A Comprehensive Guide to PayPal Identity Verification Process

Introduction to PayPal Identity Verification

What is PayPal Identity Verification?

PayPal identity verification is a security process that confirms the identity of users, both individuals and businesses, to ensure safe transactions on the platform. The goal of this process is to prevent fraud, enhance user security, and comply with regulations in various jurisdictions. PayPal requires users to verify their identity to confirm that they are legitimate users and prevent unauthorized access to financial accounts.

Why Does PayPal Ask for Identity Verification?

PayPal requests identity verification for several reasons:

- Security: To safeguard users from fraud and unauthorized transactions.

- Compliance: PayPal must adhere to anti-money laundering (AML) and Know Your Customer (KYC) regulations, ensuring that its platform is not used for illegal activities.

- Fraud Prevention: Verifying identities helps prevent fraud, chargebacks, and unauthorized payments.

- Higher Transaction Limits: Verified users can enjoy higher limits on transactions, especially for businesses.

- User Trust: Verification ensures both users and businesses are protected and assures customers that they are dealing with legitimate accounts.

How PayPal Handles Identity Verification

PayPal’s verification process is designed to be simple and secure. Users are required to submit basic personal information such as name, date of birth, and address. Additionally, PayPal may ask for identification documents such as a driver’s license or passport, along with proof of address (e.g., utility bills).

If necessary, PayPal may request additional steps, such as uploading a selfie for facial recognition to confirm the identity of the user. Once all necessary documents are submitted, PayPal reviews them and notifies the user if verification is successful.

Why is Identity Verification Important for Businesses?

For businesses, identity verification is vital to ensure legal compliance and to facilitate higher transaction volumes. Verified business accounts also gain access to advanced tools, such as invoicing and PayPal business loans. Additionally, businesses that complete the identity verification process are more trusted by customers, as verified accounts are seen as more secure and reliable.

Why PayPal’s Identity Verification is Essential for Users

For individual users, identity verification is essential for preventing fraud, ensuring secure transactions, and gaining access to higher transaction limits. This verification process enhances the overall user experience and helps protect personal and financial information from unauthorized access or misuse.

How PayPal Identity Verification Works and Required Documents

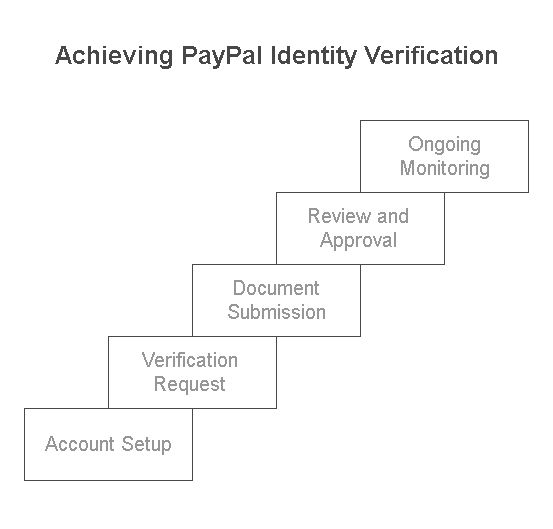

PayPal’s identity verification process is designed to ensure the security of transactions and to meet legal and regulatory requirements. The process typically involves several steps, each aimed at confirming the identity of the user while safeguarding their personal information.

When a user creates an account or attempts to perform certain actions (like sending or receiving large amounts of money), PayPal may prompt them to verify their identity. This is often required to comply with financial regulations like Know Your Customer (KYC) and Anti-Money Laundering (AML) laws.

Here are the key steps involved:

- Sign Up and Account Setup: During the account registration, PayPal collects personal information such as name, address, email, and date of birth. In some cases, PayPal may ask users to link their bank accounts or credit/debit cards to facilitate payments and verify ownership.

- Request for Verification: Depending on the type of transactions the user plans to carry out or if PayPal detects unusual activity, they may request the user to verify their identity. Users will be prompted through their account settings to submit verification documents.

- Document Submission: The user submits the required documents, which typically include government-issued photo IDs (e.g., passport or driver’s license) and proof of address (e.g., a utility bill or bank statement). PayPal may also ask for a selfie in some cases for biometric verification.

- Review and Approval: After receiving the documents, PayPal reviews the submitted information to confirm that it matches the user’s profile. Once all documents are verified, PayPal will send an approval notification, indicating that the account is fully verified. If the verification is unsuccessful, PayPal will notify the user with details on what further steps to take.

- Ongoing Monitoring: Even after the account is verified, PayPal may conduct ongoing checks to ensure the account remains secure. Users might be required to re-verify their identity periodically or whenever changes are made to their account, such as updating personal information or adding a new bank account.

Required Documents for PayPal Identity Verification

The documents required for PayPal identity verification vary depending on the country of residence and the type of account (personal or business). The most common documents requested are:

- Photo Identification: This is usually the most important document required for identity verification. It can be one of the following:

- Driver’s license

- Passport

- National identity card

- Government-issued photo ID

- Proof of Address: To confirm the user’s address, PayPal asks for documents that are typically issued within the last three months. Examples include:

- Utility bills (electricity, water, or gas)

- Bank or credit card statements

- Tax returns or official letters from a government agency

- Selfie for Facial Recognition: In some cases, PayPal may require users to take a selfie or record a short video to ensure that the individual submitting the documents matches the photo ID provided. This step adds an additional layer of verification, particularly for users with higher transaction volumes.

- Business Documents (for Business Accounts): Business users are required to provide additional documentation to confirm the legal status of the business. This can include:

- Business registration details

- Tax identification number (TIN)

- Articles of incorporation or business licenses

Types of PayPal Identity Verification

There are various methods for verifying identity on PayPal, each with specific requirements:

| Verification Method | Documents Required | Purpose |

|---|---|---|

| Photo ID Verification | Government-issued photo ID (e.g., passport) | To confirm the user’s identity visually |

| Address Verification | Utility bills or bank statements | To verify the user’s address |

| Selfie Verification | Selfie with a government-issued ID | For biometric verification |

| Business Verification | Business registration documents, TIN | To verify a business account |

Precisehire’s Role in Identity Verification

Precisehire is a professional background screening and identity verification service provider that offers customized solutions to businesses seeking secure and compliant verification processes. For businesses using PayPal for transactions, Precisehire’s identity verification services can help ensure compliance with all necessary regulations, such as KYC and AML, by conducting comprehensive background checks and verification procedures.

Additionally, Precisehire provides businesses with a streamlined process for verifying customers and partners, reducing the risk of fraud and enhancing trust with users. Businesses can integrate these verification services to maintain secure transactions, safeguard sensitive information, and remain compliant with legal standards.

Legal Aspects of PayPal Identity Verification

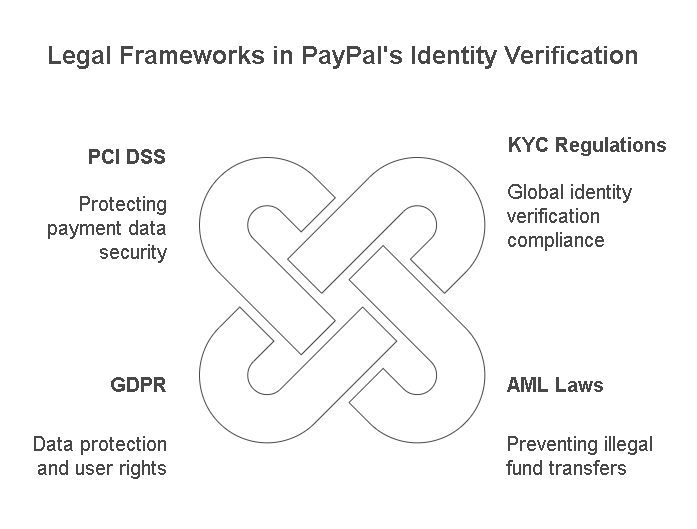

PayPal’s identity verification process is not just a security measure; it is also essential for complying with various legal regulations and protecting both users and financial institutions from fraud and illegal activities. Several legal frameworks govern PayPal’s verification process, including:

- Know Your Customer (KYC) Regulations: KYC laws are part of anti-money laundering (AML) regulations that financial institutions, including PayPal, must adhere to. These regulations require businesses to verify the identities of their customers to prevent identity theft, fraud, and money laundering. KYC laws are enforced globally, and PayPal is required to comply with them in every jurisdiction where it operates. This often means asking users to provide government-issued photo IDs and proof of address to confirm their identities.

- Anti-Money Laundering (AML) Laws: AML regulations aim to prevent the illegal transfer of funds. PayPal, as a financial service provider, must ensure that its users are not involved in any illegal activities such as money laundering or terrorist financing. As a result, identity verification is a critical part of PayPal’s due diligence process, allowing the company to monitor accounts for suspicious activities.

- General Data Protection Regulation (GDPR): For PayPal users in the European Union (EU), the GDPR governs how personal information is collected, stored, and processed. PayPal must ensure that all personal data, including identity verification documents, is handled securely and used only for specific purposes outlined by the regulation. Users must consent to the collection and processing of their personal data, and they have the right to access, correct, or delete their data at any time.

- Payment Card Industry Data Security Standard (PCI DSS): As part of PayPal’s security protocols, it follows the PCI DSS to protect user payment data. This standard mandates that PayPal ensures secure identity verification processes to reduce the risk of credit card fraud and unauthorized transactions.

Frequently Asked Questions (FAQs)

Why does PayPal ask for identity verification?

PayPal requests identity verification to comply with legal requirements, including KYC and AML regulations, to prevent fraud and money laundering. Verification ensures the security of users’ accounts and transactions, safeguarding both PayPal and its customers.

What documents do I need to verify my PayPal account?

The most common documents required for PayPal identity verification include:

- A government-issued photo ID (e.g., passport or driver’s license)

- Proof of address (e.g., utility bill, bank statement)

- In some cases, a selfie or video for facial recognition

How long does PayPal identity verification take?

Verification times can vary, but typically, PayPal will process documents within 1 to 3 business days. If additional information is needed or if there is a delay, it may take longer. PayPal will notify the user once their verification is complete.

Can I use PayPal without identity verification?

You can use PayPal for basic transactions without full verification; however, if you plan to send or receive larger amounts of money, or if you engage in specific activities (such as receiving payments for goods or services), PayPal may require identity verification.

How can I avoid delays in PayPal identity verification?

To avoid delays, ensure that you submit clear, legible copies of the required documents. Check that all details match the information on your PayPal account (e.g., name, address). Also, ensure that the documents are current and within the requested time frames (e.g., utility bills within the last three months).

Can PayPal deny my identity verification?

Yes, PayPal can deny your identity verification if the submitted documents do not match their records or if they are unclear or expired. In such cases, you will be asked to provide updated or additional documents for verification.

Can I verify my PayPal account using a business entity?

Yes, business accounts also go through the verification process, which requires submitting business registration documents, tax identification numbers, and other relevant paperwork to confirm the legitimacy of the business.

Conclusion

Identity verification plays a crucial role in ensuring the security of PayPal accounts and transactions. By verifying the identities of users, PayPal protects against fraud, money laundering, and other illegal activities, while also complying with regulatory requirements. Whether for personal accounts or businesses, the verification process ensures a secure and trustworthy environment for all PayPal users.

The process itself is straightforward but requires certain documentation such as government-issued IDs and proof of address. Users should be prepared to submit clear and accurate documentation to avoid delays. PayPal also adheres to strict legal and regulatory standards, including KYC, AML, and GDPR, to protect user data and ensure compliance.

In an increasingly digital world, the importance of secure identity verification cannot be overstated. Services like Precisehire provide comprehensive identity verification solutions, helping businesses to streamline their own verification processes while ensuring compliance with applicable laws. By following best practices for identity verification, businesses and individuals alike can safeguard their financial transactions and data privacy.