The Complete Guide to API for Identity Verification Features

What is an API for Identity Verification and Why is it Important?

An Identity Verification API is a powerful tool that allows businesses to verify the identities of their users seamlessly. By integrating these APIs into their platforms, companies can automate the process of confirming personal information, reducing the need for manual checks.

These APIs work by connecting an application to a third-party service that validates identity data. This can include verifying government-issued documents, performing biometric checks, and cross-referencing information with secure databases. For example, a financial institution might use an identity verification API to authenticate new customers applying for a loan, ensuring compliance with regulations like Know Your Customer (KYC).

Why Use an API for Identity Verification?

Identity verification APIs are transforming the way businesses operate, offering multiple benefits:

- Streamlined Onboarding: APIs eliminate the need for lengthy manual verification processes, providing users with a faster and more intuitive experience.

- Enhanced Security: Advanced verification methods like facial recognition and document scanning help prevent identity fraud and unauthorized access.

- Automation and Accuracy: APIs reduce the risk of human error, ensuring consistent and reliable identity checks.

- Scalability: These tools are designed to handle large volumes of requests, making them ideal for growing businesses with expanding customer bases.

For instance, an online retailer might use an API to verify a customer’s identity before approving a high-value purchase, minimizing the risk of fraudulent transactions.

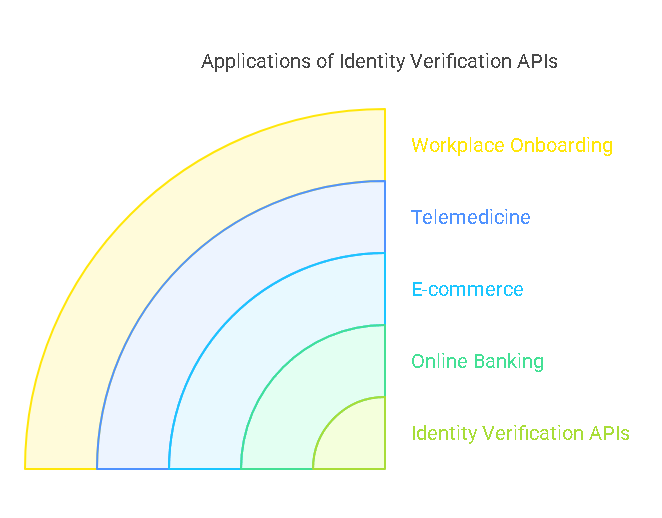

Applications of Identity Verification APIs

Identity verification APIs are essential across a wide range of industries. Some of the most common applications include:

- Online Banking:

- Verifying customer identities for account creation.

- Ensuring compliance with anti-money laundering (AML) regulations.

- E-commerce:

- Authenticating users to secure online transactions.

- Preventing fraud in peer-to-peer marketplaces.

- Telemedicine:

- Verifying patients’ identities before virtual consultations.

- Protecting sensitive medical information.

- Workplace Onboarding:

- Streamlining the hiring process by verifying candidate credentials.

- Conducting background checks for compliance and safety.

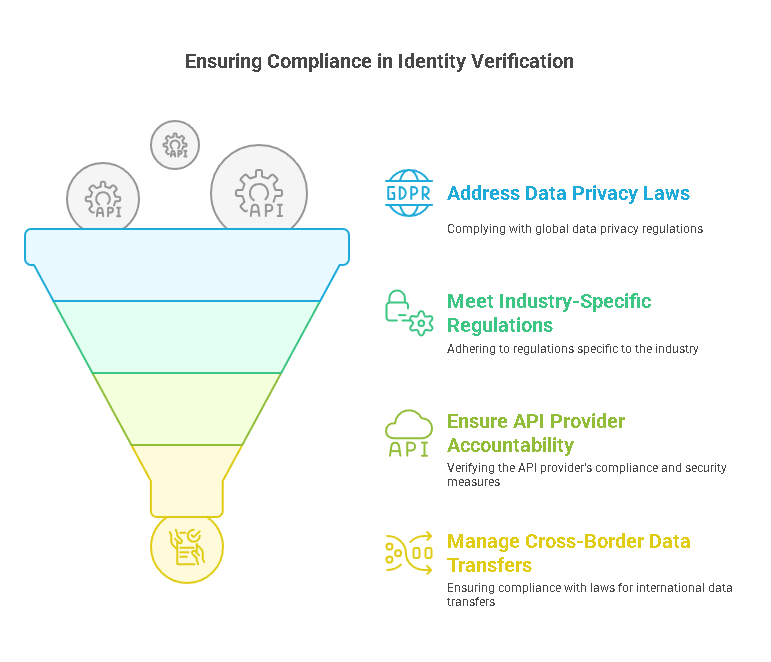

Why Businesses Need Secure Identity Verification

In today’s digital landscape, security is paramount. Cybercrime and identity theft are on the rise, making secure identity verification more critical than ever. Businesses need to implement reliable solutions to:

- Combat Fraud: Verifying users’ identities prevents account takeovers and fraudulent activities.

- Stay Compliant: Regulations like GDPR, CCPA, and HIPAA require businesses to handle identity data securely.

- Build Trust: A seamless and secure verification process reassures customers that their information is in safe hands.

As digital interactions become the norm, secure identity verification is no longer optional—it’s a necessity.

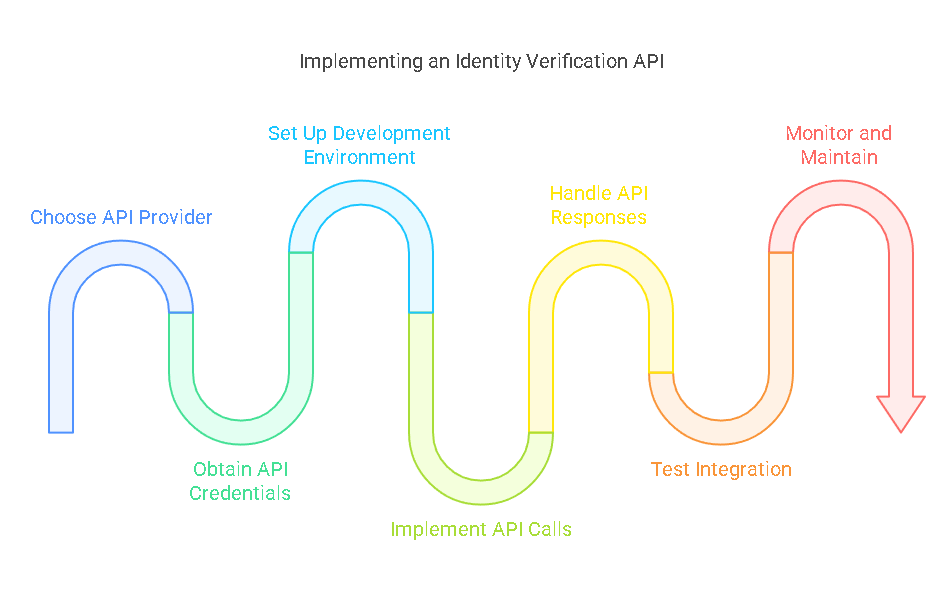

How to Implement and Use an API for Identity Verification

Implementing an identity verification API can seem complex, but with the right approach, businesses can integrate these tools smoothly. By understanding the key steps and features, companies can maximize the benefits of their chosen solution. Let’s explore how to get started.

How to Implement and Use an API for Identity Verification

Integrating an identity verification API involves a series of technical steps to ensure smooth functionality. Here’s a step-by-step guide to implementing an API effectively:

- Choose a Suitable API Provider

Research and select an API that fits your business needs. Consider factors such as supported features, compatibility with your platform, pricing, and compliance with regulations. - Obtain API Credentials

Once you’ve chosen a provider, sign up for an account and obtain the necessary API credentials, such as an API key or token, to authenticate your requests. - Set Up the Development Environment

Ensure that your application’s environment is configured to support API integration. This may involve setting up libraries, SDKs, or frameworks provided by the API provider. - Implement API Calls

Use the API documentation to understand how to make requests. Start by integrating basic functionality, such as sending user data for verification. For example, a request might include:- User details: Name, address, and date of birth.

- Document scans: Images of passports or IDs.

- Biometric data: Facial recognition scans.

- Handle API Responses

Implement logic to process the API’s responses. Responses typically include verification results, error codes, or additional requests for more information. - Test the Integration

Before going live, thoroughly test the API’s functionality in different scenarios to identify and fix any issues. - Monitor and Maintain

After deployment, monitor the API’s performance and update your integration as needed, especially when the provider releases new features or updates.

Key Features of Identity Verification APIs

Modern identity verification APIs offer a range of features to meet diverse business needs. Here are some of the most important capabilities:

- Document Verification: Scanning and validating government-issued IDs such as passports and driver’s licenses.

- Biometric Authentication: Facial recognition or fingerprint verification to confirm identity in real time.

- Database Cross-Checks: Matching user details with external databases to verify information such as addresses or employment history.

- Fraud Detection: Identifying and flagging forged or altered documents.

- Multi-Language Support: Handling identity documents from different countries and in multiple languages.

These features ensure that businesses can verify identities securely and efficiently, regardless of their industry or location.

Comparison of Popular Identity Verification APIs

When choosing an identity verification API, it’s essential to compare providers based on features, pricing, speed, and additional services. Below is an example of how different APIs stack up:

| API Provider | Features | Pricing | Processing Speed | Additional Services |

|---|---|---|---|---|

| API Provider A | Document & biometric verification | $0.10/verification | Real-time | Fraud detection, multi-language |

| API Provider B | Database cross-checks, OCR | $0.08/verification | 1–2 minutes | Address verification, analytics |

| API Provider C | Document verification only | $0.05/verification | Real-time | Bulk processing |

Note: Pricing and features vary by provider. Contact vendors for the most accurate details.

Highlighting Precisehire Services

Among the available options, Precisehire stands out as a comprehensive solution for identity verification. With a focus on businesses requiring end-to-end employment screening services, Precisehire offers:

- Advanced identity verification tools integrated into its platform.

- Compliance with regulations like GDPR and CCPA.

- Seamless API integration for background checks and credential verification.

Choosing Precisehire ensures that businesses not only verify identities securely but also streamline their overall onboarding processes.

By leveraging the right API and understanding its capabilities, businesses can ensure secure, efficient, and user-friendly identity verification processes. Next, we’ll discuss legal considerations, frequently asked questions, and the significance of staying compliant with global standards.