Navigating the Process of CPA Letters for Self-Employment Verification

Introduction to CPA Letter for Verification of Self-Employment

A CPA letter for verification of self-employment is a crucial document for individuals who work for themselves and need to prove their income or employment status. This letter, issued by a Certified Public Accountant (CPA), serves as an official statement verifying that an individual is self-employed and provides supporting evidence of their income, business operations, and employment history. While various forms of income verification exist, such as pay stubs, tax returns, or bank statements, a CPA letter is often considered the most reliable and credible method in specific situations like securing loans, applying for housing, or proving income for tax purposes.

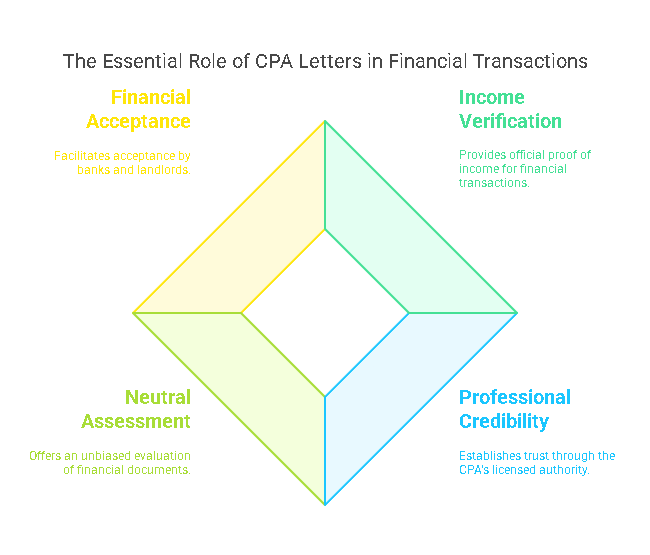

Purpose and Importance of the CPA Verification Letter

A CPA letter for verification of self-employment is generally required when a self-employed individual needs to provide evidence of their income or employment status for several reasons. The most common scenarios include applying for a mortgage, business loan, or apartment rental. It is also used in cases where the individual needs to prove income for tax purposes, such as when filing taxes with complex income sources or deductions. Because a CPA is a licensed and trusted professional, their letter holds significant weight with financial institutions, landlords, and other entities that require verification of income. The letter helps establish credibility and ensures that the verification process is conducted by a reliable, neutral party who is trained in assessing financial documents.

Role of the CPA in Self-Employment Verification

The Certified Public Accountant (CPA) plays a pivotal role in the process of verifying self-employment. The CPA is a licensed financial professional who has the expertise to review and analyze an individual’s financial records, business income, and tax filings. When issuing a verification letter for self-employment, the CPA examines various documents, such as income statements, profit and loss statements, tax returns, and other business records, to ensure that the information provided is accurate and complies with legal standards.

Unlike a simple self-reported statement of income, a CPA letter is backed by professional standards and provides a level of certainty for the requester. This verification is particularly important when a person does not receive traditional pay stubs or consistent paycheck documentation, as is the case with salaried employees. The CPA is responsible for ensuring that the letter reflects true, accurate, and verifiable information, which can help an individual in obtaining critical services like loans, housing, or other financial opportunities.

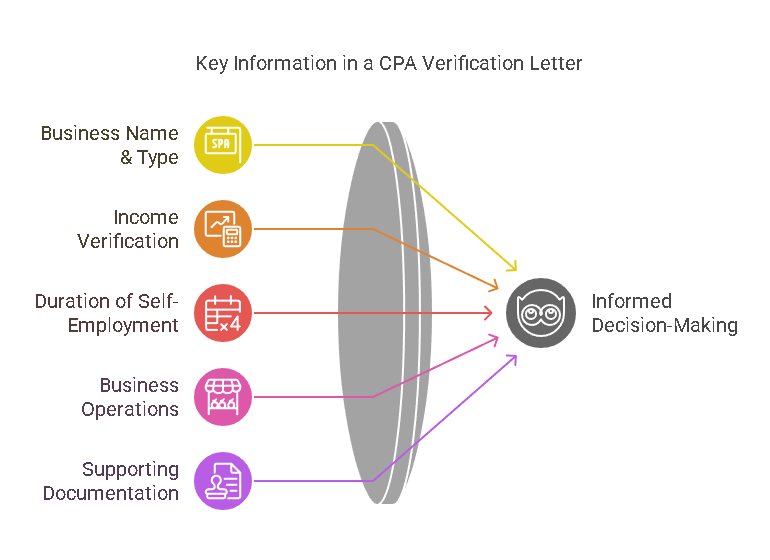

Key Information in a CPA Verification Letter

A CPA verification letter for self-employment generally includes a variety of details about the self-employed individual’s income, business operations, and employment history. Below are some of the essential elements that a CPA letter typically includes:

- Business Name and Type: The CPA will confirm the name of the business and the type of business (e.g., sole proprietorship, LLC, etc.).

- Income Verification: The CPA will detail the individual’s income from the business, often based on the last few years of financial statements or tax returns. This may include net income, gross income, or both, depending on the request.

- Duration of Self-Employment: The letter will mention how long the individual has been self-employed, which is important for proving the stability of the business and the individual’s ability to consistently earn income.

- Business Operations: The CPA may provide a brief overview of the business’s operations to demonstrate the legitimacy and viability of the individual’s self-employment.

- Supporting Documentation: Some CPAs will include additional documentation such as tax returns, financial statements, or bank records to support the income verification provided in the letter.

This detailed and comprehensive information helps the requester—be it a financial institution, landlord, or another entity—make a well-informed decision based on accurate, reliable data.

When Is a CPA Letter for Self-Employment Verification Required?

A CPA verification letter for self-employment is commonly requested in the following situations:

- Applying for a Mortgage: Lenders often require self-employed individuals to provide a CPA letter to confirm income and ensure they have the financial means to repay a loan.

- Renting an Apartment: Landlords may require proof of income before renting to self-employed individuals, as traditional pay stubs are not available.

- Securing a Business Loan: Financial institutions often ask for verification of self-employment when evaluating a loan application from a self-employed individual.

- Tax Purposes: Individuals who file taxes using non-traditional income sources may need a CPA verification letter to substantiate their income for tax reporting or to address specific inquiries from the IRS.

In each of these cases, the CPA verification letter offers an added layer of assurance and provides a clear, unbiased picture of the individual’s financial situation.

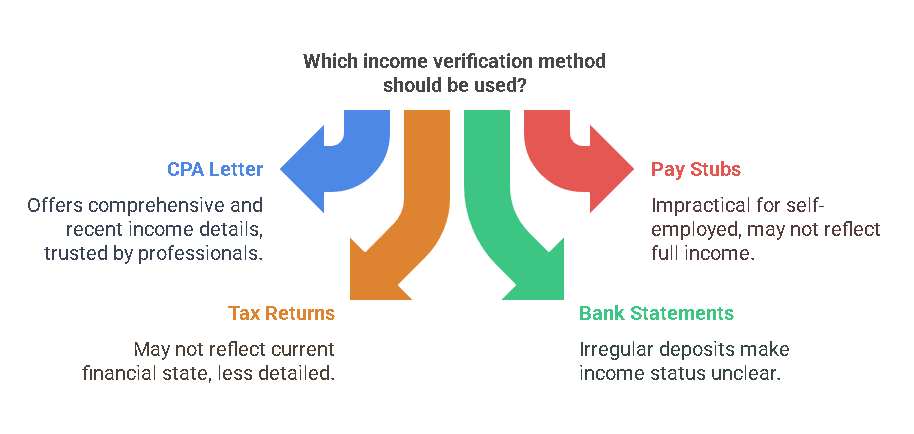

CPA Verification Letter vs. Other Forms of Income Verification

While there are several methods for verifying income, a CPA letter for self-employment verification is often preferred due to its credibility and comprehensiveness. Below is a comparison of a CPA letter and other common methods of income verification:

- Pay Stubs: Pay stubs are commonly used for employees in traditional jobs. However, self-employed individuals do not receive pay stubs, making it an impractical solution. Additionally, pay stubs may not accurately reflect the full income of a self-employed individual, especially if the income fluctuates or comes from multiple sources.

- Tax Returns: Tax returns are another common form of income verification, but they may not fully reflect the current financial state of the individual. A CPA letter, on the other hand, can provide more recent and detailed information about income, expenses, and business operations.

- Bank Statements: While bank statements can show deposits and withdrawals, they do not provide a clear picture of income or self-employment status, especially if deposits are irregular. A CPA letter offers a more formal and comprehensive verification of income and business activity.

The CPA letter for verification of self-employment is therefore an important tool for self-employed individuals seeking financial services or housing. It is considered more trustworthy than other methods due to the involvement of a licensed professional and the level of detail it offers.

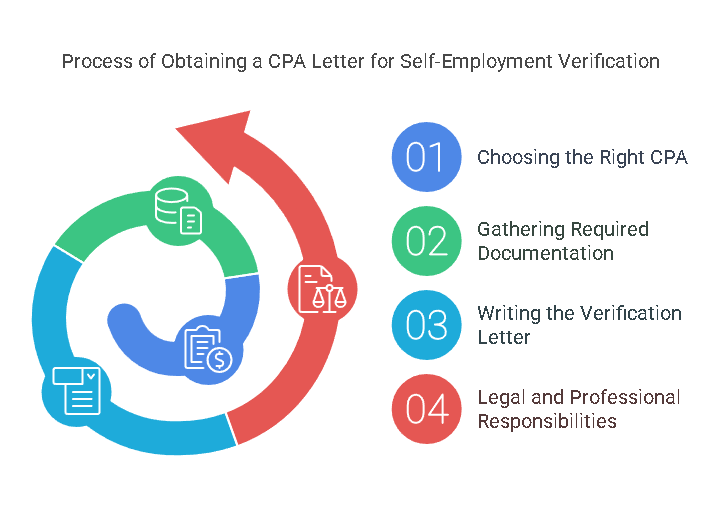

Steps for Obtaining a CPA Letter for Self-Employment Verification

Obtaining a CPA letter for self-employment verification involves several steps. Here is a breakdown of the general process:

- Finding a CPA: The first step is to find a qualified CPA who has experience in verifying self-employment. The CPA should have knowledge of the specific requirements for the type of verification needed (e.g., for a mortgage, business loan, etc.).

- Providing Required Documentation: The self-employed individual will need to provide relevant financial documents to the CPA, including tax returns, business statements, profit and loss records, and any other financial documents that reflect income and business operations.

- Drafting the Verification Letter: Once the CPA has reviewed the provided documents, they will draft a verification letter that includes the necessary details, such as income, business operations, and self-employment duration.

- Review and Finalization: The letter is then reviewed by both the CPA and the individual requesting it to ensure that all the necessary information is included and accurate. Once finalized, the CPA will sign the letter and provide it to the requester.

The process typically takes a few days to a week, depending on the complexity of the individual’s financial situation and the CPA’s workload.

Benefits of Using a CPA Verification Letter

The primary benefits of using a CPA verification letter for self-employment verification include:

- Credibility: A letter issued by a licensed CPA is considered highly credible and authoritative, making it a preferred method for proving self-employment.

- Accuracy: Unlike self-reported statements, a CPA letter is based on professionally verified financial data, ensuring accuracy.

- Comprehensive Information: The letter provides a full picture of the individual’s financial status, including income, business operations, and financial history.

A CPA letter for verification of self-employment plays a critical role in many aspects of financial and housing decisions for self-employed individuals. It serves as a formal, reliable document that helps lenders, landlords, and other entities assess the financial stability of self-employed applicants, ensuring they are well-qualified for the opportunities they seek.

The Process and Best Practices for Obtaining a CPA Letter for Self-Employment Verification

Obtaining a CPA letter for self-employment verification is a crucial step for self-employed individuals seeking to verify their income for various financial or housing purposes. This section will explore the step-by-step process for obtaining a CPA letter, including how to choose the right CPA, the required documentation, and best practices for ensuring an accurate and effective verification letter. Additionally, we will highlight the role of Precisehire, a service that helps businesses and individuals manage verification processes efficiently, ensuring compliance with industry standards and legal requirements.

Step-by-Step Process for Obtaining a CPA Letter for Self-Employment Verification

1. Choosing the Right CPA

The first step in obtaining a CPA letter for self-employment verification is selecting the right Certified Public Accountant (CPA). It’s essential to choose a CPA who is experienced in self-employment verification and understands the specific requirements of the verification process, which may differ depending on the intended purpose of the letter—whether for a mortgage, business loan, or other financial requests. Here’s what to look for when selecting a CPA:

- Experience: Look for a CPA with a proven track record in self-employment verification. Ideally, the CPA should have worked with other self-employed individuals or business owners in the past.

- Specialization: Ensure the CPA is familiar with the requirements for verifying income for specific purposes, such as securing a mortgage or applying for a loan. The CPA should understand what kind of financial documentation is needed for these different scenarios.

- Professional Reputation: Research the CPA’s reputation by checking reviews, asking for referrals, or verifying their certifications and licensure status. A reputable CPA is more likely to provide a trustworthy and reliable verification letter.

- Cost: Discuss the fees involved upfront. While fees may vary depending on the complexity of your financial situation, it’s important to have a clear understanding of the cost before engaging the CPA.

2. Required Documentation

Once you’ve chosen a CPA, the next step is to gather the required documentation. This is a critical part of the process, as the accuracy and completeness of the information provided will directly affect the quality and reliability of the verification letter. Here’s a list of the most common documents you may need to provide to the CPA:

- Tax Returns: Typically, CPAs will request copies of your tax returns for the last two to three years. These provide a comprehensive view of your income and tax filings, offering a solid foundation for verification.

- Profit and Loss Statements: If applicable, provide a profit and loss statement that outlines the revenue and expenses of your business. This will give the CPA a clear picture of your business operations and help them verify your income.

- Balance Sheet: A balance sheet can provide a snapshot of your business’s financial health, including assets, liabilities, and equity.

- Bank Statements: Some CPAs may request bank statements to corroborate your income and cash flow. Bank statements can show regular deposits, lending support to your reported earnings.

- Business Licenses and Other Certifications: If required, provide copies of business licenses, permits, or any certifications that demonstrate the legitimacy of your self-employment.

It’s important to note that the more comprehensive and organized your documentation is, the quicker and smoother the verification process will be. Keeping up-to-date and accurate records is a key part of ensuring the process goes smoothly.

3. Writing the Verification Letter

Once the CPA has reviewed your documents and verified your income and self-employment status, they will proceed to draft the verification letter. This letter must meet certain requirements to be considered credible and reliable. Here’s what should be included in the letter:

- Personal and Business Information: The CPA will start by confirming your personal information (name, address) and business details (business name, type, and operations).

- Self-Employment Duration: The letter will mention the duration of your self-employment, establishing how long you have been in business.

- Income Details: The CPA will verify your income by providing specifics about your earnings, whether it is gross income, net income, or both. They may base this information on your financial records, including tax returns and profit and loss statements.

- Verification of Business Operations: The letter will include a brief overview of your business operations, showing that you are actively engaged in self-employment.

- CPA’s Credentials: The CPA will include their name, qualifications, license number, and the date of the letter. They may also provide their professional contact information in case the requester has additional questions or needs verification.

4. Legal and Professional Responsibilities of a CPA

When providing a verification letter for self-employment, CPAs are bound by legal and professional standards. They are responsible for ensuring that the information provided in the letter is accurate and truthful. Misrepresenting or falsifying information in a CPA verification letter can have serious legal consequences, including potential legal action against the CPA for negligence or fraud. CPAs are trained to be objective and adhere to high standards of professionalism, which is why their verification letters are considered highly reliable.

Situations Where a CPA Letter for Self-Employment Verification Is Requested

A CPA letter for self-employment verification is often requested in the following situations:

- Applying for a Mortgage: Lenders require self-employed individuals to provide a verification letter to confirm their ability to repay a mortgage loan.

- Renting an Apartment: Landlords may ask for a verification letter to ensure that self-employed tenants have a stable income to cover rent.

- Securing a Business Loan: Financial institutions require proof of income to determine whether an individual is capable of repaying a business loan.

- Tax Purposes: Some self-employed individuals may need to submit a CPA verification letter to prove their income for tax filings or IRS audits.

In all of these situations, the CPA letter serves as an official, unbiased statement of your income and self-employment status. It ensures that the verification process is conducted in compliance with legal requirements and industry standards.

Types of Income Verification Methods

There are several ways to verify self-employment income, and it’s important to understand the strengths and weaknesses of each method. Below is a table comparing different income verification methods:

| Verification Method | Pros | Cons |

|---|---|---|

| CPA Verification Letter | Most credible, detailed, accurate, reliable | Requires professional assistance and can be costly |

| Tax Returns | Comprehensive view of income, legally required | May not reflect current income, especially for fluctuating earnings |

| Bank Statements | Shows actual deposits, easy to obtain | Does not show detailed income breakdown, lacks context |

| Pay Stubs | Standard for salaried employees, widely accepted | Not applicable for self-employed individuals |

While each method has its place, the CPA verification letter stands out as the most thorough and trusted form of self-employment verification, particularly in situations where credibility is critical.

Precisehire: Assisting with Verification Processes

In addition to obtaining a CPA letter, businesses and individuals may need assistance with background checks and other verification processes. Precisehire plays a key role in helping self-employed individuals and businesses manage verification processes, ensuring compliance with industry standards and legal requirements.

Precisehire’s services are designed to streamline the verification process, from background checks to employment verification. Their expertise in compliance and industry standards ensures that businesses can trust the verification information they receive, mitigating the risks associated with inaccurate or misleading data. Whether you’re a self-employed individual seeking income verification or a business conducting employee background checks, Precisehire provides comprehensive support, making the process smooth and efficient.

Best Practices for Individuals Seeking a CPA Letter

For self-employed individuals, there are several best practices to follow when seeking a CPA letter for self-employment verification:

- Maintain Accurate Records: Keep detailed and up-to-date financial records, including tax returns, profit and loss statements, and bank statements.

- Be Transparent with Your CPA: Ensure your CPA has access to all necessary documents and information. Transparency will help them provide a more accurate and effective verification letter.

- Stay Organized: Keeping your financial documents organized will speed up the verification process and ensure that nothing is overlooked.

- Understand the Purpose of the Letter: Be clear about why you need the verification letter, whether it’s for a mortgage, business loan, or other purposes. This will help your CPA tailor the letter to meet the specific requirements of the request.

Obtaining a CPA letter for self-employment verification is an important step for self-employed individuals seeking financial opportunities, housing, or tax assistance. By following the proper process, gathering the necessary documentation, and working with an experienced CPA, individuals can ensure that they have the most reliable and credible verification of their income and self-employment status.

Legal Aspects, FAQs, and Conclusion

We will explore the legal aspects of a CPA letter for self-employment verification, address some of the most frequently asked questions, and summarize the key points of the article. This section aims to provide a deeper understanding of the legal implications and practical considerations involved in the verification process, as well as reinforce the importance of working with a reputable CPA to ensure the accuracy and credibility of your self-employment verification.

Legal Aspects of CPA Letter for Self-Employment Verification

A CPA letter for self-employment verification serves as a legally binding document that confirms an individual’s self-employment status and income. However, it is important to understand the legal frameworks surrounding such verification letters and the potential consequences of inaccuracies or misrepresentations.

1. What Qualifies as Adequate Verification?

Under various legal frameworks—whether it’s for securing a mortgage, applying for a business loan, or meeting tax requirements—a CPA letter is often required to provide adequate verification of self-employment. The letter serves as the official proof that an individual is self-employed and generates income from their business operations. For many financial institutions, a CPA verification letter is considered more reliable and credible than other forms of self-employment verification, such as tax returns or pay stubs.

Each industry and application has specific requirements for verification. For example, mortgage lenders may require a letter that includes not only income details but also a history of business operations. In contrast, a business loan application may prioritize financial stability and profitability. Legal standards for these documents may vary by state or federal regulations, so it is critical that the CPA ensures their letter complies with all relevant guidelines.

2. Legal Implications for Accuracy

The legal responsibility of a CPA when issuing a verification letter cannot be overstated. A CPA is ethically and legally required to provide accurate, truthful, and substantiated information in the letter. If a CPA provides false or misleading information, they can face serious legal consequences, including professional disciplinary actions, civil penalties, or lawsuits. This underscores the importance of the CPA’s role in ensuring that all facts presented in the letter are thoroughly verified and backed by supporting documentation.

Additionally, clients (self-employed individuals) are encouraged to provide honest, transparent information to their CPA. Any attempt to mislead the CPA or provide falsified documentation can result in criminal charges or legal action for fraud.

3. Confidentiality and Privacy Rights

Another key legal consideration is the confidentiality of the documents involved in the verification process. Financial information shared with a CPA, such as tax returns, profit and loss statements, and bank records, is subject to privacy laws. CPAs are bound by confidentiality agreements and are prohibited from disclosing sensitive client information without consent, except in certain circumstances, such as a legal subpoena.

Self-employed individuals should be mindful of their privacy rights when sharing financial documents with a CPA and ensure that they understand the scope of confidentiality when engaging professional services.

FAQs: Frequently Asked Questions

How Long Does It Take to Get a CPA Letter for Self-Employment Verification?

The time it takes to receive a CPA letter varies based on several factors, including the complexity of the individual’s financial situation and the CPA’s workload. On average, it may take anywhere from a few days to a few weeks. It is advisable to start the process early to allow ample time for gathering necessary documentation and for the CPA to prepare and issue the letter.

What Documents Do I Need to Provide to the CPA for the Verification Letter?

To ensure that the CPA can prepare an accurate letter, you will need to provide a variety of financial documents. These typically include your tax returns for the past 2-3 years, profit and loss statements, bank statements, business licenses, and any other records that verify your self-employment and income. The exact documents required may vary depending on the specific needs of the verification request, so it's important to clarify with your CPA beforehand.

Is a CPA Letter Required for Self-Employed Individuals When Applying for a Mortgage?

Yes, most mortgage lenders require a CPA letter to verify income when a self-employed individual is applying for a loan. This letter acts as a formal, reliable confirmation of the individual’s ability to repay the loan, given the inherent challenges in verifying income for self-employed borrowers. Lenders typically request additional documents such as tax returns and business records to supplement the CPA letter.

How Much Does It Cost to Get a CPA Letter for Self-Employment Verification?

The cost of obtaining a CPA letter for self-employment verification varies depending on the complexity of your financial situation and the CPA’s rates. On average, you can expect to pay between $100 and $500. Some CPAs may offer flat-rate fees for this service, while others may charge based on the time it takes to prepare the letter. Be sure to inquire about pricing upfront to avoid any surprises.

Can I Use My Tax Return Instead of a CPA Letter for Self-Employment Verification?

While tax returns are a valid form of income verification, they may not always provide the level of detail or credibility required by certain institutions. For example, a lender may prefer a CPA verification letter because it provides an official confirmation from a professional accountant, who has access to additional financial records and understands the nuances of self-employment income. Tax returns, while useful, may not capture the full picture, especially if the self-employed individual’s income fluctuates.

Conclusion

Obtaining a CPA letter for self-employment verification is a crucial step for self-employed individuals who need to prove their income for various financial or housing purposes. This letter provides an official, credible, and reliable form of verification that is often required by lenders, landlords, and other institutions. By working with an experienced CPA, individuals can ensure that their verification letter is accurate and complies with all necessary legal and professional standards.

The legal aspects of a CPA verification letter emphasize the importance of accuracy, confidentiality, and adherence to industry regulations. The consequences of providing false or misleading information in a verification letter can be severe, both for the CPA and the individual requesting the letter. Therefore, it is essential to work with a trustworthy and professional CPA who understands the complexities of self-employment income.

For businesses and individuals navigating background checks, income verification, and other related processes, Precisehire provides comprehensive services that help ensure compliance with legal and industry standards. Whether it’s verifying self-employment or managing background checks for employees, Precisehire assists in streamlining these processes, making them more efficient and accurate.

By understanding the process, legal requirements, and best practices for obtaining a CPA letter for self-employment verification, individuals can avoid common pitfalls and ensure that their financial and professional affairs are properly documented and verified.