The Best Tenant Screening Services for Small Landlords A Comprehensive Guide

What Are Tenant Screening Services and Why They’re Crucial for Small Landlords

As a small landlord, your rental property is more than just an investment—it’s a significant source of income and security. Ensuring your property is occupied by reliable tenants is essential for its success. That’s where tenant screening services come in. These services provide small landlords with the tools and information needed to evaluate prospective tenants and make confident rental decisions.

Understanding Tenant Screening Services

Tenant screening services are platforms that help landlords assess the suitability of rental applicants. By compiling key background information, these services allow landlords to determine if a potential tenant is likely to pay rent on time, care for the property, and adhere to lease agreements.

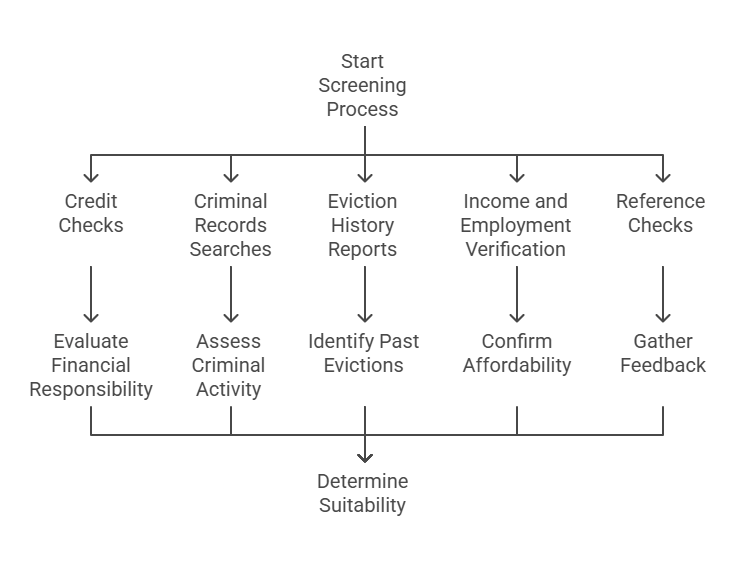

Common features of tenant screening services include:

- Credit Checks: Providing insights into a tenant’s financial responsibility and payment history.

- Criminal Records Searches: Highlighting any criminal activity that may raise concerns.

- Eviction History Reports: Identifying past evictions, which can signal potential risks.

- Income and Employment Verification: Confirming a tenant’s ability to afford the rent.

- Reference Checks: Offering feedback from previous landlords or employers.

Why Small Landlords Need Tenant Screening Services

Unlike large property management companies, small landlords often manage properties independently and operate on tight margins. A bad tenant can result in significant financial losses and unnecessary stress. Tenant screening services help mitigate these risks by offering critical information upfront.

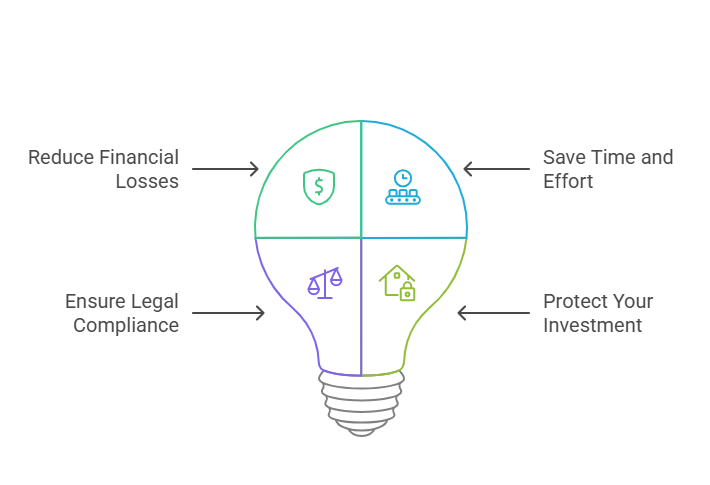

Here’s why these services are indispensable for small landlords:

- Reduce Financial Losses: Screening potential tenants helps you avoid those who might default on rent or cause costly property damage.

- Save Time and Effort: Tenant screening services streamline the process of verifying an applicant’s background, freeing up time for landlords to focus on other tasks.

- Ensure Legal Compliance: Many screening services are designed to comply with fair housing laws, helping you avoid accidental violations.

- Protect Your Investment: Choosing the right tenants can extend the longevity of your property and ensure it remains well-maintained.

Key Features to Look for in a Tenant Screening Service

Not all tenant screening services are created equal. As a small landlord, it’s essential to choose a service that aligns with your needs and budget. Here’s what to consider:

- Comprehensive Data: Look for services that provide in-depth reports covering credit, criminal, and eviction histories.

- Ease of Use: A user-friendly interface ensures a seamless experience for landlords of all experience levels.

- Customizable Reports: Some services allow landlords to select specific checks, ensuring flexibility and cost-effectiveness.

- Fast Turnaround: Quick results enable landlords to make timely decisions during the application process.

- Affordability: Budget-friendly options ensure small landlords can access professional-grade tools without breaking the bank.

By leveraging a reliable tenant screening service, small landlords can secure responsible tenants, reduce risks, and maintain the profitability of their rental properties.

Top Tenant Screening Services for Small Landlords: Features and Benefits

Choosing the right tenant screening service is critical for small landlords aiming to safeguard their properties and minimize risks. With numerous options available, selecting a platform that balances affordability, comprehensive reports, and user-friendly features is essential. Below, we provide a detailed comparison of the top tenant screening services tailored to the needs of small landlords.

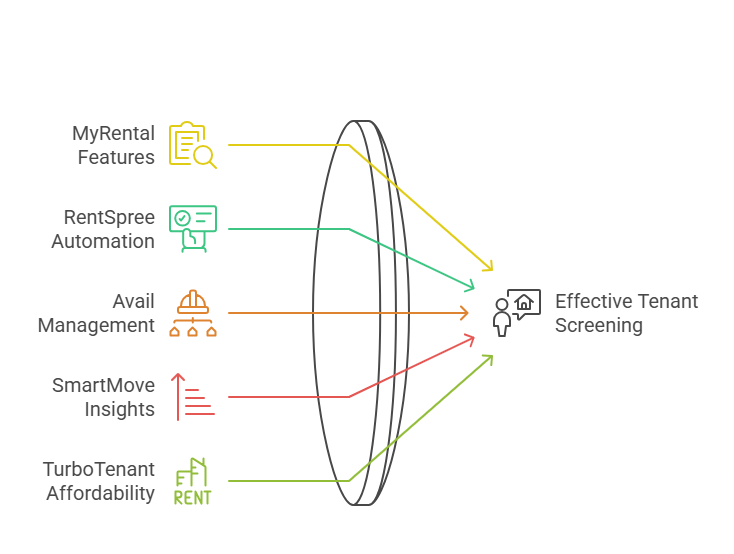

1. MyRental by CoreLogic

Overview:

MyRental is a well-regarded platform offering robust tenant screening solutions. It’s ideal for small landlords who need straightforward access to detailed reports.

Key Features:

- Credit reports with a score recommendation.

- Nationwide criminal background checks.

- Eviction history reports.

- Tenant risk scoring to help prioritize applications.

- Pay-as-you-go pricing with no subscription required.

Pricing:

- Basic reports start at $24.99 per applicant.

- Comprehensive screening packages cost $34.99.

Benefits:

MyRental is budget-friendly and provides essential tenant information in an easy-to-read format, making it a favorite among small landlords.

2. RentSpree

Overview:

RentSpree is a modern, intuitive platform catering to landlords who prefer an all-in-one application and screening solution.

Key Features:

- Comprehensive credit, criminal, and eviction reports.

- Income and employment verification tools.

- Automated rental applications for seamless tenant management.

- Free setup and tenant-paid screening.

Pricing:

- Screening costs $38 per applicant (tenant-paid).

Benefits:

RentSpree simplifies the tenant screening process by combining application management and background checks, making it a time-saving option for busy landlords.

3. Avail

Overview:

Avail is a versatile property management platform that includes robust tenant screening tools for small landlords managing multiple properties.

Key Features:

- Full credit reports and criminal background checks.

- Rental history verification.

- Income insights and employment history.

- Customizable lease agreements and payment tracking integration.

Pricing:

- Screening reports start at $30 per applicant.

- Premium plans with additional tools are available for $5/month per unit.

Benefits:

Avail stands out for its comprehensive property management features, making it an excellent choice for landlords looking to streamline operations.

4. SmartMove by TransUnion

Overview:

SmartMove is a trusted name in tenant screening, backed by TransUnion, one of the major credit bureaus. It’s designed for landlords who prioritize credit and financial data.

Key Features:

- TransUnion credit reports with resident scores.

- Eviction and criminal background checks.

- Income insights with renter affordability recommendations.

- No need to collect sensitive tenant information directly.

Pricing:

- Costs range from $25 to $42 per applicant, depending on the level of reporting.

Benefits:

SmartMove’s reputation for accuracy and its focus on financial insights make it a go-to choice for risk-averse landlords.

5. TurboTenant

Overview:

TurboTenant is a free property management platform with tenant screening capabilities, making it perfect for landlords on a tight budget.

Key Features:

- Free online rental applications.

- Credit, criminal, and eviction reports.

- Lease agreement templates and online rent collection tools.

- Tenant-paid screening ensures no upfront costs for landlords.

Pricing:

- Tenants pay $55 per application for full reports.

Benefits:

TurboTenant’s cost-effective model and additional management tools make it a practical option for landlords new to tenant screening.

Why Choose Precisehire for Tenant Screening?

Precisehire is a trusted partner for landlords, offering comprehensive tenant screening services designed to simplify and secure the rental process. Whether you’re managing a single rental property or a small portfolio, our services are tailored to meet the needs of small landlords who require detailed, reliable, and affordable solutions.

Comparison Table: Best Tenant Screening Services

| Service | Credit Check | Criminal Check | Eviction Report | Pricing | Unique Features | Ideal For |

|---|---|---|---|---|---|---|

| MyRental | ✔️ | ✔️ | ✔️ | $24.99–$34.99 | Tenant risk scoring | Budget-conscious landlords |

| RentSpree | ✔️ | ✔️ | ✔️ | $38 (tenant-paid) | Automated rental applications | Streamlined management |

| Avail | ✔️ | ✔️ | ✔️ | $30+ | Lease agreements and payment tools | Multi-property landlords |

| SmartMove | ✔️ | ✔️ | ✔️ | $25–$42 | Affordability recommendations | Financially cautious landlords |

| TurboTenant | ✔️ | ✔️ | ✔️ | $55 (tenant-paid) | Free property management features | Cost-conscious landlords |

The best tenant screening service for small landlords depends on your specific needs and budget. Whether you’re looking for a cost-effective solution like TurboTenant or a feature-rich platform like Avail, these services can help you confidently select reliable tenants while protecting your property investment.

FAQs and Tips for Choosing Tenant Screening Services for Small Landlords

Choosing the right tenant screening service is crucial for ensuring you find reliable, responsible tenants. If you’re still uncertain about the best option for your needs, here are answers to common questions that can help guide your decision-making process. We’ve also included actionable tips to help you make the most out of your tenant screening efforts.

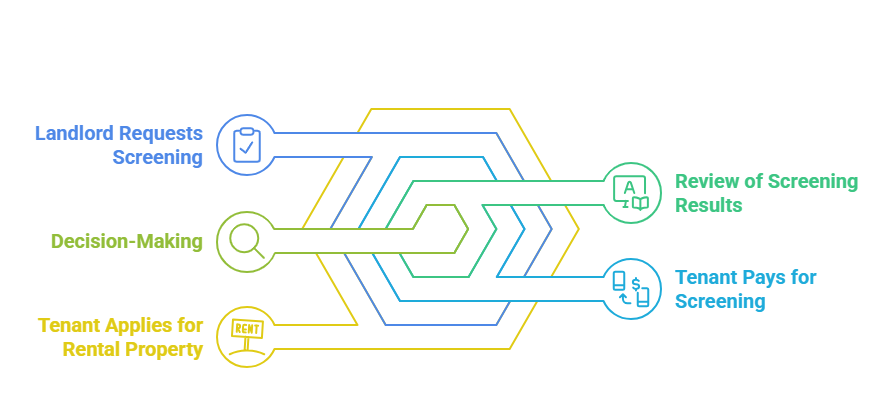

How Do Tenant Screening Services Work?

Tenant screening services streamline the process of evaluating rental applicants by providing comprehensive background checks. Here’s how they typically work:

- Tenant Applies for Rental Property: The potential tenant submits an application, usually through the landlord’s property management system.

- Landlord Requests Screening: The landlord uses the screening service to request a full background check on the applicant.

- Tenant Pays for Screening: Many services allow tenants to pay directly for the background check, reducing costs for the landlord.

- Review of Screening Results: The service compiles a detailed report that includes credit history, criminal background, eviction history, and more.

- Decision-Making: The landlord uses the report to assess whether the tenant is financially stable, trustworthy, and likely to be a good fit for the rental property.

What Should Small Landlords Consider When Choosing a Service?

When selecting a tenant screening service, small landlords should consider the following factors to ensure they choose the best option:

- Comprehensive Reporting: Ensure the service includes all necessary background checks, such as credit, criminal, and eviction history. Some services also offer additional checks like employment verification, which can be useful for understanding a tenant’s financial stability.

- Cost Structure: Compare pricing models. Some services charge a flat fee per report, while others allow tenants to pay directly, which can save landlords money. Be mindful of both upfront and hidden costs.

- Ease of Use: The platform should be user-friendly, especially for landlords with minimal experience in tenant screening. Features like automated alerts, easy-to-read reports, and seamless application management can simplify the process.

- Turnaround Time: Choose a service that provides quick results. Fast turnaround times allow you to make timely decisions and avoid delays in the leasing process.

- Legal Compliance: Ensure the service complies with fair housing laws and other tenant protection regulations to avoid legal issues. Many services automatically ensure compliance, which helps reduce liability for small landlords.

Are These Services Cost-Effective for Small Landlords?

Yes, tenant screening services can be highly cost-effective for small landlords, especially considering the potential risks they help mitigate. By investing in these services, landlords can reduce the likelihood of costly tenant issues, such as missed rent payments or property damage.

Cost Considerations:

- Many services offer pay-as-you-go options or tenant-paid models, which means landlords don’t have to pay upfront for screening.

- Some platforms, like TurboTenant and RentSpree, offer free or low-cost services with basic features, allowing landlords to get started without a significant investment.

- For landlords with multiple properties or higher tenant turnover, services like Avail or MyRental may offer better value due to their comprehensive offerings and bulk pricing.

Actionable Tips for Small Landlords:

- Use Tenant Screening Early in the Process: Start screening applicants as soon as you receive their application to avoid wasting time on unsuitable candidates.

- Review Reports Thoroughly: Don’t just rely on a single score or data point. Take the time to review each part of the tenant’s report—credit, criminal, and eviction history—so you have a complete picture of the applicant.

- Ask for Additional References: While background checks are valuable, personal references from previous landlords can provide additional insights into a tenant’s behavior and reliability.

- Don’t Skimp on Screening: It may be tempting to skip tenant screening to save money or time, but it’s a vital part of protecting your property and ensuring a steady rental income.

- Stay Consistent: Ensure you apply the same screening criteria to all applicants. Inconsistent screening practices can lead to potential legal issues and claims of discrimination.

Conclusion

Tenant screening services are essential tools for small landlords who want to protect their properties and ensure they’re renting to reliable tenants. By understanding how these services work, considering key factors when choosing a service, and following best practices, landlords can make informed decisions that benefit both their business and their tenants.

With the right tenant screening service, small landlords can streamline their processes, reduce risks, and enjoy peace of mind knowing they’ve selected the best possible tenants for their rental properties.