Complete Guide to the Employment Verification Form Texas PDF

What is Employment Verification and Why is it Important?

Employment verification is a key process used by employers to confirm the employment status of a person. Whether for hiring purposes, lending decisions, or legal matters, verifying employment is crucial in ensuring that the information provided by employees or potential employees is accurate and legitimate. In Texas, as in other states, employment verification serves as a safeguard for employers to protect against fraud, ensure the accuracy of employee records, and comply with legal requirements.

What is the Employment Verification Form Texas PDF?

The Employment Verification Form is an official document used to confirm the employment status of an individual within the state of Texas. This form is often used in various situations, including when an individual applies for loans, housing, or when applying for new jobs. The Texas-specific PDF version of the form is a standardized document that employers can fill out to provide proof of employment for their employees or former employees.

Unlike informal letters or emails, an official employment verification form provides more thorough, verifiable information and helps standardize the verification process. It includes details such as the individual’s employment dates, position, and salary, which is often necessary for various legal, financial, and business-related purposes.

Why Employers Require Employment Verification

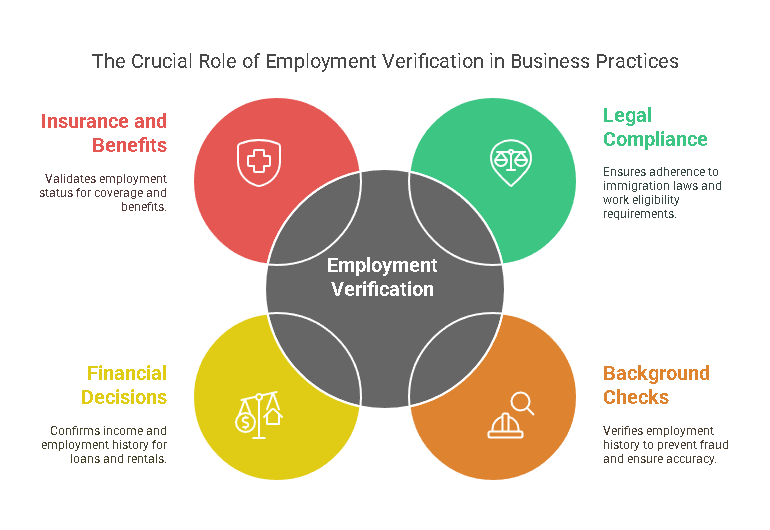

Employers may require employment verification for several reasons:

- Compliance with Legal and Regulatory Standards: Employers are required to verify that employees are legally authorized to work in the United States. This ensures compliance with immigration laws, including the I-9 form requirements for employment eligibility verification.

- Background Checks: Many companies use employment verification to conduct background checks on prospective employees. This helps prevent fraudulent hiring practices and ensures that the applicant has provided truthful and accurate employment history.

- Financial or Legal Decisions: Employers or third-party organizations (e.g., mortgage lenders) may request an employment verification form for employees to confirm their income and employment history, particularly when they are applying for loans, renting properties, or undergoing background checks.

- Insurance and Benefits: Employment verification forms are also used by insurance companies and benefits providers to confirm employment status before providing coverage or other work-related benefits.

Various Formats of Employment Verification Forms

While the Employment Verification Form Texas PDF is the standard in many cases, these forms can take different formats depending on the organization or the specific needs of the business. For example, some companies might issue verification letters, while others use an official PDF form or digital submission through HR software.

It’s important to note that the Texas-specific PDF form serves as a formal, standardized way of verifying employment, and it can be downloaded from various platforms, including government websites, employer HR departments, or other authorized sources.

How to Obtain the Employment Verification Form Texas PDF

For employers and employees in Texas, obtaining the Employment Verification Form Texas PDF is straightforward. The form can typically be downloaded from several sources, including:

- Texas State Government Websites: Government platforms may provide PDF forms for employment verification or direct you to the appropriate authorities.

- Employer HR Departments: Many businesses maintain their own employment verification forms, which employees can request directly from the HR department.

- Third-Party Services: Some businesses outsource employment verification processes to third-party services, which can provide the form in the proper format.

It’s essential for individuals to ensure they are using the correct, up-to-date version of the form to avoid any errors or delays.

Role of Employment Verification Forms in Different Industries

Employment verification forms play a critical role across several industries in Texas. Here’s how they benefit different sectors:

- Healthcare: Employers in healthcare facilities need to verify the qualifications, employment status, and work history of their staff members. The Texas employment verification form helps maintain compliance with healthcare regulations and standards.

- Financial Institutions: In banking and finance, verifying income and employment is a key part of processing loans, mortgages, and other financial products. The Texas-specific form ensures that financial institutions have the proper documentation.

- Childcare and Education: In sectors involving children and vulnerable populations, such as childcare and education, employment verification helps ensure staff members have the proper background and qualifications.

- Security and Law Enforcement: Texas law requires strict background checks for employees in positions related to security and law enforcement. Employment verification forms ensure these individuals have a legitimate and accurate employment history.

Steps to Complete the Employment Verification Form Texas PDF

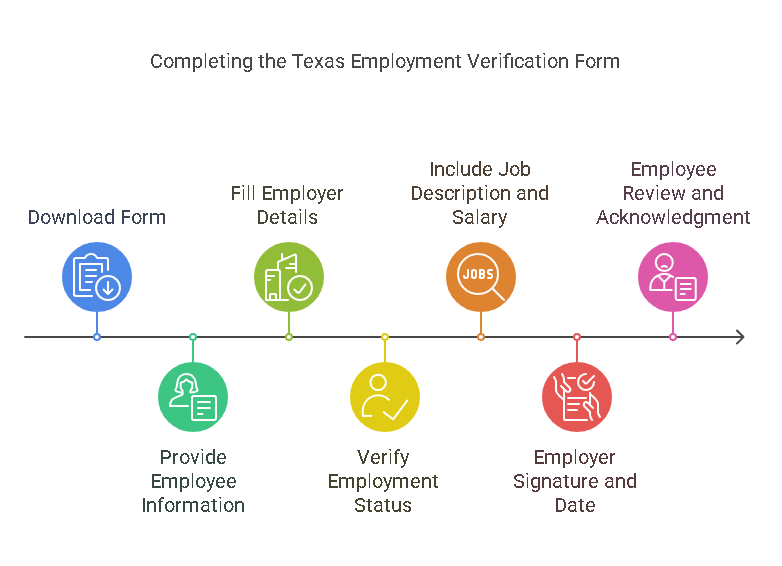

Completing the Employment Verification Form Texas PDF is a critical process for both employers and employees. Accuracy and attention to detail are essential to ensure the form complies with state regulations and that the verification is complete. In this section, we’ll walk through the necessary steps to fill out this form correctly and efficiently.

Step-by-Step Guide to Completing the Form

- Download the Texas Employment Verification Form PDF:

- The first step in completing the form is obtaining the correct document. You can download the Employment Verification Form from the official Texas state government website or request it from your employer’s HR department.

- Ensure you’re using the most recent version of the form to avoid any outdated requirements.

- Provide Employee Information:

- The form will require basic information about the employee. This typically includes:

- Full name (first, middle, last)

- Employee identification number (if applicable)

- Social Security number (for tax and verification purposes)

- Date of birth

- Contact information (phone number and email)

Tip: Ensure that all employee details are accurate, as discrepancies may delay the verification process.

- The form will require basic information about the employee. This typically includes:

- Employer Details:

- The form also needs to be filled out by the employer or their HR representative. The employer is responsible for validating the employee’s job status and providing the necessary verification details. Information required includes:

- Company name

- Employer’s contact details (phone number, email address, and physical address)

- Position/job title of the employee

- Employment start date and end date (if applicable)

- Employment status (full-time, part-time, temporary)

- The form also needs to be filled out by the employer or their HR representative. The employer is responsible for validating the employee’s job status and providing the necessary verification details. Information required includes:

- Verification of Employment Status:

- The employer must confirm whether the employee is actively employed, on leave, or no longer employed. This section is crucial because the employee’s current work status directly impacts the form’s validity.

- For employees currently on leave, such as parental or medical leave, employers should note this clearly.

- Details of Job Description and Salary (if applicable):

- If requested, the employer may need to provide additional details about the employee’s role, such as:

- Job description

- Current salary or hourly wage

- Number of hours worked per week

Tip: Employers should only provide details that are necessary and relevant to the verification request to avoid over-sharing private information.

- If requested, the employer may need to provide additional details about the employee’s role, such as:

- Employer Signature and Date:

- After completing all required fields, the employer or authorized representative must sign and date the form. This signature certifies that the information provided is correct to the best of their knowledge.

- Employee Review and Acknowledgment:

- Before submitting the form, employees should review the document to ensure all their information is accurate. If there are any discrepancies, they should be addressed with the employer immediately.

- The employee may need to sign or acknowledge the document depending on the form’s requirements.

Common Mistakes to Avoid

- Inaccurate or Incomplete Employee Information:

- Mistakes in the employee’s name, job title, or Social Security number can delay the verification process. Double-check all information for correctness before submitting the form.

- Failing to Include Employment Dates:

- Ensure that the employee’s start date and, if applicable, end date are clearly noted. This helps verify the duration of employment and avoids confusion.

- Missing Employer Information:

- Incomplete employer details, such as missing contact information or company name, can lead to delays. Verify that all sections are filled out entirely.

- Omitting Additional Requested Information:

- Some forms may require further details, such as salary, position, or job description. Not providing this information may make the verification incomplete.

Key Sections to Focus on for Accuracy

- Employee Information Section: This section should be carefully reviewed since any errors in personal details could result in verification failure.

- Employment Status and Job Details: This section must be accurate as it helps verify the applicant’s eligibility for the request (e.g., mortgage, loan, rental agreements).

- Employer’s Signature: The form cannot be processed without an authorized signature. Ensure that the person responsible for verifying employment signs the document.

Data Table: Types of Employment Verification Forms Across States

| State | Employment Verification Form Type | Notable Requirements | Differences from Texas Form |

|---|---|---|---|

| Texas | Employment Verification Form Texas PDF | Employee details, job status, salary | Specific format for Texas employers |

| California | Employment Verification Form | Requires disclosure of annual income and hours worked | Requires additional details on union membership |

| New York | Employment Verification Letter | Form not provided; relies on letter format | Formal employer signature required, with company letterhead |

| Florida | Employment Verification Form | Includes hours worked per week | Requires a Notary Public’s verification |

| Illinois | Employment Verification Form | Must include both full-time and part-time verification | State-specific format for employment categories |

How Precisehire Can Assist in Employment Verification

Many businesses find that the employment verification process can be time-consuming and complex, especially when they need to ensure compliance with various state laws. Precisehire provides tailored services that help streamline the background check and employment verification process. Their expert team handles everything from document verification to employee screening, ensuring that businesses remain compliant with Texas state laws.

Precisehire also simplifies the process by offering digital solutions for employment verification, helping employers save time and reduce paperwork. By using their services, employers can ensure that they are meeting legal requirements while also maintaining accurate records.

Legal Aspects, FAQs, and Conclusion

Understanding the legal landscape surrounding the Employment Verification Form Texas PDF is essential for employers to avoid compliance issues and potential legal consequences. In this section, we’ll explore the legal requirements for employment verification in Texas, answer frequently asked questions (FAQs), and offer a conclusion that underscores the importance of proper verification practices.

Legal Aspects of Employment Verification in Texas

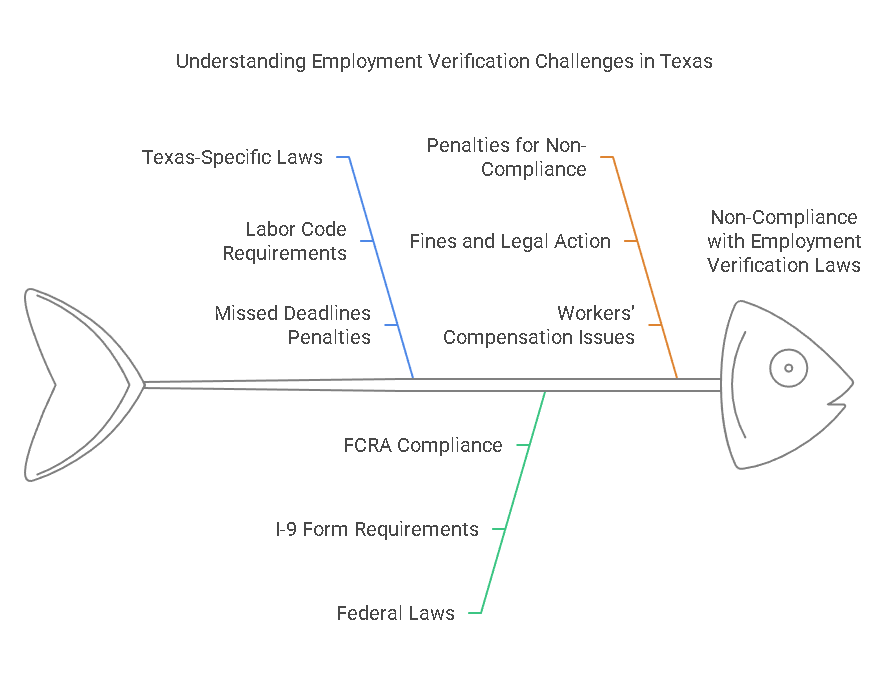

Employment verification in Texas is governed by both state and federal laws that require employers to verify the employment status of their workers. These legal frameworks help ensure that employers hire qualified individuals while preventing fraud and discrimination in hiring practices.

- Texas-Specific Laws:

- Texas Labor Code: Texas law requires employers to verify employment status for a variety of reasons, including compliance with state tax laws, worker’s compensation eligibility, and certain types of government contracting.

- Missed Deadlines: Employers who fail to comply with employment verification rules may face penalties, including fines or disqualification from participating in certain public contracts.

- Federal Laws:

- I-9 Form: The federal I-9 Form is required for all employees working in the United States. Employers must verify the identity and employment authorization of their employees within three days of hire. While this form isn’t specific to Texas, it’s an essential document in employment verification.

- Fair Credit Reporting Act (FCRA): Employers using background checks for employment purposes must comply with the FCRA, which mandates that individuals be informed and consent to having their employment history checked.

- Equal Employment Opportunity Commission (EEOC) Guidelines: The EEOC enforces anti-discrimination laws that prevent employers from using employment verification information in ways that might discriminate against applicants based on race, ethnicity, gender, or other protected characteristics.

- Penalties for Non-Compliance:

- Failure to complete the Employment Verification Form Texas PDF correctly or on time can lead to legal consequences. Penalties can range from fines to legal action for breach of contract or failure to meet employment standards.

- Employers who do not properly verify employment status may also face issues with their workers’ compensation and insurance eligibility.

Frequently Asked Questions (FAQs)

Here are some common questions employers and employees may have about the Employment Verification Form Texas PDF and the process:

Why is Employment Verification Necessary in Texas?

Employment verification is critical for confirming an individual’s eligibility for employment, especially for regulatory purposes and compliance with state and federal laws. It helps prevent fraud and ensures that businesses hire individuals who are authorized to work.

Can an Employee Request a Copy of Their Verification Form?

Yes, employees have the right to request a copy of their employment verification form. Employers are generally required to provide this information upon request, though it may be subject to certain conditions based on the employer’s policies.

What Happens if an Employer Refuses to Verify Employment?

If an employer refuses to complete the employment verification form or provide the necessary information, they may face legal repercussions. Employees have the right to challenge a refusal, and in some cases, this could result in a dispute resolution process.

How Long Should an Employment Verification Form Be Kept on File?

Employers are advised to retain employment verification forms for at least three years from the date of hire. Keeping records of verification can help employers stay compliant with tax and labor laws, as well as provide evidence in case of a dispute.

Is the Texas Employment Verification Form the Same as the Federal I-9 Form?

No, the Texas Employment Verification Form and the I-9 Form serve different purposes. The I-9 Form is a federal requirement to verify that employees are authorized to work in the U.S., while the Texas Employment Verification Form is typically used for more localized employment confirmation, such as for loan applications, leasing agreements, and government contracts.

Conclusion

Properly completing the Employment Verification Form Texas PDF is not just a bureaucratic task; it is an essential part of maintaining compliance with state and federal regulations. Employers in Texas must ensure that they fill out these forms accurately and keep them on file as required by law. By following the outlined steps and legal guidelines, businesses can avoid penalties and maintain proper employee records.

Employers can also benefit from using professional services like Precisehire to streamline the verification process. Precisehire offers comprehensive solutions that help businesses comply with Texas-specific requirements while simplifying the overall employment screening and verification process.

Ensuring that your employment verification practices are up to date will protect your business, ensure regulatory compliance, and contribute to a smoother hiring process for all parties involved.