How to Navigate Pre-Adverse Action Procedures

Understanding Pre-Adverse Action

Pre-adverse action is a critical step in the hiring process where an employer notifies a job applicant that adverse action (e.g., rejection, rescinding a job offer) may be taken based on information found in their background check. It provides the applicant with an opportunity to review and dispute any inaccurate or incomplete information before the final decision is made.

This process is mandated under the Fair Credit Reporting Act (FCRA) to ensure fairness and transparency in employment decisions. Pre-adverse action acts as a safeguard, protecting applicants from the consequences of errors in background screening reports.

Pre-Adverse Action and the FCRA: Context and Application

The FCRA governs the use of consumer reports in employment decisions. Employers who rely on these reports for hiring must comply with FCRA rules, which include issuing pre-adverse action notices. These notices ensure that applicants:

- Are aware of the information influencing the decision.

- Have a chance to dispute inaccuracies before the employer takes any final adverse action.

Under the FCRA, pre-adverse action is specifically required when the employer obtains consumer reports, such as:

- Criminal background checks.

- Credit reports.

- Driving records.

If an employer intends to make a hiring decision based on such information, they must follow the pre-adverse action process outlined in the FCRA.

Why Employers Issue Pre-Adverse Action Notices

Pre-adverse action notices serve dual purposes:

- Protecting Applicants’ Rights: By notifying candidates about potential adverse decisions, employers empower them to respond to or challenge inaccuracies in the report.

- Ensuring Compliance and Reducing Legal Risks: FCRA violations can result in lawsuits and fines. The pre-adverse action process helps employers demonstrate due diligence and compliance, mitigating the risk of legal repercussions.

By incorporating this step, employers promote transparency and accountability, fostering trust in the hiring process.

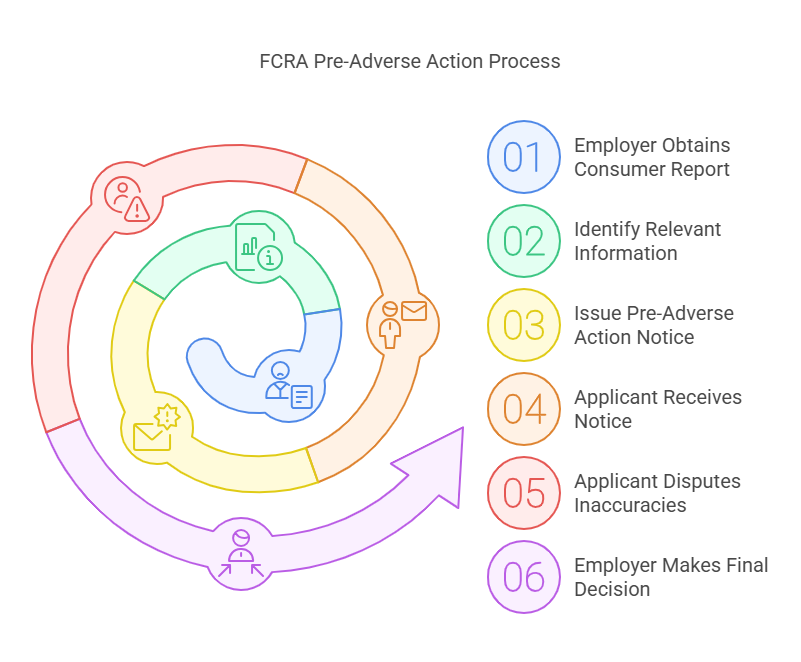

Key Steps in the Pre-Adverse Action Process

- Sending a Pre-Adverse Action Notice

The employer must inform the applicant in writing of their intent to take adverse action based on the background check. This notice should clearly state that the decision is not final and the applicant has an opportunity to respond. - Providing a Copy of the Background Check Report

A complete copy of the background check or consumer report used in the decision must be included. This allows the applicant to review the information for any inaccuracies or outdated details. - Including a Summary of Rights Under the FCRA

Employers must also provide the applicant with a copy of the FCRA “Summary of Your Rights.” This document outlines the applicant’s rights to dispute errors and ensures they understand the process and timeline.

How Pre-Adverse Action Promotes Fairness and Reduces Legal Risks

The pre-adverse action process plays a significant role in upholding fairness in employment decisions. By offering applicants a chance to address potential discrepancies, it ensures that hiring decisions are based on accurate and reliable information.

For employers, this process is also a protective measure. Failing to issue a pre-adverse action notice can lead to:

- Penalties under the FCRA.

- Lawsuits for negligence or discrimination.

- Damage to the employer’s reputation.

Following the FCRA-compliant process minimizes these risks, establishing a fair, lawful, and transparent hiring protocol.

Best Practices for Employers and Job Applicants

Best Practices for Employers

Employers play a crucial role in ensuring compliance with the Fair Credit Reporting Act (FCRA) during the pre-adverse action process. Failure to follow proper procedures can lead to significant legal and financial repercussions. Below are actionable best practices for employers.

Importance of Compliance With FCRA Requirements

To stay compliant with FCRA rules, employers must:

- Follow a structured pre-adverse action process.

- Provide clear and transparent communication to applicants.

- Maintain records of all steps taken during the hiring process.

Non-compliance not only exposes employers to potential lawsuits but can also damage their reputation, impacting future hiring efforts.

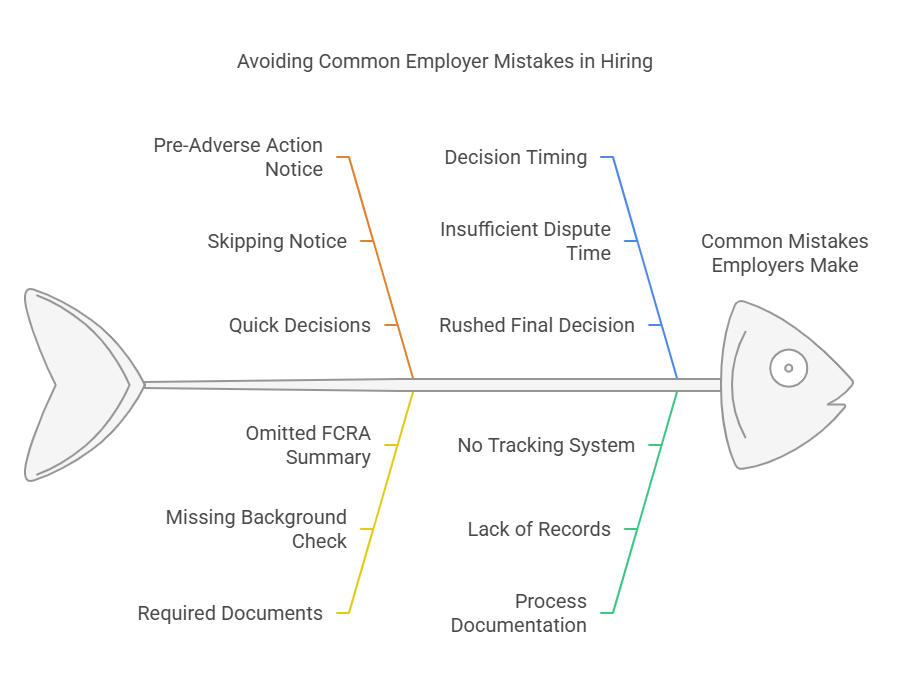

Common Mistakes Employers Make (and How to Avoid Them)

- Failing to Issue a Pre-Adverse Action Notice

- Mistake: Skipping the pre-adverse action notice and directly rejecting an applicant.

- Solution: Always send the notice before making a final decision and allow the applicant time to respond.

- Omitting Required Documents

- Mistake: Forgetting to include a copy of the background check report or the FCRA Summary of Rights.

- Solution: Verify that all documents are included before sending the notice.

- Making the Decision Too Quickly

- Mistake: Not giving the applicant enough time to dispute errors.

- Solution: Wait at least five business days after issuing the pre-adverse action notice before finalizing the decision.

- Failing to Document the Process

- Mistake: Not keeping detailed records of notices sent and responses received.

- Solution: Use a tracking system to document every step of the process.

Compliance Checklist for Employers

Use this checklist to ensure adherence to FCRA requirements during the pre-adverse action process:

- ✅ Obtain written consent from the applicant before conducting a background check.

- ✅ If considering adverse action, send a pre-adverse action notice.

- ✅ Include a copy of the background check report.

- ✅ Attach the FCRA “Summary of Your Rights.”

- ✅ Allow at least five business days for the applicant to respond.

- ✅ If no disputes are raised or inaccuracies are found, send a final adverse action notice.

Employers should also consider partnering with a trusted background screening provider like Precise Hire to streamline compliance and reduce administrative burdens.

Best Practices for Job Applicants

As a job applicant, receiving a pre-adverse action notice can be unsettling. However, this notice gives you a valuable opportunity to address any inaccuracies or discrepancies in your background report. Here are some steps to guide you through the process.

What to Do If You Receive a Pre-Adverse Action Notice

- Review the Background Check Report Thoroughly

- Check the report for incorrect information, such as outdated criminal records or misreported credit details.

- Verify that all personal details, like your name and address, are accurate.

- Understand Your Rights Under the FCRA

- You have the right to dispute any inaccuracies in your background report.

- The employer must give you a reasonable amount of time (typically five business days) to respond before taking final action.

- Contact the Background Screening Company

- If you find errors, reach out to the background screening company directly to dispute the information.

- The screening company is required to investigate and correct inaccuracies within 30 days.

Tips for Disputing Inaccurate Information

- Act Quickly: Respond as soon as you receive the pre-adverse action notice to ensure your concerns are addressed within the timeframe.

- Provide Documentation: Submit any relevant documents (e.g., court records, proof of identity) that support your dispute.

- Follow Up Regularly: Stay in contact with the screening company to track the progress of your dispute.

Guidance on FCRA Rights and Timelines

Applicants should familiarize themselves with their FCRA rights, including:

- The right to request a free copy of their background report.

- The right to dispute inaccurate information.

- The right to know if adverse action was based on information from the report.

Understanding these rights empowers applicants to take control of their situation and address potential obstacles to employment.

Partnering With Precise Hire for Compliance

Precise Hire offers reliable and FCRA-compliant background screening services tailored to employers’ needs. Their solutions ensure:

- Accurate and up-to-date reports.

- Seamless integration with the pre-adverse action process.

- Reduced legal risks for businesses.

For job applicants, Precise Hire provides clear instructions for disputing inaccuracies, making the process smoother and more efficient for all parties involved.

Pre-Adverse Action Timeline

| Step | Action | Timeframe |

|---|---|---|

| Step 1: Notice Issuance | Employer sends pre-adverse action notice. | Day 1 |

| Step 2: Applicant Response | Applicant reviews and disputes inaccuracies. | Within 5 business days |

| Step 3: Final Decision | Employer issues final adverse action notice. | After applicant’s response or waiting period |

Employers must adhere to this timeline to ensure compliance with FCRA regulations and protect applicants’ rights.

Legal Aspects of Pre-Adverse Action

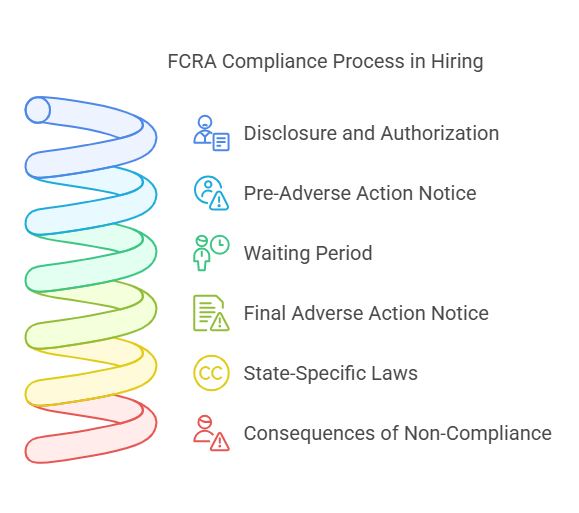

The FCRA and Pre-Adverse Action Requirements

The Fair Credit Reporting Act (FCRA) outlines specific requirements for employers using consumer reports in hiring decisions. Key legal obligations include:

- Disclosure and Authorization: Employers must inform candidates in writing and obtain written consent before running a background check.

- Pre-Adverse Action Notice: If the employer plans to take adverse action, they must first provide a pre-adverse action notice, a copy of the consumer report, and the FCRA Summary of Rights.

- Waiting Period: Employers must allow a reasonable period (commonly five business days) for the candidate to dispute or address inaccuracies.

- Final Adverse Action Notice: After the waiting period, if the employer decides to proceed with the adverse action, they must send a final notice explaining the decision.

State-Specific Laws on Pre-Adverse Action

Some states have additional requirements that build on the FCRA, including:

- Longer Waiting Periods: Certain states mandate a waiting period longer than five business days before taking adverse action.

- Ban-the-Box Laws: These laws limit when employers can inquire about criminal records, often requiring conditional job offers before running background checks.

- Notification Requirements: Some states require specific language or additional disclosures in pre-adverse action notices.

Employers must stay informed about both federal and state laws to ensure full compliance.

Consequences of Non-Compliance

Failing to follow pre-adverse action protocols can lead to serious consequences for employers, including:

- FCRA Lawsuits: Applicants can sue for statutory damages (up to $1,000 per violation), actual damages, attorney’s fees, and punitive damages.

- Class-Action Lawsuits: Non-compliance can lead to costly class-action lawsuits, particularly for systemic violations.

- Reputational Damage: Employers risk negative publicity, which can harm their brand and future hiring efforts.

To mitigate these risks, employers should work with reliable background screening providers like Precise Hire, who ensure FCRA-compliant processes.

FAQs About Pre-Adverse Action

What is the difference between pre-adverse action and adverse action?

Pre-adverse action is the initial step where the employer informs the applicant about potential adverse decisions and allows them to respond.

Adverse action is the final decision to deny employment, revoke a job offer, or take another negative action based on the background check.

How long does an employer have to wait after sending a pre-adverse action notice?

The FCRA does not specify an exact waiting period, but the generally accepted timeframe is five business days. This allows the applicant enough time to review and dispute the report if necessary.

Can a job applicant dispute information after receiving a pre-adverse action notice?

Yes, applicants can dispute inaccurate or incomplete information directly with the background screening company. The company is required to investigate the dispute and correct errors within 30 days.

Are pre-adverse action notices mandatory for all background checks?

Pre-adverse action notices are required when an employer uses a consumer report (e.g., credit reports, criminal background checks) in making hiring decisions. However, they may not be necessary for internal records or evaluations not governed by the FCRA.

What happens if an employer skips the pre-adverse action process?

If an employer skips this step, they can face penalties under the FCRA, including lawsuits, fines, and reputational harm. Following the pre-adverse action process is essential to avoid legal and financial risks.

What is the difference between pre-adverse action and adverse action?

Pre-adverse action is the initial step where the employer informs the applicant about potential adverse decisions and allows them to respond.

Adverse action is the final decision to deny employment, revoke a job offer, or take another negative action based on the background check.

How long does an employer have to wait after sending a pre-adverse action notice?

The FCRA does not specify an exact waiting period, but the generally accepted timeframe is five business days. This allows the applicant enough time to review and dispute the report if necessary.

Can a job applicant dispute information after receiving a pre-adverse action notice?

Yes, applicants can dispute inaccurate or incomplete information directly with the background screening company. The company is required to investigate the dispute and correct errors within 30 days.

Are pre-adverse action notices mandatory for all background checks?

Pre-adverse action notices are required when an employer uses a consumer report (e.g., credit reports, criminal background checks) in making hiring decisions. However, they may not be necessary for internal records or evaluations not governed by the FCRA.

What happens if an employer skips the pre-adverse action process?

If an employer skips this step, they can face penalties under the FCRA, including lawsuits, fines, and reputational harm. Following the pre-adverse action process is essential to avoid legal and financial risks.

Conclusion

The pre-adverse action process is a crucial component of fair hiring practices, ensuring transparency and protecting applicants’ rights. For employers, adhering to FCRA requirements not only demonstrates compliance but also fosters trust and credibility in their hiring processes.

By issuing pre-adverse action notices, providing background check reports, and allowing applicants to dispute inaccuracies, employers can reduce legal risks and promote fairness in their decision-making.

For job applicants, understanding your rights under the FCRA can empower you to take control of your employment prospects and ensure fair treatment.

To simplify and streamline compliance, employers can turn to trusted background screening providers like Precise Hire, which offers accurate, FCRA-compliant solutions tailored to businesses’ unique needs. Their services help organizations navigate the complexities of background checks while protecting applicants’ rights and reducing risks.