How to Write an Employment Verification Letter

What is API Identity Verification and Why Does It Matter?

API identity verification is a digital process that uses Application Programming Interfaces (APIs) to authenticate and validate an individual’s identity. APIs serve as a bridge between applications and external systems, enabling real-time access to identity verification services. This technology integrates seamlessly into websites, mobile apps, or enterprise software, allowing organizations to automate the process of verifying users without disrupting their experience.

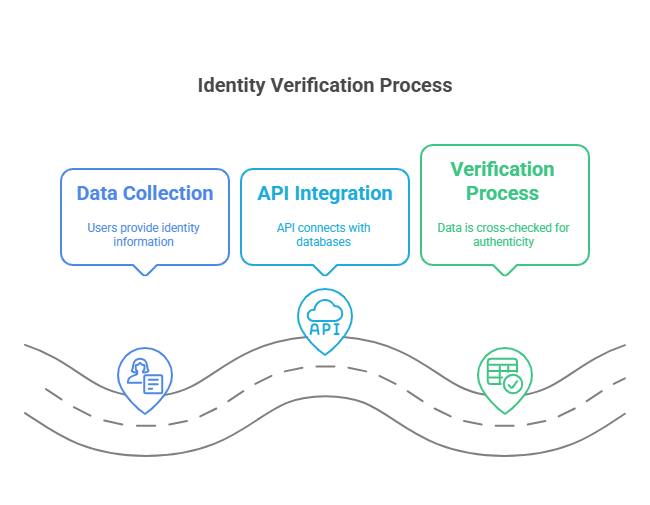

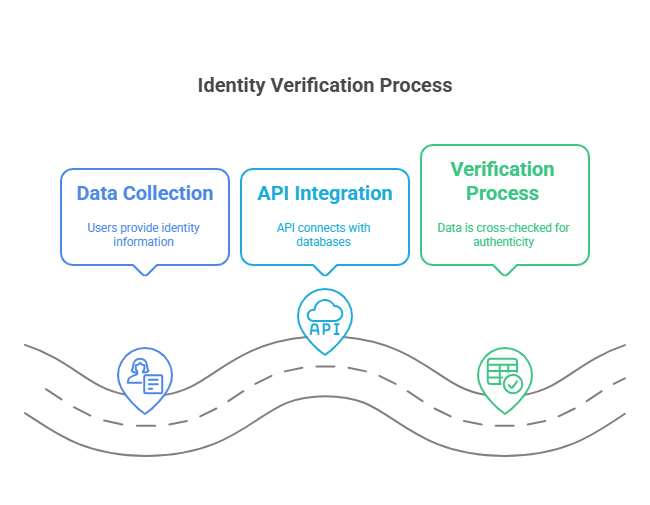

How It Works:

- Data Collection: Users provide identity information such as name, date of birth, government-issued ID, or biometric data.

- API Integration: The API connects with trusted databases or verification systems, such as government records or biometric authentication services.

- Verification Process: The API cross-checks the provided data against its sources to confirm authenticity.

This method ensures swift, accurate, and scalable identity verification for businesses of all sizes.

Importance of Identity Verification in Today’s Digital Landscape

In an era defined by digital interactions, identity verification is critical to maintaining security, trust, and compliance in online transactions.

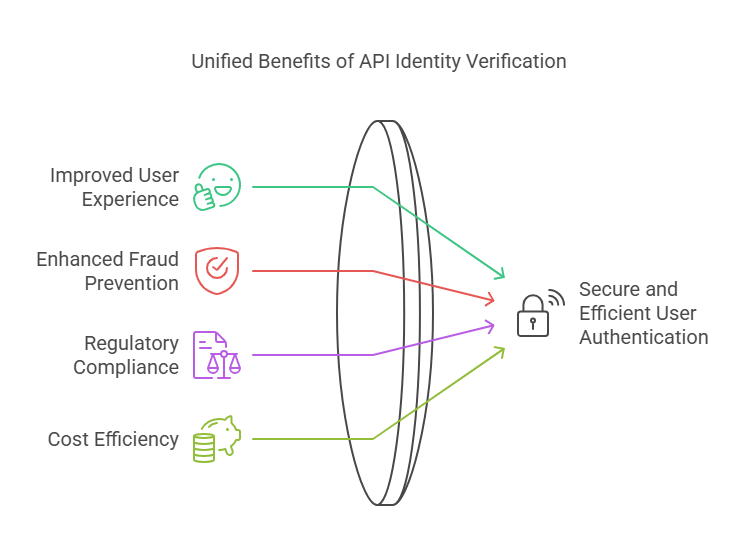

Key Benefits of Identity Verification:

- Fraud Prevention: Prevent identity theft, fake accounts, and unauthorized access.

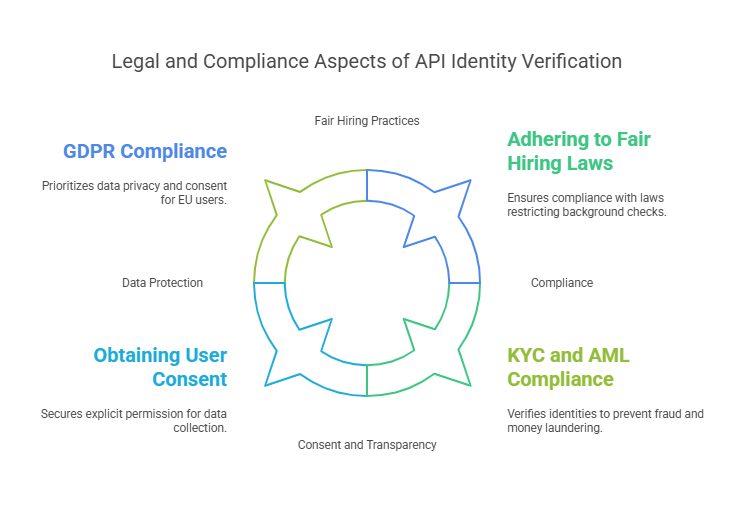

- Regulatory Compliance: Adhere to KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations.

- Enhanced Security: Safeguard sensitive information and mitigate risks in high-stakes industries.

- Seamless User Experience: Automate processes to speed up onboarding and minimize friction.

Industries That Rely on API Identity Verification:

- Banking and Fintech: For secure account creation, loan processing, and fraud detection.

- Healthcare: To protect sensitive patient data and verify healthcare professionals.

- E-commerce: To authenticate buyers and sellers and secure online transactions.

- Travel and Hospitality: To streamline bookings and verify travelers’ identities.

For instance, in the banking sector, API identity verification ensures that only legitimate users can open accounts or access services, reducing instances of financial fraud.

Key Features of API Identity Verification

API-based identity verification is designed with advanced capabilities to meet modern security and compliance needs.

Core Features Include:

- Real-Time Verification: Instantly authenticate users during onboarding or transactions.

- Scalability: Handle high volumes of verification requests with ease, ideal for businesses experiencing rapid growth.

- Data Security: Use encryption and secure transmission protocols to protect sensitive user data.

- Ease of Integration: APIs are designed to integrate seamlessly into existing platforms, reducing deployment time and cost.

- Multi-Method Verification: Support for diverse methods, including document scanning, facial recognition, and fingerprint authentication.

These features make API identity verification an essential tool for businesses seeking to enhance security while offering a frictionless user experience.