Everything You Need to Know About Employment Verification Documents

Introduction to Employment Verification Documents

Employment verification documents play a fundamental role in the professional world. They are official records that confirm an individual’s past and present employment status and provide proof of job-related details like work history, income, and job title. Whether you’re an employer checking a prospective hire’s credentials or an employee providing proof of employment for a loan, rental agreement, or job application, employment verification documents serve as an essential tool for a wide range of needs.

What Are Employment Verification Documents?

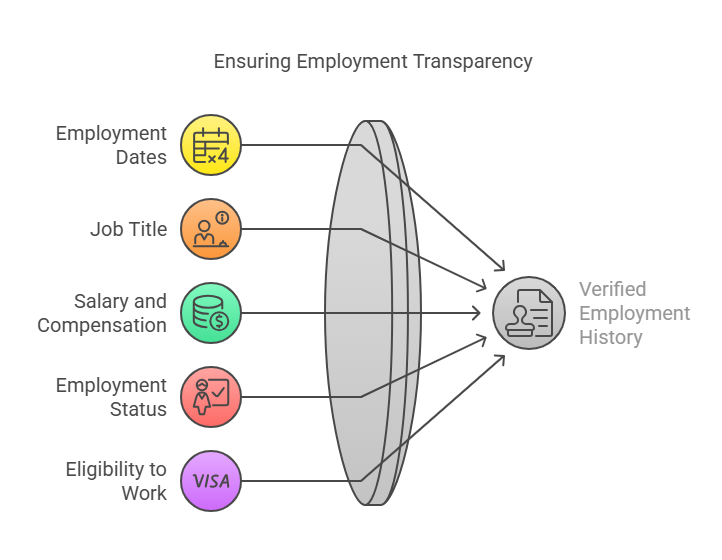

Employment verification documents are official records issued by an employer, former employer, or a third party to verify an individual’s job history. These documents may include a variety of details related to a person’s employment status, including but not limited to:

- Employment Dates: The start and end dates of the individual’s employment with a company, including the total duration of employment.

- Job Title: The specific role the individual held within the company during their employment period.

- Salary and Compensation: Information on the individual’s pay, which could include their hourly rate, salary, bonuses, commissions, and any other relevant compensation.

- Employment Status: Whether the employee was part-time, full-time, temporary, or permanent.

- Eligibility to Work: Confirmation of the employee’s legal right to work in a particular location, which could also include work visas or other necessary documentation for international employment.

Employment verification documents serve multiple purposes and may be requested by employers, employees, or third parties such as financial institutions or government agencies. By confirming the authenticity of job-related information, these documents help avoid fraudulent activity, ensuring that both employees and employers operate transparently.

Why Are Employment Verification Documents Important for Employers and Employees?

For employers, verifying an applicant’s employment history is crucial in confirming that the candidate is qualified for the position they are applying for. It helps reduce the risk of hiring an unqualified candidate or someone who may have falsified their resume. For example, a candidate may claim to have worked at a prestigious organization, but a background check can confirm whether or not that is true.

Additionally, many industries require strict verification of employment details, especially when it comes to regulated sectors such as healthcare, finance, and education. These industries may have specific compliance requirements that necessitate verifying a candidate’s job history, including any relevant licenses or certifications held by the candidate.

For employees, employment verification documents are necessary for various purposes, including:

- Job Applications: Many employers request proof of past employment as part of the hiring process.

- Loans and Mortgages: Financial institutions often ask for proof of income or employment to ensure that the applicant has the means to repay a loan.

- Rental Applications: Landlords may ask for verification of employment to ensure that the tenant has stable income to meet rent payments.

- Government Benefits: Certain government programs require employment verification to determine eligibility for assistance.

For employees, having access to these documents allows them to provide solid proof of their work history when required. Employees may also need these records when transitioning between jobs or when needing to provide evidence of their employment status for personal reasons.

The Role of Employment Verification Documents in the Hiring Process

In the hiring process, employment verification documents play a critical role in ensuring that employers make informed decisions based on accurate information. These documents help employers verify a candidate’s qualifications, including their job history, income, and eligibility to work. The hiring process is often extensive, and employers need to ensure that every candidate meets their specific criteria.

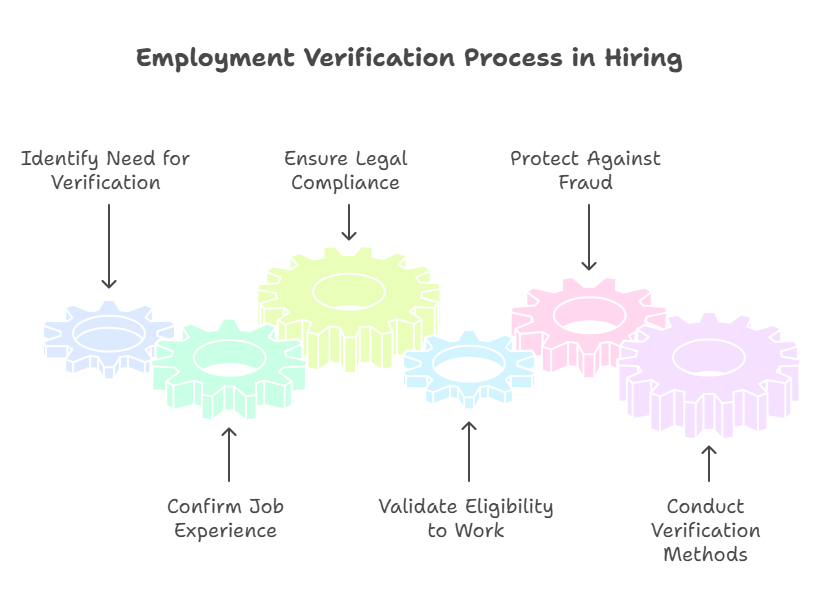

There are several key reasons why employers rely on employment verification documents:

- Confirming Job Experience: Employers want to know that the candidate has the relevant experience to succeed in the role. An applicant who claims to have worked in a specific industry for many years might need to provide verification that they indeed held such a position.

- Ensuring Legal Compliance: Many industries require that employees meet specific legal requirements or certifications before they can work in certain roles. For example, healthcare workers must be licensed, and financial service workers may need to meet specific regulatory guidelines. Employers must ensure these qualifications are in place before extending an offer.

- Validating Eligibility to Work: Employers need to ensure that an individual is legally allowed to work in the country where the job is located. This is particularly important for positions that require special permits or work visas.

- Protecting Against Fraud: In today’s competitive job market, candidates may be tempted to exaggerate or falsify their employment history. Employment verification documents help employers avoid the risk of hiring someone who may be misrepresenting their past.

Typically, employers may conduct employment verification through background checks, personal references, or direct verification from previous employers. It’s not only about confirming work history but also about ensuring that the candidate has the qualifications and legal right to take on the job.

In some industries, employment verification may be part of a mandatory process dictated by law or regulation. For example, positions in government, healthcare, or finance often require background checks, which include employment verification.

Why Employees Should Ensure They Have Access to Employment Verification Documents

Employees should always ensure they have access to the correct and up-to-date employment verification documents. Whether you’re applying for a new job or needing to demonstrate your income for a loan or lease, having quick access to these documents can save time and prevent delays. Furthermore, it is essential to verify that the information on your employment records is accurate.

Errors in employment records can create significant hurdles, particularly if you are applying for a mortgage, trying to rent an apartment, or seeking employment. If discrepancies arise in employment verification documents, it may slow down or even halt the hiring process.

For employees, it’s beneficial to regularly review their employment verification documents, ensuring that all the details, including job titles, dates of employment, and salary, are correct and match the records kept by the employer.

Types of Employment Verification Documents and How to Obtain Them

Employment verification documents are essential for confirming an employee’s job history, income, and eligibility for employment. These documents play a key role in the hiring process and are also required when employees need proof of employment for other purposes, such as applying for loans or renting a home. Understanding the different types of employment verification documents and knowing how to obtain them is crucial for both employees and employers.

Types of Employment Verification Documents

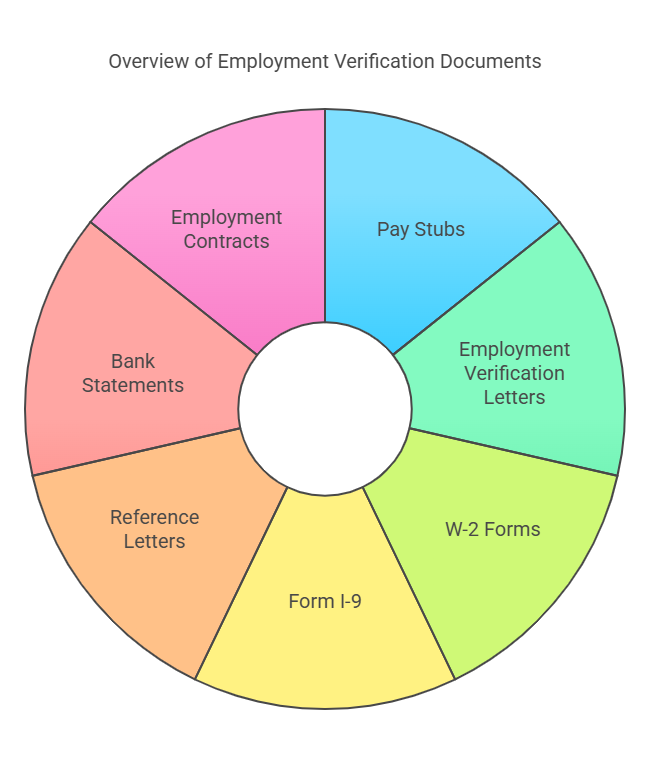

- Pay Stubs Pay stubs (or payslips) are one of the most commonly used employment verification documents. These documents provide a detailed breakdown of an employee’s wages, including gross pay, deductions (taxes, retirement contributions, insurance), and net income.

- Uses: Pay stubs are commonly used by lenders, landlords, and other financial institutions to verify income. They provide detailed proof of an employee’s earnings and tax deductions.

- How to Obtain: Employees can request their pay stubs from the employer or access them through the company’s payroll system if digital records are available.

- Employer Use: Employers rely on pay stubs to track compensation and ensure compliance with wage laws and tax regulations.

- Employment Verification Letters An employment verification letter is a formal document issued by an employer to verify an employee’s job title, dates of employment, and salary information. This letter is commonly used when an employee is applying for a loan, mortgage, or rental housing.

- Uses: Lenders, mortgage brokers, and landlords often require an employment verification letter to confirm an individual’s current employment status and income.

- How to Obtain: Employees can request employment verification letters from the HR department or their manager.

- Employer Use: Employers use these letters to confirm the details of an employee’s employment for third-party verifications.

- W-2 Forms W-2 forms are issued by employers annually and summarize an employee’s earnings, wages, and the amount of taxes withheld over the course of the year. This document is often required for tax filing purposes and is also used for verifying income.

- Uses: W-2 forms are used by banks, financial institutions, and government agencies to verify annual income and tax payments.

- How to Obtain: W-2 forms are distributed by employers to employees by the end of January each year. If the form is lost, employees can request a replacement from their employer or the IRS.

- Employer Use: Employers are required to issue W-2 forms for tax reporting purposes and to provide employees with income verification.

- Form I-9 (Employment Eligibility Verification) Form I-9 is a mandatory document used by employers to verify an employee’s eligibility to work in the United States. This form requires employees to provide documentation such as a passport, Social Security card, or driver’s license to confirm their identity and legal authorization to work.

- Uses: The Form I-9 is used to ensure that an employee is legally allowed to work in the U.S.

- How to Obtain: Employees complete Form I-9 during the hiring process. Employers must retain completed I-9 forms for each employee.

- Employer Use: Employers use the completed I-9 form to verify that the employee is eligible for employment under U.S. immigration laws.

- Reference Letters Reference letters are written by former employers, supervisors, or colleagues to recommend an individual based on their professional performance, work ethic, and character. These letters are commonly requested during job applications or to verify past work experiences.

- Uses: Employers often request reference letters to evaluate the credibility of a candidate’s qualifications and past performance.

- How to Obtain: Employees can ask previous employers or colleagues to provide a reference letter. These letters are typically offered voluntarily by people who have worked with the individual in a professional capacity.

- Employer Use: Employers use reference letters to assess a candidate’s skills, work history, and character.

- Bank Statements For employees who are self-employed or have irregular income, bank statements may be used as an alternative to pay stubs. These statements show the deposits made into an employee’s account, providing evidence of income.

- Uses: Bank statements can be used by lenders and landlords when verifying income for individuals who may not have traditional pay stubs.

- How to Obtain: Employees can obtain their bank statements from their bank’s online portal or request physical copies from their bank.

- Employer Use: Employers may accept bank statements as proof of income in specific cases, such as when verifying self-employment or freelance work.

- Employment Contracts Employment contracts outline the terms and conditions of employment, including salary, job responsibilities, benefits, and the duration of employment. These contracts serve as a formal agreement between the employer and employee.

- Uses: Employment contracts are used to verify the agreed-upon terms of employment, especially salary and job roles. These documents can be crucial when negotiating pay or job responsibilities.

- How to Obtain: Employees should have a copy of their signed employment contract on hand. If the original is lost, it can be requested from the employer.

- Employer Use: Employers use employment contracts to ensure that employees adhere to the terms of the agreement, including salary, benefits, and job responsibilities.

How Employees Can Obtain Employment Verification Documents

Employees are typically responsible for requesting the necessary verification documents. Some documents, like pay stubs and W-2 forms, are generated automatically, while others, such as reference letters or employment verification letters, must be requested. Here’s how employees can obtain these documents:

- Pay Stubs: Employees can either access pay stubs through the company’s payroll system or request a physical copy from the HR department.

- Employment Verification Letters: Employees can request these letters directly from HR or management.

- W-2 Forms: W-2 forms are automatically issued at the end of the year. If an employee does not receive their W-2 form, they can request it from HR or contact the IRS for a duplicate.

- Form I-9: Form I-9 is filled out during the hiring process. Employees should keep a copy of the completed form and can request it from HR if needed.

- Reference Letters: Employees may need to ask former employers or colleagues to provide a reference letter, which they can use for future job applications.

How Employers Use Employment Verification Documents

Employers use these documents to verify the accuracy of an employee’s job history, income, and eligibility to work. Verifying employment credentials helps reduce the risk of hiring individuals with false or incomplete information. Here are some ways employers use these documents:

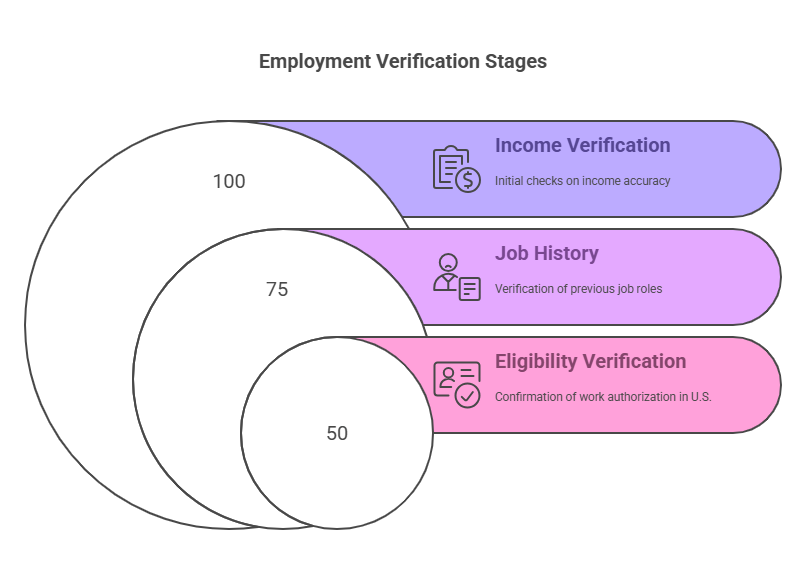

- Income Verification: Pay stubs, W-2 forms, and employment verification letters are used to confirm an applicant’s income level, ensuring they meet salary requirements for a job or loan.

- Job History: Employers use reference letters and employment verification letters to verify a candidate’s previous job titles, employment dates, and job responsibilities.

- Eligibility Verification: Form I-9 is used by employers to ensure that a new hire is legally authorized to work in the U.S., ensuring compliance with immigration laws.

Data Table: Comparison of Employment Verification Documents

| Document Type | Primary Use | How to Obtain | Advantages | Limitations |

|---|---|---|---|---|

| Pay Stubs | Verify income and employment | Request from employer or HR department | Easy to obtain, detailed breakdown of earnings | May not be available for self-employed individuals |

| Employment Verification Letters | Confirm job title, dates of employment, salary | Request from HR or manager | Official confirmation of employment | Can take time for employer to provide |

| W-2 Forms | Verify annual income and tax information | Issued by employer at year-end | Legal requirement, widely accepted | Only reflects income for the specific year |

| Form I-9 | Verify legal eligibility to work in the U.S. | Completed during hiring process | Required by law for all new hires | Must be completed during hiring |

| Reference Letters | Verify qualifications, character, and work ethic | Request from former employers or colleagues | Provides personal insight into performance | Dependent on availability of references |

| Bank Statements | Verify income when other documents are unavailable | Request from bank | Useful for self-employed individuals | Not as clear as pay stubs for confirming salary |

| Employment Contracts | Verify terms of employment and job responsibilities | Request from employer or HR | Clear outline of employment terms | Not all employees have formal contracts |

By understanding the different types of employment verification documents and how to obtain them, employees and employers can ensure a smooth verification process. PreciseHire provides a reliable solution for employment screening and verification services, assisting in confirming employment history, income, and eligibility.

Legal Aspects, FAQs, and Conclusion

Employment verification is a critical component of the hiring process and various other professional and personal activities. While obtaining and utilizing employment verification documents is straightforward, there are several legal considerations to keep in mind. It’s essential for both employers and employees to understand the rules, rights, and responsibilities surrounding these documents.

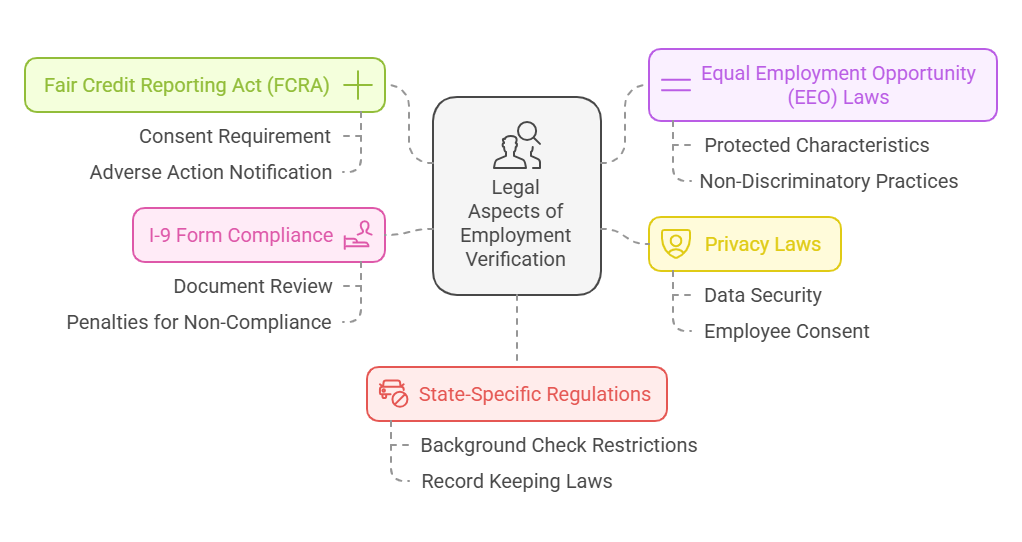

Legal Aspects of Employment Verification

- Fair Credit Reporting Act (FCRA) The Fair Credit Reporting Act (FCRA) is a federal law that regulates how background checks, including employment verification checks, are conducted. Employers must comply with FCRA requirements when using third-party services to verify employment. This includes:

- Obtaining the candidate’s consent before conducting a background check.

- Providing the candidate with a copy of the background report if any negative information results in an adverse action, such as not hiring the candidate.

Impact on Employment Verification: The FCRA ensures that employment verification processes are carried out in a transparent and non-discriminatory manner. Employees have the right to know what information is being collected about them and can challenge any inaccuracies.

- Equal Employment Opportunity (EEO) Laws Employers must comply with Equal Employment Opportunity (EEO) laws when conducting employment verification and background checks. These laws prohibit discrimination based on race, color, national origin, sex, religion, disability, or age (40 or older).Impact on Employment Verification: When verifying employment, employers must ensure that their practices do not discriminate against candidates based on protected characteristics. This includes considering how the information obtained from employment verification documents will be used to avoid discrimination.

- Privacy Laws Employment verification often involves accessing sensitive information, such as income, job history, and tax records. Privacy laws, including state-specific regulations, govern the use, storage, and sharing of this data.Impact on Employment Verification: Employers must take care to ensure that all employment verification documents are stored securely and only shared with authorized parties. Employees must also give consent when required.

- I-9 Form Compliance Employers are legally required to verify employment eligibility for all new hires by completing the Form I-9. This process involves reviewing specific documents, such as a passport or Social Security card, to confirm that the employee is authorized to work in the U.S.Impact on Employment Verification: Failure to comply with I-9 requirements can lead to penalties for employers. Therefore, it’s important that both employers and employees ensure they have the correct documentation in place.

- State-Specific Regulations In addition to federal laws, states may have their own specific requirements regarding employment verification and the use of personal data. For example, some states have laws that restrict the types of background checks that can be conducted or how long certain employment records can be kept.Impact on Employment Verification: Employers must be aware of state-specific laws and comply with any restrictions when verifying an employee’s or applicant’s information.

FAQs About Employment Verification Documents

What is an employment verification document?

Employment verification documents are records used to confirm an individual’s employment history, job status, and income. These include pay stubs, employment verification letters, W-2 forms, and more. Employers and other institutions often use these documents to verify an applicant’s qualifications for a job or loan.

How do I get a copy of my employment verification documents?

Employees can request employment verification documents from their employer’s HR department or payroll office. Common documents, like pay stubs and W-2 forms, are typically provided automatically, while others, such as reference letters or employment verification letters, must be requested.

Can I use an employment verification document to apply for a job?

Yes, employment verification documents, such as employment verification letters, pay stubs, and reference letters, are often required by employers to verify an applicant’s job history and income. Providing these documents upfront can expedite the hiring process.

What should I do if I find incorrect information on my employment verification documents?

If you notice any inaccuracies on your employment verification documents, you should contact your employer’s HR department or payroll office to request corrections. In the case of third-party background checks, you can dispute incorrect information by following the dispute resolution process outlined by the reporting agency.

How long does it take to obtain an employment verification document?

The time it takes to obtain employment verification documents varies depending on the type of document and how quickly the employer processes the request. Pay stubs and W-2 forms are typically available shortly after the pay period or tax season ends, while employment verification letters or reference letters may take longer.

Conclusion

Employment verification documents are essential for confirming an employee’s job history, income, and eligibility for employment. These documents play a key role in the hiring process, loan applications, and other situations where proof of employment is required. Employees should be proactive in maintaining and requesting these documents, while employers should ensure they follow all legal requirements and best practices when verifying employment.

In this article, we have discussed the different types of employment verification documents, how to obtain them, the legal aspects surrounding their use, and common questions about the verification process. Employers and employees alike must be aware of these documents’ importance and take the necessary steps to ensure the accuracy and legality of the information.

For businesses looking to ensure the thoroughness of their employment verification process, services like PreciseHire provide comprehensive employment screening, including background checks, income verification, and eligibility checks. With the right documentation and verification processes in place, both employees and employers can ensure a smooth and compliant hiring process.