Benefits of Using FCRA Background Checks for Hiring

Introduction to FCRA Background Checks

In today’s world, background checks have become a standard part of many hiring processes, rental agreements, and even financial assessments. One of the most important types of background checks is the FCRA background check. This type of screening is governed by the Fair Credit Reporting Act (FCRA), a law designed to ensure fairness, privacy, and accuracy when it comes to the use of background information.

This article will provide a comprehensive overview of FCRA background checks, explaining their significance, how they work, and their role in ensuring compliance with federal law. We will also cover common scenarios where FCRA background checks are used and highlight key elements of the FCRA that protect individuals’ rights.

What is an FCRA Background Check?

An FCRA background check refers to the process of collecting and reviewing a person’s background information from a consumer reporting agency (CRA) for various purposes, such as employment, housing, or financial services. These checks are regulated by the Fair Credit Reporting Act (FCRA), a law that provides guidelines for how background information can be collected, used, and shared.

In the employment context, an FCRA background check is often used to assess an applicant’s criminal history, credit history, employment history, and other relevant information. The goal is to ensure that the hiring process is fair, transparent, and based on accurate data.

The Fair Credit Reporting Act (FCRA) and Its Role in Regulating Background Checks

The Fair Credit Reporting Act (FCRA), enacted in 1970, is a federal law that governs the collection, use, and dissemination of consumer information, including background checks. The law ensures that consumers are treated fairly and that the information gathered about them is accurate, up-to-date, and used appropriately.

Key FCRA Provisions Impacting Background Checks:

- Disclosure and Consent: Before conducting an FCRA background check, the entity requesting the check (such as an employer or landlord) must obtain written consent from the individual being screened. The individual must be informed about the nature and scope of the background check.

- Accuracy of Information: The FCRA mandates that consumer reporting agencies (CRAs) maintain accurate and up-to-date information. If any errors are found on a background check report, the consumer has the right to dispute them.

- Use of Information: The FCRA prohibits employers and other entities from using certain types of information, such as arrests not leading to convictions, to make decisions that negatively impact an individual’s opportunities without providing the individual a chance to explain or correct errors.

- Notification of Negative Actions: If an FCRA background check results in a negative decision—such as a job rejection or housing denial—the individual must be notified and provided with a copy of the report used in the decision-making process.

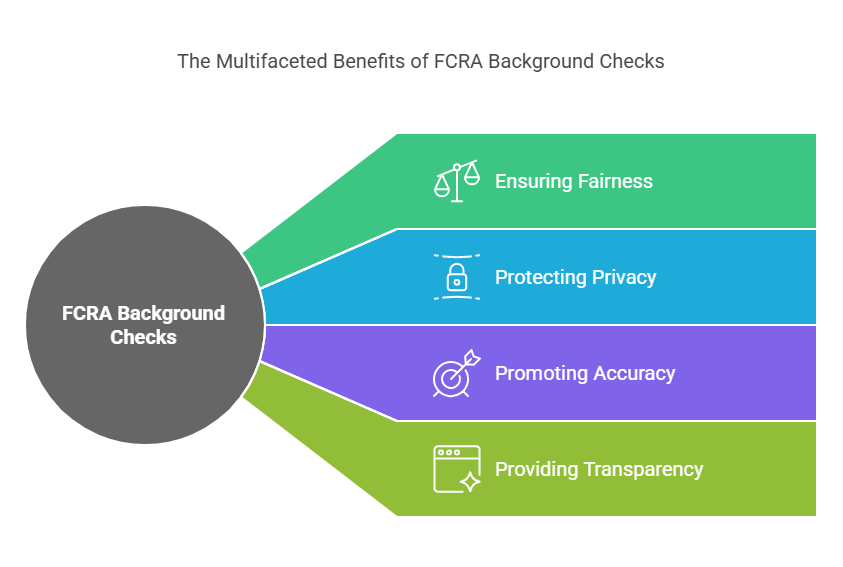

Why FCRA Background Checks are Important

FCRA background checks are critical for several reasons, particularly in ensuring that individuals’ rights are protected and that organizations make informed decisions based on accurate, up-to-date information. Here are a few key benefits:

- Ensuring Fairness: The FCRA ensures that background checks are conducted fairly and that individuals are notified of any decisions made based on their background information. It also prevents discrimination based on irrelevant or outdated data.

- Protecting Privacy: The FCRA limits how background information is collected, shared, and used. Individuals’ privacy is safeguarded by ensuring that only necessary and relevant information is gathered.

- Promoting Accuracy: By requiring that background check reports are accurate, the FCRA helps prevent harmful errors that could prevent someone from securing employment, housing, or credit.

- Providing Transparency: The FCRA mandates that consumers have access to their background information and are notified when it is used to make a decision about them.

Core Components of the FCRA and Its Application in Background Checks

To better understand the FCRA’s impact on background checks, let’s summarize the key components of the law and how they apply to the process:

| FCRA Component | Explanation |

|---|---|

| Disclosure and Consent | Employers must obtain written consent before conducting a background check. |

| Accurate Information | Consumer reporting agencies must maintain accurate, up-to-date information. |

| Adverse Action Notice | If an adverse decision is made based on a background check, the individual must be notified. |

| Dispute Resolution | Individuals have the right to dispute any inaccuracies found on their background check report. |

| Limitations on Use of Arrest Records | Arrest records without convictions cannot be used against an individual in most cases. |

| Privacy and Confidentiality | Background checks must be kept confidential, and the information shared must be relevant and necessary. |

These provisions protect individuals from unfair treatment and ensure that background checks are conducted in a transparent, responsible manner.

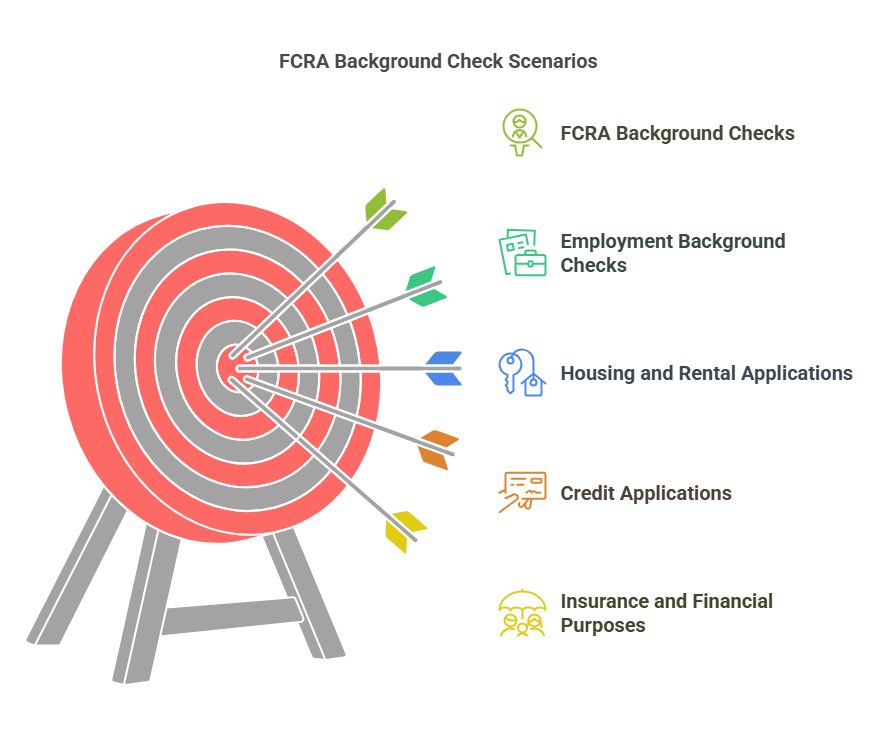

When is an FCRA Background Check Required?

FCRA background checks are commonly required in several scenarios, including:

1. Employment Background Checks

One of the most common uses of FCRA background checks is during the hiring process. Employers use these checks to verify an applicant’s criminal history, credit report, and employment history. This helps employers make informed decisions about whether a candidate is suitable for the position and if they are likely to be a good fit for the company.

In addition, some employers may use background checks for ongoing employee screening, especially for positions that involve sensitive information or responsibilities, such as in the healthcare or financial sectors.

2. Housing and Rental Applications

Landlords and property managers also use FCRA background checks to screen potential tenants. This allows them to verify the applicant’s rental history, criminal record, and credit report to assess the likelihood that they will pay rent on time and respect the property.

3. Credit Applications

When you apply for a credit card, mortgage, or loan, financial institutions conduct FCRA background checks to evaluate your creditworthiness. Your credit history, which includes past loans, credit card usage, and payment history, will be reviewed to determine your ability to repay debts.

4. Insurance and Other Financial Purposes

Some insurance companies may conduct FCRA background checks to assess risk and determine insurance premiums. For example, auto insurance providers may review your driving record, while life insurance companies may look at your health history.

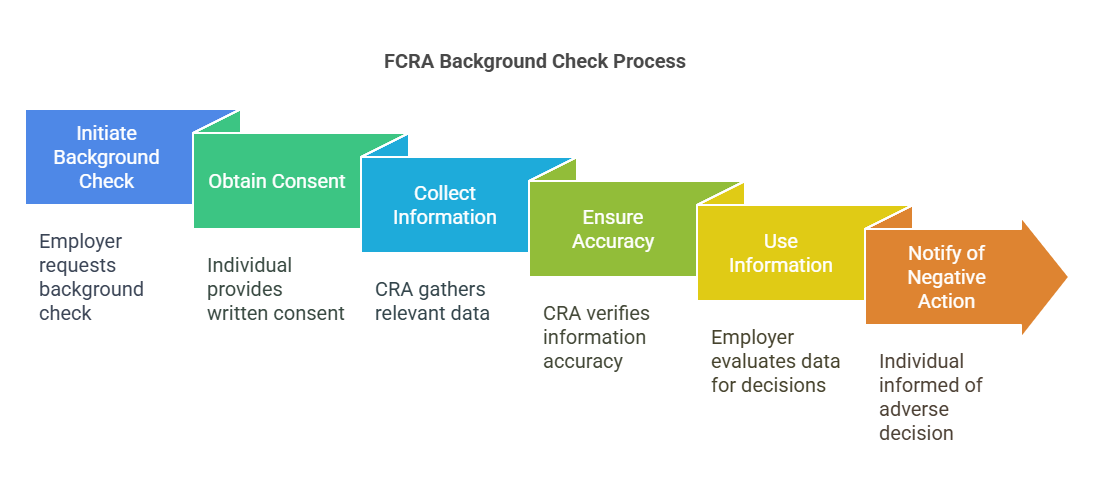

How FCRA Background Checks Work

When an organization conducts an FCRA background check, it is a systematic process that involves several stages to ensure compliance with the Fair Credit Reporting Act. Below is an outline of how this process typically works:

1. Obtaining Consent

Before initiating any background check, the organization (employer, landlord, or financial institution) must obtain explicit written consent from the individual being screened. This consent must be informed, meaning the individual understands what information will be checked and how it will be used. For employment purposes, this typically involves filling out a consent form that details the scope of the background check, including any criminal, credit, or employment history checks.

- Important Note: If the individual does not provide consent, the background check cannot proceed, and the process of making decisions based on the report will not be allowed under the FCRA.

2. Gathering Information from Consumer Reporting Agencies (CRAs)

Once consent is obtained, the organization will request a background check from a consumer reporting agency (CRA). These agencies are specialized companies that collect and aggregate information from various sources, including public records, credit bureaus, and criminal databases.

The CRA will then compile the necessary information and generate a report that will be shared with the requesting entity. It’s essential that the CRA is FCRA-compliant, meaning it follows strict guidelines on accuracy, data handling, and security.

3. Reviewing the Report

The background check report typically includes various components, such as:

- Criminal history (including arrests, charges, convictions)

- Credit report (if relevant to the position, e.g., for finance-related jobs)

- Employment history (to verify previous positions and employment dates)

- Education verification (confirming academic credentials)

- Address history (may also be included to help verify identity)

The information collected is then reviewed by the requesting party (typically an employer or a landlord) to make decisions regarding hiring, leasing, or providing financial services.

4. Adverse Action Notification

If the background check results in an adverse decision—such as a job denial, housing rejection, or credit refusal—the FCRA requires that the individual be notified. The notification must include the following:

- A copy of the background check report that led to the decision.

- A statement of the individual’s right to dispute any inaccurate information in the report.

- Contact information for the CRA that provided the report.

This allows the individual to review the information and dispute any inaccuracies, ensuring the process is fair and transparent.

5. Disputing Errors

If an individual believes there is incorrect or outdated information on their report, they can dispute the findings directly with the CRA. The CRA is legally required to investigate the dispute within 30 days and correct any inaccuracies. If the information is verified as incorrect, it must be removed or corrected.

Key Information Included in an FCRA Background Check

An FCRA background check often includes several important pieces of information, all of which are necessary for making informed decisions. Here’s a detailed breakdown of what you can expect to find in an FCRA-compliant background check:

| Component | What it Covers |

|---|---|

| Criminal Records | Arrests, convictions, charges, and court rulings from local, state, or federal sources. |

| Credit History | Credit scores, outstanding debts, bankruptcies, and payment history. |

| Employment History | Verification of previous employment, including dates of employment and job titles. |

| Education Verification | Confirmation of academic degrees and certifications, including schools attended and graduation dates. |

| Public Records | Civil lawsuits, judgments, and bankruptcies. |

| Driving Records | Information about traffic violations, accidents, and DUI charges (for relevant positions). |

| Social Security Number (SSN) Trace | Ensures the person’s SSN matches their identity and addresses associated with it. |

Best Practices for Employers and Individuals in FCRA Background Checks

To ensure that FCRA background checks are conducted properly and in compliance with the law, here are best practices for both employers and individuals undergoing background checks.

Best Practices for Employers

- Obtain Explicit Consent: Always get written consent from candidates or applicants before conducting a background check. Ensure they understand what information will be reviewed and how it will be used.

- Use a Reliable, FCRA-Compliant Provider: Partner with a trusted third-party provider, like Precise Hire, that ensures the background checks are accurate and compliant with FCRA regulations. This can help minimize errors and streamline the process.

- Avoid Discriminatory Practices: Make sure your policies align with Equal Employment Opportunity (EEOC) guidelines and that background checks do not unfairly discriminate against candidates based on race, ethnicity, gender, or disability status.

- Notify Candidates of Adverse Decisions: If the background check results in an adverse decision, provide the candidate with a copy of the report and the opportunity to dispute any inaccuracies.

- Maintain Confidentiality: Keep all background check information confidential and share it only with relevant parties who need to make informed decisions.

- Stay Updated on Compliance: Regularly review your background check policies to ensure they comply with FCRA regulations, state laws, and other federal guidelines, which may evolve over time.

Best Practices for Individuals

- Give Consent When Requested: If you’re asked to undergo a background check, provide written consent to ensure the process can proceed smoothly.

- Understand What Will Be Checked: Know what components will be included in the background check, such as criminal history or credit report, and be prepared to address any issues that may arise.

- Review Your Report: If you receive a copy of your background check, review it carefully to ensure all the information is accurate. If there are discrepancies, dispute them promptly with the CRA.

- Be Transparent: If you have any past issues, such as criminal convictions or credit problems, be transparent with potential employers or landlords about your history. It’s better to proactively address concerns than to be caught off guard later in the process.

- Know Your Rights: Familiarize yourself with the rights you have under the FCRA, such as the right to dispute errors and the right to be notified of any adverse actions based on your background check.

How Precise Hire Helps with FCRA-Compliant Background Checks

As an experienced provider of background screening services, Precise Hire offers employers a comprehensive solution for conducting FCRA background checks that are accurate, compliant, and efficient. Our services ensure that all background checks are carried out in accordance with federal and state laws, including obtaining proper consent, ensuring data accuracy, and providing adverse action notifications when necessary.

We help employers streamline their hiring process by providing detailed background reports on candidates while maintaining compliance with FCRA regulations. Our team stays up-to-date with the latest compliance requirements to ensure that your background screening is always legally sound.

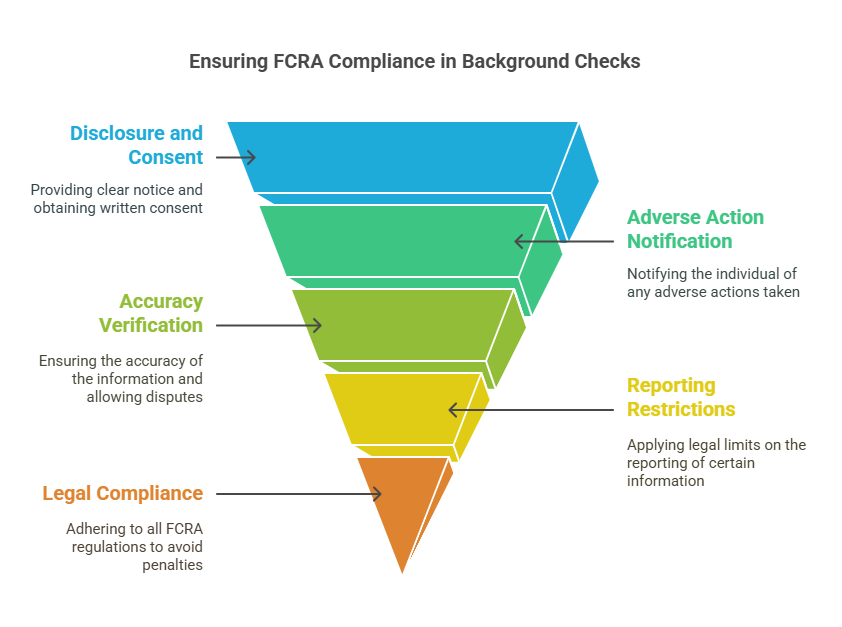

Legal Aspects of FCRA Background Checks

The Fair Credit Reporting Act (FCRA) is a federal law that regulates how background checks are conducted, ensuring they are fair, accurate, and used responsibly. Below, we’ll delve into the key legal aspects that employers, landlords, and other entities must consider when conducting FCRA-compliant background checks.

1. Disclosure and Consent Requirements

One of the fundamental legal aspects of the FCRA is the requirement that individuals must be informed and give consent before any background check can be conducted. This consent must be explicit and informed. The FCRA mandates that:

- Disclosure: Before running a background check, the requesting entity (e.g., an employer) must provide a clear and conspicuous notice to the individual that a background check will be conducted.

- Written Consent: The individual must provide written consent to the background check. This cannot be a part of the employment application form but must be a standalone document.

If these steps are not followed, the background check may not be legally valid, and the employer could face legal consequences.

2. Adverse Action Notification

If an adverse action is taken based on the results of an FCRA background check (e.g., a job offer is revoked, housing is denied, or credit is refused), the FCRA mandates that the individual be notified. The notification must include the following:

- A copy of the background check report that led to the decision.

- The name and contact information of the CRA that provided the report.

- The individual’s right to dispute inaccurate information in the report and the process for doing so.

Employers or entities must wait a reasonable amount of time after notifying the individual before taking any final adverse action. This waiting period is typically a minimum of five business days.

3. Accuracy and Dispute Resolution

The FCRA requires that the information included in background checks must be accurate, complete, and up to date. Individuals have the right to dispute any inaccuracies in their report with the CRA. The CRA must then investigate the dispute and correct any errors within 30 days.

If an individual finds incorrect information in their background check, they can contact the CRA directly to initiate the dispute process. If the CRA fails to investigate or correct the error, the individual can pursue further legal action.

4. Restrictions on Reporting Certain Information

Under the FCRA, there are restrictions on reporting certain types of information. For example:

- Criminal Records: Convictions older than seven years generally cannot be reported in a background check, although there are some exceptions for certain industries (e.g., financial services).

- Bankruptcies: Bankruptcies can only be reported for up to 10 years.

- Credit Reports: Negative credit information generally cannot be reported after seven years.

These time limits are designed to protect individuals from being penalized for outdated or irrelevant information that no longer accurately reflects their current circumstances.

5. Legal Consequences of Non-Compliance

Employers, landlords, and other entities that fail to comply with FCRA regulations can face significant legal consequences, including:

- Lawsuits: Individuals can sue for damages resulting from violations of their rights under the FCRA.

- Fines: The Federal Trade Commission (FTC) or state authorities can impose fines for non-compliance.

- Reputational Damage: Failure to adhere to the FCRA can damage an organization’s reputation and trustworthiness.

Organizations that do not follow the proper procedures when conducting background checks can face punitive damages in addition to statutory penalties, making compliance a priority for all involved parties.

FAQs About FCRA Background Checks

Let’s address some of the most frequently asked questions regarding FCRA background checks:

What information can be included in an FCRA background check?

An FCRA background check can include various types of information, depending on the purpose of the check. Typically, it includes:

- Criminal records (arrests, charges, convictions)

- Credit history (credit score, bankruptcies, payment history)

- Employment history (previous jobs, employment dates)

- Education verification (degrees, certifications)

- Public records (lawsuits, judgments)

The specific components will depend on the organization’s needs and the individual’s consent.

How long does an FCRA background check take to process?

The length of time it takes to process an FCRA background check can vary depending on the complexity of the check and the sources being verified. On average, a background check can take anywhere from 1 to 5 business days, although checks involving criminal records or international verifications may take longer.

Can an employer deny a job offer based on an FCRA background check?

Yes, an employer can deny a job offer based on the findings of an FCRA background check, but they must follow the correct procedure. This includes providing the candidate with a copy of the report, informing them of their right to dispute any inaccuracies, and allowing a waiting period before taking any final action.

How do I dispute an error on my FCRA background check report?

If you find an error in your FCRA background check, you can dispute it with the CRA that provided the report. The CRA is required to investigate the dispute within 30 days. They must either verify the information as correct or remove/rectify any inaccuracies. If the issue is not resolved to your satisfaction, you can contact the company that ordered the report or pursue further legal action.

Are FCRA background checks different from other types of background checks?

Yes, FCRA background checks are specifically governed by the Fair Credit Reporting Act, which imposes strict requirements on the accuracy, disclosure, and consent process. Non-FCRA background checks, such as informal checks or those conducted by private individuals, do not have the same legal requirements for consent, notification, or dispute resolution.

What information can be included in an FCRA background check?

An FCRA background check can include various types of information, depending on the purpose of the check. Typically, it includes:

- Criminal records (arrests, charges, convictions)

- Credit history (credit score, bankruptcies, payment history)

- Employment history (previous jobs, employment dates)

- Education verification (degrees, certifications)

- Public records (lawsuits, judgments)

The specific components will depend on the organization’s needs and the individual’s consent.

How long does an FCRA background check take to process?

The length of time it takes to process an FCRA background check can vary depending on the complexity of the check and the sources being verified. On average, a background check can take anywhere from 1 to 5 business days, although checks involving criminal records or international verifications may take longer.

Can an employer deny a job offer based on an FCRA background check?

Yes, an employer can deny a job offer based on the findings of an FCRA background check, but they must follow the correct procedure. This includes providing the candidate with a copy of the report, informing them of their right to dispute any inaccuracies, and allowing a waiting period before taking any final action.

How do I dispute an error on my FCRA background check report?

If you find an error in your FCRA background check, you can dispute it with the CRA that provided the report. The CRA is required to investigate the dispute within 30 days. They must either verify the information as correct or remove/rectify any inaccuracies. If the issue is not resolved to your satisfaction, you can contact the company that ordered the report or pursue further legal action.

Are FCRA background checks different from other types of background checks?

Yes, FCRA background checks are specifically governed by the Fair Credit Reporting Act, which imposes strict requirements on the accuracy, disclosure, and consent process. Non-FCRA background checks, such as informal checks or those conducted by private individuals, do not have the same legal requirements for consent, notification, or dispute resolution.

Conclusion

In this comprehensive guide, we’ve explored the significance of FCRA background checks and the legal framework that governs them. Understanding the requirements set forth by the Fair Credit Reporting Act is crucial for ensuring fairness, transparency, and compliance in the background check process. Employers must follow proper procedures, including obtaining consent, ensuring accuracy, and providing adverse action notifications. Individuals have important rights, such as the right to dispute errors and be informed about adverse decisions.

For employers and other entities, working with trusted providers like Precise Hire ensures that background checks are compliant with FCRA guidelines, reducing the risk of legal complications and protecting the rights of all parties involved. By understanding and adhering to the legal aspects of FCRA background checks, employers and individuals can create a more transparent, fair, and legally sound screening process.