Steps for Performing a Tenant Background Check

Introduction & Importance of Tenant Background Checks

A tenant background check is a comprehensive screening process used by landlords and property managers to evaluate potential renters before approving their applications. This process helps determine whether a prospective tenant is reliable, financially stable, and responsible enough to rent a property.

A standard tenant background check typically includes:

- Criminal history

- Credit report and score

- Rental history

- Employment and income verification

- Eviction records

By assessing these factors, landlords can make informed decisions and reduce the risk of renting to individuals who may default on rent, damage property, or pose safety concerns.

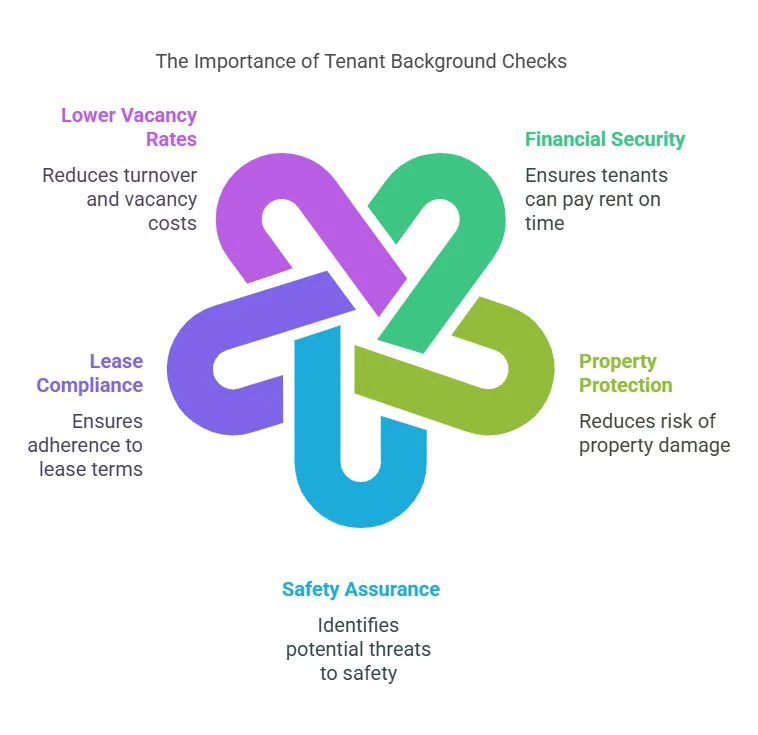

Why Landlords and Property Managers Conduct Background Checks

Property owners and managers conduct tenant background checks to safeguard their investments and ensure a stable rental environment. Without a proper screening process, landlords may face issues such as unpaid rent, lease violations, or disruptive tenants.

The key reasons for performing a tenant background check include:

- Financial Security – Ensures the tenant has a stable income and good credit history to pay rent on time.

- Property Protection – Reduces the risk of damage caused by irresponsible tenants.

- Safety Assurance – Helps identify criminal backgrounds that could pose a threat to other tenants or neighbors.

- Lease Compliance – Ensures tenants adhere to lease terms, reducing legal disputes.

- Lower Vacancy Rates – Well-screened tenants tend to stay longer, reducing turnover and vacancy costs.

Benefits of a Thorough Tenant Screening Process

A well-executed tenant background check offers numerous advantages, including:

✅ Minimized Financial Risk – Landlords can avoid tenants with a history of unpaid rent or evictions.

✅ Improved Tenant Quality – Ensures responsible and law-abiding individuals occupy the property.

✅ Reduced Legal Issues – Helps landlords comply with housing laws and avoid lawsuits.

✅ Stronger Landlord-Tenant Relationships – Screening helps match tenants with the right rental property, leading to fewer conflicts.

✅ Enhanced Community Safety – Prevents individuals with serious criminal backgrounds from moving into rental properties.

By investing time in a tenant background check, landlords and property managers can make informed rental decisions, create a safer environment, and protect their rental business from potential losses.

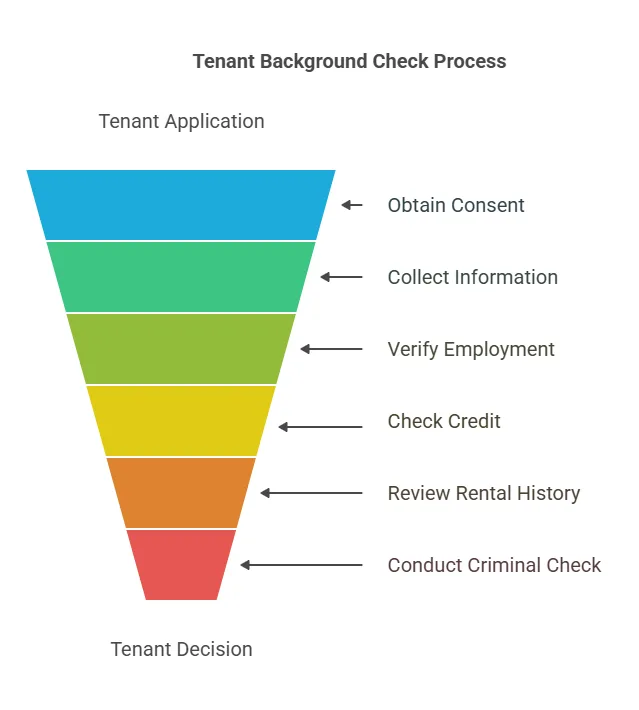

Step-by-Step Guide to Conducting a Tenant Background Check

A proper tenant background check involves multiple steps, each designed to assess different aspects of an applicant’s reliability. Let’s go through each stage in detail:

Step 1: Obtain a Signed Consent from the Tenant

Before conducting a tenant background check, it is legally required to obtain written consent from the applicant. Under the Fair Credit Reporting Act (FCRA), landlords must inform tenants that their background and credit history will be reviewed. Without consent, it is illegal to access an applicant’s financial and personal records.

To streamline this process:

- Include a background check authorization form in the rental application.

- Ensure the applicant understands what information will be reviewed.

- Keep a signed copy for your records in case of future disputes.

Step 2: Collect Necessary Tenant Information

Once consent is obtained, landlords should gather detailed information from the applicant. The more comprehensive the data, the more effective the screening process will be. Required information includes:

✅ Full name (first, middle, last)

✅ Date of birth (for identity verification)

✅ Social Security Number (SSN) (for credit and background checks)

✅ Current and previous addresses (typically for the last 3–5 years)

✅ Employment details and proof of income

✅ Landlord references (contact details of previous landlords)

✅ Personal references (optional but useful for additional insights)

This information provides a foundation for conducting credit, rental, and employment verifications.

Step 3: Verify Employment and Income Stability

Ensuring that a potential tenant has stable employment and sufficient income is crucial. A financially stable tenant is more likely to pay rent on time and fulfill their lease obligations.

How to Verify Employment:

- Request recent pay stubs (last three months) to confirm income consistency.

- Contact the employer to verify job stability, position, and salary.

- Request an employment letter as additional proof.

Income Requirements:

Most landlords require tenants to have a gross monthly income that is at least 2.5 to 3 times the monthly rent. For example, if the rent is $1,500 per month, the tenant should earn at least $3,750 per month to qualify.

For self-employed individuals or freelancers, landlords should request:

- Bank statements (last six months) to assess income consistency.

- Tax returns (typically last two years).

Step 4: Conduct a Credit Report Check

A credit report provides a detailed history of a tenant’s financial responsibility, including:

- Credit score (typically ranging from 300–850).

- Payment history (late or missed payments).

- Debt-to-income ratio (amount of debt vs. income).

- Bankruptcies or foreclosures.

What Credit Score Should a Tenant Have?

- 700+ = Excellent (low-risk tenant, strong payment history).

- 650–699 = Good (minor financial issues, still reliable).

- 600–649 = Fair (potential risk, may require higher deposit).

- Below 600 = High Risk (history of missed payments, evictions, or heavy debt).

Red Flags to Watch For:

❌ Frequent late payments

❌ Excessive debt (high credit utilization)

❌ Recent bankruptcies

❌ Multiple accounts in collections

If an applicant has a low credit score but strong rental history and income, landlords may still consider approval with conditions like a higher security deposit or a co-signer.

Step 5: Review Rental History and Contact Previous Landlords

A tenant’s rental history can reveal how they have treated past rental properties and whether they paid rent on time. This step helps prevent renting to tenants with a history of evictions, lease violations, or property damage.

Key Questions to Ask Previous Landlords:

- Did the tenant pay rent on time?

- Were there any complaints from neighbors?

- Did the tenant cause any property damage?

- Did they fulfill the lease term?

- Would you rent to this tenant again?

🚨 Red Flags: If a past landlord hesitates or refuses to answer, it may indicate past issues.

Step 6: Conduct a Criminal Background Check

A criminal background check helps ensure the safety of other tenants and the community. While not all criminal records should automatically disqualify a tenant, landlords should evaluate offenses based on:

- Severity of the crime (violent crimes, drug offenses, property damage).

- Time since the offense (a minor crime from 10 years ago may be less relevant).

- Repeat offenses (a pattern of criminal behavior is a red flag).

🚨 Legal Considerations: Some states and cities have laws restricting the use of criminal records in tenant screenings. Always comply with Fair Housing Laws to avoid discrimination claims.

Step 7: Check Eviction Records

Evictions are strong indicators of financial instability or problematic tenant behavior. A tenant background check should include an eviction history report that covers:

- Past evictions within the last 7 years.

- Reasons for eviction (non-payment, lease violations, property damage).

- Legal actions taken by previous landlords.

🚨 Frequent evictions or recent evictions (within the last two years) are a major red flag.

Step 8: Conduct an Interview with the Tenant

A short interview helps assess the tenant’s communication skills and reliability.

Suggested Questions:

- Why are you moving?

- Can you provide personal references?

- Have you ever been late on rent?

- Do you have any pets?

- How many people will be living in the rental unit?

This conversation provides valuable insights into a tenant’s honesty and responsibility.

Step 9: Make an Informed Decision

Once all information is reviewed, landlords should:

✅ Approve the tenant if they meet all criteria.

❌ Deny the application if there are major red flags (evictions, low income, severe criminal history).

📌 Issue an Adverse Action Notice if rejecting due to credit history (required by the FCRA).

Key Components of a Tenant Background Check

A complete tenant background check should include the following:

| Component | What It Reveals | Why It’s Important |

|---|---|---|

| Credit Score | Tenant’s financial responsibility | Ensures rent will be paid on time |

| Criminal History | Past criminal convictions | Helps maintain safety in the rental unit |

| Eviction Records | History of prior evictions | Identifies potential lease risks |

| Rental History | Lease violations, damages, complaints | Predicts tenant behavior |

| Employment & Income | Job stability and ability to afford rent | Confirms financial capability |

How Precise Hire Can Help with Tenant Background Checks

At Precise Hire, we offer comprehensive tenant screening services that help landlords make informed rental decisions. Our services include:

✅ Full credit report analysis

✅ Criminal background screenings

✅ Eviction history reports

✅ Employment and income verification

✅ Rental history checks

By using Precise Hire, landlords can streamline the tenant background check process, minimize risks, and select high-quality tenants with confidence.

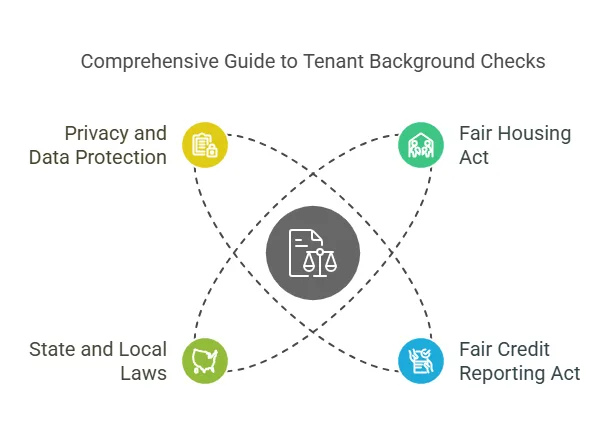

Legal Considerations for Conducting a Tenant Background Check

Landlords must adhere to specific laws when screening tenants. Understanding these legal requirements helps avoid discrimination claims and ensures fair treatment of all applicants.

1. Fair Housing Act (FHA) Compliance

The Fair Housing Act (FHA) prohibits discrimination based on:

- Race or color

- Religion

- Sex (including gender identity and sexual orientation)

- National origin

- Disability

- Familial status (such as having children)

✅ Best Practices:

- Use consistent screening criteria for all applicants.

- Avoid asking discriminatory questions.

- Document all screening decisions to prove fairness.

2. Fair Credit Reporting Act (FCRA) Requirements

The FCRA governs how landlords use consumer credit reports in tenant screenings.

✅ FCRA Requirements:

- Obtain written consent from the applicant before running a credit check.

- Provide an Adverse Action Notice if rejecting an applicant due to their credit report.

- Use information fairly and avoid discrimination.

3. State and Local Tenant Screening Laws

Some states and cities have additional laws regarding tenant background checks, including:

- Limits on security deposits

- Restrictions on criminal record screenings

- Eviction record lookback periods

🔍 Example:

- In California, landlords can only look at eviction records from the past seven years.

- In New York, it is illegal to reject a tenant based solely on criminal history unless it directly affects safety.

💡 Tip: Always check local landlord-tenant laws to ensure compliance.

4. Privacy and Data Protection Laws

Landlords must protect applicants’ personal and financial information. Do not share or misuse tenant data. Secure all documents and destroy them properly when no longer needed.

Frequently Asked Questions (FAQs) About Tenant Background Checks

Can a landlord deny a tenant based on bad credit?

Yes, landlords can legally deny a tenant if their credit report shows a history of missed payments, high debt, or financial instability. However, landlords must provide an Adverse Action Notice explaining the reason for denial.

How long does a tenant background check take?

A typical tenant background check takes 24 to 72 hours, depending on the screening company and the number of records being verified. Employment and landlord reference checks may take longer if verification is delayed.

What is the minimum credit score for renting an apartment?

There is no universal minimum credit score, but most landlords look for a score of:

- 700+ (Excellent) – Ideal tenant, very low risk.

- 650–699 (Good) – Reliable, but may require additional verification.

- 600–649 (Fair) – Higher risk, may need a co-signer or larger deposit.

- Below 600 (Poor) – High-risk tenant; many landlords may reject the application.

Can a landlord check criminal history in all states?

It depends on state and local laws. Some areas restrict how criminal records are used in tenant screening. Landlords should check local regulations before considering criminal background information.

What should landlords do if a tenant has an eviction on record?

Landlords should:

- Review the details of the eviction (was it for non-payment, property damage, or lease violations?).

- Consider how recent the eviction was (an eviction from 10 years ago may not be relevant).

- Evaluate the tenant’s current financial stability (if their income and credit have improved, they may now be a reliable renter).

Can a landlord deny a tenant based on bad credit?

Yes, landlords can legally deny a tenant if their credit report shows a history of missed payments, high debt, or financial instability. However, landlords must provide an Adverse Action Notice explaining the reason for denial.

How long does a tenant background check take?

A typical tenant background check takes 24 to 72 hours, depending on the screening company and the number of records being verified. Employment and landlord reference checks may take longer if verification is delayed.

What is the minimum credit score for renting an apartment?

There is no universal minimum credit score, but most landlords look for a score of:

- 700+ (Excellent) – Ideal tenant, very low risk.

- 650–699 (Good) – Reliable, but may require additional verification.

- 600–649 (Fair) – Higher risk, may need a co-signer or larger deposit.

- Below 600 (Poor) – High-risk tenant; many landlords may reject the application.

Can a landlord check criminal history in all states?

It depends on state and local laws. Some areas restrict how criminal records are used in tenant screening. Landlords should check local regulations before considering criminal background information.

What should landlords do if a tenant has an eviction on record?

Landlords should:

- Review the details of the eviction (was it for non-payment, property damage, or lease violations?).

- Consider how recent the eviction was (an eviction from 10 years ago may not be relevant).

- Evaluate the tenant’s current financial stability (if their income and credit have improved, they may now be a reliable renter).

Conclusion: Why a Tenant Background Check is Essential

Conducting a tenant background check is one of the most critical steps in managing a rental property. A thorough screening process helps landlords:

✅ Reduce financial risk by selecting tenants with a history of paying rent on time.

✅ Avoid property damage by ensuring responsible renters occupy the unit.

✅ Maintain a safe community by screening for criminal backgrounds.

✅ Ensure lease compliance and prevent future disputes.

At Precise Hire, we make tenant screening easy and reliable by providing comprehensive background checks, including:

- Credit and financial reports

- Eviction history verification

- Criminal background checks

- Employment and income validation

- Rental history reports

By using a professional screening service like Precise Hire, landlords can confidently select high-quality tenants, minimize risks, and protect their rental investments.

🚀 Start your tenant background check today with Precise Hire and find the right renters with confidence!