Legal Risks and Common Questions About Self Employment Verification Letters

What is a Self Employment Verification Letter and Why is it Important?

A self-employment verification letter is a formal document used to confirm an individual’s self-employed status and income. It provides proof that someone is engaged in freelance work, owning a business, or working independently, without a traditional employer. This letter is often required in situations where official proof of income or employment is necessary, but the individual does not have pay stubs, employer-issued letters, or other typical forms of employment verification.

The main purpose of a self-employment verification letter is to authenticate the self-employed individual’s business activities, income, and role. It typically comes from the self-employed person themselves or an authorized representative and outlines their professional activities and earnings.

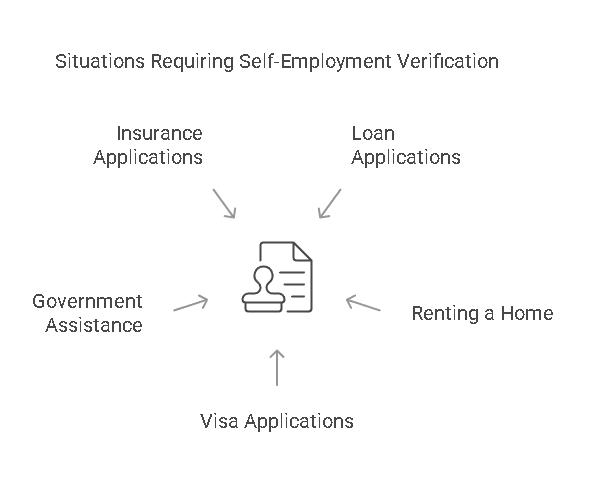

When Do You Need a Self Employment Verification Letter?

A self-employment verification letter is essential in several scenarios where proof of income or work history is necessary. Common situations where this letter might be required include:

- Loan applications: Lenders may request the letter to assess an individual’s income when applying for a mortgage, personal loan, or car loan.

- Renting a home: Landlords may require the letter to verify that a potential tenant has a steady income.

- Visa applications: Self-employed individuals who are applying for a visa or immigration status may need to prove their income and employment.

- Government assistance programs: In certain circumstances, government agencies require proof of self-employment for eligibility determinations.

- Insurance applications: Some insurance companies ask for a self-employment verification letter when processing applications for health, life, or auto insurance.

In these cases, the letter serves as a substitute for conventional pay stubs or tax documents, offering a clear indication of the self-employed person’s income and professional legitimacy.

Who Requires a Self Employment Verification Letter?

Various parties may request a self-employment verification letter, depending on the context. Some of the most common include:

- Banks and Lenders: To verify an individual’s income and employment status during the approval process for loans, mortgages, or credit applications.

- Landlords: When leasing property, landlords may need a verification letter to ensure that the tenant can afford monthly rent payments.

- Government Agencies: For programs related to taxation, social benefits, or permits, government authorities may require proof of self-employment.

- Insurance Providers: Insurance companies sometimes ask for this letter to confirm income during the application process for various insurance policies.

- Legal and Tax Advisors: Lawyers and accountants may need this letter to support documentation during legal or tax-related processes, such as tax filings or legal settlements.

These entities rely on the self-employment verification letter as an official, formal statement of the individual’s employment status and income.

Why is it Important to Have One?

A self-employment verification letter plays a vital role in various professional and personal contexts. Its importance lies in several key factors:

- Accurate and Truthful Information: Providing truthful and accurate details in the letter is essential to ensure that financial, legal, and rental transactions proceed smoothly. Any discrepancy or inaccuracy may cause delays, refusals, or legal complications.

- Building Trust: The letter helps build credibility and trust between the self-employed individual and the requesting party. Whether it is a bank assessing a loan application or a landlord considering a rental application, providing a legitimate and professional verification letter demonstrates reliability.

- Support for Financial or Legal Transactions: In many cases, a self-employment verification letter is required to prove income and ensure that individuals meet financial or legal criteria. It is often necessary to gain approval for loans, insurance policies, leases, or even immigration processes.

- Professional Documentation: This letter not only confirms self-employment but also serves as an official document outlining one’s income. It can act as a reference point when further verification of financial details is needed.

By providing a professional, clear, and accurate self-employment verification letter, self-employed individuals can maintain credibility and ensure that their professional and financial affairs are well-managed.

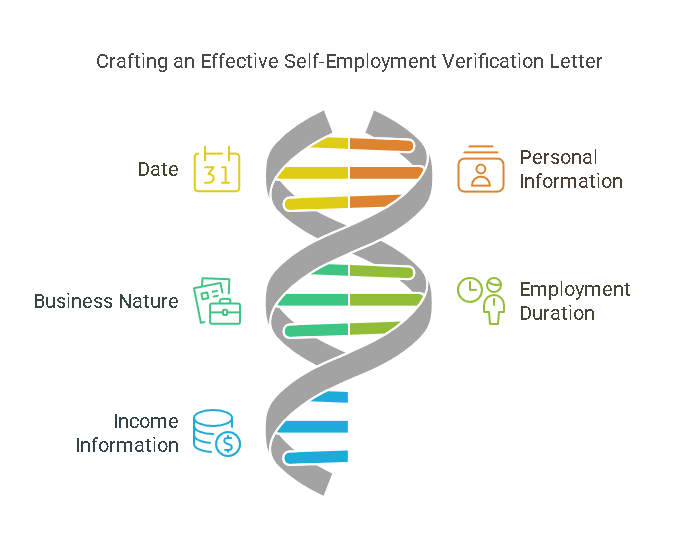

How to Write a Self Employment Verification Letter?

Writing a self-employment verification letter is a straightforward process, but it must be done with attention to detail to ensure that all required information is included and presented clearly. Below is a step-by-step guide to help you craft an effective self-employment verification letter:

- Start with the Letter’s Date: Always begin the letter by stating the date it is written. This helps to provide a clear time reference for when the verification was issued.

- Include Your Personal Information: At the top of the letter, include the full name of the self-employed individual. If applicable, include the business name or the trading name of the business (for sole proprietors or freelancers). If the letter is coming from an authorized representative (like an accountant or business manager), they should also include their name and business affiliation.

- State the Nature of the Business: In this section, describe the type of work or service the individual provides. For example, “Jane Doe is a freelance graphic designer who specializes in logo design, website graphics, and branding for small businesses.” The nature of the business can be brief but should accurately represent the self-employed individual’s role and industry.

- Include the Duration of Self-Employment: Specify how long the individual has been self-employed. This helps to establish the experience and longevity of the self-employment. For instance, “John Smith has been operating as a freelance software developer for the past five years.”

- Provide Income Information: If requested, include details about the individual’s income, whether it is a general estimate or exact earnings (depending on privacy considerations). For example, “Jane Doe earns an average annual income of $50,000 from her business activities.” In some cases, you may want to include details about how income is generated (e.g., hourly rates, project fees, or annual earnings).

- Contact Information for Verification: It’s crucial to provide contact details, either for the self-employed individual or an authorized representative. This ensures that the recipient of the letter can verify the information provided. Include a phone number, email address, and business address if applicable.

- Sign the Letter: End the letter with a formal closing and signature. If someone else is writing the letter on behalf of the self-employed individual, they should include a signature along with their title or position.

Essential Components of a Self Employment Verification Letter

To ensure the letter is both professional and complete, certain components must be included. These components are crucial for verifying employment status and income. Here is a breakdown of each essential part:

| Component | Description |

|---|---|

| Date | The date when the letter is issued. |

| Name of the Individual | The name of the self-employed individual or freelancer requesting the verification. |

| Business Name | The name of the business or service the individual operates under. |

| Nature of Work | A description of the type of work or services the individual provides. |

| Income Statement | A statement of the individual’s income, which may be an average amount or a general estimate. |

| Contact Information | Contact details, such as a phone number, email, and business address, for verification purposes. |

| Signature | The signature of the self-employed individual or the authorized person issuing the letter. |

How to Ensure Your Self Employment Verification Letter Is Professional

While the content of the letter is critical, the manner in which it is written is equally important. A professional tone and clarity are key. Here are some tips for making the letter formal and professional:

- Use Formal Language: Avoid using informal language or slang. The tone should be courteous and direct.

- Be Clear and Concise: Keep the letter short, focusing only on the relevant details that the requesting party requires. Avoid unnecessary information.

- Proofread for Accuracy: Double-check the letter for any errors in spelling, grammar, or factual inaccuracies, especially when referencing income figures or employment dates.

- Formatting: Ensure the letter is properly formatted with clear headings and neatly aligned text. This will make the letter appear more professional.

Precisehire’s Role in Self-Employment Verification

For businesses or individuals who require assistance with verifying self-employment status, services like Precisehire can be valuable. Precisehire specializes in background checks and verification services, including confirming self-employment and income details. By using Precisehire’s services, organizations can ensure the accuracy of self-employment verification letters and gain confidence in the legitimacy of the information provided.

Precisehire can also help streamline the verification process by cross-checking self-employment data against reliable sources, such as tax filings or business registration documents, ensuring that all necessary components of the verification are accurate and compliant with legal and financial regulations.

By leveraging these services, self-employed individuals can easily meet requirements set by banks, landlords, and other organizations that need proof of income or employment, while businesses can minimize risks associated with fraudulent or inaccurate documentation.

Legal Aspects of Self Employment Verification Letters

A self-employment verification letter serves as an official document to validate an individual’s status as self-employed. Therefore, it must be handled with care to ensure its accuracy and legal compliance. Here’s what you need to know about the legal aspects of these letters:

- Accuracy of Information: The most important legal consideration when writing or submitting a self-employment verification letter is ensuring the accuracy of the information. If false or misleading information is provided, there can be serious consequences, especially in the context of financial or legal matters. For instance, if a self-employment verification letter is used to secure a loan or rental agreement, providing inaccurate income details could lead to contract disputes or legal actions.

- Potential Legal Consequences for False Information: If an individual knowingly provides incorrect or false information in a self-employment verification letter, they could be held legally liable. This is particularly true in situations involving financial institutions or government agencies. In some cases, misrepresentation of income or employment status could lead to charges of fraud, which may result in penalties, fines, or even imprisonment. It’s important to ensure that all information in the letter is truthful and verifiable.

- Additional Legal Documents: While a self-employment verification letter may be sufficient in some situations, additional documents may be required depending on the context. For example:

- Tax Returns: Many financial institutions or government bodies may request recent tax returns or income statements in addition to the verification letter to validate self-employment claims.

- Invoices or Contracts: If the individual is a freelancer or contractor, they may need to provide copies of invoices or contracts as proof of income or work history.

- Bank Statements: In some cases, recent bank statements might be required to confirm the financial activity and income level of a self-employed person.

Frequently Asked Questions

How do I prove self-employment without a verification letter?

If a self-employment verification letter is not available, individuals can provide alternative documents such as tax returns, bank statements, contracts, or invoices that demonstrate their income and employment status.

Can I provide tax returns instead of a self-employment verification letter?

Yes, tax returns can serve as a legitimate proof of self-employment, especially when the letter is not explicitly required. In some cases, financial institutions or government agencies may prefer tax returns or other supporting documents to verify income.

What if I am a freelancer and don’t have a formal business structure?

Freelancers who do not operate under a formal business structure can still issue a self-employment verification letter. The letter should outline the nature of the work being done, the duration of the freelancing activity, and any relevant income details. The lack of a formal business structure should not prevent you from proving self-employment.

How long should a self-employment verification letter be?

A self-employment verification letter should be concise and to the point. Typically, it should not exceed one page. It should include all necessary information in a clear and structured manner, avoiding unnecessary details.

Do I need to notarize a self-employment verification letter?

In most cases, a notarization is not required for a self-employment verification letter. However, some institutions or government agencies may request notarization for added authenticity. It’s important to check the specific requirements of the organization requesting the letter.

Conclusion

A self-employment verification letter is a critical document that provides proof of self-employment and income for individuals who are not employed by a traditional employer. Whether used for loan applications, housing, or legal purposes, this letter serves as a formal statement of an individual’s work and earnings.

Ensuring the accuracy and professionalism of the letter is crucial to avoid legal issues or delays in financial or legal processes. By following the steps outlined in this guide, individuals can craft a reliable self-employment verification letter that meets the requirements of the requesting party.

For those looking to streamline the verification process or require additional services for employment or background checks, Precisehire offers a comprehensive suite of tools to ensure self-employment claims are verified and legitimate. By utilizing services like Precisehire, individuals and businesses can confidently navigate the self-employment verification process, ensuring compliance and authenticity every step of the way.