Essential Tenant Screening Questions A Complete Guide

Introduction to Tenant Screening Questions

Tenant screening is a critical step in the rental process that allows landlords and property managers to evaluate potential tenants to ensure they are reliable, responsible, and financially capable of paying rent. This process helps landlords avoid costly mistakes such as leasing to tenants who may not pay rent on time, cause damage to the property, or engage in illegal activities. One of the most effective ways to conduct a thorough tenant screening process is by asking the right questions.

What is Tenant Screening and Why Is It Crucial for Landlords?

Tenant screening is the process by which landlords evaluate potential tenants before signing a lease agreement. This process helps landlords assess whether a potential tenant is likely to be a good fit for the property and whether they will honor the terms of the lease. It typically involves collecting information from applicants and reviewing their background, including rental history, creditworthiness, employment status, and criminal history.

For landlords, tenant screening is essential because it mitigates the risk of dealing with problematic tenants. By asking the right tenant screening questions, landlords can uncover red flags such as poor rental history, inconsistent income, or criminal activity that may indicate potential issues. With proper tenant screening, landlords can protect their investment, maintain the property’s condition, and create a stable rental income stream.

The Importance of Asking the Right Questions

The tenant screening process involves a series of steps, and asking the right questions plays a pivotal role in gathering the necessary information to make an informed decision. Without asking the right questions, landlords may miss critical details that could affect the tenant’s suitability.

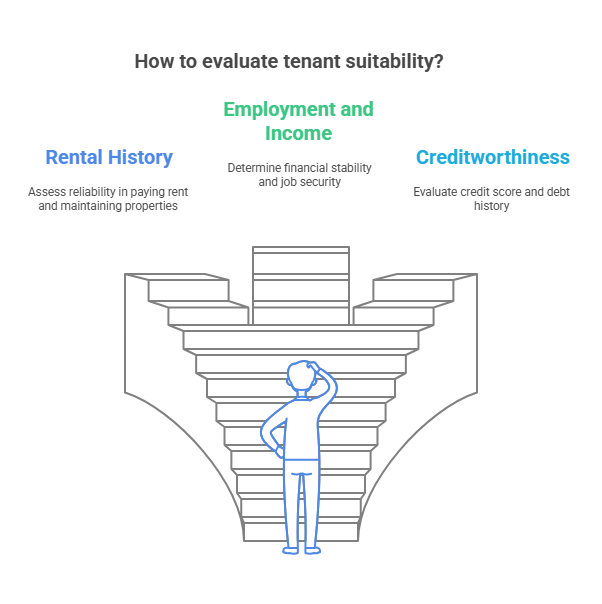

Some questions will help landlords evaluate:

- Rental History: Whether the applicant has a reliable history of paying rent on time and maintaining rental properties.

- Employment and Income: Whether the applicant has the financial means to afford the rent and whether their job status is stable.

- Creditworthiness: Whether the applicant has a good credit score or has a history of unpaid debts.

- Criminal Background: Whether the applicant has a criminal record that could pose a risk to the property or the neighborhood.

By gathering this information through detailed and well-structured questions, landlords can better understand the applicant’s qualifications and make more informed decisions.

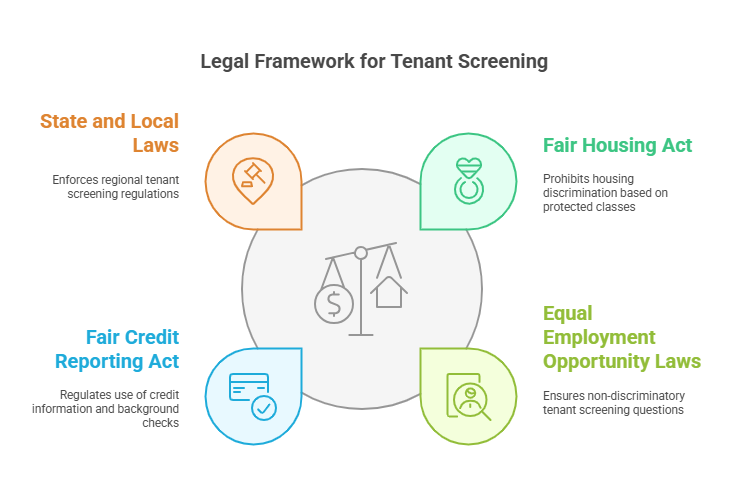

The Tenant Screening Process and the Role of Questions

The tenant screening process involves multiple steps, which include:

- Application Submission: The tenant submits an application form, which may include personal, employment, and rental history details.

- Initial Screening: The landlord reviews the application and asks follow-up questions to clarify any inconsistencies or gather additional information.

- Background Checks: The landlord conducts background checks, which typically include credit checks, criminal background checks, and eviction history.

- References and Interviews: The landlord may contact previous landlords, employers, or personal references to verify the information provided.

- Final Decision: Based on the responses to the questions and the results of the background checks, the landlord makes a decision to either approve or deny the rental application.

The questions asked during the application process provide a foundation for the screening process, allowing landlords to narrow down potential tenants. Each question serves a specific purpose, whether it’s verifying financial stability, confirming reliability, or assessing whether the applicant is a good fit for the property.

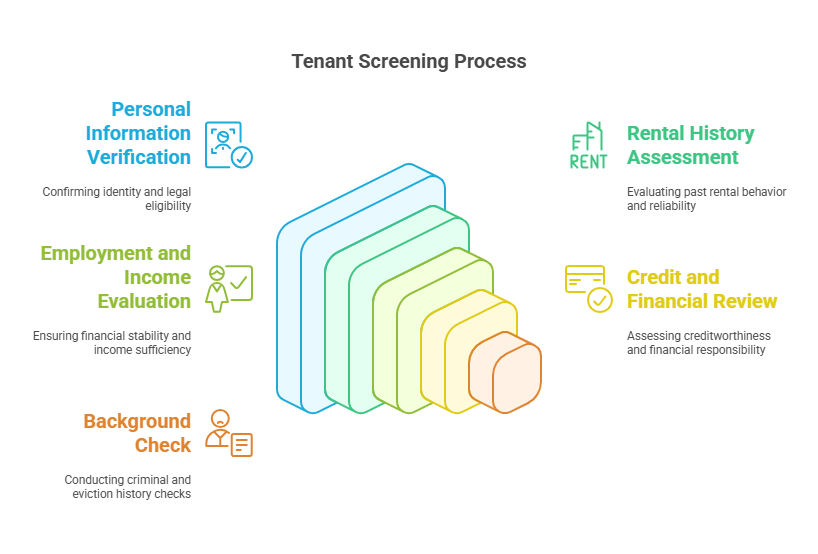

Common Types of Tenant Screening Questions

- Personal Information: Full name, date of birth, contact details, and Social Security Number (for background checks).

- Rental History: Information about previous rental properties, including the name of the previous landlord, the duration of tenancy, reasons for leaving, and payment history.

- Employment and Income: Questions related to current employment status, job title, employer contact details, monthly income, and job stability.

- Creditworthiness: Questions regarding credit score, existing debts, and financial responsibilities.

- Background Check: Questions related to criminal history, past evictions, and other relevant legal information.

These categories form the foundation of a thorough tenant screening process, ensuring that landlords get a well-rounded understanding of each applicant’s qualifications.

The Consequences of Not Conducting Thorough Tenant Screening

Failing to conduct a thorough tenant screening process can have serious consequences for landlords and property managers. The most obvious consequence is the financial risk associated with renting to tenants who may not pay rent on time or at all. Other risks include:

- Property Damage: Tenants who do not respect the property can cause significant damage, leading to costly repairs and loss of property value.

- Legal Issues: Renting to tenants with a history of criminal activity or evictions can result in legal disputes and potential liability for the landlord.

- High Turnover: If a tenant is not a good fit, they may leave early, forcing the landlord to find a replacement tenant and experience periods of vacancy, which can result in lost rental income.

Thorough tenant screening helps landlords avoid these issues by ensuring that they rent to tenants who have a proven track record of being responsible and reliable.

Key Tenant Screening Questions and How to Ask Them

When screening potential tenants, the questions you ask can make all the difference in choosing the right individual for your rental property. By asking the right questions, landlords can assess a candidate’s reliability, financial stability, and suitability for the property. This section will discuss in detail the key tenant screening questions across various categories and provide guidance on how to ask them.

1. Personal Information Questions

Personal information questions serve as the foundation for tenant screening. They help landlords confirm the identity of the applicant, ensure that they are legally able to rent the property, and facilitate the next steps in the screening process, such as background checks.

Key Questions to Ask:

- Full Name: “What is your full legal name?”

This helps to verify the applicant’s identity. - Date of Birth: “What is your date of birth?”

This confirms the tenant is of legal age to sign a lease. - Contact Information: “What is your current phone number and email address?”

Having updated contact information ensures effective communication during the screening process. - Social Security Number: “Can you provide your Social Security number for background and credit checks?”

This is essential for conducting thorough background checks and credit history assessments.

How to Ask:

It’s important to ask these questions in a professional and non-invasive manner. Many landlords include these questions on their rental application form, ensuring the information is collected upfront in a way that complies with privacy laws. Be mindful of the applicant’s comfort and ensure that their personal data is kept confidential.

2. Rental History Questions

Rental history is one of the most critical components of tenant screening, as it helps landlords determine if an applicant has a history of paying rent on time and taking care of rental properties. A good rental history is a strong indicator of reliability.

Key Questions to Ask:

- Previous Landlords: “Can you provide contact information for your previous landlords?”

This allows you to reach out to verify the applicant’s rental history. - Duration of Tenancy: “How long did you live at your previous rental properties?”

A longer stay typically indicates a responsible tenant who is less likely to frequently move. - Reasons for Leaving: “Why did you leave your previous rental properties?”

Look for patterns such as tenant evictions or problematic behavior. - Payment History: “Did you ever miss or delay a rent payment at your previous residences?”

Asking this helps you assess financial reliability and if they’ve ever faced issues paying rent.

How to Ask:

When asking about rental history, it’s important to ask questions that are open-ended yet specific. This gives the tenant an opportunity to explain any issues in their past, which could help you gauge their reliability. Ensure you ask for documentation such as receipts or references from previous landlords, as these can verify the applicant’s claims.

3. Employment and Income Questions

Employment and income questions help determine whether the tenant can afford the rent. Financial stability is crucial for long-term tenant success, as an applicant who has a steady income is more likely to make timely payments.

Key Questions to Ask:

- Current Employment Status: “Are you currently employed? If so, what is your job title?”

This provides insight into the applicant’s employment status and potential financial stability. - Employer Information: “Can you provide your employer’s name and contact details?”

This allows landlords to verify employment details. - Monthly Income: “What is your monthly income before taxes?”

The tenant’s income should generally be at least 2.5 to 3 times the monthly rent to ensure they can afford it comfortably. - Job Stability: “How long have you been employed with your current employer?”

A stable job history can indicate a more reliable tenant.

How to Ask:

Income-related questions should be asked directly and professionally. While you can request a tenant to provide pay stubs or proof of income (e.g., bank statements or tax returns), avoid asking questions about the applicant’s spending habits, which could be considered invasive. Be mindful of local laws that may limit how much financial information can be requested.

4. Credit and Financial Questions

A credit report is often a key indicator of an applicant’s financial responsibility. A poor credit score might suggest that a potential tenant has a history of late payments, unpaid debts, or poor money management. However, credit history alone should not be the sole determining factor.

Key Questions to Ask:

- Credit Score: “Do you have a recent credit report that you can provide, or do you consent to a credit check?”

This helps you assess the applicant’s ability to handle debt and their general financial responsibility. - Outstanding Debts: “Do you have any current outstanding debts or financial obligations?”

This can help you understand the applicant’s overall financial situation and any potential risk. - Bankruptcy History: “Have you ever filed for bankruptcy? If so, when?”

Bankruptcy can be a red flag, but it’s important to understand whether it occurred due to unusual circumstances or financial hardship.

How to Ask:

It is best to request consent to run a credit check rather than directly ask applicants about their credit score. Ensure you explain why you are requesting this information and how it will be used. Keep in mind that laws regarding credit checks may vary by jurisdiction, and applicants should be informed of their rights in relation to credit reporting.

5. Background Check Questions

Criminal and eviction history can provide insight into an applicant’s character and behavior. While having a criminal record or a history of eviction does not necessarily mean that an applicant will be a poor tenant, it is important to assess these factors carefully.

Key Questions to Ask:

- Criminal History: “Have you ever been convicted of a crime?”

This helps landlords assess whether the applicant’s criminal history poses a risk to the safety and well-being of other tenants and neighbors. - Past Evictions: “Have you ever been evicted from a rental property?”

A history of evictions is a serious red flag and should be carefully evaluated. - References: “Can you provide references from previous landlords or personal references?”

References are an excellent way to verify the applicant’s character and ensure they are trustworthy.

How to Ask:

Criminal background checks should always be conducted in accordance with local, state, and federal laws, and applicants should be informed that a background check will be run. Be sure to treat all applicants equally and avoid discriminatory practices. For example, some jurisdictions have laws preventing landlords from disqualifying applicants solely based on a criminal record or eviction history, depending on the circumstances.

Tenant Screening Question Comparison Table

| Category | Questions | Purpose |

|---|---|---|

| Personal Information | Full name, date of birth, contact information, SSN | Verify identity, facilitate background checks |

| Rental History | Previous landlords, duration of tenancy, reasons for leaving | Assess payment history, reliability, and fit |

| Employment & Income | Job status, employer details, monthly income, job stability | Evaluate financial stability and ability to pay |

| Credit & Financial | Credit score, outstanding debts, bankruptcy history | Assess financial responsibility and risk |

| Background Check | Criminal history, eviction history, references | Ensure safety and reliability, assess risk |

How Precisehire Can Help

Using reliable tenant screening services such as Precisehire can simplify the process. Precisehire offers comprehensive tenant screening services, including background checks, credit checks, and employment verification. These services ensure that landlords have access to accurate and up-to-date information, helping them make informed decisions.