How to Conduct a TransUnion Background Check

What Is a TransUnion Background Check?

A TransUnion background check is a screening report that provides crucial insights into an individual’s credit history, criminal records, employment history, and personal background information. As one of the three major credit bureaus in the United States, TransUnion specializes in offering accurate and reliable consumer data that is widely used for employment, tenant, and financial screening.

Unlike general background check services, TransUnion has direct access to credit reports and financial records, making it a preferred choice for landlords, employers, and financial institutions looking to assess a person’s financial responsibility and trustworthiness.

Why Are TransUnion Background Checks Important?

Background checks serve a vital role in risk management and decision-making across various industries. A TransUnion background check helps businesses, property owners, and lenders make informed choices by verifying an individual’s identity, financial history, and legal standing.

Here’s why TransUnion background checks are essential:

1. Employment Screening

Employers use background checks to:

✅ Verify a candidate’s identity and work history.

✅ Check for criminal records that may impact workplace safety.

✅ Assess financial responsibility, especially for roles involving money management.

✅ Ensure compliance with regulatory requirements (e.g., in the banking and healthcare sectors).

2. Tenant Screening

Landlords and property managers rely on TransUnion reports to:

✅ Review a tenant’s credit score and financial stability.

✅ Check for eviction history and unpaid rent records.

✅ Assess criminal background to maintain a safe living environment.

✅ Verify the applicant’s rental history and payment reliability.

3. Financial Assessments

Banks, lenders, and insurance companies use TransUnion background checks to:

✅ Evaluate creditworthiness before approving loans or credit cards.

✅ Detect fraudulent activity or identity theft.

✅ Assess a person’s financial stability for large transactions, such as mortgages.

How TransUnion Compares to Other Background Check Services

TransUnion is a leading name in background screening, but it is not the only provider. Below is a comparison of TransUnion vs. other background check services:

| Feature | TransUnion | Experian | Equifax | Other Background Check Providers |

|---|---|---|---|---|

| Credit Report Access | ✅ Yes | ✅ Yes | ✅ Yes | ❌ Limited |

| Criminal History Check | ✅ Yes | ❌ No | ❌ No | ✅ Yes |

| Employment Verification | ✅ Yes | ❌ No | ❌ No | ✅ Yes |

| Tenant Screening | ✅ Yes | ❌ No | ❌ No | ✅ Yes |

| FCRA Compliance | ✅ Yes | ✅ Yes | ✅ Yes | ✅ Varies |

| Custom Reports | ✅ Yes | ✅ Yes | ✅ Yes | ✅ Limited |

Why Choose TransUnion Over Competitors?

- Access to Credit Data – Unlike most general background check providers, TransUnion specializes in credit and financial reports, making it more suitable for tenant screening and financial risk assessments.

- FCRA-Compliant Reports – TransUnion ensures that all background checks comply with legal regulations, preventing unauthorized use of consumer data.

- Comprehensive Data Accuracy – TransUnion’s reports pull data from multiple sources, including court records, public databases, and credit bureaus, ensuring up-to-date and reliable results.

- Industry-Specific Screening – Whether it’s for employment, rental applications, or financial decisions, TransUnion tailors reports based on industry needs.

How Does a TransUnion Background Check Work?

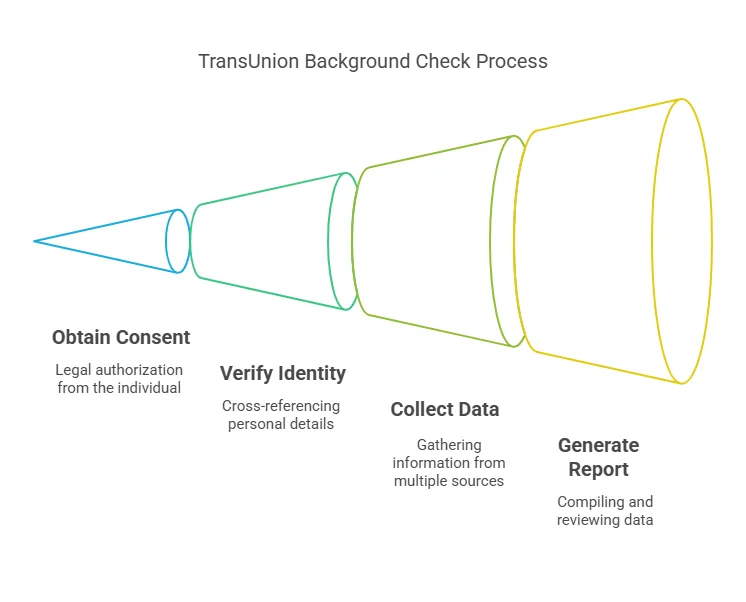

A TransUnion background check follows a structured process to ensure data accuracy, legal compliance, and fast turnaround times. Here’s how the process typically works:

1. Obtaining Authorization & Consent

Before conducting a background check, TransUnion requires written consent from the individual being screened. This is a legal requirement under the Fair Credit Reporting Act (FCRA) and ensures that the applicant is aware of the background check process.

Employers, landlords, and lenders must:

✔ Provide a clear disclosure stating that a background check will be conducted.

✔ Obtain written permission before proceeding with the screening.

✔ Ensure that the information obtained will be used fairly and lawfully.

2. Identity Verification

Once consent is obtained, TransUnion verifies the applicant’s identity by cross-referencing personal details with multiple databases. Key details checked include:

✔ Full Name – Matches legal records and past addresses.

✔ Date of Birth – Ensures accurate record retrieval.

✔ Social Security Number (SSN) – Confirms identity and prevents fraud.

✔ Current & Past Addresses – Tracks residence history.

Verifying identity is crucial for preventing fraud and ensuring accuracy in the background check process.

3. Data Collection from Multiple Sources

After verifying identity, TransUnion collects data from various sources, including:

- Credit Bureaus – Provides credit scores, financial responsibility, and payment history.

- Criminal Databases – Searches federal, state, and county records for felony or misdemeanor convictions.

- Public Records – Includes court filings, bankruptcies, liens, and judgments.

- Employment & Rental History – Confirms work history and past landlord-tenant relationships.

This multi-source approach ensures that the background check is comprehensive and up to date.

4. Report Generation & Review

Once all relevant information is gathered, TransUnion compiles the data into a detailed report. The report is then reviewed by employers, landlords, or financial institutions to make informed hiring, rental, or financial decisions.

Most TransUnion background checks are completed within 24-72 hours, depending on the complexity of the report.

What Information Is Included in a TransUnion Background Check?

TransUnion background checks provide detailed and accurate reports, covering multiple aspects of an individual’s background. Below are the key data points included in the report:

1. Credit History

One of TransUnion’s key strengths is its access to credit reports and financial history. The credit section of the report includes:

✔ Credit score & credit utilization – Determines financial responsibility.

✔ Bankruptcies, liens, and debt collections – Highlights past financial struggles.

✔ Late payments and financial risk factors – Helps assess reliability in financial commitments.

2. Criminal Records

A criminal background check conducted through TransUnion includes:

✔ Felony and misdemeanor convictions – Shows past legal violations.

✔ Pending criminal cases – Identifies ongoing investigations.

✔ Sex offender registry checks – Helps employers and landlords ensure safety.

3. Employment Verification

Employers often use TransUnion background checks to confirm job history and professional credentials. This section includes:

✔ Past employment records – Verifies work experience.

✔ Job titles and duration of employment – Ensures resume accuracy.

✔ Professional license verification – Confirms necessary certifications.

4. Tenant Screening Data

For landlords and property managers, TransUnion provides tenant screening reports, including:

✔ Rental history & eviction records – Identifies potential risks.

✔ Payment consistency – Determines if the applicant pays rent on time.

✔ Landlord complaints or disputes – Assesses tenant behavior.

5. Identity Verification & Fraud Detection

To protect against identity fraud, TransUnion performs additional checks, such as:

✔ Social Security number validation – Confirms identity.

✔ Aliases and past addresses – Detects inconsistencies.

✔ Watchlist and sanction list screenings – Flags potential security concerns.

Who Uses TransUnion Background Checks?

1. Employers

Businesses of all sizes use TransUnion background checks to:

✔ Verify work history and criminal background before hiring.

✔ Check financial stability for positions involving money handling.

✔ Reduce hiring risks and avoid workplace safety issues.

2. Landlords & Property Managers

Rental property owners rely on TransUnion’s tenant screening reports to:

✔ Assess creditworthiness and financial responsibility.

✔ Identify previous eviction records and rental payment history.

✔ Ensure a safe and reliable tenant.

3. Banks & Financial Institutions

Lenders and credit issuers use TransUnion background checks to:

✔ Evaluate loan and credit card applicants for risk assessment.

✔ Identify financial red flags like unpaid debts or bankruptcies.

✔ Prevent identity theft and fraudulent applications.

4. Insurance Companies

Insurance providers use TransUnion data to:

✔ Assess claim history and fraud risk.

✔ Determine policy premiums based on credit and background data.

✔ Identify high-risk applicants before approving coverage.

Benefits of Using TransUnion for Background Screening

1. Legal Compliance & FCRA Regulations

TransUnion ensures that all background checks are fully compliant with the Fair Credit Reporting Act (FCRA), protecting both businesses and consumers from unfair screening practices.

2. Accurate & Reliable Data

Because TransUnion is one of the three major credit bureaus, its reports provide accurate financial history and identity verification.

3. Fast Turnaround Times

Most TransUnion background checks are completed within 24-72 hours, making the process efficient for employers and landlords who need quick decisions.

4. Customizable Reports

Different industries require different data. TransUnion allows businesses to tailor background checks based on specific screening needs.

5. Identity Protection & Fraud Prevention

TransUnion background checks help businesses avoid hiring, renting to, or lending money to fraudulent individuals by verifying identities and detecting inconsistencies.

How Precise Hire Enhances Background Screening with TransUnion

At Precise Hire, we offer industry-leading background screening solutions powered by TransUnion’s trusted data.

Our Services Include:

✔ Employment Background Checks – Verify work history, criminal records, and credit reports.

✔ Tenant Screening Reports – Assess rental applicants’ creditworthiness and eviction history.

✔ Comprehensive Financial Reports – Ensure creditworthiness for financial institutions.

✔ Identity Verification & Fraud Prevention – Reduce risk of fraud and identity theft.

By partnering with Precise Hire, businesses and landlords gain access to fast, accurate, and legally compliant background screening solutions.

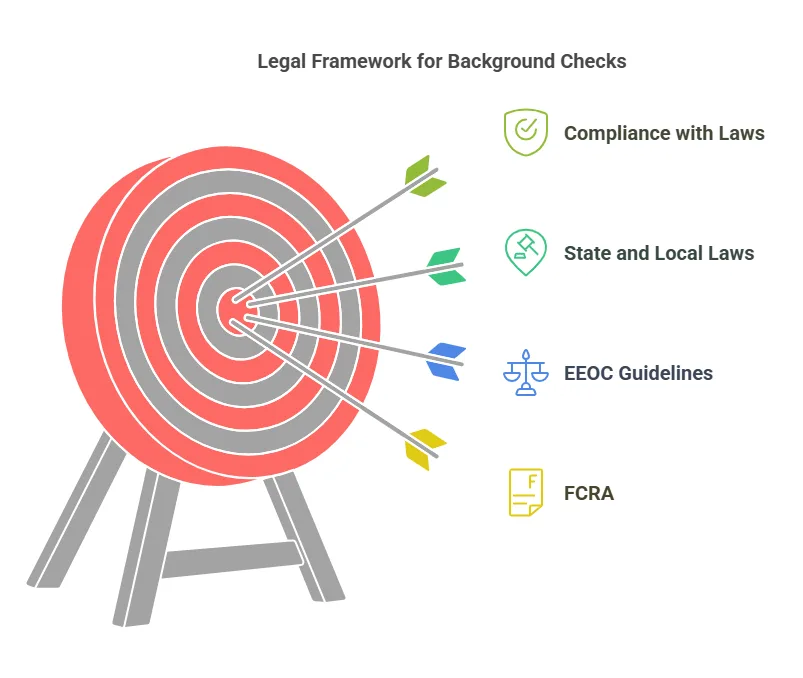

Legal Regulations and Compliance in Background Checks

Background checks, including those conducted through TransUnion, are subject to several laws and regulations to protect consumer rights. Below are the most critical legal frameworks businesses and landlords must follow when conducting background checks.

1. Fair Credit Reporting Act (FCRA)

The Fair Credit Reporting Act (FCRA) is a federal law that regulates how background checks, including credit and criminal history reports, are obtained and used. Key FCRA compliance requirements include:

✔ Written Consent – Employers, landlords, or financial institutions must obtain written permission before conducting a background check.

✔ Pre-Adverse Action Notice – If a negative decision is based on the report, the individual must be informed and given time to dispute inaccuracies.

✔ Access to Reports – Individuals have the right to request a copy of their background report.

✔ Dispute Resolution – Consumers can dispute incorrect or outdated information, and TransUnion is required to investigate within 30 days.

2. Equal Employment Opportunity Commission (EEOC) Guidelines

The EEOC enforces laws that prohibit discrimination during the hiring process. Employers using background checks must ensure they do not:

✔ Discriminate based on race, gender, age, or disability when evaluating background check results.

✔ Use blanket bans on individuals with criminal records without considering job-related factors.

✔ Provide an opportunity for applicants to explain or dispute negative information before making final hiring decisions.

3. State and Local Background Check Laws

Many states and cities have their own regulations regarding background checks, including:

✔ “Ban the Box” Laws – Restrict when employers can inquire about criminal history during hiring.

✔ State-Specific Credit Check Laws – Some states prohibit the use of credit history for hiring decisions unless the job involves financial responsibilities.

✔ Tenant Screening Laws – Some states regulate how landlords can use eviction and credit history to approve rental applications.

Businesses and landlords using TransUnion background checks must ensure they comply with both federal and state laws to avoid legal risks.

Frequently Asked Questions (FAQs) About TransUnion Background Checks

Here are some of the most common questions and concerns regarding TransUnion background checks and employment screening.

How long does a TransUnion background check take?

A standard TransUnion background check typically takes 24-72 hours to process. However, factors such as criminal record searches, employment verification, and state-specific record retrieval can extend the timeline.

What if there is incorrect information in my TransUnion background check?

If an individual discovers inaccurate information in their background report, they can file a dispute with TransUnion. Under the FCRA, TransUnion must investigate and correct any errors within 30 days.

Can an employer deny me a job based on my TransUnion background check?

Yes, an employer can reject a job application based on the results of a TransUnion background check. However, under the FCRA, the employer must:

✔ Provide a Pre-Adverse Action Notice before making a final decision.

✔ Allow the applicant time to dispute incorrect information.

✔ Issue a Final Adverse Action Notice if the decision stands.

What information does a TransUnion tenant screening report include?

A TransUnion tenant screening report includes:

✔ Credit history and credit score

✔ Eviction records

✔ Criminal background check (if permitted by law)

✔ Rental payment history

Landlords use this data to determine whether an applicant is a reliable tenant.

Do TransUnion background checks show all criminal records?

Not always. While TransUnion retrieves criminal records from federal, state, and local databases, some factors can limit results:

✔ Some states restrict reporting older convictions (e.g., records older than 7 years).

✔ Expunged or sealed records will not appear in the report.

✔ Some counties may have delays in updating criminal record databases.

If an applicant believes their report is incomplete, they should verify their records with the appropriate authorities.

How long does a TransUnion background check take?

A standard TransUnion background check typically takes 24-72 hours to process. However, factors such as criminal record searches, employment verification, and state-specific record retrieval can extend the timeline.

What if there is incorrect information in my TransUnion background check?

If an individual discovers inaccurate information in their background report, they can file a dispute with TransUnion. Under the FCRA, TransUnion must investigate and correct any errors within 30 days.

Can an employer deny me a job based on my TransUnion background check?

Yes, an employer can reject a job application based on the results of a TransUnion background check. However, under the FCRA, the employer must:

✔ Provide a Pre-Adverse Action Notice before making a final decision.

✔ Allow the applicant time to dispute incorrect information.

✔ Issue a Final Adverse Action Notice if the decision stands.

What information does a TransUnion tenant screening report include?

A TransUnion tenant screening report includes:

✔ Credit history and credit score

✔ Eviction records

✔ Criminal background check (if permitted by law)

✔ Rental payment history

Landlords use this data to determine whether an applicant is a reliable tenant.

Do TransUnion background checks show all criminal records?

Not always. While TransUnion retrieves criminal records from federal, state, and local databases, some factors can limit results:

✔ Some states restrict reporting older convictions (e.g., records older than 7 years).

✔ Expunged or sealed records will not appear in the report.

✔ Some counties may have delays in updating criminal record databases.

If an applicant believes their report is incomplete, they should verify their records with the appropriate authorities.

Conclusion: Why TransUnion Background Checks Matter

A TransUnion background check is a powerful tool that helps employers, landlords, and financial institutions make informed decisions while ensuring compliance with legal regulations. Key takeaways include:

✔ Comprehensive Screening – TransUnion provides detailed reports, including credit history, employment verification, and criminal records.

✔ Legal Compliance – Employers and landlords must follow FCRA, EEOC, and state regulations when using background checks.

✔ Fast & Reliable Reports – Most background checks are completed within 24-72 hours, ensuring quick decision-making.

✔ Consumer Rights Protection – Individuals have the right to review, dispute, and correct inaccurate background check information.

For businesses and landlords seeking accurate and compliant background screening solutions, partnering with a trusted service provider like Precise Hire ensures a smooth and legally sound process.

Partner with Precise Hire for Reliable Background Checks

At Precise Hire, we specialize in comprehensive background screening solutions powered by TransUnion’s trusted data. Our services help businesses, landlords, and financial institutions make secure, informed decisions while maintaining full compliance with FCRA and EEOC regulations.

Our Key Services:

✔ Employment Background Checks – Verify work history, criminal records, and professional licenses.

✔ Tenant Screening Reports – Assess rental applicants’ creditworthiness and eviction history.

✔ Financial & Credit Reports – Ensure credit reliability for financial institutions and lenders.

✔ Identity Verification & Fraud Prevention – Reduce risks of identity theft and fraud.

By partnering with Precise Hire, you gain access to fast, accurate, and legally compliant background screening solutions designed to meet your industry’s needs.