How to Navigate Direct Express Identity Verification Process

Direct Express Identity Verification: Introduction & Overview

Direct Express Identity Verification is a secure authentication process used to confirm the identity of individuals accessing Direct Express accounts. Direct Express is a government-issued prepaid debit card system primarily used to disburse federal benefits, such as Social Security, Supplemental Security Income (SSI), and Veterans Affairs (VA) payments.

To ensure only authorized users access these funds, Direct Express employs identity verification protocols that confirm an individual’s identity during account registration, login attempts, and high-risk transactions. These verification steps help prevent fraud, identity theft, and unauthorized access.

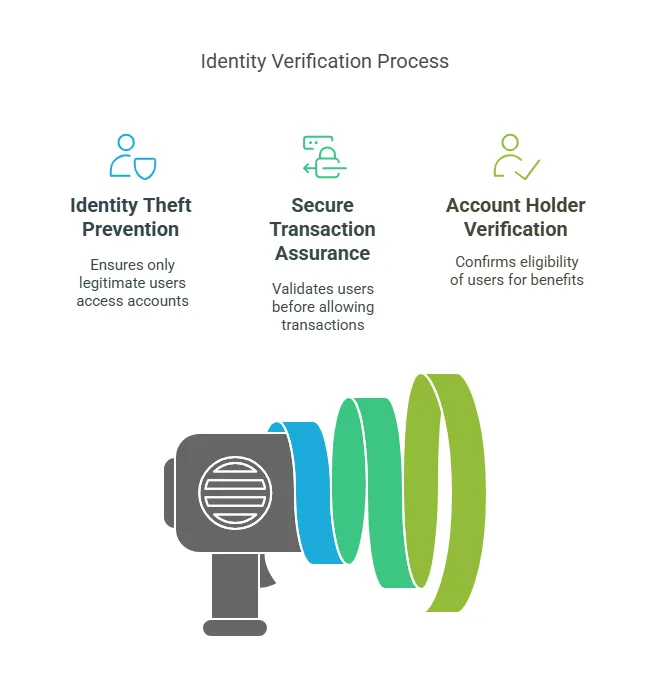

Why Is Direct Express Identity Verification Important?

With the rise of cybercrime and financial fraud, identity verification is crucial for securing accounts and preventing unauthorized transactions. Here are some key reasons why Direct Express Identity Verification plays a vital role:

1. Fraud Prevention and Security

✔ Stops identity theft by ensuring only the real account holder can access their benefits.

✔ Prevents unauthorized transactions by verifying identities before funds are accessed or transferred.

✔ Mitigates financial fraud risks by detecting suspicious activities and flagging anomalies.

2. Ensuring Secure Transactions

✔ Uses multi-layered authentication methods to validate users before allowing money transfers.

✔ Prevents phishing and hacking attempts by adding security barriers like biometric verification and one-time passwords (OTP).

✔ Enhances trust in the Direct Express card system, making it more reliable for government beneficiaries.

3. Verifying Account Holders

✔ Confirms the identity of new users during the account setup process.

✔ Ensures that only eligible recipients access federal benefit payments.

✔ Reduces errors and cases of mistaken identity in financial transactions.

Direct Express Identity Verification is an essential security measure that protects both government funds and individual users from fraud and cyber threats.

How Does Direct Express Compare with Other Identity Verification Systems?

Many banks, financial institutions, and government agencies implement identity verification systems. However, Direct Express has a unique approach tailored to benefit recipients. Here’s how it compares to other verification systems:

| Feature | Direct Express | Traditional Banks | Private Identity Verification Services |

|---|---|---|---|

| Purpose | Secure federal benefit payments | Secure banking transactions | General identity verification for online platforms |

| Verification Method | Personal details, government-issued ID, OTP, security questions | ID, SSN, biometric login, multi-factor authentication | AI-powered identity matching, document scanning, biometrics |

| Accessibility | Designed for Social Security and VA beneficiaries | Open to all banking customers | Available for businesses and individuals |

| Compliance | Follows KYC, AML, FCRA, and government regulations | Follows banking regulations | May follow GDPR, CCPA, and business compliance laws |

Key Takeaways:

✔ Direct Express Identity Verification is tailored for government benefits, making it highly secure and compliant with federal regulations.

✔ Unlike traditional banks, Direct Express is focused solely on benefit payments, making its security measures more specific to that audience.

✔ Private identity verification services offer broader solutions, but Direct Express is streamlined for benefit recipients with simple, user-friendly authentication steps.

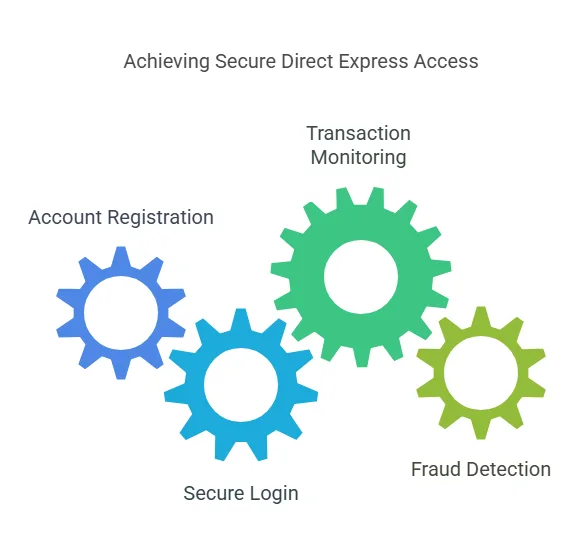

Step-by-Step Process of Direct Express Identity Verification

To protect Social Security, VA benefits, and other government funds, Direct Express employs a comprehensive identity verification process. Below is a step-by-step guide on how it works:

Step 1: Account Registration & Initial Verification

When a user first enrolls in the Direct Express program, they must complete identity verification to activate their account. This includes:

✔ Providing personal details such as full name, date of birth, and Social Security Number (SSN).

✔ Submitting a government-issued ID (e.g., driver’s license, passport) to confirm their identity.

✔ Answering security questions that help verify the user against federal records.

Step 2: Secure Login Authentication

To prevent unauthorized account access, Direct Express requires users to verify their identity each time they log in. This may include:

✔ One-Time Passwords (OTP) sent via SMS or email.

✔ Multi-Factor Authentication (MFA) using personal security questions.

✔ Biometric verification (for mobile app users), such as fingerprint or facial recognition.

Step 3: Transaction Monitoring & Identity Checks

For high-risk transactions, additional verification steps ensure funds are transferred securely. This includes:

✔ Requiring users to confirm their identity before transferring funds to another account.

✔ Detecting suspicious activities and prompting extra verification (e.g., answering security questions).

✔ Flagging unusual spending patterns and requiring additional authentication.

Step 4: Fraud Detection & Dispute Resolution

If fraud is suspected, Direct Express takes swift action to suspend the account and verify the user’s identity. The resolution process involves:

✔ Requesting the user to provide a photo ID or answer additional security questions.

✔ Investigating and comparing identity details with official records.

✔ Restoring access once identity verification is successfully completed.

What Information Is Required for Identity Verification?

To complete identity verification, users must provide the following information:

| Required Information | Purpose |

|---|---|

| Full Name | Confirms the account matches the registered individual |

| Date of Birth | Ensures age verification and fraud prevention |

| Social Security Number (SSN) | Matches federal records for benefit eligibility |

| Government-Issued ID | Verifies the individual’s legal identity |

| Phone Number & Email | Used for OTP verification and secure communication |

| Security Questions | Provides an extra layer of protection |

| Biometric Data (Optional) | Used for mobile authentication and fraud detection |

These identity verification measures protect users from fraud, identity theft, and unauthorized account access.

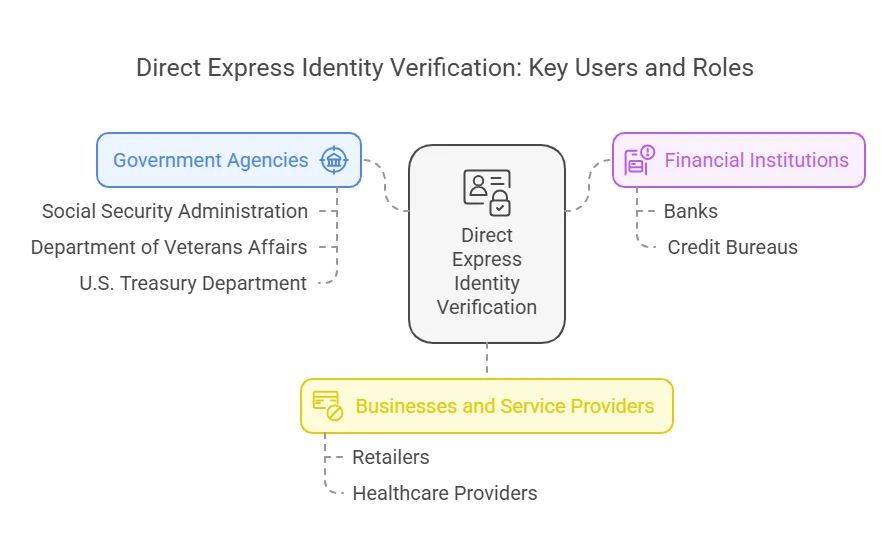

Who Uses Direct Express Identity Verification?

Direct Express Identity Verification is used by various entities to protect government funds and prevent unauthorized access. Here are the main users:

1. Government Agencies

✔ Social Security Administration (SSA) – Ensures Social Security benefits reach the right recipients.

✔ Department of Veterans Affairs (VA) – Protects VA benefit payments from fraudulent claims.

✔ U.S. Treasury Department – Regulates fund disbursement security.

2. Financial Institutions

✔ Banks use Direct Express identity verification to prevent account fraud when linking government benefit accounts to checking or savings accounts.

✔ Credit bureaus may validate identity details for fraud detection and compliance purposes.

3. Businesses and Service Providers

✔ Retailers and merchants use Direct Express verification to prevent unauthorized purchases with government-issued cards.

✔ Healthcare providers may verify patient identities for insurance and medical billing purposes.

By ensuring only verified users access funds and services, Direct Express Identity Verification plays a critical role in securing financial transactions.

Benefits of Using Direct Express for Secure Identity Verification

The Direct Express Identity Verification process provides several key advantages for both users and organizations relying on this system.

1. Enhanced Security Against Fraud

✔ Prevents identity theft by ensuring only the account holder can access funds.

✔ Uses multi-factor authentication (MFA) and biometric security to stop unauthorized access.

✔ Detects suspicious activities in real-time, preventing fraudulent transactions.

2. Quick & Seamless Verification

✔ Most identity verification steps are automated, reducing delays in accessing funds.

✔ Users can complete verification remotely using mobile authentication or email verification.

✔ Government agencies and banks trust Direct Express for fast, secure identity confirmation.

3. Compliance with Federal Regulations

✔ Ensures compliance with KYC (Know Your Customer) and AML (Anti-Money Laundering) laws.

✔ Adheres to FCRA regulations to protect consumer data and prevent misuse.

✔ Meets U.S. Treasury standards for securing government benefit disbursements.

4. Reduces Fraudulent Claims and Unauthorized Payments

✔ Verifies recipient eligibility before releasing government benefits.

✔ Flags and blocks suspicious transactions to protect beneficiaries.

✔ Protects elderly and disabled recipients from scams and fraudsters.

5. Easy Account Recovery & Dispute Resolution

✔ If users forget their credentials or lose access, Direct Express provides fast identity recovery options.

✔ Identity disputes are resolved quickly through secure verification steps.

✔ Users can request additional security protections, such as biometric logins or extra authentication layers.

Precise Hire: Your Trusted Partner in Identity Verification

For businesses and organizations seeking secure identity verification solutions, Precise Hire offers advanced background screening and identity authentication services tailored to meet security compliance standards.

Why Choose Precise Hire?

✔ Comprehensive Identity Verification – We verify government records, biometrics, and financial data for fraud prevention.

✔ Fast & Secure Screening – Our automated verification system ensures quick and accurate results.

✔ FCRA & KYC Compliance – We follow strict legal guidelines to protect consumer data and prevent identity fraud.

✔ Custom Solutions for Businesses & Government Agencies – Whether you’re a financial institution, employer, or service provider, we offer identity solutions designed to meet your needs.

To learn more about our identity verification and background screening services, visit Precise Hire today!

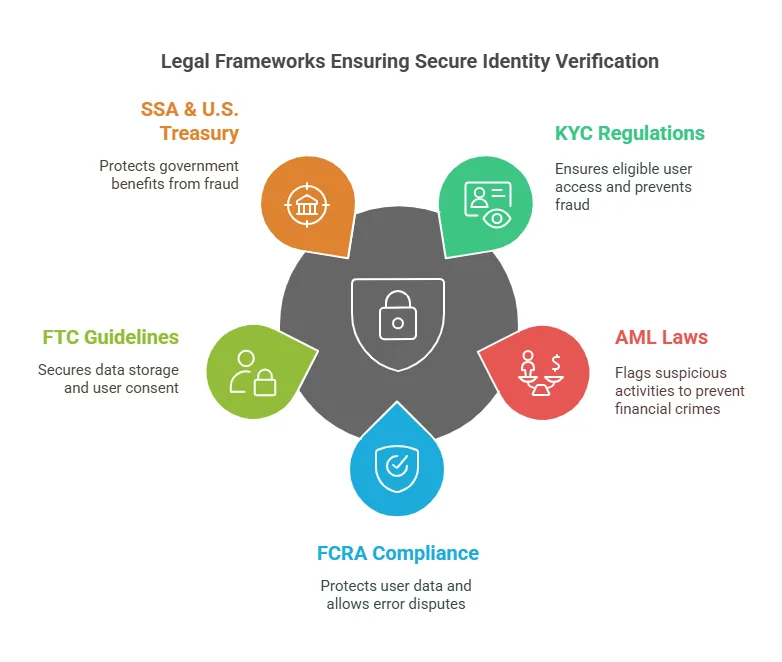

Legal Regulations and Compliance

Identity verification processes must comply with multiple federal laws and guidelines to protect users and prevent fraudulent activities. Below are the key legal frameworks governing Direct Express Identity Verification:

1. Know Your Customer (KYC) Regulations

✔ KYC laws require financial institutions to verify a customer’s identity before allowing transactions.

✔ Ensures that only eligible users access federal benefit payments.

✔ Prevents fraud, money laundering, and the use of accounts for illegal financial activities.

2. Anti-Money Laundering (AML) Laws

✔ The Bank Secrecy Act (BSA) and related AML regulations prevent financial crimes such as fraud and money laundering.

✔ Direct Express uses identity verification to flag suspicious activities and report them to authorities.

✔ Prevents benefit fraud by ensuring that only authorized recipients access funds.

3. Fair Credit Reporting Act (FCRA)

✔ The FCRA regulates how identity and financial information is used in background checks and account verification.

✔ Direct Express identity verification complies with FCRA standards to protect user data.

✔ Users have the right to dispute errors in their identity records and correct inaccuracies.

4. Federal Trade Commission (FTC) Consumer Protection Guidelines

✔ Direct Express follows FTC regulations to protect users from identity theft and data breaches.

✔ Ensures that all identity verification data is stored securely and not shared without user consent.

✔ Allows users to dispute unauthorized transactions and report fraudulent activities.

5. Social Security Administration (SSA) & U.S. Treasury Compliance

✔ The SSA and U.S. Treasury require identity verification to protect government benefits.

✔ Strict security measures prevent fraudulent claims and unauthorized access to benefits.

✔ Ensures that only eligible recipients receive funds, reducing fraud risks in government disbursements.

These legal frameworks ensure that Direct Express Identity Verification is secure, transparent, and fully compliant with financial regulations.

Frequently Asked Questions (FAQs) About Direct Express Identity Verification

Why is identity verification required for Direct Express accounts?

Identity verification ensures that only the rightful account holder can access their government benefits. This prevents fraud, identity theft, and unauthorized transactions, keeping funds secure.

What documents are needed for Direct Express identity verification?

Users typically need to provide:

✔ Full Name and Date of Birth

✔ Social Security Number (SSN)

✔ Government-Issued ID (Driver’s License, Passport, or State ID)

✔ Phone Number & Email for OTP Verification

What should I do if my identity verification fails?

If your Direct Express identity verification fails, follow these steps:

✔ Double-check your information – Ensure that you entered your details correctly.

✔ Update your government records – If your name or SSN does not match, you may need to update your records.

✔ Contact Direct Express Customer Support – You can call 1-888-741-1115 for further assistance.

✔ Provide additional documents – In some cases, Direct Express may request extra proof of identity.

How does Direct Express protect my information during identity verification?

Direct Express uses advanced encryption, multi-factor authentication (MFA), and fraud monitoring systems to protect your identity information. It complies with FCRA, KYC, and AML regulations to ensure user data is handled securely.

Can I access my Direct Express account without completing identity verification?

No. Identity verification is mandatory to access your Direct Express account. If you fail to verify your identity, you cannot activate or use your account to receive benefits.

These FAQs address the most common concerns about Direct Express Identity Verification, helping users navigate the process easily.

Why is identity verification required for Direct Express accounts?

Identity verification ensures that only the rightful account holder can access their government benefits. This prevents fraud, identity theft, and unauthorized transactions, keeping funds secure.

What documents are needed for Direct Express identity verification?

Users typically need to provide:

✔ Full Name and Date of Birth

✔ Social Security Number (SSN)

✔ Government-Issued ID (Driver’s License, Passport, or State ID)

✔ Phone Number & Email for OTP Verification

What should I do if my identity verification fails?

If your Direct Express identity verification fails, follow these steps:

✔ Double-check your information – Ensure that you entered your details correctly.

✔ Update your government records – If your name or SSN does not match, you may need to update your records.

✔ Contact Direct Express Customer Support – You can call 1-888-741-1115 for further assistance.

✔ Provide additional documents – In some cases, Direct Express may request extra proof of identity.

How does Direct Express protect my information during identity verification?

Direct Express uses advanced encryption, multi-factor authentication (MFA), and fraud monitoring systems to protect your identity information. It complies with FCRA, KYC, and AML regulations to ensure user data is handled securely.

Can I access my Direct Express account without completing identity verification?

No. Identity verification is mandatory to access your Direct Express account. If you fail to verify your identity, you cannot activate or use your account to receive benefits.

These FAQs address the most common concerns about Direct Express Identity Verification, helping users navigate the process easily.

Conclusion: The Importance of Secure Identity Verification

Direct Express Identity Verification plays a critical role in protecting government benefits, preventing fraud, and ensuring secure transactions. With rising cyber threats and identity theft cases, robust verification processes help secure user accounts and maintain financial integrity.

Key Takeaways:

✔ Direct Express Identity Verification confirms user identity before accessing government benefit payments.

✔ Multi-layered security measures such as OTP authentication, biometric verification, and fraud detection prevent unauthorized access.

✔ Compliance with KYC, AML, and FCRA laws ensures that user information is protected and handled legally.

✔ Government agencies, financial institutions, and businesses rely on Direct Express verification for secure transactions.

✔ If identity verification fails, users can resolve issues by updating records and contacting Direct Express support.

By following secure verification processes, Direct Express helps millions of government benefit recipients access their funds safely and efficiently.

Partner with Precise Hire for Reliable Identity Verification Services

If you need secure, FCRA-compliant identity verification for your business or organization, Precise Hire offers advanced screening solutions for:

✔ Employers – Verify employee identities before hiring.

✔ Financial Institutions – Prevent fraud in banking transactions.

✔ Government Agencies – Ensure only eligible individuals receive benefits.

🔹 Visit Precise Hire today to learn more about our identity verification and background screening services!