Steps for Achieving Clear Identity Verification

Introduction & Overview of Clear Identity Verification

Clear Identity Verification is an advanced security system designed to verify the identity of individuals in a highly efficient and secure manner. This solution uses a combination of biometric data, personal information, and government-issued identification to verify the identity of individuals, primarily in online transactions, access control, and critical financial or personal interactions. The verification process provided by Clear Identity ensures that the person engaging with a service or system is the one they claim to be, offering a significant defense against fraud, identity theft, and unauthorized access.

Clear Identity Verification provides a cutting-edge alternative to traditional methods of verification like passwords, PIN codes, and security questions. It often involves biometric features such as fingerprints, facial recognition, or iris scanning, offering an extra layer of security that’s difficult to spoof or bypass.

The Role of Clear Identity Verification in Identity Management

Identity management involves securely identifying, authenticating, and authorizing individuals or entities in systems and databases. Clear Identity Verification plays a key role in this broader landscape, helping companies, governments, and financial institutions securely manage users by verifying their identities with a combination of:

- Personal information such as names, dates of birth, and government-issued IDs (like driver’s licenses or passports).

- Biometric data including fingerprints, facial recognition, voice recognition, and sometimes even retina or iris scans.

- Digital identity tokens, which are encrypted credentials used in secure login processes.

Clear Identity Verification enables organizations to adopt contactless, non-invasive, and secure methods of validating user identity, making it ideal for industries that deal with sensitive information, such as banking, healthcare, and online retail.

Why is Clear Identity Verification Important?

In the digital age, identity verification is more crucial than ever. Clear Identity Verification is integral to preventing fraud, securing sensitive data, and ensuring trustworthiness in online transactions and services. Here are some of the main reasons it is crucial:

- Prevents Fraudulent Transactions: By verifying the identity of users, Clear Identity Verification helps prevent fraudulent transactions, ensuring that only authorized individuals can access accounts, make purchases, or receive benefits.

- Reduces Identity Theft Risks: Traditional password-based systems are vulnerable to breaches and hacks. Clear Identity Verification reduces these risks by using biometrics, which are much harder to steal or replicate.

- Secures Access to Sensitive Data: Financial institutions, healthcare providers, and governments store highly sensitive data. Clear Identity Verification ensures that only the rightful individual can access this information.

- Increases User Trust: When users know their identities are being securely verified, they are more likely to trust the services and platforms they interact with, which is important for businesses and organizations that rely on user engagement.

Comparing Clear Identity Verification with Other Solutions

While there are many identity verification solutions on the market today, Clear Identity Verification stands out for its emphasis on both convenience and security. Here’s how it compares with other common verification methods:

| Method | Clear Identity Verification | Traditional Methods (e.g., Passwords, PIN) | Other Biometric Systems |

|---|---|---|---|

| Ease of Use | High – Contactless and quick | Low – Users must remember credentials | Medium – Can require specific devices or apps |

| Security | Very high – Uses multi-layered authentication, including biometrics | Low – Susceptible to phishing or data breaches | High – But might be invasive and need specific hardware |

| Speed of Verification | Fast – Real-time verification in seconds | Slow – Requires manual input and authentication steps | Medium – Often requires more interaction |

| Accuracy | High – Biometric features are hard to replicate | Low – Accounts can be hacked or forgotten | High – Biometric-based, but subject to error if not calibrated |

As illustrated, Clear Identity Verification provides a comprehensive solution that combines the best aspects of both convenience and security, offering fast, reliable, and safe verification compared to traditional systems or other biometric technologies.

How Clear Identity Verification Works & Its Benefits

Clear Identity Verification operates through a multi-step process, ensuring that only the verified individual can access specific services, systems, or transactions. Let’s break down the process and the benefits of using this verification system.

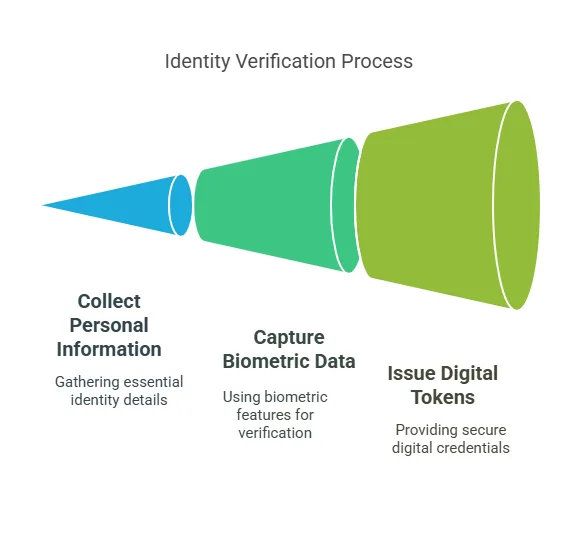

Step-by-Step Process of Clear Identity Verification

The Clear Identity Verification process is designed to be user-friendly while ensuring robust security. Below is the typical flow of the verification process:

Step 1: Data Collection

- Personal Information: Users start by entering personal details such as full name, date of birth, address, and government-issued IDs (e.g., passport or driver’s license).

- Biometric Data Capture: Users may be asked to upload a selfie, scan their fingerprints, or provide other biometric data. This data is compared against official records to verify the person’s identity.

Step 2: Verification and Authentication

- The provided data is sent through secure verification systems. This step may involve:

- Matching biometric information to databases (such as the Facial Recognition Database or the National Biometric Database).

- Cross-referencing the user’s ID against government-issued records for authenticity.

- Secure verification tokens being sent to confirm identity (e.g., one-time passwords via email or SMS).

Step 3: Real-Time Confirmation

- Upon successful verification, users receive instant access to services or systems that require identity confirmation.

- If there is any discrepancy or failed verification, the system will either alert the user or request further steps (e.g., additional documents or manual review).

Types of Information Required for Clear Identity Verification

Clear Identity Verification typically requires users to provide several pieces of personal and biometric information to successfully authenticate their identity:

| Required Information | Purpose |

|---|---|

| Full Name | Confirms the identity by matching with official records. |

| Date of Birth | Ensures that the person meets age-related requirements. |

| Government-Issued ID | Confirms the user’s identity through a government-backed system. |

| Biometric Data (e.g., Fingerprints, Facial Recognition) | Provides unique, hard-to-replicate identifiers. |

| Contact Information (Email, Phone) | For sending verification codes or recovery details. |

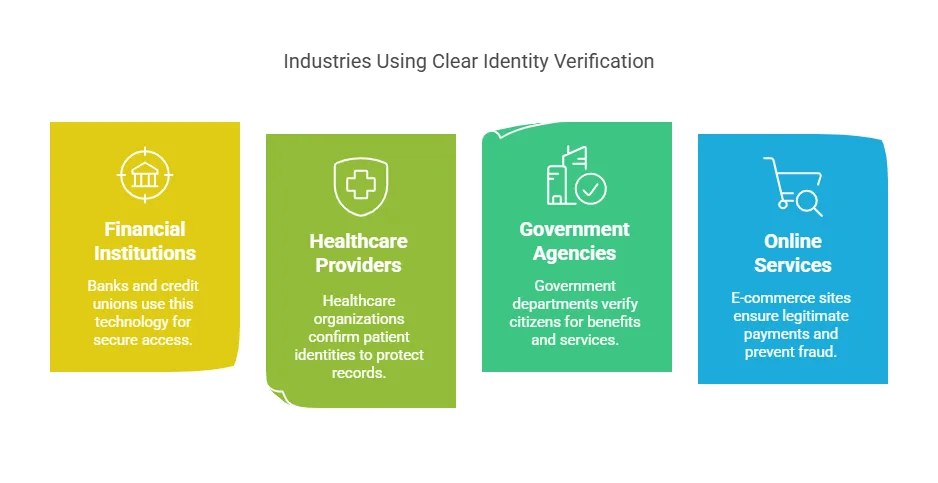

Who Uses Clear Identity Verification?

Clear Identity Verification is widely used across various industries due to its reliability and security. Here are some key sectors that rely on this technology:

1. Financial Institutions

- Banks, credit unions, and other financial services use Clear Identity Verification to ensure that only authorized users can access bank accounts, make transactions, or open new accounts.

2. Healthcare Providers

- Healthcare organizations use Clear Identity Verification to confirm that patients accessing their medical records are the correct individuals, maintaining the confidentiality of sensitive information.

3. Government Agencies

- Government departments rely on Clear Identity Verification to verify citizens before granting benefits, filing taxes, or providing welfare services.

4. Online Services & Retailers

- E-commerce websites and online service providers also use this technology to ensure that payments are being made by legitimate customers and to prevent chargebacks or fraud.

Benefits of Clear Identity Verification

There are numerous advantages to adopting Clear Identity Verification, both from a security standpoint and user experience perspective:

- Enhanced Security

Clear Identity Verification helps prevent identity theft by using biometric data, which is far harder to replicate than passwords or PINs. This ensures that only authorized individuals can access their accounts, reducing the risk of fraud. - Convenience for Users

Users no longer need to remember complex passwords or fill out cumbersome forms to verify their identities. With biometric authentication and contactless verification, the process is fast, user-friendly, and seamless. - Real-Time Identity Confirmation

Unlike traditional methods of verification, which may take hours or even days, Clear Identity Verification offers real-time authentication. This speed is particularly beneficial in industries like banking, healthcare, and e-commerce, where instant access is crucial. - Cost-Effective

For businesses, implementing Clear Identity Verification can reduce the costs associated with fraud and chargebacks. It also helps lower customer service expenses by reducing manual identity checks and disputes. - Compliance with Legal Regulations

Clear Identity Verification solutions adhere to KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations, ensuring compliance with legal standards. Businesses that use this system can be confident in their regulatory compliance.

Precise Hire: Your Partner in Identity Verification

At Precise Hire, we provide advanced identity verification solutions that integrate seamlessly with your systems. Our services offer enhanced security while ensuring compliance with FCRA, KYC, and AML regulations. Whether you’re a financial institution, a business, or a government agency, we can help secure your transactions and protect sensitive data.

Legal Regulations and Compliance in Clear Identity Verification

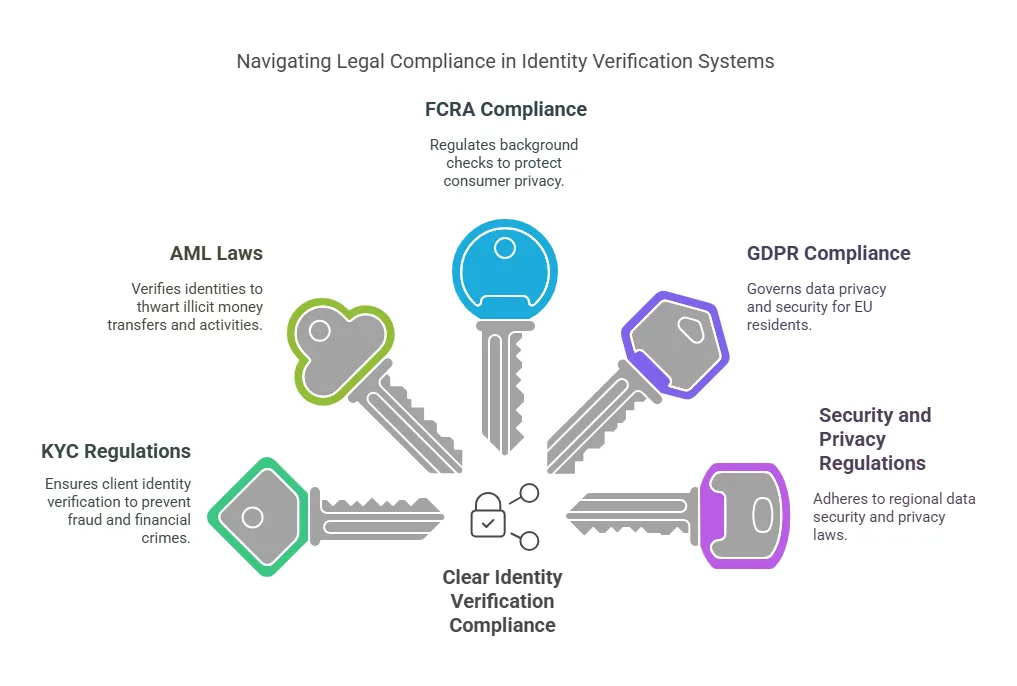

Clear Identity Verification is not just about providing a secure way to authenticate users; it also needs to adhere to stringent legal requirements to ensure the privacy, security, and fair treatment of all users. Below are the key legal frameworks that govern identity verification:

1. Know Your Customer (KYC) Regulations

Know Your Customer (KYC) regulations are essential for financial institutions and businesses dealing with high-value transactions or sensitive data. These regulations are designed to verify the identity of clients to prevent fraud, money laundering, and terrorist financing.

- Clear Identity Verification helps businesses ensure they meet KYC compliance by using personal information, government IDs, and biometric data.

- Businesses must verify that their customers are not on sanction lists or have criminal backgrounds before allowing them access to services.

- This system significantly reduces the risk of financial crimes by making it difficult for fraudsters to impersonate legitimate customers.

2. Anti-Money Laundering (AML) Laws

Anti-Money Laundering (AML) laws aim to detect and prevent the illicit transfer of money. Clear Identity Verification plays a crucial role in this area by ensuring that the individuals making financial transactions are verified, thus preventing money laundering schemes.

- AML compliance requires businesses to verify the identity of individuals and ensure that any suspicious transactions are reported to the relevant authorities.

- Clear Identity Verification helps businesses meet AML requirements by providing detailed identity profiles that are used to flag potential money laundering activities.

3. Fair Credit Reporting Act (FCRA)

The Fair Credit Reporting Act (FCRA) protects the privacy of consumer information by regulating how background checks and identity verification are conducted. For businesses using Clear Identity Verification to access personal data, compliance with the FCRA is mandatory.

- FCRA compliance ensures that consumers are informed when their data is being collected and that they can challenge any inaccuracies in the information.

- Clear Identity Verification is FCRA-compliant by ensuring transparent data collection and providing consumers with dispute resolution processes for any discrepancies.

4. General Data Protection Regulation (GDPR)

In the European Union, GDPR governs how businesses collect, store, and process personal data. While Clear Identity Verification may be most commonly used in the United States, global businesses must ensure they are compliant with GDPR if they handle European Union residents’ data.

- GDPR mandates that businesses ensure data privacy by securing personal information, using clear consent procedures, and offering users the right to be forgotten (removal of their data).

- Clear Identity Verification systems that store personal data must meet GDPR’s security and transparency standards, ensuring that users’ data is not misused.

5. Security and Privacy Regulations

Clear Identity Verification must also comply with various security and privacy laws that are region-specific. These may include:

- Federal and State Laws related to data security.

- Compliance with local privacy laws, such as the California Consumer Privacy Act (CCPA), which governs consumer data privacy in California.

Frequently Asked Questions (FAQs) About Clear Identity Verification

What types of biometric data does Clear Identity Verification use?

Clear Identity Verification can use a variety of biometric data types, including:

- Facial Recognition: Matching the user's face to a database of verified identities.

- Fingerprint Scanning: Verifying users through their unique fingerprint patterns.

- Voice Recognition: Using voice patterns to confirm identity.

- Iris Scanning: Using the unique patterns in a person’s iris for secure verification.

Each of these methods provides an extra layer of security and is much more difficult to replicate than traditional passwords.

How does Clear Identity Verification protect my personal data?

Clear Identity Verification uses advanced encryption and secure storage systems to protect your personal information. This ensures that your sensitive data, such as biometric details and government-issued IDs, are never exposed to unauthorized parties. Additionally, multi-factor authentication (MFA) and real-time fraud detection help protect your data throughout the verification process.

Can Clear Identity Verification be used for online transactions?

Yes, Clear Identity Verification is widely used for online transactions. It ensures that only the legitimate user can authorize transactions, preventing unauthorized purchases and financial fraud. It is particularly beneficial for sectors such as e-commerce, banking, and digital wallets, where secure, seamless transactions are crucial.

What happens if my identity verification fails?

If Clear Identity Verification fails, you will typically be asked to provide additional information or documents to verify your identity. This could include submitting a different form of ID or undergoing a secondary biometric check. If the issue persists, support teams can assist you in resolving the problem.

Is Clear Identity Verification compliant with international privacy laws?

Yes, Clear Identity Verification complies with both domestic and international privacy laws. It adheres to GDPR in the EU, KYC and AML regulations in the financial sector, and FCRA guidelines for U.S. consumers. Clear Identity Verification ensures that data privacy and user consent are a priority, especially when operating in multiple jurisdictions.

What types of biometric data does Clear Identity Verification use?

Clear Identity Verification can use a variety of biometric data types, including:

- Facial Recognition: Matching the user's face to a database of verified identities.

- Fingerprint Scanning: Verifying users through their unique fingerprint patterns.

- Voice Recognition: Using voice patterns to confirm identity.

- Iris Scanning: Using the unique patterns in a person’s iris for secure verification.

Each of these methods provides an extra layer of security and is much more difficult to replicate than traditional passwords.

How does Clear Identity Verification protect my personal data?

Clear Identity Verification uses advanced encryption and secure storage systems to protect your personal information. This ensures that your sensitive data, such as biometric details and government-issued IDs, are never exposed to unauthorized parties. Additionally, multi-factor authentication (MFA) and real-time fraud detection help protect your data throughout the verification process.

Can Clear Identity Verification be used for online transactions?

Yes, Clear Identity Verification is widely used for online transactions. It ensures that only the legitimate user can authorize transactions, preventing unauthorized purchases and financial fraud. It is particularly beneficial for sectors such as e-commerce, banking, and digital wallets, where secure, seamless transactions are crucial.

What happens if my identity verification fails?

If Clear Identity Verification fails, you will typically be asked to provide additional information or documents to verify your identity. This could include submitting a different form of ID or undergoing a secondary biometric check. If the issue persists, support teams can assist you in resolving the problem.

Is Clear Identity Verification compliant with international privacy laws?

Yes, Clear Identity Verification complies with both domestic and international privacy laws. It adheres to GDPR in the EU, KYC and AML regulations in the financial sector, and FCRA guidelines for U.S. consumers. Clear Identity Verification ensures that data privacy and user consent are a priority, especially when operating in multiple jurisdictions.

Conclusion: The Importance of Secure Identity Verification

In today’s digital landscape, secure identity verification is more crucial than ever. Clear Identity Verification offers a robust, seamless, and highly secure solution to ensure that individuals are who they claim to be. By leveraging biometric data, personal information, and advanced encryption technologies, Clear Identity Verification helps prevent fraud, reduces the risk of identity theft, and ensures that only authorized individuals can access sensitive data and services.

Key Takeaways:

- Clear Identity Verification is a reliable and secure method for authenticating identities online, reducing the risk of fraud and improving security.

- Compliance with KYC, AML, FCRA, GDPR, and other privacy regulations ensures that Clear Identity Verification meets the highest standards of data protection.

- By using a combination of biometric data, personal information, and government-issued IDs, Clear Identity Verification offers fast, secure, and seamless user verification.

- It is used by a variety of industries, including financial institutions, healthcare providers, government agencies, and e-commerce businesses.

- Users can trust Clear Identity Verification for privacy protection and ease of use.

Partner with Precise Hire for Secure Identity Verification Solutions

If you’re looking for secure, reliable identity verification for your business, Precise Hire provides cutting-edge solutions to enhance your security protocols and ensure compliance with all regulatory standards. Visit Precise Hire for more information on how we can help protect your business and customer data with our advanced identity verification services.