How to Choose the Right Identity Verification Solutions

What are Identity Verification Solutions?

Identity Verification Solutions refer to a range of tools and methods designed to authenticate and confirm the identity of individuals or entities. These solutions are widely used across various sectors to ensure that the person or organization interacting with a business is who they claim to be. With the growing risks associated with online transactions and interactions, identity verification has become a fundamental aspect of maintaining trust and security in digital environments.

From online banking and e-commerce to healthcare and government services, identity verification is crucial for preventing fraud, enhancing user experiences, and complying with various regulations. These solutions verify critical details, such as names, addresses, social security numbers, or biometrics, to authenticate a person’s identity securely.

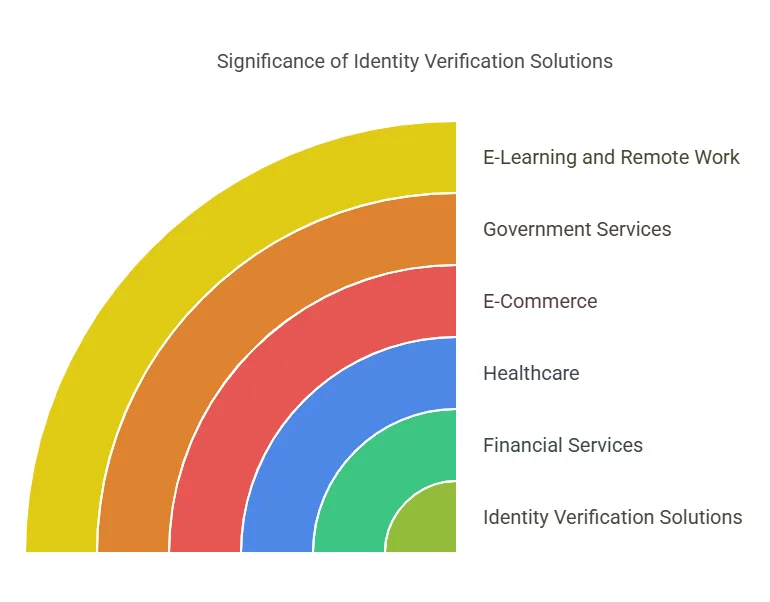

The Significance of Identity Verification Solutions in Various Industries

Identity verification solutions are important across multiple industries for different reasons. Let’s break down the significance of these solutions in some key sectors:

- Financial Services: In the financial industry, identity verification is critical for preventing fraudulent transactions, identity theft, and money laundering. Financial institutions use identity verification solutions as part of their Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance efforts. These solutions help verify the identity of individuals before they open accounts, access services, or perform high-value transactions.

- Healthcare: In healthcare, ensuring that the person accessing medical services is who they say they are is of paramount importance. Identity verification prevents medical identity theft, ensures the accuracy of patient records, and supports billing integrity. It also helps ensure that healthcare professionals comply with privacy regulations, such as HIPAA (Health Insurance Portability and Accountability Act) in the United States.

- E-Commerce: For e-commerce platforms, identity verification is a vital part of ensuring secure online transactions. Whether it’s verifying a buyer’s identity during checkout or confirming a seller’s legitimacy, these solutions prevent fraudulent transactions and protect both consumers and businesses from cybercriminal activity. In addition, identity verification fosters consumer trust, allowing shoppers to feel confident when making online purchases.

- Government Services: Government agencies use identity verification to confirm an individual’s identity before granting access to critical services such as voting, welfare programs, or applying for social security benefits. This is also crucial for ensuring the integrity of online services, reducing fraud, and promoting secure interactions between citizens and governmental bodies.

- E-Learning and Remote Work: In today’s remote working environment, verifying the identity of employees, students, and professionals is necessary to ensure that access to sensitive data, proprietary information, or online classes is restricted to authorized users only. Identity verification is particularly essential in maintaining the integrity of online certifications, exams, and professional credentials.

Different Types of Identity Verification Solutions

There are multiple types of identity verification solutions, each designed to meet the specific needs of businesses and industries. These solutions can be broadly categorized into the following:

- Document Verification: This process involves verifying the authenticity of documents that an individual presents to confirm their identity. Examples include government-issued IDs, passports, driver’s licenses, and utility bills. Document verification is essential for sectors like banking, travel, and legal services. Technologies like Optical Character Recognition (OCR) can automate the reading and validation of documents to ensure their legitimacy.

- Biometric Authentication: Biometric authentication uses physical characteristics to verify an individual’s identity. Common biometric methods include fingerprint scanning, facial recognition, iris scanning, and voice recognition. Biometric authentication is gaining popularity due to its accuracy and convenience, particularly in high-security areas such as banking apps, airport security, and law enforcement.

- Two-Factor Authentication (2FA): Two-factor authentication adds an extra layer of security by requiring two forms of identification. Typically, this involves something the user knows (e.g., a password) and something the user has (e.g., a code sent to their mobile phone or email). 2FA is widely used in online banking, email accounts, and corporate security to enhance login processes and prevent unauthorized access.

- Know Your Customer (KYC) Procedures: KYC procedures involve verifying the identity of individuals and assessing their risk profile to ensure that businesses are not involved in illegal activities, such as money laundering or financing terrorism. These procedures are commonly required by financial institutions, insurance companies, and other regulated businesses. KYC processes typically include verifying personal details, checking government-issued ID, and validating the individual’s financial history.

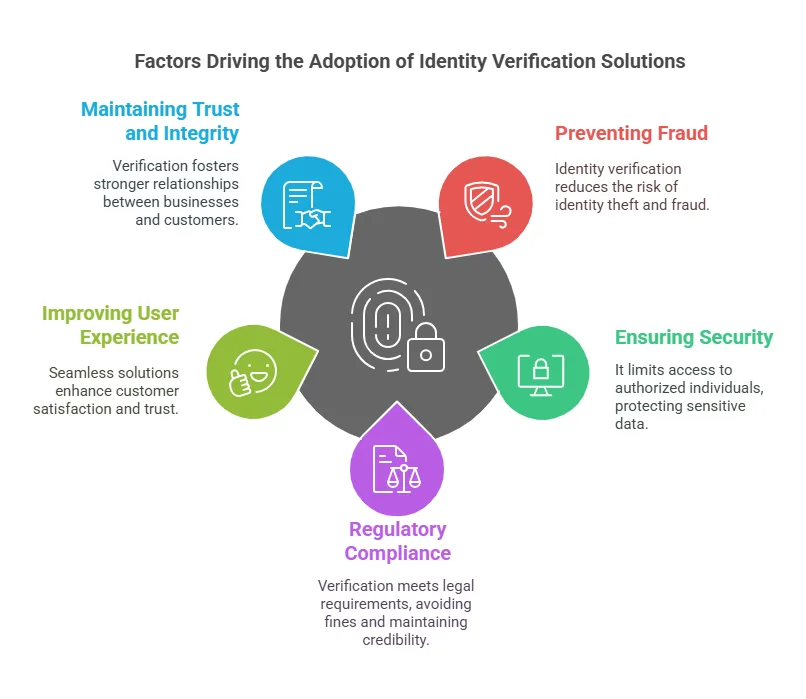

Why Businesses and Individuals Use Identity Verification Solutions

Businesses and individuals use identity verification solutions for a range of reasons, including:

- Preventing Fraud: One of the primary reasons for using identity verification solutions is to combat fraud. With the rise of cybercrime, fraudulent activities such as identity theft, credit card fraud, and account takeover have become prevalent. Identity verification ensures that the person performing the transaction is who they claim to be, significantly reducing the chances of fraud.

- Ensuring Security: Identity verification enhances security by limiting access to sensitive information or services to authorized individuals only. Whether it’s securing online banking, accessing medical records, or logging into a work-related platform, identity verification is a fundamental step in protecting data and ensuring that only legitimate users can gain access.

- Regulatory Compliance: Many industries, particularly financial services, healthcare, and e-commerce, are subject to strict regulatory requirements regarding customer identification. For example, KYC and AML regulations mandate that businesses verify their customers’ identities before providing certain services. Compliance with these regulations is crucial for avoiding fines and maintaining industry credibility.

- Improving User Experience: Modern identity verification solutions are designed to be fast, seamless, and user-friendly. Solutions such as biometric authentication and document verification provide smooth experiences for users while ensuring high levels of security. This results in increased customer trust and satisfaction, making the verification process not just secure but convenient.

- Maintaining Trust and Integrity: As more businesses operate online, maintaining trust and integrity with customers becomes increasingly important. Identity verification reassures consumers that businesses are taking necessary steps to safeguard their personal information and secure transactions, fostering a stronger relationship between companies and their customers.

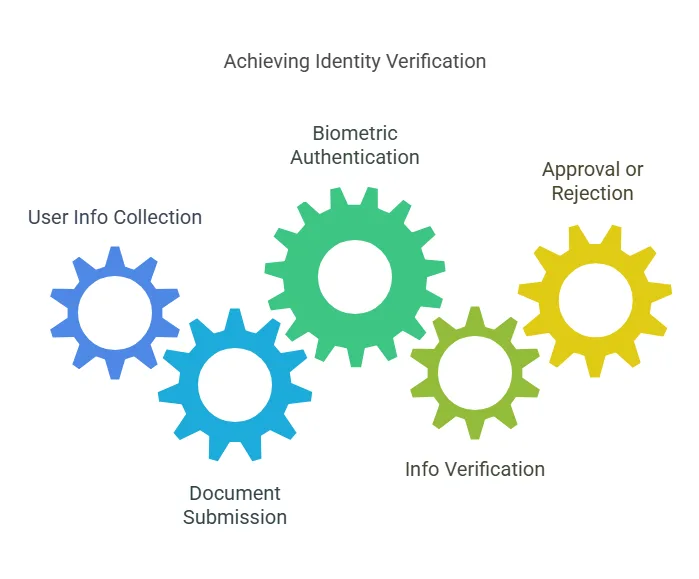

Step-by-Step Process of Using Identity Verification Solutions

The process of using identity verification solutions generally follows a series of steps to ensure accuracy, security, and compliance. Here’s a breakdown of the typical process:

- User Information Collection: The first step involves collecting essential personal details from the user. This could include full name, date of birth, address, social security number, or other identifying information. The information collected depends on the specific industry and the level of verification required.

- Document Submission: In many cases, users are asked to submit government-issued documents, such as a passport, driver’s license, or identity card. This allows the business or service provider to compare the information provided by the individual with the data on the submitted document.

- Biometric Authentication (If Applicable): If biometric verification is part of the process, the individual will be prompted to scan their fingerprint, face, or eye. This step is usually powered by advanced machine learning algorithms that analyze the biometric data and compare it to stored reference data for a match.

- Verification of Information: Once all necessary data is submitted, the identity verification solution cross-references the provided information with databases, such as government records, credit bureaus, or social media profiles. This helps verify the authenticity of the documents and the individual’s identity.

- Approval or Rejection: After the verification process is complete, the system issues a report to the service provider. If the information matches the verification sources, the identity is confirmed, and the user is granted access to the service. If any discrepancies are found, the system may flag the account for further investigation, or the verification attempt could be rejected.

Benefits of Using Identity Verification Solutions

Identity verification solutions offer numerous advantages to both businesses and consumers. Some of the key benefits include:

- Enhanced Security: By verifying the identity of users, businesses can ensure that only authorized individuals are granted access to sensitive data and services. This minimizes the risk of security breaches, account takeovers, and fraudulent transactions.

- Reduced Fraud: Identity verification solutions help detect and prevent various forms of fraud, such as account creation fraud, financial fraud, and identity theft. With automated and real-time verification, businesses can quickly spot fraudulent activity and take action to protect their assets and customers.

- Regulatory Compliance: Many industries, especially those involving financial transactions, are required to comply with stringent regulations such as KYC, AML, and GDPR. Identity verification solutions help businesses adhere to these laws, ensuring that they can avoid penalties and maintain a positive reputation.

- Operational Efficiency: Automation of the identity verification process streamlines workflows, reduces the need for manual intervention, and speeds up customer onboarding. This makes the process more efficient and improves the overall customer experience.

- Improved Customer Trust: With the rise of cyber threats, customers expect businesses to take proactive measures to protect their data. Implementing robust identity verification solutions not only enhances security but also fosters customer trust by reassuring them that their personal information is secure.

The Technology Behind Identity Verification Solutions

The success of modern identity verification solutions lies in the integration of advanced technologies such as:

- Artificial Intelligence (AI): AI powers identity verification systems by analyzing vast amounts of data, detecting patterns, and identifying discrepancies. AI-driven solutions improve accuracy and reduce human error, making the verification process faster and more reliable.

- Biometrics: Biometrics, such as facial recognition, fingerprint scanning, and voice recognition, provide highly secure and unique ways to verify a person’s identity. These methods are difficult to forge, making them highly effective in preventing fraud and unauthorized access.

- Machine Learning: Machine learning algorithms continually learn and improve from data, which enables the system to refine its verification capabilities over time. This helps identity verification solutions stay ahead of evolving fraud tactics and cybersecurity threats.

Precise Hire’s Identity Verification Services

At Precise Hire, we offer comprehensive identity verification solutions that ensure secure, accurate, and compliant verification for businesses across various industries. Our platform simplifies the verification process with fast turnaround times, enhanced security, and robust compliance with industry standards. By leveraging cutting-edge technologies like AI, biometrics, and machine learning, we help businesses verify the identities of their users while maintaining a seamless experience.

Legal Aspects of Identity Verification

Compliance with legal and regulatory requirements is a key consideration when implementing identity verification solutions. Several important laws and regulations govern the use of these solutions:

- Know Your Customer (KYC): KYC regulations are designed to help businesses verify the identities of their customers and assess their risk profiles. This process is critical for financial institutions, insurance companies, and other regulated sectors. Failure to comply with KYC regulations can lead to severe penalties and reputational damage.

- Anti-Money Laundering (AML): AML laws require businesses to detect and prevent money laundering activities. Identity verification is a key component of AML compliance, as it helps businesses identify and assess the legitimacy of their customers.

- General Data Protection Regulation (GDPR): GDPR, which applies to companies operating in the European Union (EU), requires businesses to protect personal data and ensure that user privacy is respected. Identity verification solutions must comply with GDPR by ensuring that personal data is handled securely and transparently.

- Privacy Laws: Various privacy laws, such as the California Consumer Privacy Act (CCPA) and the Health Insurance Portability and Accountability Act (HIPAA), regulate the collection, storage, and use of personal information. Businesses using identity verification solutions must ensure that they comply with these laws to avoid privacy violations.

Frequently Asked Questions (FAQs)

Why is identity verification important for businesses?

Identity verification helps businesses prevent fraud, comply with regulations, and secure customer data, creating a trustworthy environment for users and clients.

What is the difference between biometric and document-based verification?

Biometric verification relies on unique physical traits such as fingerprints or facial recognition, while document-based verification involves verifying government-issued documents like passports or driver’s licenses.

How does KYC relate to identity verification?

KYC procedures are a regulatory requirement in many industries, ensuring that businesses verify the identities of their customers to reduce the risk of fraud and money laundering.

Is biometric authentication more secure than passwords?

Yes, biometric authentication is often considered more secure than traditional passwords because biometric traits are unique to each individual and difficult to replicate.

How can businesses choose the best identity verification solution?

Businesses should consider factors such as industry-specific compliance requirements, the technology behind the solution (e.g., biometrics, AI), speed, accuracy, and user experience when selecting an identity verification solution.

Conclusion

In a world increasingly reliant on digital transactions and online services, Identity Verification Solutions are critical to ensuring security, preventing fraud, and maintaining compliance with legal and regulatory standards. These solutions are versatile, providing businesses with the tools to authenticate users through various methods like document verification, biometrics, and KYC procedures. By using reliable platforms such as Precise Hire, businesses can streamline their verification processes, reduce fraud, and provide a secure environment for their customers. With the right identity verification solution in place, businesses can confidently navigate today’s digital landscape.