Overcoming Challenges in IRS Identity Verification

Introduction & Importance of IRS Identity Verification

The IRS Identity Verification process is a security measure used by the Internal Revenue Service (IRS) to confirm that a taxpayer’s identity is legitimate before processing their tax return or allowing access to sensitive tax information. This verification step is crucial in preventing identity theft, fraudulent tax filings, and unauthorized access to personal financial records.

In recent years, tax-related identity theft has been on the rise, with criminals filing fraudulent tax returns to claim refunds under stolen identities. To combat this, the IRS has implemented strict identity verification procedures to ensure that tax returns and refunds go to the rightful individuals.

Why Does the IRS Require Identity Verification?

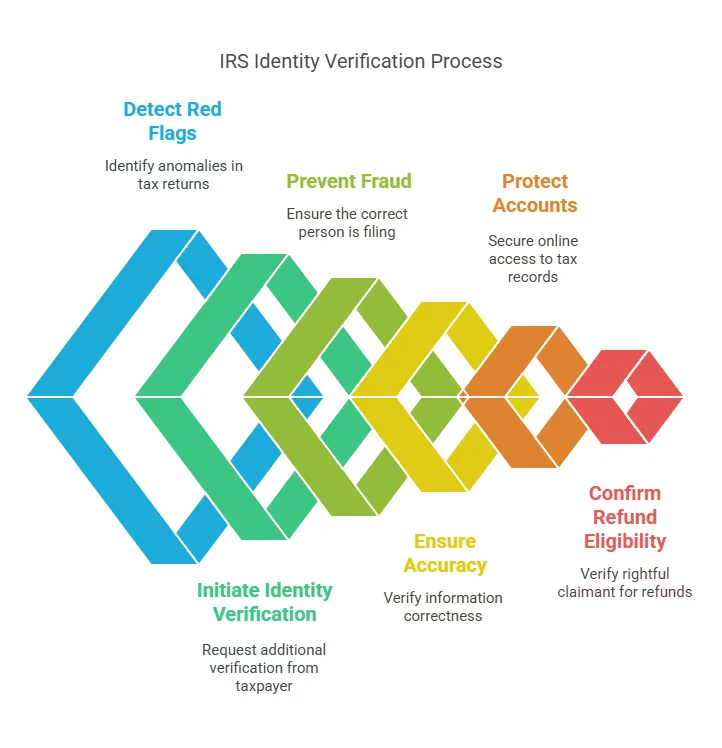

The IRS Identity Verification process exists primarily to protect taxpayers from fraud and secure the tax filing system. When a tax return raises certain red flags, the IRS may require additional identity verification before processing it further. Here are some key reasons why the IRS mandates identity verification:

✅ Preventing Tax Fraud & Identity Theft – Scammers attempt to file fraudulent tax returns using stolen Social Security Numbers (SSNs) to claim refunds. Identity verification ensures that the correct person is filing the tax return.

✅ Ensuring Accurate Tax Returns – If discrepancies arise in the return, such as incorrect income information or duplicate filings, the IRS may require the filer to verify their identity before processing the return.

✅ Protecting Taxpayer Accounts – Identity verification is required when a taxpayer is accessing their IRS account online to prevent unauthorized individuals from viewing or altering tax records.

✅ Confirming Refund Eligibility – If the IRS detects unusual refund activity, it may request verification to ensure the filer is the rightful taxpayer.

Common Reasons Why Taxpayers Need to Verify Their Identity

The IRS may ask a taxpayer to verify their identity for several reasons. Some of the most common scenarios include:

- Receiving an IRS Identity Verification Letter (5071C, 5747C, 4883C, or 6331C)

- The IRS sends these letters when it suspects possible identity theft or fraudulent activity related to a tax return.

- Taxpayers must verify their identity before the IRS processes their refund.

- Accessing IRS Online Services

- When taxpayers try to create an IRS online account, they must verify their identity using government-approved methods.

- This prevents unauthorized individuals from gaining access to sensitive tax records.

- Filing a Tax Return with Suspicious Activity

- If a tax return has conflicting information, duplicate filings, or unusual refund claims, the IRS may require additional verification.

- Requesting Certain Tax Transcripts or Records

- Some sensitive tax documents, such as IRS Tax Return Transcripts, require identity verification before they can be accessed.

- Recovering a Locked IRS Account

- If a taxpayer’s IRS account is locked due to multiple failed login attempts, they must go through an identity verification process to regain access.

Why Is IRS Identity Verification Important?

🔹 Prevents identity theft – By ensuring that only legitimate taxpayers access their accounts and refunds, identity verification reduces the risk of financial fraud.

🔹 Enhances tax filing security – Verifying identity adds a layer of protection to the tax system, making it harder for criminals to exploit it.

🔹 Ensures taxpayers receive their refunds – If identity verification is required but ignored, tax refunds may be delayed or denied.

🔹 Complies with federal regulations – The IRS is legally obligated to implement strong identity verification measures under federal tax security laws.

Step-by-Step Guide to Verifying Your Identity with the IRS

If the IRS requires you to verify your identity, follow these steps to complete the process successfully:

Step 1: Determine Why You Need to Verify Your Identity

The IRS typically requests identity verification for the following reasons:

- You received a letter (such as 5071C, 5747C, 4883C, or 6331C) from the IRS.

- You are attempting to access IRS online services (such as your IRS account or tax transcript).

- Your tax return triggered a fraud alert, and the IRS needs confirmation before processing it.

Step 2: Gather the Required Documents

To complete the IRS identity verification process, you will need:

✅ Your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN)

✅ A government-issued photo ID (such as a driver’s license, state ID, or passport)

✅ A copy of the IRS letter you received (if applicable)

✅ Your most recent tax return to verify past filing details

✅ A device with a webcam or camera if using online verification

Step 3: Choose Your Identity Verification Method

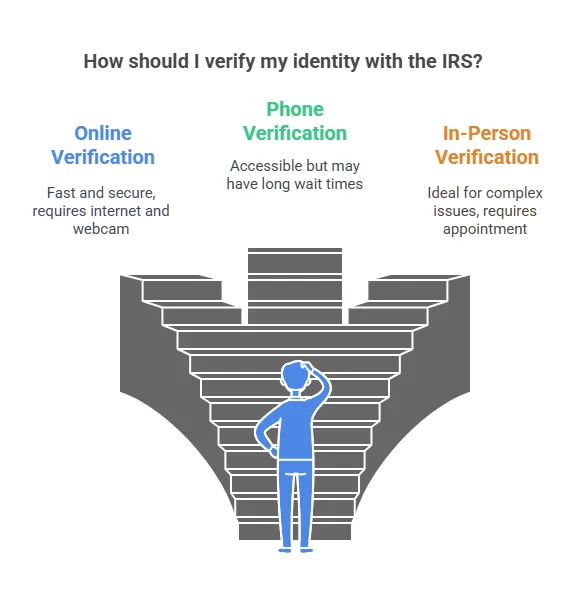

The IRS offers multiple ways to verify your identity, depending on the reason for verification and your personal preference.

Key Methods of IRS Identity Verification

1. Online Verification (Using ID.me)

Best for: Taxpayers who received a 5071C letter, need to access IRS online services, or create an IRS account.

How to verify online:

1️⃣ Visit the IRS’s Identity Verification Service website or go to ID.me.

2️⃣ Sign in or create an ID.me account (IRS now uses ID.me for secure identity verification).

3️⃣ Provide your Social Security Number and tax return details.

4️⃣ Upload a picture of your government-issued photo ID.

5️⃣ Take a live selfie using your phone or webcam to match your ID.

6️⃣ Follow the on-screen prompts to complete the process.

📌 Pros:

✔️ Fast and secure process.

✔️ Available 24/7.

✔️ Immediate confirmation once verified.

📌 Cons:

❌ Requires internet access and a webcam or smartphone.

❌ Some users may experience difficulty with facial recognition technology.

2. IRS Letter 5071C Verification (Online or Phone)

Best for: Taxpayers who received a 5071C, 5747C, 4883C, or 6331C letter from the IRS.

If you receive a letter requesting identity verification, follow these steps:

Option 1: Verify Online

1️⃣ Visit www.irs.gov/verifyreturn.

2️⃣ Enter your letter reference number and tax return details.

3️⃣ Complete the identity verification questionnaire.

4️⃣ If successful, your tax return will continue processing.

Option 2: Verify by Phone

1️⃣ Call the IRS Identity Verification phone number listed on your letter.

2️⃣ Provide your IRS letter reference number and Social Security Number.

3️⃣ Answer personal and financial security questions.

4️⃣ If verification is successful, your tax return will be processed.

📌 Pros:

✔️ Online option is fast and accessible.

✔️ Phone verification available if online verification fails.

📌 Cons:

❌ Phone wait times can be long during tax season.

❌ If you fail verification, you may need to verify in person.

3. IRS In-Person Verification (Taxpayer Assistance Center)

Best for: Taxpayers unable to verify online or by phone.

If online or phone verification is unsuccessful, you may need to verify your identity in person.

How to verify in person:

1️⃣ Schedule an appointment at a local IRS Taxpayer Assistance Center (TAC).

2️⃣ Bring the required identity documents (SSN card, government-issued ID, tax return).

3️⃣ An IRS representative will review your documents and confirm your identity.

📌 Pros:

✔️ Ideal for those without internet access.

✔️ Helpful for resolving complex identity verification issues.

📌 Cons:

❌ Requires an in-person visit, which may be inconvenient.

❌ Appointments may take weeks during peak tax season.

4. IRS Identity Protection PIN (IP PIN) Verification

Best for: Taxpayers who have experienced identity theft and want extra security for tax filing.

The IRS Identity Protection PIN (IP PIN) is a six-digit number that prevents someone else from filing a tax return using your Social Security Number.

How to get an IP PIN:

1️⃣ Go to IRS.gov/GetAnIPPIN.

2️⃣ Verify your identity using ID.me.

3️⃣ The IRS will issue a new IP PIN each year for secure tax filing.

📌 Pros:

✔️ Extra security against tax-related identity theft.

✔️ Ensures only the taxpayer can file their return.

📌 Cons:

❌ Must renew annually.

❌ If lost, retrieval requires additional verification.

Precise Hire: Your Trusted Identity Verification Partner

At Precise Hire, we specialize in identity verification services that help individuals and businesses safeguard sensitive information. Whether you need assistance with IRS identity verification, tax compliance, or fraud prevention, we provide:

✅ Fast and reliable identity checks

✅ Secure verification processes

✅ Expert support for navigating IRS verification issues

By partnering with Precise Hire, you can ensure your IRS identity verification process is smooth and hassle-free.

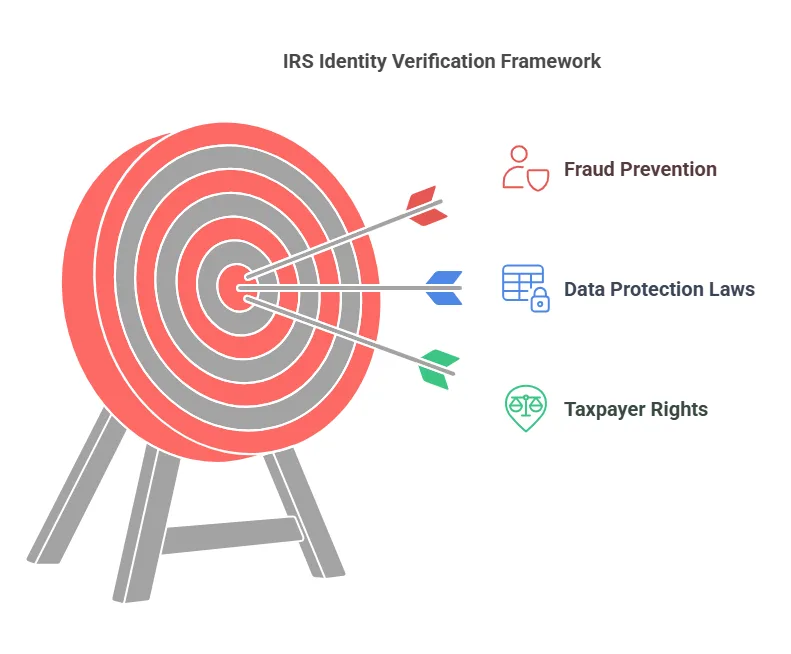

Legal Aspects of IRS Identity Verification

The IRS follows strict federal laws and security measures to ensure taxpayer data is protected and used appropriately. Here are some key legal considerations:

1. Fraud Prevention and Taxpayer Security

The IRS Identity Verification process is designed to prevent fraud by:

🔹 Stopping identity theft – Ensuring that only the legitimate taxpayer can file a tax return.

🔹 Blocking fraudulent refunds – Scammers often attempt to file tax returns using stolen SSNs to claim refunds.

🔹 Verifying tax account access – Preventing unauthorized access to sensitive tax records.

2. IRS Data Protection & Privacy Laws

The IRS adheres to strict data security laws, including:

✅ The Privacy Act of 1974 – Protects personal tax data from unauthorized disclosure.

✅ The IRS Restructuring and Reform Act of 1998 – Ensures taxpayers have rights regarding their information.

✅ The Taxpayer Bill of Rights – Grants taxpayers the right to privacy and confidentiality of their tax records.

📌 What This Means for You:

- Your tax information cannot be shared without your consent.

- IRS employees must follow strict security protocols when handling identity verification.

- Your personal and financial data is encrypted during online verification.

3. Taxpayer Rights in Identity Verification

Taxpayers have specific rights when verifying their identity with the IRS:

🛑 Right to Privacy – The IRS cannot disclose your information to unauthorized parties.

🛑 Right to Challenge Errors – If your identity verification fails, you can appeal the decision.

🛑 Right to Assistance – The IRS must provide help if you cannot verify your identity.

🛑 Right to a Fair Process – You must be given fair treatment and multiple verification options.

If you suspect your identity has been compromised, you can report tax-related identity theft to the IRS and request an Identity Protection PIN (IP PIN) for added security.

Frequently Asked Questions (FAQs) About IRS Identity Verification

How do I know if the IRS needs me to verify my identity?

If the IRS requires identity verification, they will send you a letter such as:

📌 5071C Letter – Sent when your tax return is flagged for potential identity theft.

📌 5747C Letter – Requires in-person identity verification.

📌 4883C or 6331C Letter – Issued when additional information is needed before processing your tax return.

💡 Tip: The IRS will never email, call, or text you out of the blue for identity verification. If you receive an unexpected request, it could be a scam.

What happens if I fail IRS identity verification?

If you cannot verify your identity online or over the phone, you may need to:

✔️ Visit a local IRS Taxpayer Assistance Center (TAC) in person.

✔️ Provide additional documents, such as a passport or Social Security card.

✔️ Contact the IRS Identity Theft Assistance Unit for help.

🚨 Important: Failing to verify your identity could result in delays in processing your tax return or refund.

Can I verify my IRS identity without ID.me?

Yes, if you cannot use ID.me, you can verify your identity by:

✔️ Calling the IRS directly using the number on your letter.

✔️ Visiting a local IRS office with identity documents.

✔️ Using alternative verification methods (such as past tax return details).

However, ID.me is the fastest and most recommended method for online verification.

How long does IRS identity verification take?

⏳ Online verification via ID.me: 5-15 minutes (if successful).

📞 Phone verification: 30-60 minutes (depending on IRS call wait times).

🏢 In-person verification: Several weeks (due to appointment availability).

Once verified, your tax return will continue processing, which can take up to 9 weeks.

What if someone else used my Social Security Number to file a tax return?

If you suspect identity theft, take these steps immediately:

1️⃣ Contact the IRS Identity Theft Unit at 1-800-908-4490.

2️⃣ File IRS Form 14039 (Identity Theft Affidavit).

3️⃣ Monitor your credit report for any unauthorized activity.

4️⃣ Request an IRS IP PIN to prevent future fraudulent filings.

🚨 Warning: Tax identity theft is a serious issue. If someone has used your SSN, act quickly to prevent further damage.

How do I know if the IRS needs me to verify my identity?

If the IRS requires identity verification, they will send you a letter such as:

📌 5071C Letter – Sent when your tax return is flagged for potential identity theft.

📌 5747C Letter – Requires in-person identity verification.

📌 4883C or 6331C Letter – Issued when additional information is needed before processing your tax return.

💡 Tip: The IRS will never email, call, or text you out of the blue for identity verification. If you receive an unexpected request, it could be a scam.

What happens if I fail IRS identity verification?

If you cannot verify your identity online or over the phone, you may need to:

✔️ Visit a local IRS Taxpayer Assistance Center (TAC) in person.

✔️ Provide additional documents, such as a passport or Social Security card.

✔️ Contact the IRS Identity Theft Assistance Unit for help.

🚨 Important: Failing to verify your identity could result in delays in processing your tax return or refund.

Can I verify my IRS identity without ID.me?

Yes, if you cannot use ID.me, you can verify your identity by:

✔️ Calling the IRS directly using the number on your letter.

✔️ Visiting a local IRS office with identity documents.

✔️ Using alternative verification methods (such as past tax return details).

However, ID.me is the fastest and most recommended method for online verification.

How long does IRS identity verification take?

⏳ Online verification via ID.me: 5-15 minutes (if successful).

📞 Phone verification: 30-60 minutes (depending on IRS call wait times).

🏢 In-person verification: Several weeks (due to appointment availability).

Once verified, your tax return will continue processing, which can take up to 9 weeks.

What if someone else used my Social Security Number to file a tax return?

If you suspect identity theft, take these steps immediately:

1️⃣ Contact the IRS Identity Theft Unit at 1-800-908-4490.

2️⃣ File IRS Form 14039 (Identity Theft Affidavit).

3️⃣ Monitor your credit report for any unauthorized activity.

4️⃣ Request an IRS IP PIN to prevent future fraudulent filings.

🚨 Warning: Tax identity theft is a serious issue. If someone has used your SSN, act quickly to prevent further damage.

Conclusion: Why IRS Identity Verification Matters

The IRS Identity Verification process plays a crucial role in protecting taxpayers, preventing fraud, and securing tax returns. By understanding the verification steps and legal considerations, taxpayers can ensure a smooth and hassle-free tax filing experience.

✅ Key Takeaways:

- The IRS may require identity verification for security reasons or fraud prevention.

- Taxpayers can verify their identity online (via ID.me), by phone, or in person.

- Legal protections ensure that IRS identity verification is secure and fair.

- Failing to verify identity can delay tax returns or refunds.

- Precise Hire provides identity verification solutions to help taxpayers navigate IRS verification challenges.

🚀 Need Help with IRS Identity Verification? Contact Precise Hire for expert assistance in securing your identity and ensuring your tax records remain safe.