly and that their privacy is respected during the background check process. Employers must comply with several FCRA requirements when conducting Level 3 background checks, including:

- Disclosure and Consent: Before initiating a background check, employers must inform candidates in writing that a background check will be conducted and obtain their consent. The disclosure must be clear, concise, and separate from other documents (e.g., the job application).

- Pre-Adverse Action Notice: If the background check results in a decision that could negatively affect the candidate (e.g., not offering employment based on the findings), the employer must provide the candidate with a copy of the background check report and a notice explaining their rights. The candidate should be given a reasonable amount of time (typically 5 business days) to dispute the findings.

- Adverse Action Notice: If the employer decides not to proceed with the hiring process based on the background check, they must send the candidate an Adverse Action Notice. This notice informs the candidate that their application was denied due to the background check results and includes instructions on how to dispute the report.

- Accuracy of Information: Employers must take reasonable steps to ensure that the information they use to make employment decisions is accurate and up-to-date. They must also provide candidates with the opportunity to correct errors in their background checks.

Failure to comply with the FCRA’s disclosure, consent, and notification requirements can lead to legal consequences, including lawsuits and financial penalties.

2. Equal Employment Opportunity Commission (EEOC) Guidelines

The Equal Employment Opportunity Commission (EEOC) enforces federal laws that prohibit discrimination in employment. When conducting Level 3 background checks, employers must be mindful of EEOC guidelines, which require that background checks be applied consistently and fairly across all candidates for the same position. The guidelines emphasize:

- Avoiding Discriminatory Practices: Employers should not use criminal history or other background check information in a way that disproportionately affects candidates from certain protected groups (e.g., based on race, gender, or national origin). For example, an employer cannot reject a candidate solely based on a criminal conviction unless it is relevant to the job in question.

- Relevance to Job Requirements: The EEOC encourages employers to focus on whether the information uncovered in the background check is relevant to the job. For example, a conviction for a non-violent offense may not be relevant to a position that does not require security clearances or the handling of sensitive materials.

- Individualized Assessment: If an employer considers criminal history as a factor in hiring decisions, they must conduct an individualized assessment of the candidate. This means evaluating the nature of the offense, the time that has passed since the conviction, and the candidate’s rehabilitation efforts before making a decision.

3. State-Specific Regulations

In addition to federal regulations like the FCRA and EEOC guidelines, employers must also be aware of state-specific laws governing background checks. Some states have stricter requirements regarding what can be considered during the hiring process, such as:

- Ban the Box Laws: Many states and cities have passed Ban the Box laws, which prohibit employers from asking about a candidate’s criminal history on the job application. These laws are designed to give individuals with criminal records a fair chance at employment by delaying inquiries into their criminal background until later in the hiring process.

- Time Limitations on Criminal Records: Some states limit how far back an employer can look into a candidate’s criminal history. For example, certain states may not allow employers to consider convictions that are more than 7 or 10 years old unless the candidate is applying for a job in a highly regulated field (such as law enforcement).

Employers must stay up-to-date with local regulations to ensure compliance and avoid legal challenges.

4. Penalties for Non-Compliance

Non-compliance with FCRA, EEOC, or state-specific laws related to Level 3 background checks can result in serious consequences. These may include:

- Fines and Penalties: Employers who fail to comply with the FCRA’s disclosure, consent, or notification requirements can face penalties. Fines can range from $100 to $1,000 per violation, with potential damages for willful violations.

- Lawsuits: Candidates who believe their rights have been violated during the background check process can file lawsuits against the employer. In cases of willful non-compliance, damages may be awarded to the affected candidate, including actual and punitive damages.

- Reputational Damage: Employers who fail to follow proper background check procedures risk reputational damage, which can affect their ability to attract and retain top talent.

FAQs About Level 3 Background Checks

What specific information is included in a Level 3 background check?

A Level 3 background check typically includes:

- Criminal history check (local, state, and national)

- Credit report (if relevant to the position)

- Employment history verification

- Education verification

- Reference checks

How long does it take to complete a Level 3 background check?

The time required for a Level 3 background check can vary depending on the complexity of the information being verified. Typically, it takes anywhere from a few days to a couple of weeks. Delays can occur if there are discrepancies in the data or if additional verifications are needed.

Can an employer deny employment based on the results of a Level 3 background check?

Yes, an employer can deny employment based on the findings of a Level 3 background check. However, they must ensure that the decision is compliant with FCRA guidelines and is based on factors that are relevant to the job. Employers must also follow proper notification procedures if they decide to take adverse action based on the background check.

What industries typically require Level 3 background checks?

Industries that typically require Level 3 background checks include:

- Government and defense (for security clearance positions)

- Financial services (for positions involving sensitive financial data)

- Healthcare (for positions involving patient care or handling confidential information)

- Technology (for roles requiring access to proprietary or classified information)

Are Level 3 background checks more expensive than other types of background checks?

Yes, Level 3 background checks are generally more expensive than lower-level checks due to the depth and breadth of the investigation. The cost can vary depending on the scope of the search, the number of verifications needed, and the industry in which the employer operates.

What specific information is included in a Level 3 background check?

A Level 3 background check typically includes:

- Criminal history check (local, state, and national)

- Credit report (if relevant to the position)

- Employment history verification

- Education verification

- Reference checks

How long does it take to complete a Level 3 background check?

The time required for a Level 3 background check can vary depending on the complexity of the information being verified. Typically, it takes anywhere from a few days to a couple of weeks. Delays can occur if there are discrepancies in the data or if additional verifications are needed.

Can an employer deny employment based on the results of a Level 3 background check?

Yes, an employer can deny employment based on the findings of a Level 3 background check. However, they must ensure that the decision is compliant with FCRA guidelines and is based on factors that are relevant to the job. Employers must also follow proper notification procedures if they decide to take adverse action based on the background check.

What industries typically require Level 3 background checks?

Industries that typically require Level 3 background checks include:

- Government and defense (for security clearance positions)

- Financial services (for positions involving sensitive financial data)

- Healthcare (for positions involving patient care or handling confidential information)

- Technology (for roles requiring access to proprietary or classified information)

Are Level 3 background checks more expensive than other types of background checks?

Yes, Level 3 background checks are generally more expensive than lower-level checks due to the depth and breadth of the investigation. The cost can vary depending on the scope of the search, the number of verifications needed, and the industry in which the employer operates.

Conclusion

Level 3 background checks are a critical component of the hiring process for high-security or high-responsibility positions. Employers must ensure they comply with legal regulations, such as the FCRA and EEOC guidelines, to protect candidates’ rights and make informed, fair hiring decisions. By partnering with a trusted background screening provider like Precise Hire, employers can ensure that their background checks are thorough, compliant, and accurate.

In today’s competitive job market, conducting proper background checks is not just a legal requirement—it’s a way to build trust, reduce risk, and hire the right candidates for sensitive roles. Both employers and candidates should understand their rights and responsibilities to ensure a smooth, transparent, and legally compliant background screening process.

If you’re ready to ensure your hiring practices are legally compliant and effective, consider working with Precise Hire, a professional background screening provider that specializes in Level 3 background checks.