The Impact of Credit Checks on Employment Opportunities

Understanding Credit Checks in Employment and How They Impact Job Offers

Credit checks in employment are a common tool that employers use to assess a candidate’s financial responsibility and integrity. However, a negative result from a credit check can have serious consequences for the candidate, including the potential for a rescinded job offer. In this section, we’ll explore the role of credit checks in the hiring process, why employers use them, and how they impact job offers.

What is a Credit Check?

A credit check is a review of an individual’s financial history, typically conducted by employers as part of the hiring process. It provides insight into a person’s ability to manage their finances and their trustworthiness in handling sensitive information, particularly for positions with financial responsibilities.

Credit checks focus on a variety of financial indicators, including:

- Credit score: A numerical representation of an individual’s creditworthiness based on their credit history.

- Debt levels: The total amount of debt an individual owes, which can indicate their ability to manage financial obligations.

- Bankruptcies: If the individual has filed for bankruptcy, which can be a red flag for employers.

- Late payments: Records of any late payments on loans or credit cards.

There are two types of credit checks commonly used in employment:

- Hard pull: This is a credit inquiry that occurs when an employer checks your credit as part of the hiring process. A hard pull may impact your credit score.

- Soft pull: A soft pull happens when an employer checks your credit for informational purposes, typically when you are being pre-screened for a job. Soft pulls do not affect your credit score.

When Do Employers Use Credit Checks?

Employers typically use credit checks in the hiring process for positions that involve significant financial responsibility, such as:

- Financial roles: Accountants, financial analysts, and roles that require handling company funds.

- Positions with access to sensitive information: Employees who will have access to confidential company data or personal customer information.

- Management roles: Higher-level positions where employees are expected to set financial priorities and make key financial decisions.

Employers assess the information on a candidate’s credit report to gauge their trustworthiness and reliability, particularly in roles where financial mishandling could pose risks to the company. However, credit checks are not limited to just financial positions; some employers use them as a general screening tool.

Why Job Offers are Rescinded After a Credit Check

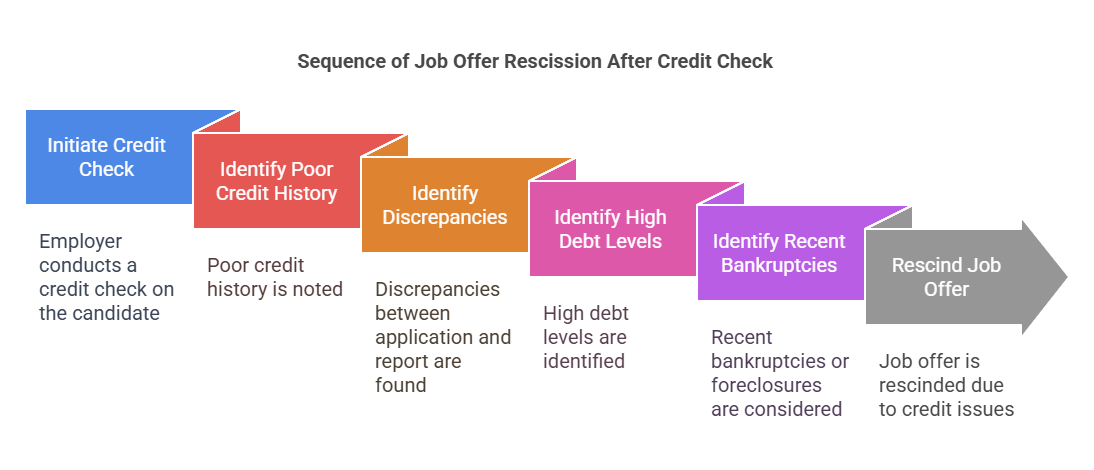

While credit checks are commonly used in hiring, there are several reasons why a job offer might be rescinded after a credit check:

- Poor credit history: A low credit score may indicate financial instability, which some employers believe could affect a candidate’s ability to perform in the job. For example, a candidate with a history of late payments, excessive debt, or bankruptcy may be perceived as having poor financial management skills.

- Discrepancies or false information: If an employer finds discrepancies between the information the candidate provided in their application and the information on their credit report, they may view it as dishonesty or misrepresentation, which can lead to a rescinded job offer.

- High levels of debt: Excessive debt could be seen as a sign of financial irresponsibility, and employers may worry that the candidate could face financial stress, potentially affecting their job performance.

- Recent bankruptcies or foreclosure: These financial events may raise concerns about a candidate’s ability to handle responsibility, particularly in positions where financial management is critical.

In some cases, the decision to rescind an offer is not based on a specific issue on the credit report but rather the overall financial instability indicated by the report.

The Impact of Rescinded Job Offers

A rescinded job offer can be emotionally and professionally damaging for the candidate. Losing a job offer after a credit check can cause frustration, confusion, and even embarrassment. The individual may feel unjustly judged based on their financial history, particularly if their credit issues were caused by factors beyond their control (e.g., medical debt, economic hardship, etc.).

In addition to the emotional toll, a rescinded job offer may damage a candidate’s career prospects:

- Impact on reputation: The candidate may feel embarrassed or lose trust in the hiring process, which could affect their willingness to apply for future positions.

- Career delays: A rescinded offer could set back the job search by weeks or months, as the individual must begin the process again.

- Lack of clarity: Some candidates are not provided with an explanation for why the offer was rescinded, leading to confusion and possible negative assumptions about the employer.

Legal and Ethical Concerns

While employers are allowed to rescind a job offer after a credit check, there are significant legal and ethical concerns to consider:

- Fair Credit Reporting Act (FCRA): The FCRA governs how credit checks must be conducted. Employers must obtain written consent from candidates before running a credit report, and they must notify candidates if the results lead to an adverse decision, such as a rescinded offer.

- Discrimination: In some cases, rescinding an offer based solely on a candidate’s credit history may be considered discriminatory. If the decision disproportionately affects certain groups (e.g., minorities or individuals with lower socioeconomic backgrounds), it could potentially violate anti-discrimination laws.

- Lack of transparency: Employers should be transparent with candidates about how credit reports will be used in hiring decisions. This can help candidates understand how their credit history might impact their job prospects and give them a chance to explain any negative aspects of their credit report.

How Employers Can Minimize Risks

Employers should be mindful of the potential legal and ethical challenges involved in rescinding job offers based on credit checks. Here are some steps they can take to minimize risks:

- Transparent Communication: Clearly explain to candidates that a credit check is part of the hiring process and how the results will be used to make decisions.

- Offer the candidate a chance to explain: If the credit report reveals negative information, employers should offer candidates the opportunity to explain any financial difficulties, such as medical debt or a temporary loss of income.

- Consistent policies: Employers should have a clear and consistent policy regarding credit checks and how they will be used in the hiring process. This policy should be applied equally to all candidates.

- Work with experts: Utilizing professional services like Precise Hire can help ensure that credit checks are conducted legally and ethically, reducing the risk of discrimination and ensuring compliance with all regulations.

How Candidates Can Protect Themselves

Job seekers can take proactive steps to protect themselves from job offer rescission due to credit checks:

- Check your credit report: Before applying for jobs that require a credit check, review your own credit report to understand your financial history and address any inaccuracies or issues.

- Be honest and transparent: If you know that your credit history might raise concerns, consider discussing it with the employer during the interview process. Explain any negative items and how you are working to improve your financial situation.

- Look for employers that don’t require credit checks: Some industries and roles do not require credit checks, so consider focusing on those opportunities.

Title Suggestion for Part 2: “Navigating Job Offer Rescission After a Credit Check: How Employers and Job Seekers Can Protect Themselves”

Legal Aspects of Job Offer Rescission After a Credit Check

Rescinding a job offer due to a credit check is governed by laws designed to protect candidates’ rights. The most important regulation is the Fair Credit Reporting Act (FCRA), which ensures that credit checks are conducted fairly:

- Consent: Employers must obtain written consent before conducting a credit check.

- Adverse Action: If a decision is made based on the results of a credit report, the employer must notify the candidate, provide a copy of the report, and allow the candidate an opportunity to dispute inaccuracies.

Can a Job Offer Be Rescinded Based Solely on Credit History?

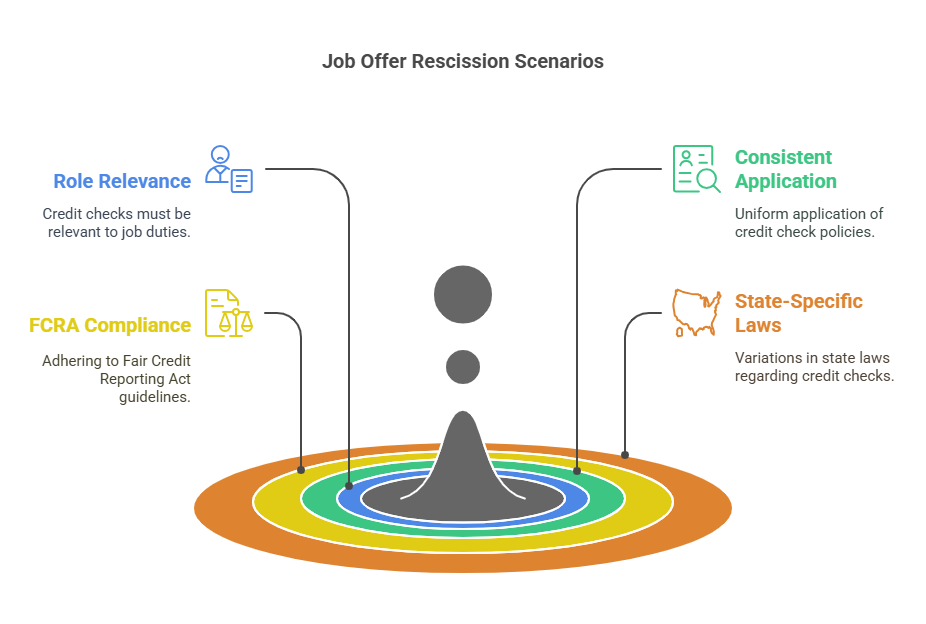

Yes, a job offer can be rescinded based solely on a credit check, but only under specific circumstances:

- Role relevance: The employer must demonstrate that the credit report is directly relevant to the job responsibilities.

- Consistent application: The decision to rescind a job offer based on a credit report must be applied consistently across all candidates for the same role.

- FCRA compliance: Employers must comply with FCRA guidelines, including obtaining consent and allowing the candidate to review the report.

State-Specific Laws and Regulations

Certain states have specific laws regarding the use of credit checks in employment:

- Ban-the-box laws: Some states have laws that prevent employers from asking about criminal history or credit reports on job applications.

- Credit check restrictions: Several states limit the types of jobs where employers can use credit reports as a factor in hiring decisions.

FAQs

Can an employer rescind a job offer based on a credit check?

Yes, if the credit check reveals information that is deemed relevant to the job, but the employer must comply with all legal requirements.

How does a poor credit report affect my job prospects?

A poor credit report may be seen as a red flag, especially for jobs involving financial responsibility or access to sensitive data.

What steps can I take if my job offer is rescinded due to my credit report?

You can request a copy of the credit report, explain any discrepancies or negative items, and explore legal options if you feel the decision was discriminatory.

Can I request a copy of the credit report used to rescind the job offer?

Yes, under the FCRA, employers must provide you with a copy of the credit report if it played a role in their decision.

Are there certain jobs that are more likely to check my credit history?

Jobs in finance, management, and positions with access to sensitive information are more likely to require credit checks.

Conclusion

A rescinded job offer due to a credit check can have significant professional and emotional consequences. Both employers and job seekers must understand the legal, ethical, and practical aspects of credit checks in employment to navigate the process effectively. Employers should ensure they are transparent and consistent in their use of credit reports, while candidates should proactively manage their credit and be prepared to address any concerns during the hiring process. By following best practices, both parties can ensure that credit checks are used fairly and responsibly in hiring decisions.