Insurance Companies That Don’t Check Driving Records

Introduction to Insurance Companies That Don’t Check Driving Records

In the world of auto insurance, driving record checks are standard practice for many insurers to assess the risk level associated with a potential policyholder. Typically, these checks look at a driver’s history, including violations, accidents, and license suspensions. However, some insurance companies choose not to check driving records, offering a different approach to underwriting. This can be appealing for drivers who may have a less-than-perfect driving history or those who need quick access to coverage.

What Does It Mean When an Insurance Company Doesn’t Check Your Driving Record?

Insurance companies typically perform driving record checks as part of their underwriting process. This involves evaluating a person’s history behind the wheel, including any violations, accidents, and the number of claims made. The purpose is to assess the risk a driver poses and to determine an appropriate premium for their coverage. These checks are a standard practice in the industry because they help insurers gauge the likelihood of a driver filing a claim based on their driving habits.

However, some insurance companies may choose not to check driving records. This means they do not review an individual’s history of traffic violations or accidents when providing a quote or issuing a policy. Instead, these companies might use other factors such as age, the type of vehicle, or geographic location to assess the risk.

Why Do Some Insurance Companies Not Check Driving Records?

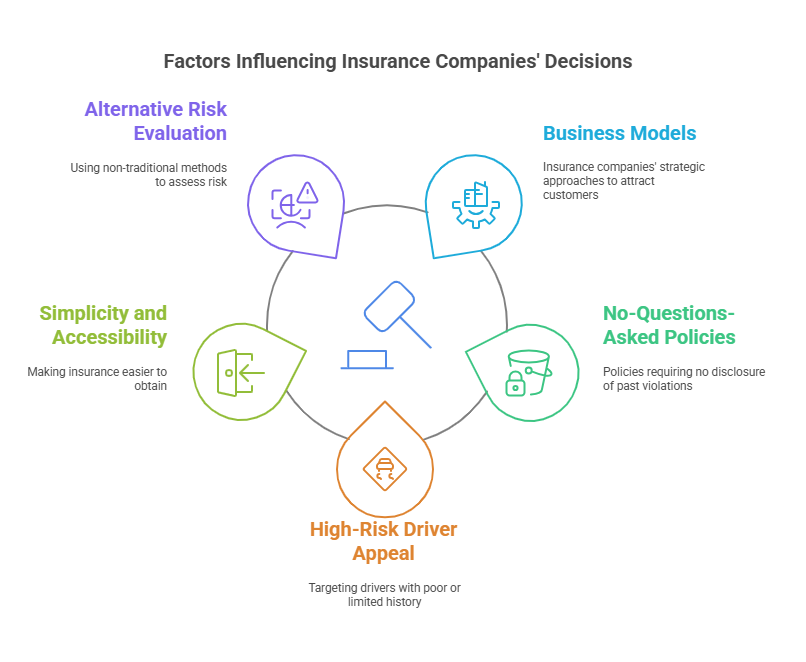

Insurance companies that don’t check driving records typically have specific business models aimed at attracting certain groups of drivers. Here are some potential reasons why certain insurers may not require this check:

- No-Questions-Asked Policies: Some insurance companies offer policies where the applicant doesn’t have to disclose previous violations or accidents, catering to those who may have a poor driving history but still need coverage.

- Appealing to High-Risk Drivers: These insurers may specialize in offering coverage to high-risk drivers, including those who are new drivers, have previous violations, or have trouble finding insurance through traditional providers.

- Simplicity and Accessibility: By not requiring driving record checks, some companies streamline their process and make it easier for individuals to obtain insurance, even if they’ve had a few mishaps on the road.

- Different Risk Evaluation Models: These insurers may assess risk through alternative methods, such as credit scores, car safety features, or driving behavior monitoring systems (e.g., telematics or mobile apps that track driving habits).

Who Benefits From Insurance Companies That Don’t Check Driving Records?

Several types of drivers stand to benefit from insurance companies that do not check driving records:

- Young Drivers: Inexperienced drivers, especially teenagers or those who are newly licensed, might face higher premiums or difficulty obtaining insurance from traditional providers due to their lack of a clean driving history.

- Drivers with Previous Violations or Accidents: Individuals with a history of traffic violations or accidents may find it difficult to secure affordable insurance. Insurance companies that don’t check driving records can offer them a chance at coverage without the stigma of their past mistakes.

- High-Risk Drivers: Those classified as high-risk drivers, such as those with multiple DUIs, reckless driving offenses, or numerous claims, often find that insurers who don’t check driving records are more lenient in providing policies.

- People in Need of Short-Term Coverage: Individuals who require temporary or short-term insurance coverage for a specific period may prefer insurers that don’t require detailed background checks, allowing them to quickly access insurance without the hassle of divulging past driving issues.

What Types of Insurance Companies Are More Likely to Avoid Driving Record Checks?

Certain types of insurance companies are more inclined to forgo driving record checks in favor of more accessible policies:

- Online Insurers: Online or digital-first insurers often cater to a broader market and may not have the same rigid underwriting processes as traditional insurers. By streamlining their processes, they can quickly offer coverage without requiring detailed background checks.

- High-Risk or Specialty Insurers: Companies that specialize in high-risk auto insurance are more likely to offer policies to drivers with poor driving records. These insurers are equipped to handle high-risk clients, which may include those with multiple accidents or violations.

- Non-Traditional Insurance Providers: Some non-traditional insurance providers, such as peer-to-peer or mutual insurance companies, may not require driving record checks. They might rely on the collective risk model, where a group of policyholders helps cover each other’s claims.

- Niche Insurance Providers: Some insurers cater specifically to niche markets, such as those needing temporary or non-standard coverage. These companies may not perform driving record checks as part of their simplified insurance process.

Finding Insurance Companies That Don’t Check Driving Records

If you’re looking for insurance companies that don’t check driving records, the process can be more complex than simply comparing premiums. Here’s how you can find insurers who don’t require driving record checks:

- Research Niche and High-Risk Insurers: Some insurers specialize in high-risk drivers or offer policies that don’t require a driving record check. These insurers may have flexible policies designed for drivers with poor or limited driving histories. Look for companies that specifically market themselves as catering to high-risk drivers.

- Online Insurance Providers: Many online-only insurance providers may not require a driving record check, as they often simplify the application process. These companies may focus on convenience and ease of access, offering quicker, no-questions-asked approval without asking for a background check.

- Review Insurance Terms and Conditions: After narrowing down your options, take the time to read the fine print of each insurer’s policy. Some companies advertise “no-questions-asked” or “no driving record check” policies, but you may find that they perform record checks at a later stage of the process. Additionally, be mindful of any clauses that could affect your coverage, such as higher premiums for not checking driving records upfront.

- Consult an Insurance Broker: Insurance brokers often have access to specialized policies that aren’t always available directly to the public. If you’re looking for insurers that don’t check driving records, a broker can help you locate companies that provide these types of policies, making the process more manageable.

- Use Comparison Websites: Some comparison websites allow you to filter insurance options based on specific needs, such as providers that don’t check driving records. By entering your requirements, you can find the most appropriate insurance companies without wasting time on those that require a driving history check.

Advantages of Choosing Insurance Companies That Don’t Check Driving Records

Opting for insurance companies that don’t check driving records has several advantages, especially for individuals with less-than-perfect driving histories. Here are some of the key benefits:

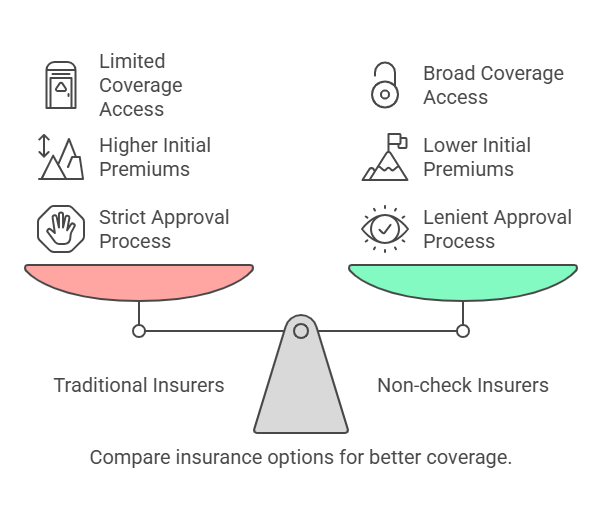

- Easier Approval Process: If you’ve faced violations, accidents, or license suspensions, traditional insurers may deny you coverage. Insurers who don’t check driving records offer a chance for approval despite past driving issues. This makes it easier for individuals with poor driving histories to obtain the necessary insurance.

- Potentially Lower Initial Premiums: While insurers that don’t check driving records may charge slightly higher premiums in some cases, they can often offer competitive initial rates. For those who struggle to find coverage elsewhere, these insurers provide a more affordable starting point than high-risk insurers who always charge high rates.

- Access to Coverage for High-Risk Drivers: Individuals with a history of serious violations or accidents, such as DUIs, may not qualify for coverage from traditional insurance companies. Insurers that don’t check driving records provide a critical safety net, ensuring these individuals have access to insurance, which may otherwise be unavailable.

- Easier Access for Young or Inexperienced Drivers: New drivers or young individuals who lack an extensive driving record may also benefit from insurers that don’t perform background checks. They can secure coverage even if they haven’t had the time to establish a safe driving record.

Disadvantages of Insurance Companies That Don’t Check Driving Records

While opting for an insurer that doesn’t check driving records can be appealing, there are a few potential drawbacks:

- Higher Premiums: Insurers that don’t check driving records might charge higher premiums to offset the risk of covering high-risk drivers. While this may provide easier access to insurance, it comes at a cost in terms of ongoing premiums.

- Limited Coverage Options: Some insurers that don’t check driving records offer only basic or limited coverage plans. This can leave you without the full range of protection available from insurers who assess your driving history. For example, you may miss out on comprehensive or collision coverage, which could leave you exposed in the event of a major accident.

- Risk of Non-Compliance: Depending on your state’s laws and your specific driving history, you may risk not meeting legal requirements for coverage. If your driving record shows serious violations that the insurer didn’t assess, your policy may be non-compliant with local regulations, potentially leading to penalties or higher premiums.

Precisehire

PreciseHire is a comprehensive background screening service that helps employers manage risk by checking driving records as part of their hiring process. For businesses that rely on employees who drive for work, ensuring a clean driving record is vital. PreciseHire offers reliable, thorough background checks to help employers reduce the risk associated with hiring individuals who may have driving issues.

By using PreciseHire’s services, businesses can ensure that they are hiring qualified, responsible individuals and can mitigate potential liabilities associated with poor driving histories. Whether you are looking for background checks for drivers or other employees, PreciseHire.com provides the necessary tools to ensure workplace safety and compliance.

Data Table: Comparison of Insurance Companies That Don’t Check Driving Records

| Insurance Company | Coverage Options | Premium Range | Eligibility Requirements | Pros | Cons | Contact Info |

|---|---|---|---|---|---|---|

| HighRisk Insurance Co. | Basic Auto Insurance | $100 – $300/month | No driving record check | Easier approval for high-risk drivers | Higher premiums and limited coverage | 1-800-123-4567 |

| QuickCover Insurance | Comprehensive, Liability | $150 – $350/month | Must be a high-risk driver | Fast online quotes and easy application | May not offer full coverage | 1-877-555-9999 |

| NoRecord Insurance Group | Liability, Collision | $120 – $250/month | No previous violations | Affordable rates for drivers with prior issues | Less flexibility in coverage options | 1-888-987-6543 |

Best Practices for Choosing Insurance Companies That Don’t Check Driving Records

When selecting an insurance company that doesn’t check driving records, it’s important to follow a set of best practices to ensure that you’re getting the best coverage for your needs:

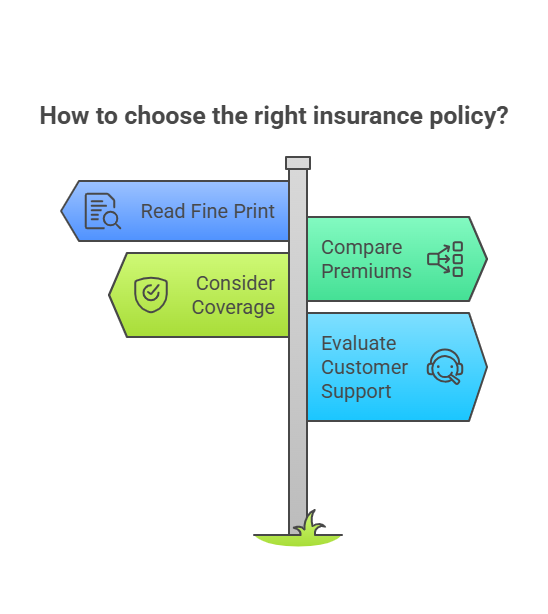

- Conduct Thorough Research: Take the time to research multiple insurers that do not check driving records. Look for companies that specialize in offering coverage to high-risk drivers or those who don’t want to go through a background check. Compare policies, coverage options, and premiums.

- Compare Premiums and Coverage: Not all insurers who don’t check driving records are the same. Premiums can vary significantly, so it’s essential to compare quotes from several companies. Make sure you compare both the cost and the types of coverage available, including liability, comprehensive, and collision insurance.

- Understand Potential Limitations: Insurers that don’t check driving records may offer more limited coverage or may charge higher premiums. Be sure to understand the full scope of coverage, including any exclusions or restrictions that may apply to your policy. Know what is and isn’t covered in case you need to make a claim.

- Consider Customer Reviews and Reputation: Look at customer reviews and testimonials to gauge the company’s reputation. Check how they handle claims, customer service responsiveness, and their overall satisfaction rate. A company may offer no-questions-asked policies, but customer service and support can make all the difference when filing a claim.

- Evaluate the Claims Process: Ensure the insurer has an easy and transparent claims process. Insurance companies that don’t check driving records may have different procedures in place when it comes to handling claims, so you’ll want to be sure it’s efficient and hassle-free.

Common Mistakes to Avoid

While it can be tempting to select an insurance company that doesn’t check driving records, there are several common mistakes that drivers should avoid:

- Not Reading the Fine Print: Always read the full terms and conditions of your policy. While an insurer may not require a driving record check upfront, there may be additional fees or increased premiums in the future if they discover previous violations during the claims process.

- Ignoring Potential Premium Increases: Some companies that don’t check driving records initially may increase premiums once they assess the risk. Be cautious of policies that seem too good to be true at the start, and ensure you’re aware of potential cost increases.

- Assuming a Better Deal Without Comparing Options: Just because a company doesn’t check your driving record doesn’t mean it’s automatically the best option. Always shop around, compare different insurers, and consider all aspects of the policy (e.g., coverage limits, exclusions, premiums) to make an informed decision.

- Not Considering Full Coverage Options: Many companies that don’t check driving records may offer only basic or liability coverage. If you require comprehensive coverage, make sure the policy you’re choosing includes it. Be careful not to underestimate your needs based on initial premiums.

- Overlooking Customer Support: An important factor in choosing an insurer is customer support. Ensure that the company offers reliable assistance, particularly in case of a claim. Choosing a low-cost option without evaluating the service aspect can lead to difficulties later.

Frequently Asked Questions About Insurance Companies That Don’t Check Driving Records

Are there any reputable insurance companies that don’t check driving records?

Yes, there are reputable insurers that cater to high-risk drivers or individuals who prefer not to undergo a driving record check. Companies like HighRisk Insurance Co. and QuickCover Insurance provide these options, though it’s important to carefully review the coverage and the reputation of the insurer.

Can I get affordable insurance if my driving record is poor?

It’s possible to find affordable insurance if you have a poor driving record, but you might need to choose insurers that specialize in high-risk drivers. These insurers may offer more flexible policies, though they often come with higher premiums than those offered by traditional companies. Shopping around and comparing quotes is essential.

What is the cost difference for insurance companies that don’t check driving records?

Insurance companies that don’t check driving records often charge higher premiums to compensate for the risk of insuring high-risk drivers. The exact difference in cost will depend on your specific driving history and the insurance provider, but expect to pay more than with traditional insurers who assess driving records upfront.

How can I ensure I’m getting the best deal with an insurer that doesn’t check my driving record?

To get the best deal, it’s important to compare quotes from multiple insurers. Consider not only the premium but also the coverage options and customer service reputation. Be aware of any hidden fees or exclusions in the fine print, and ensure the policy fits your specific needs.

Do insurers that don’t check driving records offer full coverage?

Some insurers that don’t check driving records may offer full coverage options, but it’s essential to read the policy details carefully. Full coverage may include liability, collision, and comprehensive insurance, but these options may be limited or more expensive with insurers who do not check driving records.

Conclusion

Choosing an insurance company that doesn’t check driving records can be an appealing option for drivers with a less-than-perfect driving history, but it’s important to consider both the benefits and drawbacks. These insurers can provide easier access to coverage, particularly for high-risk drivers, but they may come with higher premiums and limited coverage options.

By following best practices—such as researching multiple insurers, comparing premiums, and reading the fine print—you can make an informed decision that works best for your needs. Avoid common mistakes, such as not comparing multiple options or failing to understand the full scope of coverage.

Remember that understanding your options and the potential risks involved can help you find the right insurer. If you’re concerned about background checks, whether for personal or business reasons, consider exploring background screening services like PreciseHire, which offers detailed driving record checks and other risk management solutions for both employers and individuals.

Take the time to find the right insurance provider, and ensure that the policy you choose offers the protection you need while fitting within your budget.