Self-Employment Verification Made Easy: A Step-by-Step Guide

Self-Employment Verification: Everything You Need to Know

Self-employment verification is the process of confirming and proving an individual’s self-employed status. It typically involves gathering and presenting financial documents, legal paperwork, and other records that demonstrate independent work activities, income, and professional legitimacy. This verification is especially critical for freelancers, contractors, gig workers, and small business owners who do not receive the standard employer-issued verification documents like pay stubs or employment letters.

Verification is essential for demonstrating financial stability, professional credibility, and compliance with legal or regulatory requirements. For instance, if a self-employed individual is applying for a mortgage, securing a lease, or seeking a business loan, lenders or landlords may request proof of consistent income. Similarly, government agencies may require this information to verify eligibility for certain benefits or during tax audits.

Why Is Self-Employment Verification Needed?

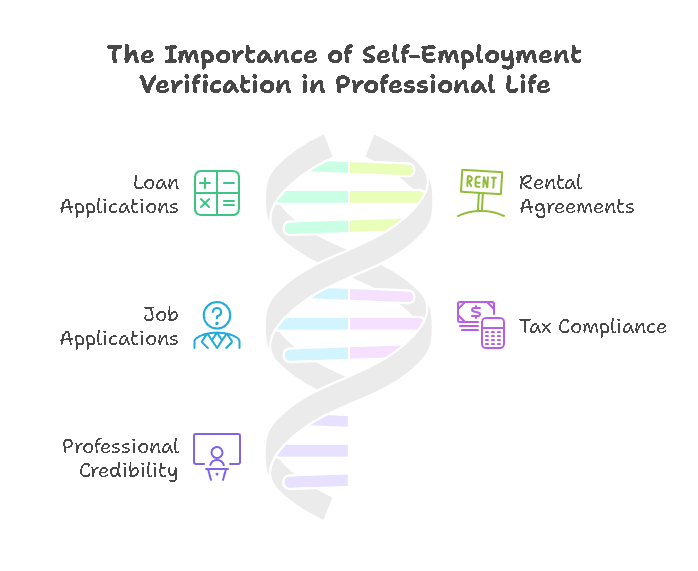

Self-employment verification is crucial for various professional and financial scenarios. Here’s why this process matters:

- Loan Applications:

Lenders often require proof of income to assess a borrower’s ability to repay loans. For self-employed individuals, this can involve providing several years of tax returns, profit and loss (P&L) statements, or bank statements showing steady income. Without this verification, lenders may be hesitant to extend credit. - Rental Agreements:

Landlords use income verification to ensure tenants can meet their rent obligations. Since self-employed individuals don’t have traditional pay stubs, landlords typically request other forms of proof, such as recent tax filings, bank statements, or a portfolio of client invoices. - Job Applications or Contracts:

In industries where independent contractors or freelancers are hired, such as consulting, creative services, or IT, companies may ask for proof of self-employment. This ensures that the candidate has the necessary experience, skills, and reliability. - Tax and Legal Compliance:

Self-employed individuals must verify their income and expenses for tax reporting purposes. Accurate documentation not only ensures compliance with tax regulations but also helps avoid potential penalties during audits. - Professional Credibility:

In certain fields, proving self-employment can enhance professional reputation. For instance, consultants or freelance writers may showcase contracts or client testimonials as part of their verification process to secure new clients or projects. - Insurance and Benefits Eligibility:

Self-employed individuals applying for health insurance, workers’ compensation, or unemployment benefits may need to provide verification to prove their eligibility under specific programs.

These scenarios highlight how self-employment verification supports financial transparency, compliance, and trust in various professional and personal interactions.

Common Documents for Self-Employment Verification

Self-employment verification requires presenting accurate and comprehensive documentation. Here are the most commonly used documents:

- Tax Returns (IRS Form 1040 with Schedule C or Schedule SE):

Tax returns are a primary and reliable form of verification. They provide detailed information about income, expenses, and other financial data for a given year. For many, the Schedule C (Profit or Loss from Business) is essential as it outlines business revenue and deductions. - Profit and Loss (P&L) Statements:

These financial statements summarize business income and expenses over a specific period, helping verify operational profitability. They are often used by lenders and landlords to assess an individual’s financial stability. - Bank Statements:

Regular income deposits into a bank account can provide further proof of self-employment. A consistent flow of payments from clients or customers demonstrates financial reliability. - Invoices and Contracts:

For freelancers and contractors, signed contracts and paid invoices validate their self-employment activities. These documents serve as evidence of completed work and income earned. - Business Licenses or Permits:

A valid business license indicates that an individual is legally authorized to operate a business in their locality or industry. This is particularly important for small business owners. - Client Testimonials or References:

Positive feedback from clients or professional references can serve as supplementary proof of self-employment and credibility in certain industries. - Insurance or Bonding Certificates:

Certain professions require liability insurance or bonding. Proof of such coverage can reinforce self-employment claims, especially in industries like construction or event planning.

Maintaining organized and updated records of these documents ensures a smoother verification process and reduces the risk of delays or challenges.

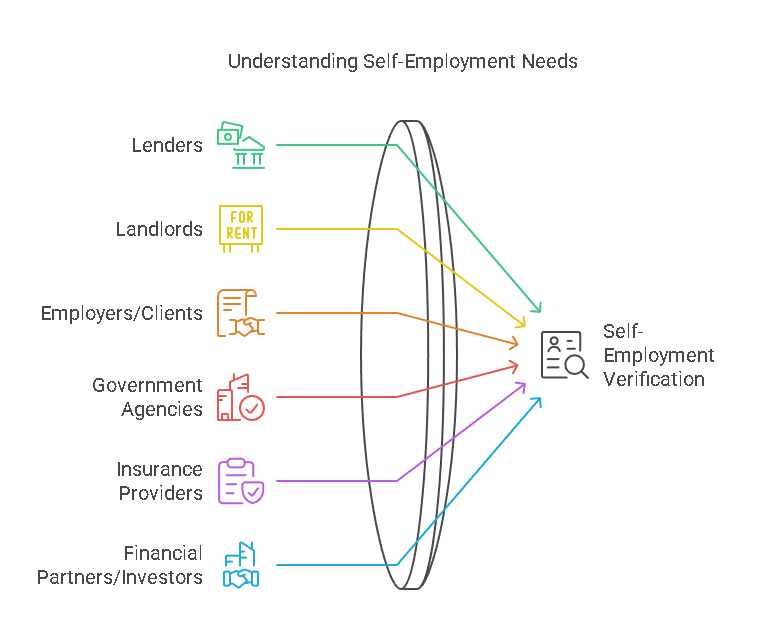

Who Needs to Verify Self-Employment?

Various entities may request self-employment verification for different purposes. Here’s a closer look at the key groups involved:

- Lenders:

When applying for loans, such as mortgages or business loans, financial institutions require proof of income to assess a borrower’s repayment capacity. Without employer-issued pay stubs, self-employed individuals must rely on their tax filings, bank statements, or P&L statements for verification. - Landlords:

For self-employed renters, landlords often request documentation to confirm their ability to pay rent consistently. Tax returns and bank statements are common documents provided during the rental application process. - Employers or Clients:

In industries reliant on independent contractors, employers or clients may require verification of self-employment before entering into professional agreements. This ensures that the individual has the skills and experience necessary for the project. - Government Agencies:

Self-employment verification may be necessary to qualify for certain government programs, such as unemployment benefits or tax credits. It may also be required during audits to confirm income and tax compliance. - Insurance Providers:

Health insurance or professional liability insurers may require proof of self-employment, particularly when offering plans tailored to freelancers or small business owners. - Financial Partners or Investors:

Entrepreneurs seeking investment or partnerships may need to verify their self-employment status and financial history to establish credibility and secure funding.

By understanding who may need verification and why, self-employed individuals can better prepare their documentation and streamline the process.

How to Verify Self-Employment

The process of verifying self-employment involves several key steps:

- Gather Essential Documents:

Start by collecting key records, such as tax returns, bank statements, invoices, and contracts. Make sure these documents are recent and accurate. - Organize Financial Statements:

Prepare profit and loss statements or other financial summaries that demonstrate consistent income. Organizing these documents in chronological order helps streamline the review process. - Provide Business Credentials:

Submit copies of business licenses, permits, or registrations to establish the legitimacy of your business operations. - Request Professional Assistance (If Necessary):

If your financial situation is complex, consider hiring an accountant or using a third-party verification service to ensure your records meet the required standards. - Submit Documentation Promptly:

Provide the requested documents to the verifying entity within the specified timeframe. Ensure all records are complete and error-free to avoid delays. - Maintain Accurate Records:

Make it a habit to keep accurate and up-to-date documentation. This not only simplifies future verification requests but also ensures compliance with tax and legal requirements.

With these steps, self-employed individuals can effectively demonstrate their professional status, ensuring they meet the demands of lenders, landlords, or other verifying entities.

How to Complete Self-Employment Verification: Best Practices and Services

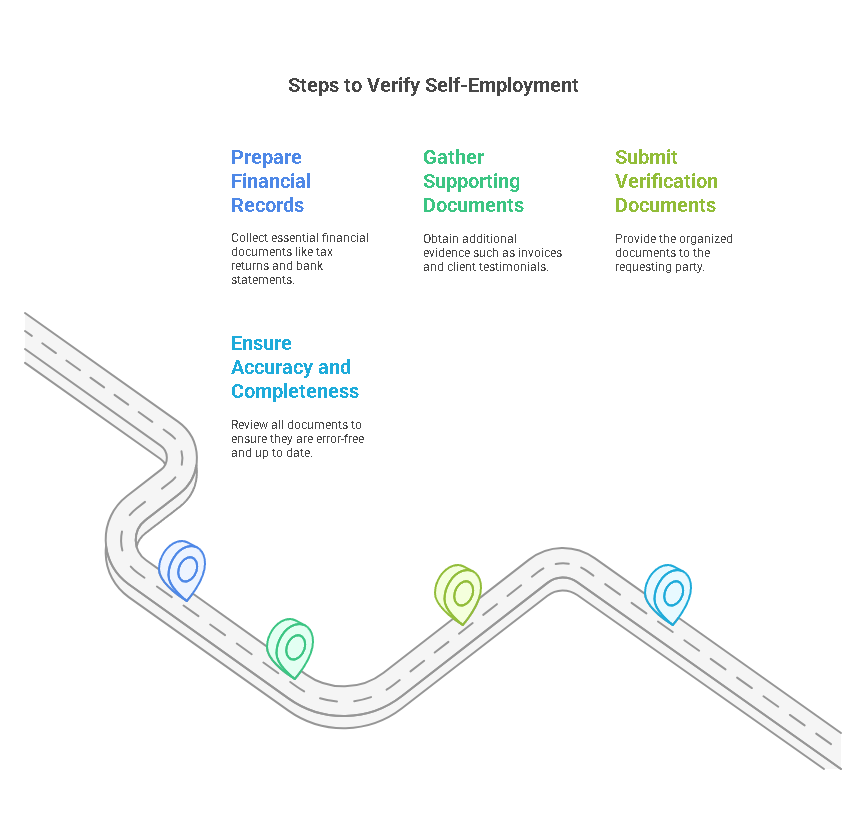

Steps to Verify Self-Employment

Verifying self-employment can be a straightforward process when approached methodically. Here are the essential steps to ensure your status is accurately confirmed:

- Prepare Financial Records

Financial records are the cornerstone of self-employment verification. Collect these key documents:- Tax Returns: Provide your IRS Form 1040 along with Schedule C (or other applicable forms) to show your income and business expenses.

- Profit and Loss (P&L) Statements: Create detailed statements outlining your income and operating expenses.

- Bank Statements: Highlight consistent deposits from clients or customers, ensuring these align with your reported income.

- Gather Supporting Documents

Supplement financial records with additional evidence:- Invoices and Contracts: Submit signed agreements and paid invoices as proof of completed work.

- Business Licenses or Permits: These documents affirm your legitimacy as a business entity.

- Client Testimonials: Include references or endorsements, particularly if they come from reputable clients in your industry.

- Submit Verification Documents

Once you’ve organized your materials, provide them to the requesting party. Depending on the purpose of verification (e.g., applying for a loan or securing a rental), submission methods may vary. Lenders and employers often require scanned copies, while government agencies may accept online uploads. - Ensure Accuracy and Completeness

Before submitting, review all documents to confirm they are error-free and up to date. Discrepancies or outdated records can lead to delays or rejection.

By following these steps, self-employed individuals can streamline the verification process, improving their chances of success in financial or professional endeavors.

Challenges in Self-Employment Verification

While self-employment verification is essential, it comes with unique challenges. Here’s a breakdown of common hurdles and ways to overcome them:

- Limited Records

New entrepreneurs or freelancers may not have sufficient documentation, especially if they’ve only recently started their ventures. Without prior tax returns or a history of financial records, proving income becomes difficult.Solution:- Maintain meticulous records from the outset, including invoices, contracts, and bank statements.

- Use accounting software to track income and expenses, generating reliable financial summaries.

- Verification Delays

Third-party verifications, such as background checks or tax audits, can slow down the process. Government agencies or lenders may require extended time to review submitted materials.Solution:- Submit documents early to allow sufficient processing time.

- Provide complete and well-organized documentation to minimize follow-ups or rejections.

- Income Variability

Freelancers and gig workers often experience fluctuating income, which may raise concerns for lenders or landlords. Without stable, predictable earnings, proving financial reliability becomes challenging.Solution:- Use multi-year financial data to demonstrate consistent long-term income.

- Supplement irregular income data with savings records or assets as proof of financial stability.

- Compliance Issues

Errors in tax filings or incomplete records can complicate verification. Non-compliance with tax laws can also lead to further scrutiny during audits.Solution:- Work with professional accountants to ensure accuracy in tax filings.

- Regularly update and review records to maintain compliance.

Understanding and addressing these challenges helps individuals navigate the verification process with confidence and efficiency.

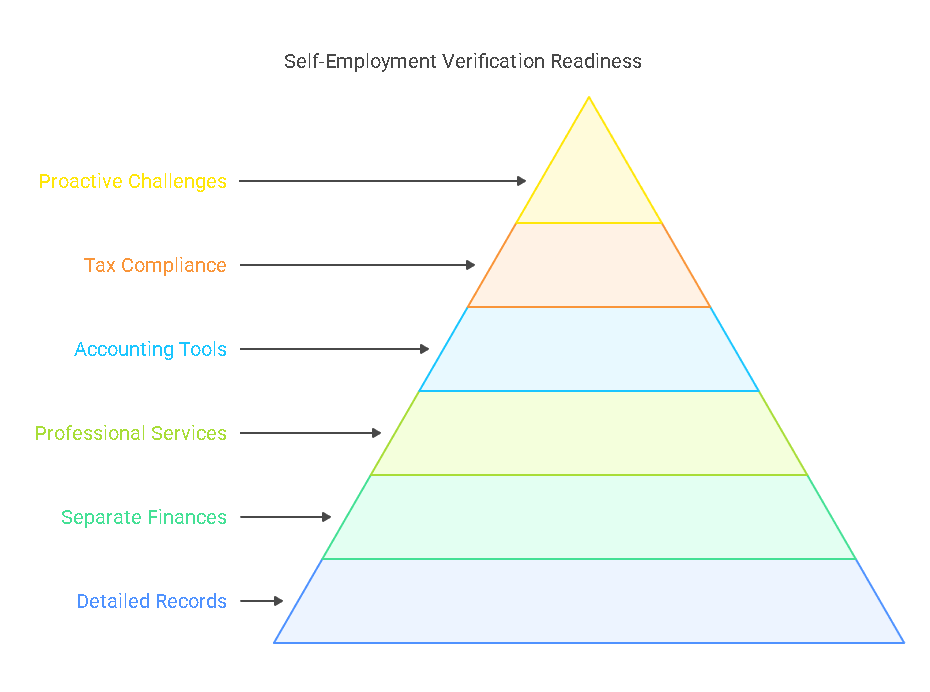

Best Practices for Self-Employment Verification

Adopting best practices can simplify self-employment verification and minimize complications:

- Keep Detailed Records

Maintaining well-organized financial records ensures you’re prepared for verification requests. Regularly update:- Tax returns

- P&L statements

- Receipts and invoices

- Separate Personal and Business Finances

Use dedicated business bank accounts and credit cards. This makes it easier to track income and expenses while reducing errors during verification. - Use Professional Services

Hiring an accountant or financial advisor can help ensure accurate record-keeping and compliance with tax regulations. Professional services also add credibility when presenting documents to lenders or other third parties. - Invest in Accounting Tools

Digital accounting software such as QuickBooks, Wave, or FreshBooks simplifies tracking income, expenses, and generating financial statements. Many tools also offer features for invoicing and tax preparation. - Stay Compliant with Tax Laws

Ensure your tax filings are accurate and on time. Compliance not only prevents legal issues but also strengthens your credibility during verification. - Proactively Address Challenges

Anticipate potential obstacles, such as gaps in financial records, and take steps to mitigate them. For example, if income variability is a concern, provide additional documentation like client contracts or savings statements.

By following these practices, self-employed individuals can maintain readiness for verification requests and foster trust in professional and financial interactions.

PreciseHire’s Services for Self-Employment Verification

PreciseHire specializes in providing comprehensive and efficient self-employment verification services. Here’s how it helps:

- Streamlined Verification Process

PreciseHire simplifies the verification process by collecting and analyzing necessary documents on behalf of self-employed individuals and their verifying parties. - Support for Employers and Clients

Businesses hiring freelancers or contractors can rely on PreciseHire to validate self-employment claims. This ensures accurate assessments during recruitment and onboarding processes. - Accuracy and Compliance

PreciseHire guarantees accurate verification by thoroughly reviewing tax filings, financial records, and other supporting documents. This helps clients comply with regulatory requirements. - Timeliness and Convenience

PreciseHire ensures swift processing of self-employment verifications, reducing delays for individuals applying for loans, jobs, or benefits. - Custom Solutions for Businesses

Employers and organizations can benefit from tailored verification solutions, including background checks and document validation for independent contractors.

By leveraging PreciseHire’s services, self-employed individuals and businesses can confidently navigate the verification process, ensuring accuracy and efficiency.

The Importance of Self-Employment Verification in Financial Transactions

Self-employment verification plays a pivotal role in financial dealings. Accurate verification provides assurance to:

- Lenders, who evaluate an individual’s capacity to repay loans.

- Landlords, who assess a tenant’s ability to meet rent obligations.

- Government Agencies, ensuring applicants qualify for financial aid or benefits.

Mistakes or discrepancies in verification can lead to loan denials, lease rejections, or audit complications. As such, maintaining detailed records and seeking professional assistance where needed is vital.

This proactive approach ensures smooth financial interactions and strengthens trust among all parties involved in the verification process.

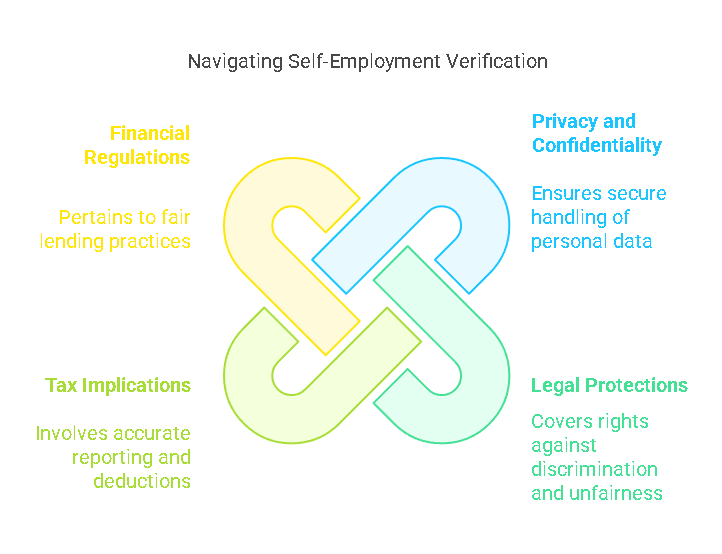

Legal Considerations for Self-Employment Verification

Self-employment verification intersects with several legal domains, including privacy, taxation, and anti-discrimination laws. Understanding these aspects ensures individuals and businesses comply with regulations while safeguarding rights.

1. Privacy and Confidentiality

Self-employed individuals share sensitive data like tax returns, financial statements, and personal identifiers during the verification process. Privacy concerns arise when these documents are mishandled or exposed.

- Data Protection Laws: Compliance with privacy laws like the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) is critical. These regulations mandate secure handling of personal data and grant individuals control over how their data is used.

- Best Practices:

- Submit documents through encrypted platforms.

- Share only essential information.

- Confirm the requesting party’s compliance with privacy laws before submission.

- Legal Recourse: If sensitive data is mishandled, individuals may pursue legal action for damages or file complaints with relevant regulatory authorities.

2. Legal Protections for Self-Employed Workers

Self-employed individuals enjoy specific rights under labor and contract laws:

- Fair Contracting Standards: Contracts involving freelancers or independent contractors often include clauses outlining verification procedures and confidentiality terms.

- Non-Discrimination: Clients or institutions cannot deny services, loans, or employment based solely on self-employment status.

- Right to Appeal: Self-employed individuals have the right to contest unfair decisions resulting from the verification process, such as loan rejections or disputes over income.

3. Tax Implications

Self-employment verification is pivotal for tax compliance, as it directly affects deductions, credits, and liabilities.

- IRS Compliance: Proper documentation ensures that income is accurately reported, reducing the risk of audits or penalties.

- Deductions and Benefits: Verified self-employment allows individuals to claim deductions like home office expenses, equipment purchases, and travel costs.

- Legal Consequences: Failing to verify or underreporting income can lead to audits, fines, or legal action by the IRS.

4. Financial and Lending Regulations

When applying for loans or mortgages, self-employed individuals must meet specific financial regulations:

- Verification Standards: Lenders often require multiple years of financial history to assess creditworthiness.

- Fair Lending Practices: Institutions must follow anti-discrimination laws like the Equal Credit Opportunity Act, ensuring fair treatment regardless of employment type.

Challenges and Misconceptions in Legal Contexts

1. Misconception: All Self-Employed Individuals Face the Same Requirements

Verification requirements vary based on industry, income level, and the entity requesting proof. For example, freelance graphic designers may rely on invoices, while real estate agents might present licenses and tax returns.

2. Challenge: Delays in Verification

Some processes, such as securing tax transcripts from the IRS or obtaining certified copies of business licenses, can be time-consuming. Proactively maintaining up-to-date records can mitigate delays.

3. Misconception: Verification Always Requires Tax Returns

While tax returns are a primary document, other forms of evidence like bank statements, client contracts, or profit-and-loss reports can serve as alternatives.

Frequently Asked Questions (FAQs)

What Documents Are Needed to Verify Self-Employment?

Key documents include:

- Tax Returns: The most reliable evidence, often accompanied by IRS transcripts.

- Profit and Loss Statements: Reflects the financial health of the business.

- Invoices and Contracts: Prove ongoing business operations and client relationships.

- Bank Statements: Demonstrates consistent income deposits.

- Business Licenses: Verifies the legitimacy of the enterprise.

Can I Verify Self-Employment Without Tax Returns?

Yes, alternative documents like invoices, signed contracts, or profit-and-loss statements can suffice. However, tax returns are often preferred for their comprehensiveness.

How Long Does the Verification Process Take?

Timelines vary based on the entity requesting verification:

- Lenders or Landlords: 2–5 business days if all documents are in order.

- IRS Tax Transcripts: 5–10 business days for processing.

- Third-Party Verification Services: Same-day results in many cases.

Do I Need Self-Employment Verification for a Mortgage?

Yes, mortgage lenders require detailed financial records to assess income stability and repayment ability. Providing at least two years of tax returns and supporting documents strengthens your application.

Can I Verify Self-Employment for Freelance Work?

Absolutely. Freelancers often need to verify their status when applying for projects or contracts. Providing client references, signed agreements, and financial records typically satisfies these requirements.

The Role of PreciseHire in Self-Employment Verification

1. Streamlined Verification Services

PreciseHire offers a professional and efficient process for verifying self-employment status. By leveraging technology, the platform simplifies document collection and evaluation, ensuring quick and accurate results.

2. Tailored Solutions for Employers and Individuals

- For Employers: PreciseHire helps employers verify the self-employment claims of freelancers and contractors during hiring processes.

- For Self-Employed Individuals: The service guides individuals in preparing and submitting necessary documents, ensuring compliance with legal and financial requirements.

3. Compliance and Security

PreciseHire adheres to data protection laws, providing a secure environment for document submission. Its expertise ensures compliance with IRS regulations and lending standards.

Best Practices for Self-Employment Verification

1. Keep Organized Records

Maintaining comprehensive and organized financial documents is crucial for a seamless verification process.

- Digital Tools: Use accounting software like QuickBooks or Wave to generate profit-and-loss statements.

- Cloud Storage: Store scanned copies of invoices, contracts, and licenses in secure cloud platforms for easy access.

2. Understand Your Rights

- Legal Protections: Familiarize yourself with laws governing verification requests to ensure fair treatment.

- Dispute Mechanisms: Know how to contest unfair rejections or incorrect assessments.

3. Seek Professional Help

Accountants and financial advisors can assist in preparing documents and navigating complex verification requirements. Services like PreciseHire provide additional support, offering tailored solutions for self-employed individuals.

Additional Use Cases for Self-Employment Verification

1. Rental Applications

Landlords often require self-employed tenants to verify income stability. Providing consistent bank statements and profit-and-loss reports can satisfy their concerns.

2. Government Programs

Self-employed individuals applying for unemployment benefits or government grants must verify their status through tax records and business documentation.

3. Business Partnerships

When entering joint ventures, self-employment verification builds trust and ensures transparency regarding financial contributions and responsibilities.

Conclusion

Self-employment verification is a multifaceted process critical for various financial, legal, and professional endeavors. By understanding the legal considerations, maintaining organized records, and following best practices, self-employed individuals can navigate this process with confidence.

PreciseHire plays a pivotal role in streamlining verification, offering tailored services that prioritize accuracy, compliance, and efficiency. Whether you’re securing a loan, applying for housing, or confirming eligibility for a program, PreciseHire ensures a seamless and reliable verification experience.

In a world where self-employment continues to rise, accurate verification not only opens doors to opportunities but also safeguards credibility and compliance for all parties involved.