810 Refund Freeze Identity Verification: Legal Implications and How to Avoid Issues

What Is The 810 Refund Freeze Identity Verification?

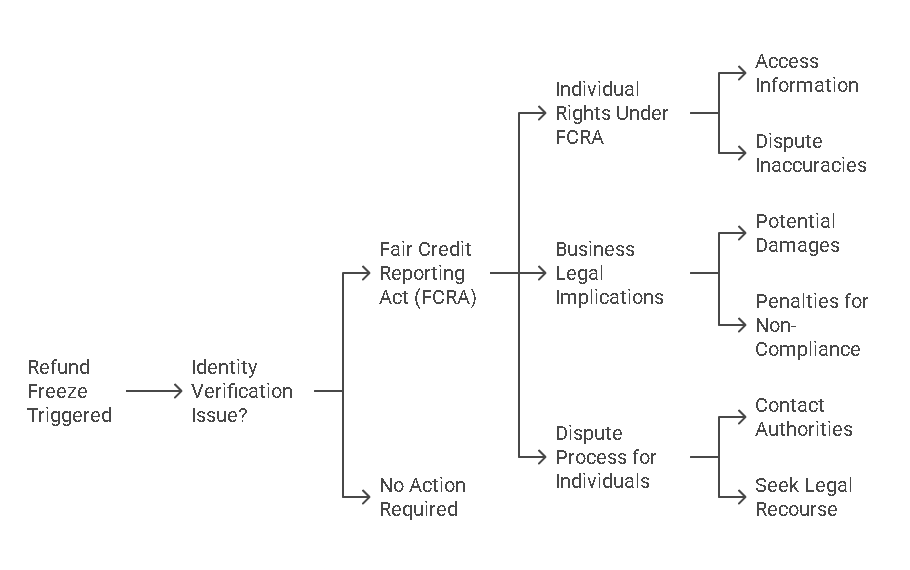

A 810 refund freeze refers to a temporary hold placed on a taxpayer’s refund due to concerns about the validity of their identity. This verification process typically occurs when authorities, such as the IRS or state tax agencies, suspect fraud, mismatched information, or identity theft. When an individual files a tax return and there are discrepancies in their identity data—such as a name mismatch, incorrect Social Security Number (SSN), or suspicious filing behavior—the IRS may implement a refund freeze. This freeze stops the release of funds while further identity verification is completed. It can be a frustrating situation for taxpayers, as it delays the much-needed refund, but the process is vital in preventing fraudulent activity and ensuring that tax refunds are issued to the correct individuals.

The 810 refund freeze identity verification process is commonly triggered when there are flags raised within the tax filing system or when suspicious activity is detected. If you’ve encountered a 810 refund freeze, it’s important to understand why it happens and how to resolve the issue to get your refund back on track.

Why Is The 810 Refund Freeze Applied?

Reasons for a Refund Freeze

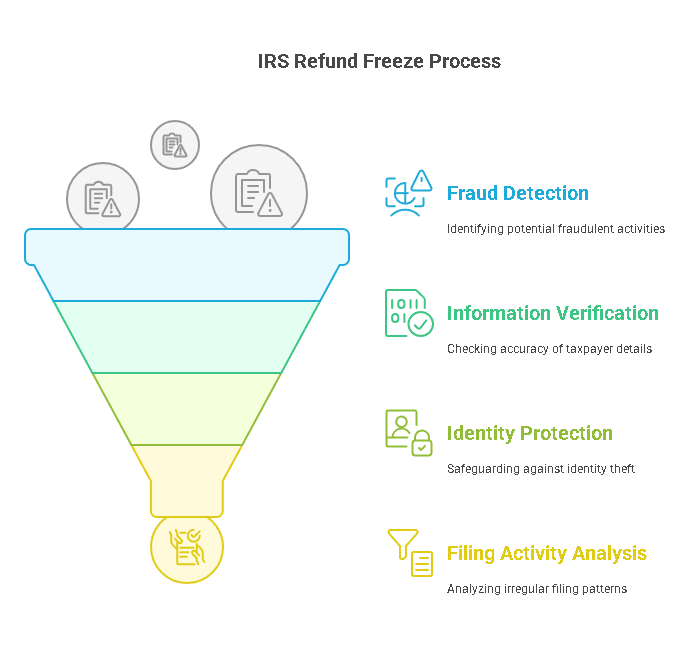

Refund freezes are primarily applied as a protective measure to ensure that the tax system remains secure. Several factors can lead to a 810 refund freeze:

- Fraud Prevention: One of the leading reasons a refund freeze is applied is due to potential fraudulent claims. If the IRS suspects that someone is attempting to steal a refund using another person’s identity or a fake identity, they may impose a freeze to halt the refund until the issue is investigated and resolved.

- Mismatched or Incorrect Information: Sometimes, the freeze may be triggered by discrepancies in the taxpayer’s personal information, such as mismatched names, addresses, or incorrect Social Security Numbers. These errors can occur when a taxpayer enters incorrect details on their tax return or when there is outdated information in government records.

- Identity Theft: A 810 refund freeze may be imposed when an individual’s personal details, such as their SSN, are used fraudulently in a tax filing. The IRS often applies a freeze as a precautionary measure to protect the rightful taxpayer and prevent fraudulent claims.

- Suspicious Filing Activity: If the IRS detects irregularities in a person’s filing history—such as multiple returns filed from different addresses, unusual claims, or inconsistent patterns—this could trigger a refund freeze.

In essence, a refund freeze is a necessary action to protect the taxpayer and ensure that only legitimate refunds are processed. While it may cause delays, the verification process is in place to safeguard against financial fraud and theft.

How Does The Identity Verification Process Work?

Once a 810 refund freeze is applied, the IRS or state authorities will typically initiate a series of steps to verify the taxpayer’s identity. Understanding this process can help alleviate concerns and expedite the resolution of the issue:

- Notification of Refund Freeze: The taxpayer will first be notified of the refund freeze. The notification may come in the form of a letter, often labeled “CP01H” or “CP53” from the IRS. This letter will explain that there is a need for additional verification before the refund can be processed. The taxpayer will also be provided with instructions on how to proceed.

- Document Submission: In most cases, the individual will be required to submit specific documents to verify their identity. These may include:

- Proof of identity, such as a government-issued ID (driver’s license, passport, or state ID).

- Proof of address (such as a utility bill or bank statement).

- Copies of previous tax returns (if applicable).

- Any other supporting documentation the IRS or state agency deems necessary.

- Verification of Personal Information: Once the documents are submitted, the IRS or relevant tax authority will compare the submitted documents with their records. This step includes verifying the accuracy of the SSN, name, and address. If there are inconsistencies or errors in the records, the IRS may reach out for further clarification or documentation.

- Review of Tax Filing History: The IRS will also review the individual’s tax filing history to check for any unusual activity or patterns. If there are multiple returns filed under the same SSN or suspicious claims, this will likely raise red flags, causing additional delays.

- Response to Queries: During the verification process, the IRS may contact the taxpayer if additional information is required. It’s essential to respond promptly to avoid further delays in processing the refund.

- Resolution and Release of Funds: Once all necessary documents are reviewed and validated, the IRS will lift the freeze, and the refund will be processed. This can take several weeks, depending on the complexity of the case. If the taxpayer fails to submit the required documentation or does not respond to queries, the freeze may persist, and the refund will remain on hold.

Challenges Faced by Individuals and Businesses

Delays and Financial Impact

For individuals, having a refund freeze placed on their tax return can be incredibly frustrating. Taxpayers rely on their refunds to manage expenses, pay off debts, or invest in their financial futures. The extended processing time due to an identity verification freeze can lead to financial strain, especially if individuals are not prepared for the delay.

The process also presents challenges for businesses, particularly those who employ independent contractors or rely on tax filings for other financial services. If a business or employee has a freeze on their refund, it may impact their ability to receive critical funds needed to keep operations running smoothly.

Confusion and Stress

A refund freeze can also cause confusion. Many taxpayers are not aware of the process or the reasons behind the freeze. They may feel stressed, overwhelmed, or uncertain about how to proceed. This is especially true if the taxpayer is unsure what specific documentation is needed or if the refund freeze notification lacks clarity. Additionally, if the taxpayer misses a deadline or submits incorrect information, this can cause further complications, leading to even longer delays in processing.

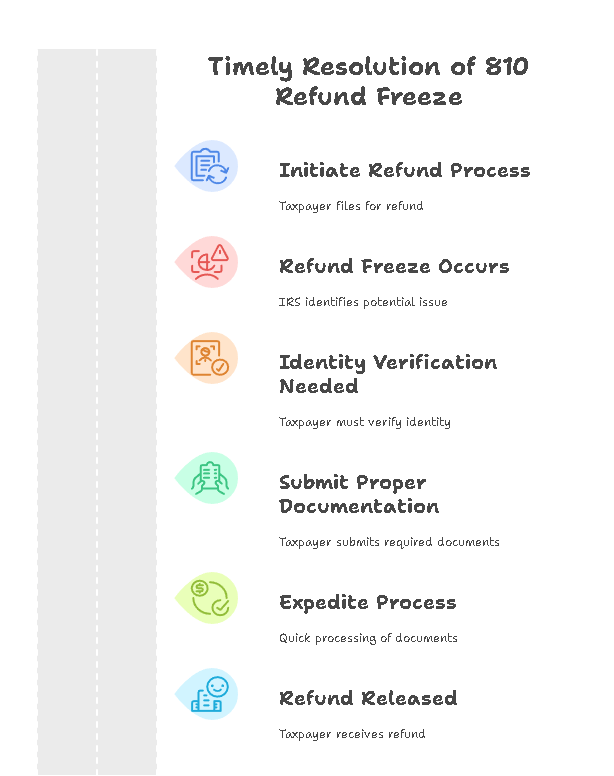

Importance of Timely Resolution

Preventing Financial Strain

Resolving the 810 refund freeze promptly is critical to avoid financial hardship. When a taxpayer’s refund is delayed, they may face mounting bills, difficulty meeting financial obligations, or issues with their business’s cash flow. The quicker the identity verification process is completed, the sooner the refund will be released.

Role of Proper Documentation

Proper documentation plays a key role in resolving a 810 refund freeze. By ensuring that all personal details are accurate and the correct supporting documents are provided, individuals can expedite the process. Having an organized approach and submitting the required documents as soon as possible will help ensure that the refund is processed without unnecessary delays.

In conclusion, the 810 refund freeze identity verification process is an essential safeguard to protect taxpayers and prevent fraudulent activity. However, it can cause delays and confusion for individuals awaiting their refunds. Understanding the steps involved and knowing how to address the issue is crucial for timely resolution.

Resolving 810 Refund Freeze Identity Verification Issues

When facing a 810 refund freeze due to identity verification issues, individuals must follow a series of well-defined steps to resolve the issue and ensure that their refund is processed promptly. In this section, we’ll provide a step-by-step guide on how to resolve a refund freeze, highlight common mistakes to avoid, explain the role of Precisehire in facilitating identity verification, and offer tips for avoiding future refund freezes.

How to Resolve a 810 Refund Freeze

Resolving a 810 refund freeze can be a time-consuming process, but following these steps can help ensure that the issue is addressed effectively and as quickly as possible.

1. Contact the Relevant Authorities or Agencies The first step in resolving a 810 refund freeze is to contact the agency or authority responsible for processing your refund. In most cases, this will be the IRS, but it could also involve state tax authorities depending on where you filed your taxes.

The IRS will generally send a notification letter (such as a CP01H or CP53 notice) informing you of the refund freeze. The letter will explain the specific issue, provide instructions on how to proceed, and may include a phone number or contact information for assistance. If you have any questions about the freeze, contacting the IRS or state tax office directly will provide clarity on what documents are required for verification.

2. Gather and Submit the Required Documents Once you’ve contacted the relevant authorities, you’ll need to gather and submit documentation that confirms your identity and supports the information on your tax return. The exact documents required may vary depending on the circumstances, but common documents to submit include:

- Proof of identity: A government-issued ID such as a driver’s license, passport, or state-issued ID.

- Proof of address: Utility bills, bank statements, or any other official correspondence that confirms your current address.

- Social Security Number (SSN) verification: You may be asked to provide documentation showing that your SSN matches the IRS records. This may include a Social Security card or any official correspondence from the Social Security Administration (SSA).

- Copies of previous tax returns: If there were any discrepancies in your prior filings, you might be asked to submit copies of your prior year’s returns.

Submitting the correct documents is crucial for expediting the verification process. Be sure to double-check the requirements in the notification letter to ensure you’ve included all necessary documentation.

3. Follow Up on the Verification Process After submitting your documents, it’s essential to follow up with the relevant agency to ensure that your identity verification is being processed. Verification can take several weeks, depending on the complexity of the issue and the volume of cases being handled.

If you haven’t received any updates on your refund after the suggested time frame, don’t hesitate to contact the IRS or state tax office for a status update. Keep a record of all communication, including dates and reference numbers, in case you need to escalate the matter.

4. Resolve Any Additional Issues If the authorities find any inconsistencies or errors in the information you provided, they may request additional documents or clarification. It’s important to address these issues as quickly as possible to avoid further delays.

In some cases, the IRS may also initiate an interview to verify your identity in person or over the phone. If this happens, make sure you are prepared by having all relevant documentation on hand.

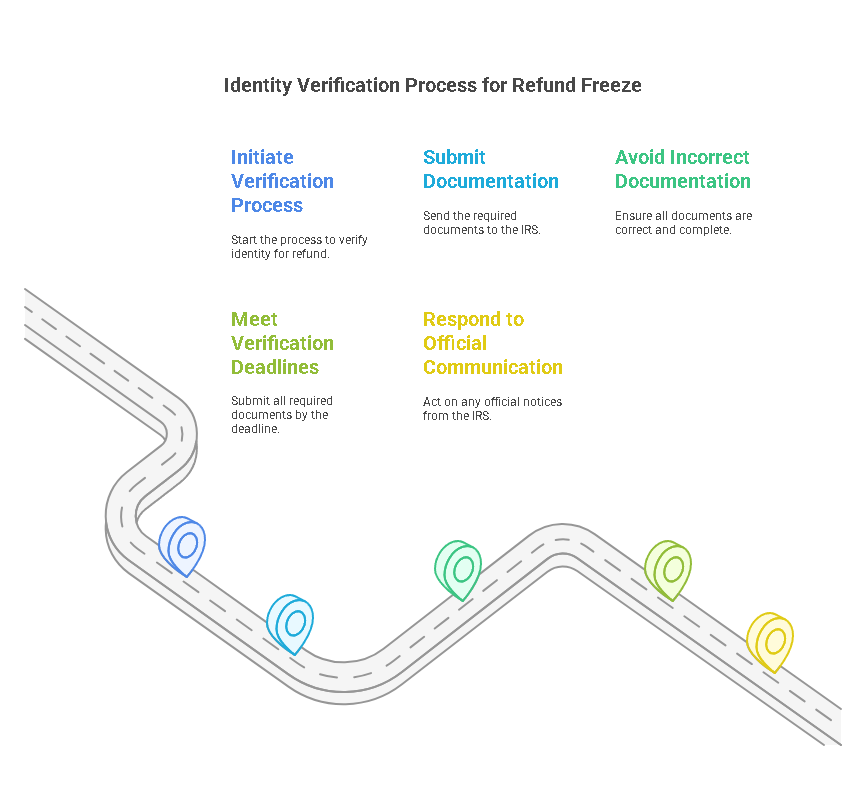

Common Mistakes to Avoid

While working through the identity verification process, it’s important to avoid some common mistakes that could delay the resolution of your refund freeze:

1. Failing to Submit the Correct Documentation One of the most common mistakes is not submitting the correct documentation or submitting incomplete forms. Always ensure that you send the required paperwork in the exact format requested. For example, if the IRS asks for a certified copy of your birth certificate, make sure it’s certified before sending it. Submitting unverified or incomplete documents will only prolong the verification process.

2. Missing Deadlines for Verification If a deadline is provided for submitting documentation or responding to a request, it’s crucial that you meet it. Missing deadlines can result in the rejection of your refund claim and additional delays in processing. If you’re unable to submit the documents by the specified deadline, notify the IRS or tax authority in advance and request an extension.

3. Ignoring Official Communication Many taxpayers make the mistake of ignoring official communication from the IRS or state tax authorities. If you receive a letter or notice about the refund freeze, take immediate action to understand and address the situation. Ignoring the communication can lead to further complications, such as additional delays, penalties, or rejection of your refund claim.

Precisehire’s Role in Identity Verification

Precisehire can help individuals and businesses address identity verification issues effectively, particularly in situations involving refund freezes. Precisehire offers reliable identity verification services that ensure the accuracy of your personal information and streamline the verification process, reducing the likelihood of refund freezes.

1. Thorough Background Checks Precisehire provides comprehensive background checks that include verification of personal information, employment history, and criminal records. By ensuring that your background data is accurate and up-to-date, you reduce the chances of discrepancies that could lead to a refund freeze.

2. Proactive Verification Services Precisehire offers proactive verification services to help businesses and individuals avoid refund freezes. By regularly monitoring your identity and financial records, Precisehire can help you spot discrepancies early, giving you enough time to address any potential issues before they trigger a refund freeze.

3. Expertise in Compliance Precisehire’s team of experts is familiar with the latest identity verification regulations and best practices. By partnering with Precisehire, you ensure that your verification processes are in full compliance with government requirements, preventing issues with identity verification that could lead to delays or refund freezes.

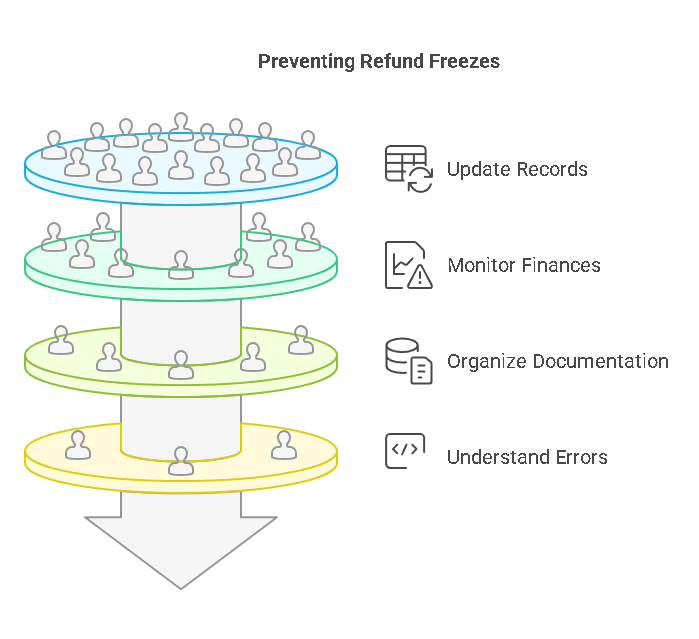

Tips for Avoiding Future Refund Freezes

To minimize the risk of a refund freeze in the future, here are some practical tips that individuals and businesses can implement:

1. Keep Personal Information Up to Date Always ensure that your personal information, including your name, address, and Social Security Number, is accurate and current in all relevant records. Regularly update your information with the IRS, state tax authorities, and any other agencies you interact with to ensure that there are no discrepancies when you file your taxes.

2. Monitor Your Credit and Financial Records Regularly monitor your credit report and financial records to ensure there are no inaccuracies or suspicious activities. Early detection of discrepancies can help prevent future issues with identity verification, including refund freezes.

3. Ensure Proper Record-Keeping Maintain accurate and organized records of all relevant documentation, such as tax returns, financial statements, and government-issued IDs. When verification is needed, having well-organized records will help expedite the process and reduce the likelihood of errors that could lead to delays.

4. Understand Common Identity Verification Errors Familiarize yourself with common errors that may trigger a refund freeze, such as incorrect SSNs, address mismatches, and missing or inconsistent tax filings. By understanding what could go wrong in the verification process, you can take proactive steps to prevent these issues from arising.

Resolving a 810 refund freeze due to identity verification issues requires careful attention to detail, prompt action, and a thorough understanding of the required steps. With the right approach and the assistance of reliable verification services like Precisehire, individuals can navigate the process with minimal delay and ensure that their refunds are processed efficiently.

Common Errors in Identity Verification and Their Solutions

| Error Type | Cause | Solution |

|---|---|---|

| Incorrect Social Security Number (SSN) | Typographical errors, mismatched records | Double-check your SSN on all documents and ensure it matches official records. |

| Name Mismatch | Name spelling errors, inconsistent formats | Verify your name as it appears on legal documents like your SSN card or ID. |

| Incorrect Address | Outdated address on file with IRS or other agencies | Update your address with the IRS and all relevant agencies. |

| Missing or Incorrect Tax Filing | Errors in tax return forms or omissions in filings | Ensure all fields are accurately completed and submit any missing documents promptly. |